Expansion Revenue Statistics: Your Complete Guide to SaaS Growth in 2025

- Sophie Ricci

- Views : 28,543

Table of Contents

Expansion Revenue Statistics

- Customer acquisition costs have surged 222% over the last eight years, making growth increasingly expensive

- In 2013, brands lost an average of $9 per new customer, but today it’s $29 per customer acquired

- Average B2B company spends $942 to $1,907 per customer depending on the acquisition channel used

- Probability of selling to a new prospect is only 5-20%, while selling to existing customers jumps to 60-70%

- 44% of companies prioritize acquisition over the 18% who focus on retention, showing massive efficiency gap

- It costs 5 to 25 times more to acquire customers than to retain them, yet most prioritize new customer hunting

- Sustainable businesses maintain at least a 3:1 ratio of LTV to CAC, while ratios below 3:1 are unsustainable

- Email marketing delivers an ROI of $36 to $40 for every $1 spent for warm audiences

- It takes sending 306 cold emails to generate just one B2B lead, showing the challenge of cold outreach

- Personalized subject lines get 32.7% more replies compared to generic subject lines in cold email campaigns

- First follow-up email alone can boost reply rates by 49%, making persistence critical for success

- 80% of sales require five or more follow-ups, yet 92% of sales reps give up after just four attempts

- 84% of B2B decision-makers start their buying process with a referral, making referrals the lowest CAC channel

- Companies with formalized referral programs see 86% more revenue growth than those without structured programs

- Average B2B buying group now includes 10-11 people, directly contributing to longer sales cycles and higher costs

Your biggest growth opportunity isn’t landing that next new customer. It’s right there in your existing customer base, waiting to be unlocked.

In today’s competitive SaaS landscape, acquiring a new customer costs 5 to 25 times more than retaining an existing one. Yet many companies still chase new logos while leaving money on the table with their current customers.

This guide breaks down everything you need to know about expansion revenue—from what it really means to the exact benchmarks you should be tracking. Whether you’re looking to hit your growth targets or just understand why your best customers aren’t spending more, you’ll find practical insights backed by real data.

Let’s dive in.

💰 Revenue Sitting in LinkedIn Feeds

Your expansion targets are on LinkedIn daily. We help you reach them systematically.

What is Expansion Revenue in B2B SaaS?

Think of expansion revenue as the extra money you make from customers who are already paying you. It’s not about landing brand-new accounts—it’s about growing the ones you have.

Here’s what it includes:

Upsells: When a customer moves to a higher-priced plan. Maybe they started on your Basic plan at $49/month, and now they’re paying $149/month for Premium because they need more features.

Cross-sells: Selling additional products or services to existing customers. If someone uses your project management tool and then buys your time-tracking add-on, that’s a cross-sell.

Add-ons and usage-based growth: This happens when customers naturally use more of your product—more seats, more storage, more API calls. As their business grows, so does their spending with you.

The beauty of this revenue? You’ve already done the hard work of winning these customers’ trust. The heavy lifting of demos, security reviews, and contract negotiations is behind you. Now you’re just helping them get more value from what they already love.

Why is Expansion Revenue Important?

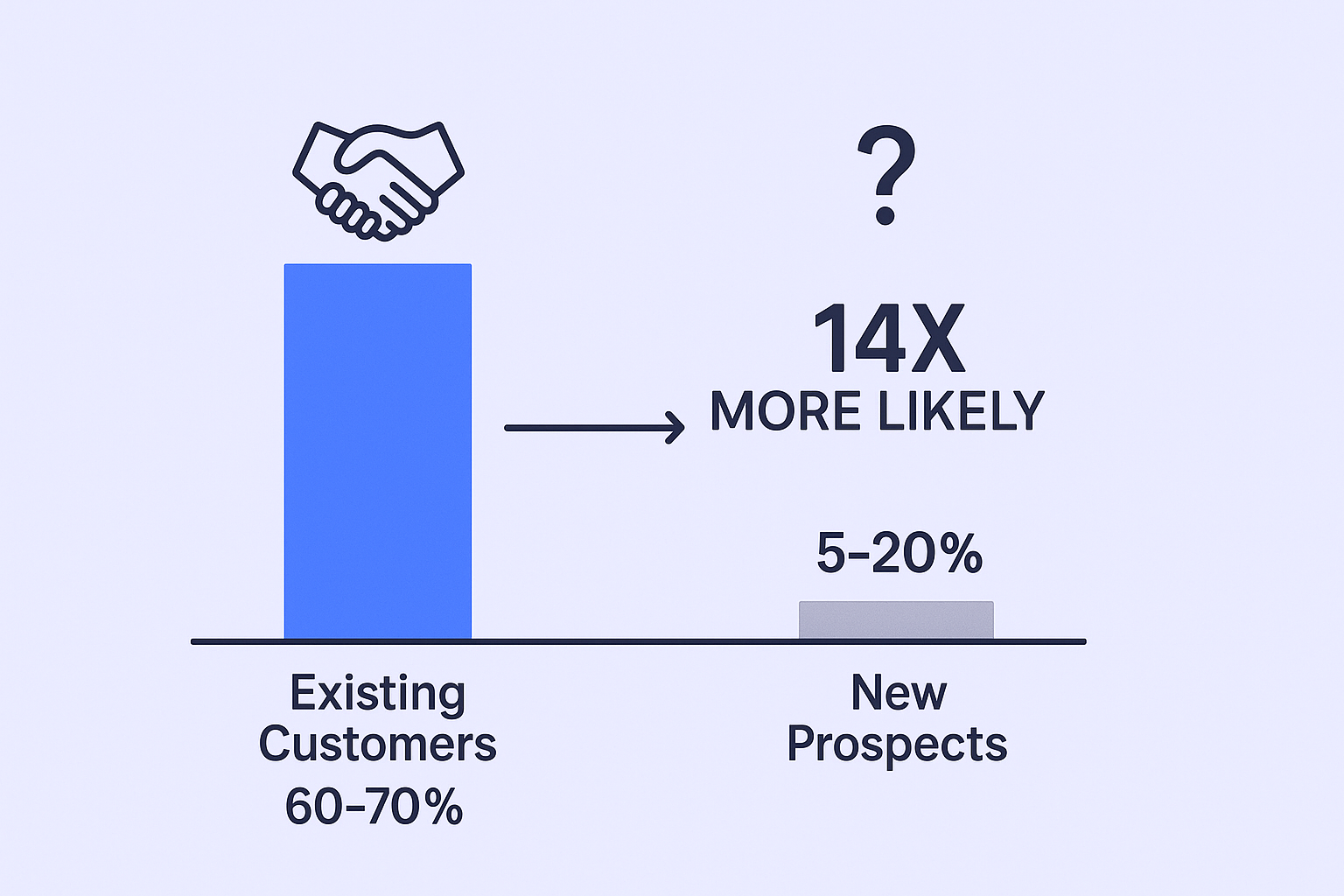

Here’s the raw truth: selling to an existing customer has a 60-70% success rate. Selling to a brand-new prospect? Only 5-20%. That’s not a typo—you’re literally up to 14 times more likely to close a deal with someone who already knows you.

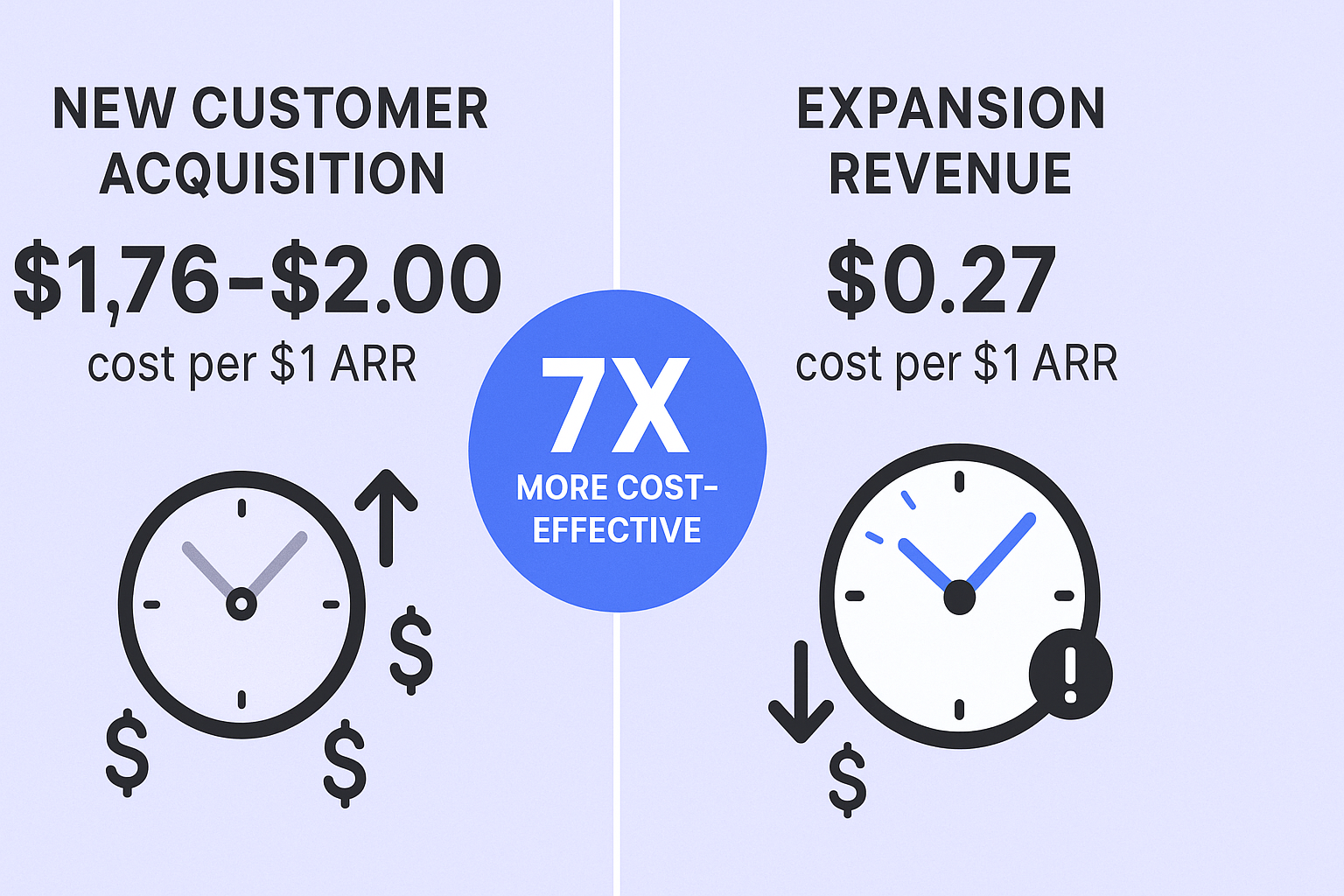

The economics are even more compelling. According to recent benchmarks, it costs a median of $1.76 to $2.00 to acquire just $1 of new annual recurring revenue. But for expansion? You’ll spend only about $0.27 to generate a dollar of upsell revenue. That makes expansion roughly 7x more cost-effective than new customer acquisition.

Think about what this means for your business:

- Faster profitability: While it takes most SaaS companies over a year to recoup new customer acquisition costs, expansion deals become profitable in just one quarter.

- Predictable growth: When you have a solid base of happy customers who keep spending more, you’re not starting from zero every quarter.

- Higher valuation: Investors love companies with strong expansion metrics. Research shows that every 1% increase in revenue retention can boost company valuation by 12% over five years.

Top-performing SaaS companies now generate 40% of their total new revenue from existing customers. For businesses over $50 million in ARR, that number jumps to 58-67%. The message is clear: the companies that win at expansion dominate their markets.

🎯 Target Expansion Accounts Like Elite Performers

Our LinkedIn outbound engine identifies and engages your ideal expansion prospects daily.

The Role of Customer Success in Driving Expansion Revenue

Your Customer Success team isn’t just there to keep customers happy—they’re sitting on a goldmine of expansion opportunities that most companies completely overlook.

Here’s why CS is your secret weapon: they talk to customers every single day. They see when usage spikes. They hear about new projects before they happen. They know which teams are hitting limits and which executives are frustrated by missing features.

The best CSMs spot expansion triggers before they become obvious:

- A customer consistently hitting their monthly limits

- New teams or departments starting to use the product

- Users repeatedly trying to access premium features

- Support tickets asking about advanced capabilities

- Major company milestones (acquisitions, new product launches, geographic expansion)

Modern CS teams don’t rely on gut feeling anymore. They use data from product analytics, support tickets, email conversations, and CRM interactions to automatically surface accounts ready for expansion. These aren’t cold pitches—these are warm, timely conversations about solving real problems.

The ideal workflow? Your CS team validates the need, shows how an upgrade solves a specific pain point, and then hands off to sales to close the commercial terms. It’s collaborative growth at its best.

Want to tap into this? Schedule regular check-ins with your CS team. Ask them: “Who’s getting the most value? Who’s outgrowing their current plan? Who’s launching something new?” The answers might surprise you.

Strategies to Measure and Impact Expansion Revenue

You can’t improve what you don’t measure. Here are the metrics that actually matter—and what to do about them.

Net Revenue Retention (NRR)

This is the single most important metric for measuring expansion success. NRR shows how much revenue you retained and grew from your existing customer base over time.

The formula:

NRR = (Starting ARR + Expansion – Churn – Downgrades) / Starting ARR × 100

Benchmarks to know:

- 100%+ is good (you’re growing despite churn)

- 115-125% is elite (top quartile performance)

- 101% is the current median for private SaaS companies

An NRR above 100% is magical because it means your business would still grow even if you stopped acquiring new customers entirely. That’s the holy grail of SaaS economics.

Expansion MRR Rate

This tracks the velocity of your growth from existing customers.

The formula:

Expansion MRR Rate = (Expansion MRR / Total MRR at period start) × 100

Benchmarks:

- 10-30% annually is healthy

- 3-6% monthly is best-in-class

Use this metric to understand if your expansion motion is accelerating or stalling.

Average Revenue Per Account (ARPA) Growth

Simply put: is each customer worth more this year than last year?

Track ARPA over time within the same customer cohorts. Top performers see 10-15% annual ARPA growth from their existing base. If yours is flat or declining, that’s a red flag that expansion isn’t happening.

📈 Fill Your Pipeline With Upsell-Ready Accounts

LinkedIn targeting puts your message in front of decision-makers showing expansion signals.

Actionable Tactics to Drive These Numbers

Now for the good stuff—what you can actually do to move these metrics.

Identify Product-Qualified Leads (PQLs)

These are users showing behavioral signals that they’re ready to upgrade:

- Hitting usage limits (seats, storage, API calls)

- Clicking on locked premium features repeatedly

- High engagement with core features

- Rapidly adding new team members

Set up automated alerts for these triggers. When someone hits 90% of their limit, reach out proactively: “Hey Sarah, noticed you’re crushing it this month and getting close to your project limit. Let’s chat about upgrading so nothing slows you down.”

Time Your Outreach Perfectly

Context is everything. Random upgrade pitches get ignored. Triggered outreach based on specific user actions gets responses.

Examples:

- Milestone celebrations: “Congrats on hitting 1,000 customers! Now let’s talk about how our Enterprise plan can help you scale to 10,000.”

- Feature exploration: “Saw you checked out our advanced reporting three times this week. Want a quick walkthrough?”

- Expansion signals: “Your team just invited 10 new users—nice! Our Business plan gives you unlimited seats at a lower per-user cost.”

Focus on Outcomes, Not Features

Nobody cares about “SSO integration” or “advanced analytics.” They care about saving time, reducing risk, and driving revenue.

Instead of: “The Enterprise plan has SSO.” Say: “The Enterprise plan will save your IT team 10+ hours per week on user provisioning and make your security audits way easier.”

Show ROI with real numbers and case studies. Make the value so obvious that saying no feels like leaving money on the table.

Statistics Related to Expansion Revenue

Let’s cut through the noise with the numbers that matter most in 2025.

The Cost Reality

- New customer acquisition: $1.76-$2.00 per $1 of new ARR (median across private SaaS)

- Expansion revenue: $0.27 per $1 of upsell ARR

- Simple math: Expansion is 5-7x more cost-effective than hunting new logos

Success Rates

- Selling to existing customers: 60-70% close rate

- Selling to new prospects: 5-20% close rate

- Bottom line: You’re up to 14x more likely to close expansion deals

Growth Contribution

- Median expansion revenue: 40% of total new ARR (across all SaaS companies)

- At scale (>$50M ARR): 58-67% of new ARR comes from expansion

- Top quartile companies: Generate 42-48% of new revenue from existing customers

Benchmark Performance

Metric | Good | Elite | Current Median |

Net Revenue Retention | 100%+ | 120%+ | 101% (private) |

Annual Expansion Rate | 10-30% | 30%+ | Varies by stage |

CAC Payback (New) | 12-18 months | <12 months | 14-16 months |

CAC Payback (Expansion) | 1-3 months | <1 month | 3 months |

The Valuation Impact

Here’s why investors obsess over these numbers:

- Companies with NRR >110% command premium valuations

- Every 1% increase in retention can boost valuation by 12% over 5 years

- 40% of SaaS value now comes from expansion potential, not just new customer growth

These aren’t vanity metrics. They’re the difference between sustainable growth and constantly scrambling to replace churned revenue.

Examples of Expansion Revenue in Action

Theory is nice. Real-world execution is better. Here’s how the best companies actually do it.

Slack: The Viral Land-and-Expand Machine

Slack’s strategy was brilliantly simple: make it stupidly easy for a single team to start using their product—often on a free plan.

The playbook:

- One small team adopts Slack to solve an immediate pain point

- The product is so good that users naturally invite colleagues

- Slack spreads virally across departments

- Eventually the whole company is on it and hits free plan limits

- Upgrading becomes a no-brainer because everyone’s already hooked

Your takeaway: Don’t always go for the enterprise-wide deal on day one. Land small, prove value fast, and let the product sell itself to other teams. Monitor free accounts with high engagement—those are your expansion opportunities.

Twilio: Consumption That Scales With Success

Twilio built their entire business model around a simple principle: when customers succeed, we succeed automatically.

They use pay-as-you-go, usage-based pricing. As a customer’s business grows and they need to send more messages or make more calls, Twilio’s revenue grows organically—no upsell conversation needed.

Their Dollar-Based Net Expansion Rate recently hit 108%, meaning customers automatically spend 8% more year-over-year just by growing their own businesses.

Your takeaway: If your product has consumption components, your job shifts from “selling more” to “helping customers get more value.” Their growth becomes your growth. Focus on being a strategic advisor, not a traditional salesperson.

Snowflake: The Consumption Powerhouse

Snowflake took usage-based pricing to another level by separating storage (cheap) from compute (expensive).

The strategy:

- Customers can dump all their data into Snowflake affordably

- As more teams need to query that data, compute usage explodes

- Different departments (data science, marketing, finance) all start running analyses

- Revenue scales with usage, automatically

The result? Net Revenue Retention rates as high as 169% in their early public years, now stabilized at a still-elite 125%.

Your takeaway: The initial sale might be complex and slow. That’s okay. Play the long game. Help customers see a future where their entire organization depends on your platform. That vision creates the conditions for massive expansion.

🚀 Scale Beyond Your Current Customer Base

Combine your expansion motion with our LinkedIn campaigns to reach lookalike enterprise accounts.

7-day Free Trial |No Credit Card Needed.

Leveraging Product Analytics and CRM Integration

The difference between average and exceptional expansion selling comes down to one thing: using data to move from guesswork to precision.

From Gut Feel to Data-Driven Decisions

Product analytics shows you exactly what users do inside your product:

- Which features they love (and which they ignore)

- Where they get stuck or frustrated

- What actions successful customers take

- When accounts show signs of expansion readiness

This isn’t marketing data or demographic information. This is pure behavioral intent—the most accurate signal you can get.

Setting Up Automated Sales Triggers

The real magic happens when you connect product analytics to your CRM. Suddenly, expansion opportunities trigger automatic alerts and tasks.

Real examples of automated plays:

The “Premium Feature Hunter” Alert: Set up: When a user on Standard plan clicks on Enterprise-only features 3+ times in a week → Create task for account owner Outreach: “Hey John, noticed you’ve been exploring our Advanced Reporting. Want to see it in action? I can show you how it works and we can discuss if it makes sense for your team.”

The “Hitting the Ceiling” Alert:

Set up: When account reaches 90% of monthly limit → Send Slack notification to sales Outreach: “Sarah, your team is absolutely crushing it this month! You’re close to your API limit. Let’s make sure you don’t hit any service interruptions—I can get you set up with more headroom today.”

Other Useful Resources

To understand how to systematically reach CFOs and VPs at expansion-ready accounts through LinkedIn targeting, explore these resources:

Email Deliverability & Tools:

- Compare Glockapps alternative options for email deliverability monitoring supporting expansion campaigns

- Explore inbox placement tools ensuring upsell messaging reaches decision-makers

Pipeline & Meeting Management:

- Explore free pipeline management tools for tracking expansion opportunities from PQLs to closed deals

- Learn how to schedule appointments with clients streamlining expansion meeting coordination

Decision-Maker Strategy:

- Learn how to reach B2B decision-makers targeting CFOs and VPs approving expansion budgets

LinkedIn Profile Optimization:

- Review LinkedIn headline for student understanding profile fundamentals

Platform Intelligence:

- Review LinkedIn learning usage statistics showing platform professional development engagement

Expansion revenue statistics document the systematic opportunity most companies underleverage—selling to existing customers delivers 60-70% success rate versus 5-20% to new prospects (up to 14x more likely to close), costs only $0.27 per $1 expansion ARR versus $1.76-$2.00 for new customer acquisition (7x more cost-effective), and top performers generate 40% of total new revenue from existing customers rising to 58-67% for companies above $50M ARR proving expansion as primary growth engine not secondary tactic. The documented benchmarks reveal elite performance territory: 100%+ NRR is good baseline, 115-125% is elite (current median 101% for private SaaS), 10-30% annual expansion healthy with 3-6% monthly best-in-class, and companies with NRR >110% commanding premium valuations where 1% retention increase boosts valuation 12% over 5 years since 40% of SaaS value derives from expansion potential not just new customer growth. The operational infrastructure exists—Customer Success teams identifying expansion triggers (usage spikes, hitting limits, new departments adopting, support tickets requesting premium features), product analytics surfacing Product-Qualified Leads showing behavioral signals (90% of limits, clicking locked features repeatedly, high engagement, rapidly adding team members), automated alerts creating sales tasks from “Premium Feature Hunter” patterns or “Hitting the Ceiling” warnings or “Department Expansion” activity, and CRM integration providing 360-degree view combining company details with usage patterns and health scores enabling hyper-personalized advisor messaging. Yet execution gap emerges in reaching decision-makers who approve expansion budgets: Customer Success identifies expansion opportunity (“marketing team crushing it, ready for Enterprise plan”), product analytics confirms PQL signals (“hitting 90% of project limits consistently”), automated alerts trigger sales tasks (“3+ users from new department just logged in”)—but converting these insights into actual expansion meetings requires systematic outreach to CFOs, VPs, and budget holders who may not be daily product users CS teams engage with, demanding multi-threaded account penetration targeting financial decision-makers, navigating organizational hierarchies, and coordinating timing across stakeholders most teams lacking systematic decision-maker targeting infrastructure cannot execute consistently despite perfect expansion signal identification. The case studies prove systematic execution compounds results—Slack’s land-and-expand achieving viral adoption then inevitable upgrades, Twilio’s 108% Dollar-Based Net Expansion automatically scaling with customer success through consumption model, Snowflake’s 169% early NRR (stabilized 125%) separating storage from compute creating departmental usage explosion—yet these outcomes require not just product excellence but systematic stakeholder engagement reaching executives approving budgets, coordinating cross-departmental conversations, and timing outreach around expansion signals most companies identifying opportunities through CS teams and product analytics still struggle to convert into actual closed expansion deals without systematic decision-maker targeting eliminating the gap between “we know who should expand” and “we closed the expansion deal.” The article’s repeated banner positioning addresses this execution gap directly: “Turn Data Into Qualified Expansion Meetings” targeting CFOs and VPs systematically, “Revenue Sitting in LinkedIn Feeds” recognizing expansion targets active on LinkedIn daily, “Target Expansion Accounts Like Elite Performers” providing LinkedIn engine identifying and engaging expansion prospects, “Fill Your Pipeline With Upsell-Ready Accounts” reaching decision-makers showing expansion signals, and “Scale Beyond Your Current Customer Base” combining expansion motion with LinkedIn campaigns reaching lookalike enterprise accounts. Our complete LinkedIn outbound system bridges the expansion execution gap—delivering 15-25% response rates through done-for-you targeting, campaign design, and scaling that reaches CFOs, VPs, and budget holders at expansion-ready accounts (not just CS-engaged product users), identifies lookalike prospects matching your best customers’ expansion profiles, coordinates multi-threaded stakeholder engagement across departments showing Product-Qualified Lead signals, and times outreach around expansion triggers (new department adoption, usage ceiling approaching, feature exploration patterns, milestone achievements) converting CS team insights and product analytics signals into actual qualified expansion meetings with decision-makers who control budgets, without requiring the manual decision-maker research, organizational hierarchy navigation, stakeholder coordination, timing orchestration, or executive outreach expertise preventing most companies from systematically converting their documented expansion opportunities (60-70% close rates, 7x cost efficiency, 40-67% of new ARR potential) into actual elite NRR performance (115-125% category) through systematic LinkedIn targeting that turns expansion signals into qualified meetings with budget holders driving the upsells, cross-sells, and add-ons documented throughout expansion revenue statistics as primary growth engine for SaaS companies above $50M ARR generating majority of new revenue from existing customer base through systematic decision-maker engagement most teams identifying expansion triggers through CS and analytics still lack infrastructure to execute consistently converting opportunities into closed expansion deals.

- blog

- Statistics

- Expansion Revenue Statistics & Benchmarks 2025 Guide