Discounting Statistics in Sales: The 2025 Data You Need to Know

- Sophie Ricci

- Views : 28,543

Table of Contents

Discounting Statistics in Sales

- 70% of consumers admit a discount pushed them to buy something they hadn’t originally planned on purchasing

- Average eCommerce discount rates range from 10% to 30% depending on product category and store type

- Fashion sector hit an average discount rate of 38% during Q2 2023, showing aggressive competitive pricing

- Coupons offer an average price reduction of 19% for online shoppers across various categories

- 38% of all online shopping transactions now use a coupon code or discount, making deals the norm

- Retail eCommerce sales are expected to exceed $4.3 trillion worldwide in 2025, intensifying competition

- Abandoned cart rate averages near 70% due to high discount expectations from trained consumers

- Media and streaming sector discounts closely follow general eCommerce averages at around 38% for acquisition

- Fashion and apparel typically offer 30-40% discounts as normal practice due to seasonal inventory turnover

- Beauty and skincare industries average 15-25% discounts, focusing on trial and conversion strategies

- Electronics and tech maintain thin margins with 10-15% max discounts in most competitive cases

- B2B and SaaS annual contract discounts might hit 15-20%, traded for longer commitment terms and value

- Customers abandon carts to search for promo codes, disrupting checkout flow and reducing conversion rates

- Fashion brands can afford aggressive discounts with 200-300% markups on cost, maintaining healthy margins

- Frequent discounting trains customers to wait for sales rather than purchase at full price, harming long-term profitability

You’re about to close a deal. Everything’s lined up perfectly. Then your prospect hits you with it: “Can you do 20% off?”

Your stomach drops. You need this sale. But you also need to protect your margins.

Here’s the thing—70% of consumers admit a discount pushed them to buy something they hadn’t planned on. That’s powerful. But it’s also dangerous.

Because while discounts can accelerate deals, they can also tank your profitability, devalue your brand, and train customers to never pay full price again.

🎯 Target Buyers Ready to Pay

LinkedIn outbound finds decision-makers who value solutions over discounts—protecting your margins while scaling revenue

This isn’t just another stats dump. This is your playbook for understanding exactly how discounting works in 2025, what the numbers actually mean for your business, and how to use pricing strategy without shooting yourself in the foot.

Let’s dive into the data that matters.

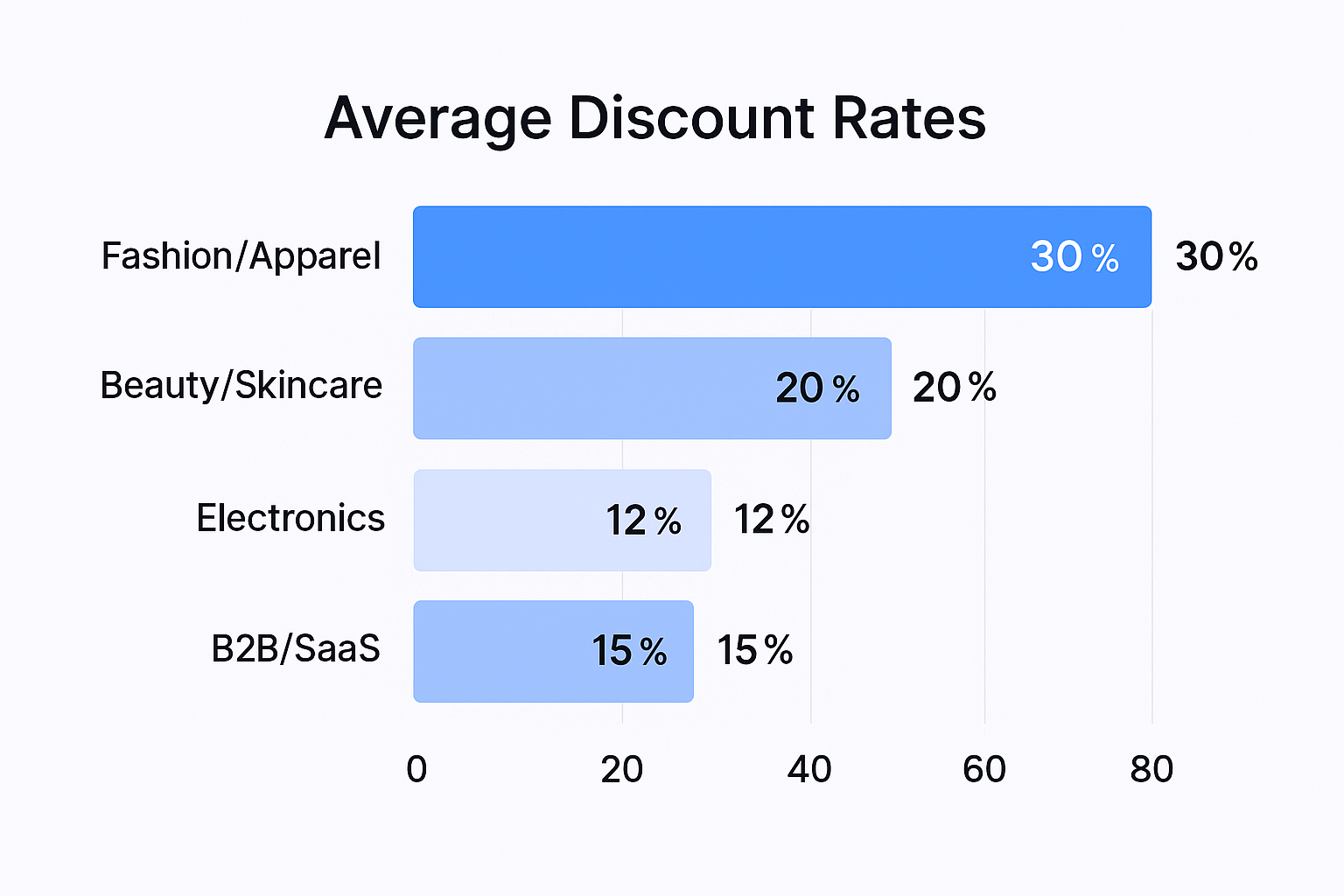

Average Discount Rate in eCommerce Ranges from 10% to 30% Depending on Category

Here’s the baseline: most online retailers operate within a 10% to 30% discount range depending on what they’re selling.

Fashion brands? They’re usually closer to that 30% mark, especially during seasonal shifts. Electronics? Often stick to 10-15% because margins are already thin. Beauty and skincare land somewhere in the middle at around 15-20%.

The actual selling price you land on depends heavily on your store type and what you’re competing against. A boutique fashion brand might discount differently than a mass-market retailer, even in the same category.

Why does this matter? Because if you’re selling in ecommerce and you’re nowhere near these benchmarks, you’re either leaving money on the table or you’re confusing your customers. They’ve been trained by the market to expect certain discount levels in certain categories.

During Q2 2023, Average Discounts Reached Around 38% in Top Sectors

Now here’s where things get wild.

In Q2 2023, the fashion sector hit an average discount rate of 38%. That’s not a sale. That’s the new normal during competitive periods.

The media sector—think streaming services, digital content, subscription platforms—matched that same 38% average.

Why did these sectors go so aggressive? Competition. When everyone’s fighting for the same customer, discounts become the easy weapon. But here’s the problem: when everyone discounts at 38%, nobody wins. You’re all just racing to the bottom.

This is especially true in categories where switching costs are low. If I can cancel your service and jump to a competitor with one click, you better believe you’re going to feel pressure to discount.

Coupons Offer an Average Price Reduction of 19% for Online Shoppers

Here’s an interesting twist in the data: when you specifically look at coupon usage, the average discount drops to 19%.

Why does a coupon feel different than a straight discount? Psychology.

A coupon makes the customer feel like they did something to earn the deal. They searched for it. They applied it at checkout. That small action creates buy-in. They feel smart, not cheap.

The smart play? When you add business value through coupons, you can offer a smaller discount and get better results than a bigger blanket sale. A 19% coupon can perform better than a 25% sitewide discount because of how it’s framed and delivered.

38% of Online Shopping Transactions Use a Coupon Code or Discount

This stat should wake you up: 38% of all online purchases now involve some kind of discount or coupon code.

Read that again. More than one in three transactions.

We’ve normalized discounting to the point where customers expect it. They don’t ask “if” there’s a deal available—they assume there is and go hunting for it.

This creates a huge problem for brands: the cart abandonment trap. People add items to their cart, then pause to search for a better price or a promo code. If they can’t find one, they often just… leave.

Your sales tax calculation, your pricing transparency, your whole checkout flow—it all gets disrupted by discount-seeking behavior. And once customers learn your discount patterns (like end-of-quarter sales), they’ll wait instead of buying now.

Retail eCommerce Sales Are Expected to Exceed $4.3 Trillion Worldwide in 2025

Let’s zoom out for perspective.

The global ecommerce market is projected to hit $4.3 trillion in 2025. That’s trillion with a T.

Why does this matter for discounting? Because with a market that massive, competition is absolutely brutal. Every store type, every category, every geography—everyone’s fighting for a piece.

That competitive pressure naturally pushes more brands toward discounting as a growth lever. When there’s this much opportunity, it’s tempting to slash prices to grab market share fast.

💰 Win Deals at Full Price

Our LinkedIn targeting finds qualified prospects who care about value, not just discounts—complete campaign design included

But here’s the catch: the winners in a $4.3 trillion market aren’t just the ones who sell the most. They’re the ones who sell profitably. And that means being strategic about when and how you discount.

Abandoned Cart Rate Averages Near 70% Due to High Discount Expectations

This is the killer stat.

70% of shopping carts get abandoned before purchase. And a major reason? Customers have been trained to expect discounts.

Think about your own behavior. You add stuff to your cart on a site you’ve never bought from. Before you check out, you open a new tab and Google “[brand name] promo code.” If you find one, you use it. If you don’t, you might close the tab and think “I’ll come back later when there’s a sale.”

That later often never comes.

The psychology is fascinating. Customers aren’t abandoning because they don’t want the product. They’re abandoning because they suspect they’re not getting the best deal. They’re waiting you out.

And when they do abandon, what often brings them back? An automated email offering… you guessed it… a discount. Which just reinforces the behavior.

Add to this the friction of unexpected sales tax and shipping costs at checkout, and you’ve got a perfect storm of cart abandonment driven by price expectations.

Media Sector Discounts Closely Follow General eCommerce Averages Around 38%

The media and streaming sector—Netflix, Spotify, Hulu, all the subscription services—they’re right there with fashion at 38% average discounting.

Why? Because content is infinitely switchable. There’s no shipping cost. No physical product to return. Just a button that says “cancel subscription” and another button that says “try [competitor] free for 30 days.”

The media sector has realized that customer acquisition cost is high, so they use heavy intro discounts to get people in the door, then hope those people stick around at full price.

The problem? When every service offers “3 months for $0.99,” customers start rotating through services, never paying full price anywhere. They become discount tourists.

Average Discount Rate in eCommerce: What the Numbers Really Mean

Okay, let’s break down what’s actually happening with these discount rates across different store types and why it matters for your actual selling price.

Here’s the reality: not all discounts are created equal.

A 20% discount on a product with a 50% gross margin is completely different from a 20% discount on a product with a 20% gross margin. In the first case, you still make money. In the second, you’re selling at a loss or barely breaking even.

Fashion ecommerce can afford aggressive discounts because markups are high—often 200-300% on cost. A fashion brand might pay $20 for a shirt, list it at $80, then discount to $56 (30% off) and still make healthy profit.

But electronics? Margins might be 10-15% on cost. A 20% discount there is business suicide.

So when you see “average discount rate” stats, don’t blindly copy them. Ask yourself:

- What’s my actual margin?

- How does sales tax affect my final pricing?

- What’s my customer lifetime value if I acquire them at this price point?

- Does this discount attract the right customer or just bargain hunters?

The smartest brands don’t compete on price. They add business value through better service, faster shipping, superior product quality, or tighter community. And they reserve discounts for strategic moments—new customer acquisition, clearing old inventory, or rewarding loyal customers—not as a crutch for every sale.

🚀 Scale Without Price Wars

LinkedIn outbound delivers qualified pipeline through precision targeting and proven campaign frameworks—no race to bottom required

Interpreting Discount Rate Statistics Across Industries

Different industries play the discounting game totally differently. Let’s break it down.

Fashion and Apparel: This is the Wild West of discounting. Seasons change, trends die fast, and inventory needs to move. Average discounts of 30-40% are normal. Fast fashion brands like H&M and Zara have trained customers to expect constant deals. The play here is to use discounts strategically to clear out seasonal inventory while protecting your core collection pricing.

Beauty and Skincare: More moderate at 15-25% discounts. Why? Products have shorter shelf lives, and customers are often more loyal to brands that work for them. The discount strategy here focuses on trial and conversion—get new customers to try your product, then rely on repeat purchases at full price. That’s where brands like Salesso come in for businesses doing cold outreach to beauty retailers—finding the right contacts to pitch your product is just as important as your pricing strategy.

Electronics and Tech: Thin margins mean discounts of 10-15% max in most cases. Apple barely ever discounts. Why? Brand positioning. But smaller electronics retailers might offer 10% off to compete, knowing that’s about all the margin allows. The key here is adding value through bundles, warranties, or services rather than straight price cuts.

B2B and SaaS: This is where discounting gets really interesting. B2B businesses rarely advertise public discounts, but heavy negotiation happens on every deal. Annual contract discounts might hit 15-20%, but they’re traded for longer commitment terms. Smart B2B sellers use discounting as one lever in a complex negotiation, not as the main event.

Subscription Services: As we covered, media subscriptions average 38% discounting, mostly in the form of intro offers. The whole business model depends on acquiring customers cheap, then hoping they forget to cancel. Churn becomes the enemy, and once churn gets high, you’re stuck in a discount spiral just to maintain your subscriber base.

The lesson? Don’t just look at competitors’ discount rates. Understand their business model, their margins, and their strategic goals. Then craft your discounting approach to fit your actual economics, not just match the market.

🔥 Attract Quality Over Quantity

Our complete LinkedIn outbound system targets ideal buyers, designs converting campaigns, and scales your pipeline profitably

7-day Free Trial |No Credit Card Needed.

FAQs

What's the difference between discounts and coupons?

What is a good discount rate for ecommerce?

How do discounts affect customer behavior?

Do frequent discounts hurt your brand?

Is the "Who's VieweHow can I reduce cart abandonment without huge discounts?d Your Profile" feature truly useful?

Conclusion

Look, here’s the bottom line on discounting in 2025.

Discounts are powerful. 70% of customers buy unplanned items because of discounts. Coupons reduce prices by an average of 19%. Nearly 40% of transactions now involve some kind of deal. The market is massive at $4.3 trillion, but it’s also hypercompetitive.

But power without strategy is just noise.

The brands winning right now aren’t the ones offering the biggest discounts. They’re the ones being strategic about when, how, and why they discount. They understand their margins. They add business value beyond price. They use discounts as a tool, not a crutch.

Your action plan? Start here:

Audit your current discounting strategy. Are you training customers to wait for sales? Are your margins healthy? Are you attracting the right buyers?

Set clear rules. Decide what types of customers get what levels of discount, and stick to it.

Test alternatives. Before you drop prices, try improving your value proposition, your checkout experience, or your sales tax transparency.

Track the right metrics. Don’t just measure revenue. Measure profit, customer lifetime value, and repeat purchase rates at different discount levels.

Discounting isn’t going anywhere. In a market where 38% of sectors are offering aggressive deals and 70% of carts are abandoned, you need a pricing strategy that works.

Just make sure it’s a strategy that builds your business, not one that slowly bleeds it dry.

Whether you’re in fashion competing at 30% off, in SaaS negotiating annual contracts, or in cold outreach (like Salesso) helping businesses connect with the right prospects, understanding the psychology and economics of discounting gives you an edge.

Price with intention. Discount with purpose. Grow with profit.

Other Useful Resources

To understand how to systematically cut 5.7-month ramp times by providing qualified pipeline from day one, explore these resources:

Email Deliverability & Infrastructure:

- Compare Folderly alternatives for email deliverability monitoring supporting new rep outreach campaigns

- Explore inbox placement tools ensuring early-stage messaging reaches decision-makers

Prospecting Strategy:

- Review comprehensive B2B prospecting methods understanding systematic approaches eliminating 7,000+ activity burden

Pipeline & Meeting Management:

- Learn how to schedule appointments with clients streamlining new rep demo coordination

Decision-Maker Strategy:

- Learn how to reach B2B decision-makers targeting ideal prospects for early wins

LinkedIn Profile Optimization:

- Review LinkedIn headline for student understanding profile fundamentals

Platform Intelligence:

- Review LinkedIn learning usage statistics showing platform professional development engagement

Account executive ramp-up statistics document the systematic productivity crisis—average 5.7 months for SaaS (up 32% from 4.3 months in 2020), 9-12 months Enterprise, 4-6 months Mid-Market, 1-3 months SMB, and 3.2 months SDRs revealing industry-wide ramp time expansion creating enormous costs where every month longer costs $125K per rep with $500K annual quota (6-month versus 3-month ramp = $125K+ lost per person, scale across 5 hires = $625K opportunity loss), 22% turnover occurring in first 90 days from poor onboarding (total cost to ramp estimated at 3x base salary including recruiting, training, lost productivity), yet 88% admit onboarding is subpar lasting just a week creating vicious cycle where slow ramps pressure top performers to cover shortfalls causing burnout, pull managers from coaching to firefighting, and restart hiring processes repeatedly. The infrastructure solutions exist—structured 30-60-90 day programs boost retention 82% and productivity 70%+ (Days 1-30 foundation, 31-60 application, 61-90 autonomy), continuous coaching improves quota attainment 28% (AI coaching delivers 3.3x year-over-year growth, 90% rate manager coaching positively), AI tools provide 30% productivity gains with sellers 3.7x more likely to meet quota (real-time call coaching closes deals 11 days faster, prospecting automation saves 5 hours weekly), tiered quotas (0% months 1-2, 50% month 3, 75% month 4, 100% month 5) set realistic expectations, and companies with aligned sales/marketing see 19% faster growth plus 15% higher profits demonstrating organizational coordination advantages—yet implementing these solutions systematically while addressing the root cause preventing fast ramps proves difficult for most organizations. The fundamental barrier emerges clearly: new hires need pipeline to learn, practice, build confidence, and generate early wins proving what good looks like, yet it takes 7,000+ activities to close first deal creating catch-22 where reps must build pipeline to ramp but can’t ramp without pipeline to practice on, spending first 90 days sifting through bad data, chasing unqualified prospects, dealing with empty lead flow preventing the momentum required for skill development where no pipeline means no practice, no wins, no progress ballooning ramp times from promised 4 months to actual 5.7-7+ months as new hires struggle navigating complex buying committees, handling sophisticated objections, and negotiating contracts without adequate qualified opportunities to develop competencies systematically. The promotional transition compounds challenges—top SDRs promoted to AE roles possess meeting-booking skills that don’t automatically translate to full-cycle deal closing, yet they make critical mistake stopping prospecting wrongly assuming leads will flow creating pipeline drought precisely when they need maximum practice opportunities to develop new competencies, while information overload without structure (firehose of product docs, sales decks, process guides dumped in week one) plus unrealistic quotas (full quota from day one demotivating before fair shot) and lack of ongoing coaching (72% say manager one-on-one is most important yet most managers lack time or training to deliver) prevent systematic skill development even when pipeline exists creating multi-factorial ramp crisis no single solution addresses comprehensively. The article’s repeated banner positioning addresses the fundamental pipeline root cause: “Cut Sales Ramp Time by 50%” delivering qualified pipeline from day one eliminating 5-month ramp, “Eliminate the Pipeline Problem Today” filling new rep pipelines in week one, “Fix Your Lead Quality Problem” building targeted campaigns giving qualified pipeline needed, “LinkedIn Outbound Accelerates Ramp-Up” providing complete targeting/design/scaling putting meetings on calendars from day one, and “Stop Waiting for Reps to Ramp” delivering consistent pipeline while team learns to close. Our complete LinkedIn outbound system eliminates the ramp-up crisis at its root—delivering 15-25% response rates through done-for-you targeting, campaign design, and scaling that provides qualified pipeline from day one enabling new hires to practice on real opportunities with budget/authority/need/timeline (not sifting through bad data for 90 days), generate early wins building confidence and learning “what good looks like” (preventing 22% first-90-day turnover from poor onboarding), compress 7,000+ activities to first deal through pre-qualified prospects (versus building pipeline from scratch during ramp window), support 30-60-90 day onboarding structure with actual deals to apply training on (Days 31-60 application phase needs pipeline to conduct discovery calls, demos, first deal by day 45-60), and enable continuous coaching focused on deal execution not prospecting mechanics (managers coach on closing skills using qualified opportunities versus firefighting empty pipelines or teaching list building) converting ramp-up knowledge into actual faster productivity without the pipeline building burden, bad data waste, empty lead flow, prospecting learning curve, or catch-22 of needing pipeline to ramp but can’t ramp without pipeline preventing most organizations from achieving the documented advantages of formal onboarding (82% retention, 70%+ productivity), continuous coaching (28% quota improvement, 3.3x AI coaching growth), AI tools (30% productivity, 3.7x quota likelihood, 11-day faster closes, 5-hour weekly savings), tiered quotas, and sales/marketing alignment (19% faster growth, 15% higher profits) systematically cutting 5.7-month average ramp (up 32% from 4.3 months creating $125K+ per rep cost) back toward faster productivity where every week earlier generates revenue, prevents turnover, builds confidence, and eliminates the vicious cycle of slow ramps pressuring performers, burning out managers, and restarting hiring processes documented throughout ramp-up statistics as primary barrier to sales team scaling and growth acceleration in competitive 2025 environment where longest ramps (9-12 months Enterprise) prevent quick market penetration and shortest possible ramps (1-3 months SMB) require immediate pipeline access systematic LinkedIn outbound directly provides from day one eliminating the 7,000-activity first-deal burden new hires building pipelines from scratch cannot overcome within reasonable timeframes.

- blog

- Statistics

- Discounting Statistics in Sales: 2025 Data & Trends