Forecast Accuracy Statistics: The Essential Guide to Hitting Your Sales Quota

- Sophie Ricci

- Views : 28,543

Table of Contents

Forecast Accuracy Statistics

- 93% of sales leaders can’t forecast revenue within a 5% margin of error, even with just two weeks left in the quarter

- Only 20% of sales organizations achieve forecasts within the “excellent” 5% range according to industry standards

- 43% of organizations miss their sales projections by 10% or more, showing widespread forecasting failure

- 80% of organizations fail to achieve forecast accuracy greater than 75%, far below best-in-class standards

- Less than 50% of sales leaders and sellers have high confidence in their company’s forecasting accuracy

- Fewer than 20% of sales leaders would rate their organization’s forecast as “predictable” in recent polls

- 67% of organizations lack a structured, formalized approach to forecasting, relying on inconsistent methods

- Best-in-class sales organizations consistently hit 90-95% forecast accuracy, enabling confident planning and resource allocation

- 97% of companies with industry-leading forecasting processes reach their sales quota, compared to only 55% without

- Teams that master forecasting are 10% more likely to grow annual revenue and twice as likely to outcompete peers

- Deals with no activity for 30+ days are 80% less likely to close, yet often remain in active forecasts

- Markers of customer indecision appear in 90% of analyzed sales calls, causing deals to stall rather than close

- AI-driven forecasting can reduce forecast errors by 20-50% through objective data analysis and pattern recognition

- Companies using AI report a 65% reduction in lost sales due to better inventory and resource planning

- Sales projections within a 5% margin are rated “excellent”, while 10% margin earns a “good” rating per Forrester research

It’s the final week of the quarter. The pressure’s on, deals are slipping, and leadership is asking that one question that sends chills down the sales floor: “Is this number real?”

Here’s the uncomfortable truth: 93% of sales leaders can’t forecast revenue within a 5% margin of error—even with just two weeks left in the quarter.

For most sales professionals, forecasting feels like tedious admin work. A number you submit for your manager’s dashboard. But this perspective misses something critical: forecast accuracy isn’t just a reporting metric—it’s one of the most powerful, learnable skills that separates top performers from everyone else.

This guide transforms forecasting from a chore into your strategic weapon. You’ll learn what “good” actually looks like, understand the key metrics that matter, diagnose what’s killing your accuracy, and discover a concrete playbook to take control of your numbers—and your commission check.

What is a Good Level of Forecast Accuracy?

At its core, forecast accuracy measures how closely your predicted sales value matches what actually closes. It’s the ultimate test of predictability and the foundation of smart business strategy.

But what counts as “good” in the real world?

The Gold Standard

Industry benchmarks give us clear targets. According to Forrester research, sales projections within a 5% margin are “excellent,” while 10% margin earns a “good” rating. Best-in-class sales organizations consistently hit 90-95% forecast accuracy—a level of precision that allows confident planning and resource allocation.

The Reality Check: A Confidence Crisis

Despite these clear benchmarks, most organizations fall dramatically short. The data reveals a massive gap between standard and reality:

Only 20% of sales organizations achieve forecasts within the “excellent” 5% range. Even more concerning, 43% miss their projections by 10% or more. Some reports paint an even bleaker picture: 80% of organizations fail to achieve forecast accuracy greater than 75%.

This poor performance breeds skepticism. Less than 50% of sales leaders and sellers have high confidence in their company’s forecasting accuracy. A January 2024 poll found that fewer than 20% of sales leaders would rate their organization’s forecast as “predictable.”

🎯 Fix Your Pipeline at the Source

Predictable LinkedIn Outbound Campaigns Deliver Consistent Quality Leads Every Quarter

The root cause? An estimated 67% of organizations lack a structured, formalized approach to forecasting—leaving sales professionals to rely on inconsistent methods and gut feelings.

The Vicious Cycle

This creates a destructive pattern. Widespread failure to meet benchmarks erodes leadership’s trust in the numbers. When leaders don’t trust forecasts, they increase scrutiny on individual deals. This heightened pressure causes dysfunctional behaviors: some “sandbag” by intentionally under-forecasting to guarantee wins, while others inflate pipelines with optimistic “happy ears” thinking.

Both behaviors, driven by broken trust, become primary contributors to forecast errors—feeding the cycle of poor performance and further destroying confidence across the organization.

The Role of Demand Forecasting in Attaining Business Results

Inaccurate forecasting ripples across entire businesses, affecting everything from inventory to hiring. But for you as a sales professional, these consequences are deeply personal—directly shaping your reputation, income, and career trajectory.

The High Cost of Inaccuracy

Over-forecasting: The Credibility Killer

Consistently forecasting deals that fail to close is the fastest way to lose leadership trust. While missed earnings expectations damage market confidence and valuations at the company level, for individuals it results in a reputation for being unreliable. This invites intense micromanagement, skepticism about future opportunities, and loss of autonomy.

Under-forecasting: The Opportunity Cost

“Sandbagging” might feel safe—a way to ensure wins. But it signals a lack of strategic insight and starves the organization of necessary resources. Under-forecasting leads to underinvestment in growth initiatives. For you, this manifests as smaller marketing budgets generating fewer quality leads, or hiring freezes on support roles that leave you buried in administrative tasks.

The Career-Boosting Benefits of Precision

Mastering forecast accuracy provides tangible, career-altering advantages. It’s a key performance indicator reflecting your command over your pipeline and business acumen.

Become the Source of Truth

Sales professionals who build track records of precision become trusted advisors within their organizations. Their deals are viewed as bankable, gaining preferential access to critical internal resources—legal, finance, solutions engineering—needed to navigate complex approvals and close deals faster.

Drive Your Own Success

An accurate forecast is the foundation of proactive selling. When you can reliably predict quarterly performance, you identify pipeline gaps early and ask for specific, targeted help. This allows strategic course-correction rather than reactive scrambling in the final days.

The Ultimate Link to Quota Attainment

The connection between forecasting skill and sales success isn’t theoretical. According to Aberdeen Group research, a staggering 97% of companies with industry-leading forecasting processes reach their sales quota. In contrast, only 55% of organizations without best-in-class approaches meet targets. Furthermore, teams that master forecasting are 10% more likely to grow annual revenue and twice as likely to outcompete industry peers.

📈 Want 97% Quota Attainment?

Start With Predictable Lead Flow From Our Proven LinkedIn Targeting and Campaign System

Your forecast accuracy functions as internal currency. High accuracy buys autonomy, trust, and preferential access to limited resources required to win. A history of precision signals to leadership that investing a solution engineer’s time or legal’s attention in your deal is sound business. In contrast, low accuracy incurs a “tax” in the form of micromanagement, skepticism, and friction in securing those same resources.

What Factors Affect Your Attainable Forecast Accuracy

Before you can fix your forecast, you must diagnose what’s breaking it. Inaccuracy rarely results from a single mistake—it’s typically the outcome of several underlying issues in process and judgment.

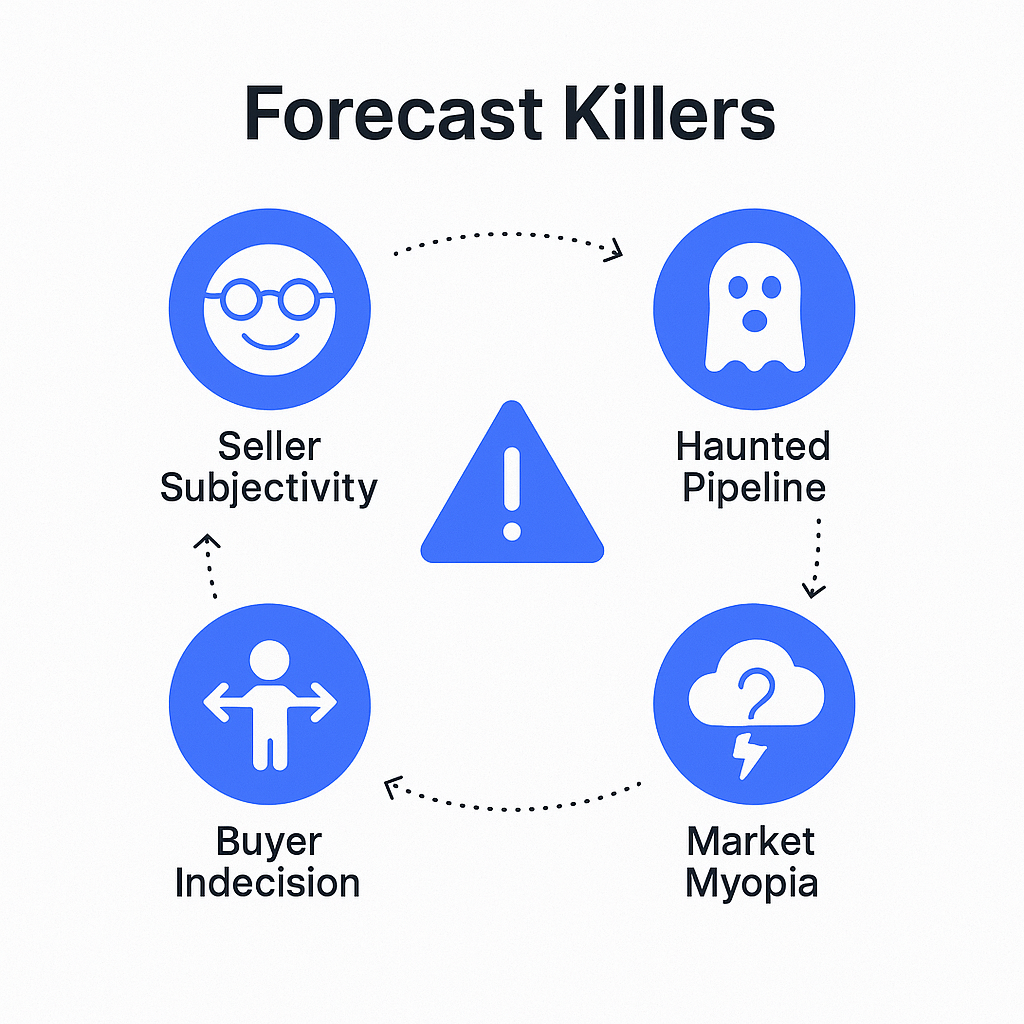

These five “forecast killers” are the most common culprits:

Seller Subjectivity (The “Happy Ears” Epidemic)

This is the classic challenge of relying on gut feelings and optimistic interpretations rather than objective, verifiable data from sales data. Sales professionals, naturally optimistic, fall into the trap of hearing what they want from prospects. This is especially prevalent with sparse pipelines and emotional investment in few deals.

The key to combating this: shift focus from what the buyer says to what the buyer does. Customer words are subjective; customer actions are demand data.

The Haunted Pipeline (Garbage In, Garbage Out)

Nothing undermines forecast accuracy faster than a CRM cluttered with phantom opportunities. These deals pad the pipeline, creating false security, but aren’t real. They appear in three forms:

💀 Stop Chasing Ghost Deals

Our LinkedIn Outbound Strategy Delivers Pre-Qualified Prospects With Real Budget and Intent

- “Ghost Deals”: Opportunities without specific deal amounts

- “Timeless Wonders”: Deals missing projected close dates

- “Walking Dead Deals”: Stale opportunities that constantly slip quarters

Research shows deals with no activity for 30+ days are 80% less likely to close—yet they often remain in active forecasts.

Undefined Deal Stages (The “Feels Like” Problem)

A primary cause of inaccuracy is advancing deals based on subjective feelings (“it feels like we’re in the proposal stage”) rather than objective, buyer-centric milestones. A robust sales process must have clearly defined entry and exit criteria for each stage based on concrete actions taken by the customer, not just the seller.

For example, deals shouldn’t move to “proposal review” simply because you sent the proposal, but only after the buyer confirms receipt and schedules a formal review session.

Market Myopia (Ignoring the Headwinds)

Even the most rigorously managed sales process can be derailed by external forces. Sales professionals who operate in a vacuum, ignoring broader market conditions, set themselves up for failure. Factors like economic downturns, inflation, new competitive launches, or regulatory changes can all impact buyer ability and willingness to purchase.

Buyer Indecision (The “JOLT Effect”)

Often, deals don’t die with a definitive “no.” They wither in customer indecision. Research published in “The JOLT Effect” found markers of customer indecision in 90% of analyzed sales calls. Sales professionals who misinterpret stalling as continued progress—believing the customer is “still thinking about it”—will have wildly inaccurate forecasts.

The Causal Chain

These five killers aren’t isolated—they often form a debilitating sequence. It begins with lack of a defined, objective sales process (Killer #3). Without clear criteria, you’re forced to rely on seller subjectivity (Killer #1). This directly results in a haunted pipeline (Killer #2) filled with poorly qualified deals lacking concrete amounts, close dates, or verified buyer commitment.

When this fragile pipeline inevitably gets struck by external shocks—market headwinds (Killer #4) or key stakeholder cold feet from buyer indecision (Killer #5)—the forecast collapses. Operating on subjectivity, you’re already emotionally invested and more likely to interpret red flags as minor delays rather than existential threats.

This demonstrates that fixing forecast accuracy requires starting at the root: defining the process to enforce objectivity, which in turn cleans the pipeline and makes it more resilient to unavoidable real-world shocks.

How to Assess Forecast Quality

Before improvement begins, you must know your starting point. This requires conducting a personal audit within your CRM.

Look back at the past four quarters. Compare your “forecast submission” value at various points (week 4, week 8, week 12) to the final “closed won” actuals for each period.

This exercise allows you to calculate your personal accuracy metrics and identify any consistent bias patterns—providing a clear, data-backed understanding of your historical performance. This baseline becomes your starting point and measures your progress over time.

Without this self-audit, you’re flying blind. You might think you’re accurate when you’re consistently off by 15%, or believe you’re conservative when you’re actually inflating numbers. The data doesn’t lie, and it gives you an objective foundation to build improvement strategies.

How the Main Forecast Accuracy Metrics Work

To improve forecast accuracy, you must first understand how it’s measured. While becoming a data scientist isn’t required, grasping key metrics is non-negotiable for any sales professional wanting to take control of their performance.

These metrics provide objective feedback needed to diagnose issues and track improvement:

MAPE (Mean Absolute Percentage Error)

Think of this as your long-term accuracy “batting average.” MAPE measures the average percentage difference between forecasted and actual values, making it excellent for tracking personal improvement over time or comparing accuracy against peers, regardless of deal size or quota.

For example, if you forecast $100,000 and close $90,000, the absolute error is $10,000, and the percentage error for that forecast is 11.1%. MAPE is the average of these percentage errors across all your forecasts in a given period.

MAE (Mean Absolute Error)

This metric represents the average dollar value of a miss. Unlike MAPE, which is a percentage, MAE quantifies the raw financial impact of an inaccurate forecast in the same units as the sale (dollars). It answers: “On average, by how many dollars was my forecast off?”

For instance, if you miss one forecast by $10,000 and another by $20,000, your MAE is $15,000.

Forecast Bias

This diagnostic metric reveals whether you’re a chronic optimist or pessimist. It measures the consistent tendency to either over-forecast (positive bias, often due to “happy ears”) or under-forecast (negative bias, aka “sandbagging”). A persistent bias—whether positive or negative—signals a systemic flaw in judgment or process that needs addressing.

RMSE (Root Mean Squared Error)

This metric acts as a “big miss” penalty. By squaring the differences between forecast and actual values, RMSE gives disproportionately more weight to large forecast errors. It’s particularly useful for understanding if your forecast is generally stable with minor deviations or prone to occasional massive mistakes that severely impact the business.

Quick-Reference Guide

Metric | What It Measures | Ask Yourself This | Why It Matters |

MAPE | Average percentage your forecast is off | “Over the last year, what was my average percentage error?” | Your credibility score over time. High MAPE tells your manager your pipeline is unpredictable |

MAE | Average dollar amount of your forecast error | “On average, how many dollars away from actual is my forecast?” | Quantifies real financial impact of your misses and helps in risk assessment |

Forecast Bias | Consistent tendency to over- or under-forecast | “Am I consistently wearing ‘happy ears’ or sandbagging deals?” | Reveals systemic flaws in judgment or qualification process needing correction |

RMSE | Standard deviation of forecast errors, penalizing large misses | “Is my forecast generally close, or do I make occasional massive errors?” | High RMSE indicates high volatility and risk, even if average error (MAE) is low |

How to Monitor Forecast Accuracy

Taking control of forecast accuracy requires discipline and a structured approach. This practical, five-step playbook provides a clear path to transform your forecasting from guesswork into a reliable game plan.

Step 1: Establish Your Baseline (Self-Audit)

Before improvement can begin, know your starting point. Conduct a personal audit within your CRM. Look at the past four quarters and compare “forecast submission” values at various points (week 4, 8, 12) to final “closed won” actuals.

This allows you to calculate your personal MAPE and identify any consistent forecast bias, providing clear, data-backed understanding of historical performance.

Step 2: Conduct a Ruthless Weekly Pipeline Review

This is about disciplined CRM hygiene. Every week, review every single deal in your forecast against this simple checklist:

- Does every opportunity have complete critical fields, including realistic amount and close date?

- Does every deal have a clearly defined, owner-assigned next step with a specific date?

- Has any deal been inactive for 30+ days? If so, immediately re-qualify or move out of active forecast

- Does the current deal stage reflect an objective, verifiable buyer action (e.g., “Have they provided feedback on the proposal?” or “Is budget allocated?”) rather than just seller action?

Step 3: Become a Sales Cycle Expert

Every sales professional must know their average sales cycle length. This number becomes a critical health metric for every pipeline deal.

An opportunity sitting in your pipeline significantly longer than average is a major red flag. It’s likely a “Walking Dead Deal” bloating your forecast that should be critically re-evaluated or removed.

Step 4: Reframe Your 1:1s (From Reporting to Strategizing)

Proactively change the nature of your weekly 1:1 meetings with your manager. Instead of simply reporting numbers, come prepared for a strategic coaching session about deal health.

Move beyond superficial questions. Shift the conversation from “Do you have executive sign-off?” to more powerful, verifiable questions like “Do all executive stakeholders know they’re in an active buying process?”

This approach transforms 1:1s from simple inspections into collaborative sessions that actively improve deal strategy and forecast accuracy.

Step 5: Commit with Confidence (and Discipline)

Use forecast categories with strict discipline. A common framework includes “Commit,” “Best Case,” and “Pipeline.”

Commit: These are deals you’d bet your job on. There’s overwhelming, objective evidence they’ll close within the quarter. All approvals are secured, and contracts are in final stages.

Best Case: These are well-qualified deals where you’re confident, but one or two critical milestones still need clearing (e.g., final legal review, executive sign-off).

This disciplined use of categories requires honesty with yourself and your managers. Some organizations encourage this honesty by incentivizing results that fall within a specific percentage of the salesperson’s committed forecast.

The Future: Your AI-Powered Co-Pilot

The evolution of sales technology is shifting CRMs from passive record systems to active intelligence partners. Artificial intelligence and accuracy machine learning are at the forefront, offering powerful tools to enhance forecasting capabilities.

🚀 AI Meets LinkedIn Outbound

Combine Data-Driven Targeting With Scalable Campaign Design For Predictable Revenue Growth

7-day Free Trial |No Credit Card Needed.

How AI/ML Solves Core Problems

AI-powered forecasting tools address fundamental “forecast killers” by replacing subjective human judgment with objective data analysis:

Reduces Human Bias: AI doesn’t have “happy ears” or emotional attachment to deals. It analyzes historical data from thousands of past deals to assign win probabilities based on what actually happened in similar situations, not what a rep hopes will happen—directly combating seller subjectivity.

Spots Risks Humans Miss: AI models analyze dozens of signals simultaneously—deal stage progression speed, rep activity levels, customer email sentiment—to detect anomalies and flag at-risk deals. This serves as an early warning system for “Walking Dead Deals” that humans might overlook until too late.

Continuous Learning: Unlike static spreadsheets or fixed rules, AI models continuously learn from every new win and loss. As more data flows into the system, algorithms become smarter and forecasts more accurate over time, creating an intelligent system that constantly improves.

The Impact is Significant

Studies show AI-driven forecasting can reduce forecast errors by 20-50%. This enhanced accuracy has direct impact on business outcomes, with companies using AI reporting a 65% reduction in lost sales due to better inventory and resource planning.

AI shouldn’t be viewed as a replacement but rather as a personal “deal coach” or co-pilot. It provides objective, data-driven insights that help you make better decisions about where to focus time, which deals need immediate attention, and how to call your number with confidence.

Measuring Forecast Accuracy is a Good Servant but a Poor Master

While metrics are essential for improvement, they’re tools—not the end goal. The danger lies in becoming so fixated on hitting specific accuracy percentages that you lose sight of what matters: closing business and building genuine customer relationships.

Balance is key. Use forecast accuracy to inform your approach, not dictate it. The best sales professionals understand that accuracy metrics reveal patterns and trends, but human judgment, relationship-building, and strategic thinking still drive deals forward.

Think of forecast accuracy as your diagnostic dashboard. It tells you when something’s wrong and helps you identify the problem, but it doesn’t replace the art of selling. A surgeon uses monitors and measurements to guide surgery, but their skill and experience ultimately save the patient’s life.

Focus on controllable actions, not just outcomes. You can’t always control whether a deal closes, but you can control:

- The quality of your discovery process

- The rigor of your qualification criteria

- The consistency of your CRM hygiene

- The honesty of your deal assessment

When you focus on these controllable elements, accuracy naturally improves.

Build trust through consistency. The real power of forecast accuracy isn’t in hitting a specific number one time—it’s in demonstrating predictability over time. Even if you’re not at 95% accuracy yet, consistent 75% accuracy with transparent communication builds more trust than erratic swings between 50% and 90%.

Use data to inform, not replace, your sales instincts. The goal is augmented intelligence: combining the pattern recognition of AI and metrics with the contextual understanding and relationship insights only humans possess.

Other Useful Resources

To understand how to systematically generate the 90 qualified opportunities needed annually while spending less than 30-33% of time selling, explore these resources:

Email Deliverability & Infrastructure:

- Compare Folderly alternatives for email deliverability monitoring supporting outbound campaigns

- Explore inbox placement tools ensuring messages reach decision-makers across 5-month sales cycles

Pipeline & Meeting Management:

- Explore free pipeline management tools for tracking 5.3x pipeline coverage requirements

- Learn how to schedule appointments with clients streamlining 5-7 weekly demo coordination

Decision-Maker Strategy:

- Learn how to reach B2B decision-makers engaging 5-stakeholder buying committees efficiently

LinkedIn Profile Optimization:

- Review LinkedIn headline for student understanding profile fundamentals

Platform Intelligence:

- Review LinkedIn learning usage statistics showing platform professional development engagement

Account executive activity statistics document the systematic quota crisis—80-90% projected to miss quota in 2025 despite median $800K targets (up from $740K), 51% achieving quota (down from 66%), and 19% median win rate (down from 23%) creating brutal 5.3x pipeline coverage requirement ($5.30 qualified pipeline per $1 quota) where hitting $800K with $47K median deals demands 17 annual closes requiring approximately 90 qualified opportunities throughout the year at 19% win rate. The productivity crisis compounds challenges systematically—reps spend only 30-33% of time actually selling with 43% burning 10-20 hours weekly on administrative work (note-taking, CRM updates, content searching, meetings) consuming two-thirds of day before even picking up phone, yet automation delivering 14.5% higher productivity and real-time visibility enabling 28% higher year-over-year revenue growth remain underimplemented preventing time reclamation for actual selling. The activity benchmarks document execution burden: 60-70 total daily activities (17-33 calls, 23-33 emails, 12-13 LinkedIn actions) generating 5-7 weekly demos across 5-month median sales cycles with 5 decision-makers average creating volume requirements, 36-40% of pipeline depending on marketing/SDR teams demanding tight collaboration (seamless teams achieve 3-5x better outcomes versus misaligned), and cold email reply rates declining for 69% of senders due to spam filtering/AI content fatigue revealing diminishing returns from traditional high-volume approaches. The consultative selling imperative creates discipline demands most struggling to maintain—top performers conducting thorough needs discoveries (58% more likely), listening 54-57% of conversations (speaking only 43-46%) versus average performers speaking 68% and low performers 72%, handling objections viewing them as clarification opportunities not rejections (60% say no 4 times before yes yet 44% quit after single no), collaborating deeply throughout buyer process (59% more likely), and building strong ROI cases (63% more likely) recognizing buyers complete 70% research before engaging requiring advisory positioning not product pushing. The mathematical reality proves brutal: median $800K quota ÷ $47K deal size = 17 deals needed ÷ 19% win rate = 90 opportunities required annually, yet generating 90 qualified opportunities while maintaining 43-46% talk-to-listen ratio, conducting meticulous 5-7 weekly discovery demos, handling objections through 4 “no” responses before “yes”, collaborating across marketing/SDR handoffs, and protecting 30-33% selling time from 10-20 hour administrative burden demands infrastructure most AEs manually executing 60-70 daily activities (17-33 calls, 23-33 emails, 12-13 LinkedIn) across 5-month cycles with 5 stakeholders cannot systematically maintain preventing quota achievement. The article’s repeated banner positioning addresses the fundamental solution: “Hit Your Sales Quota Consistently” filling pipeline with qualified prospects automatically, “Automate Your Pipeline Generation” booking meetings while focusing on closing, “Stop Relying on Marketing Alone” generating 30-50 qualified LinkedIn meetings monthly eliminating 36-40% dependency, “Need More Quality Demos?” filling calendars with ideal prospects who show, and “Build 5X Pipeline Coverage Fast” scaling discovery to 200+ monthly conversations systematically achieving required 5.3x coverage. Our complete LinkedIn outbound system eliminates the quota crisis infrastructure—delivering 15-25% response rates through done-for-you targeting, campaign design, and scaling that generates the 90 annual qualified opportunities needed ($800K quota ÷ $47K deals ÷ 19% win = 90 pipeline) without consuming the 67-70% non-selling time in administrative burden, executing 30-50 monthly qualified meetings eliminating 36-40% marketing/SDR dependency creating collaboration friction (3-5x outcome difference aligned versus misaligned), filling 5-7 weekly demo slots systematically with pre-qualified prospects, engaging 5-stakeholder buying committees coordinately across 5-month sales cycles, and automating prospecting mechanics (60-70 activities: 17-33 calls, 23-33 emails, 12-13 LinkedIn daily) protecting the precious 30-33% selling time for actual consultative conversations where top performers excel—conducting thorough discoveries (58% more likely), maintaining 43-46% talk-to-listen ratio versus average 68% or low 72%, handling objections through 4 “no” responses before “yes” (while 44% quit after 1), collaborating deeply (59% more likely), building ROI cases (63% more likely), and applying advisory positioning buyers completing 70% research demand rather than generic product pushing—converting activity statistics knowledge into actual quota achievement (reversing 80-90% miss rate to 51% achievement back toward historical 66%) through systematic LinkedIn outbound execution that builds required 5.3x pipeline coverage generating 90 opportunities annually supporting 17 closed deals hitting $800K median quota without the administrative burden, marketing dependency, manual activity volume, or consultative discipline gaps preventing most account executives from converting documented top-performer behaviors into consistent quota achievement in 2025’s increasingly difficult selling environment where cycles lengthened to 5 months, stakeholders increased to 5, quotas rose to $800K, win rates dropped to 19%, and achievement fell from 66% to 51% creating the documented 80-90% quota miss crisis systematic LinkedIn pipeline automation directly addresses.

FAQs

What's the average sales forecast accuracy?

How often should I update my forecast?

What's more important: MAPE or MAE?

How do I handle deals that keep slipping?

Can AI really improve my forecast accuracy?

- blog

- Statistics

- Forecast Accuracy Statistics: Key Metrics for Sales Success