Deal Slippage Statistics: The Hidden Reason You're Missing Quota (And How to Fix It)

- Sophie Ricci

- Views : 28,543

Table of Contents

Deal Slippage Statistics

- Low-performing sales reps are 217% more likely to experience deal slippage than top performers

- 79% of sales organizations miss their forecast by more than 10%, with slippage as a primary culprit

- When B2B SaaS deals extend beyond two months, win rates drop by a staggering 113%, making time the enemy

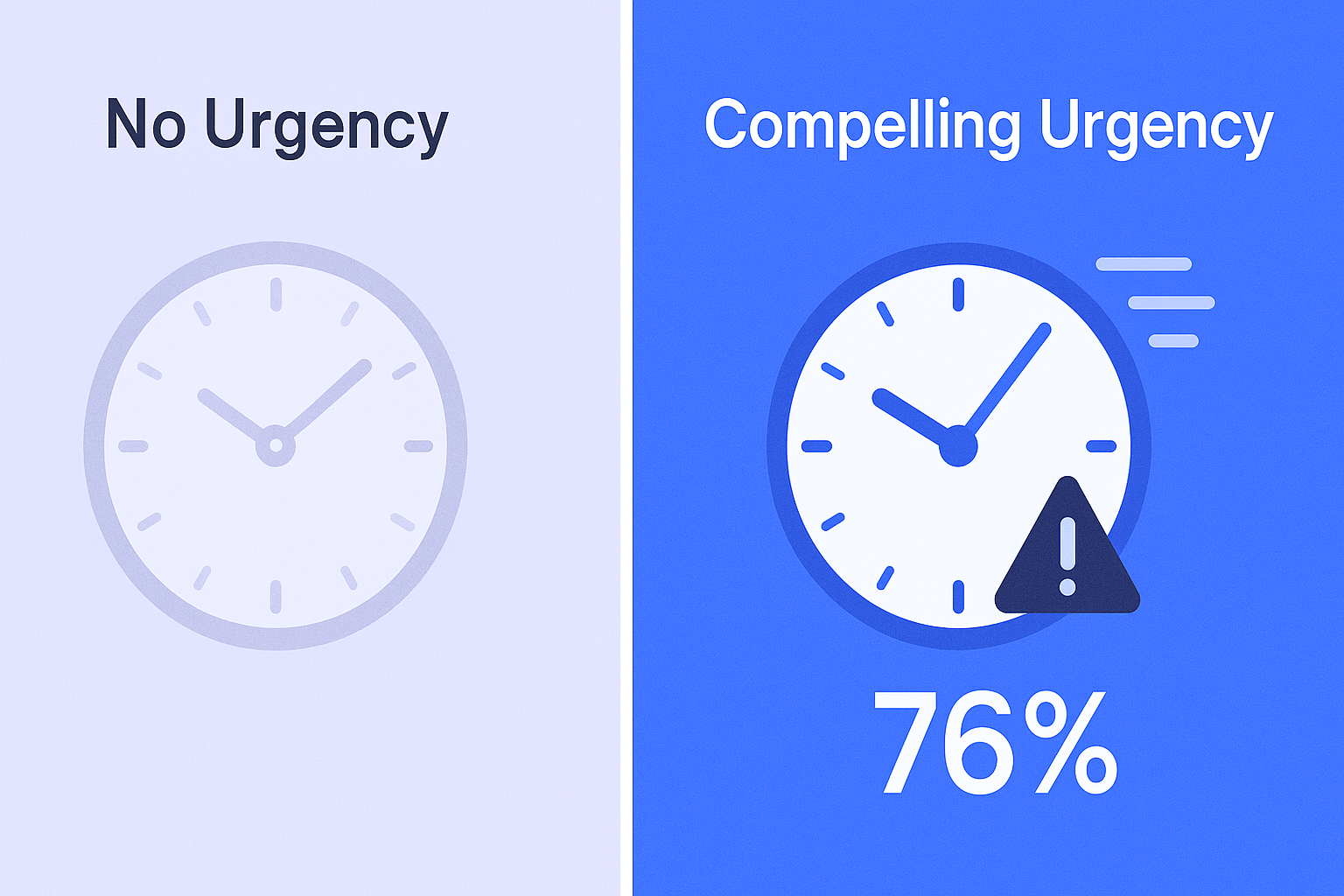

- 76% of deals lack a compelling event to drive urgency, making them vulnerable to endless delays

- 3% of all lost deals die at the contract/closing stage after surviving the entire sales cycle

- Budget freezes hit 40% of deals that die at closing stage, representing a major risk factor

- Leadership changes account for 35% of deals that fail at the contract stage unexpectedly

- Lost momentum kills 25% of deals that reach the closing stage but fail to complete

- Top sales teams convert around 80% of committed deals, while lower-performing teams only close 60%

- Only 20% of sales organizations forecast with less than a 5% margin of error on their projections

- 43% of organizations miss their forecast by more than 10%, showing widespread inaccuracy problems

- 78% of sellers are currently missing quota, making deal slippage a critical issue to address

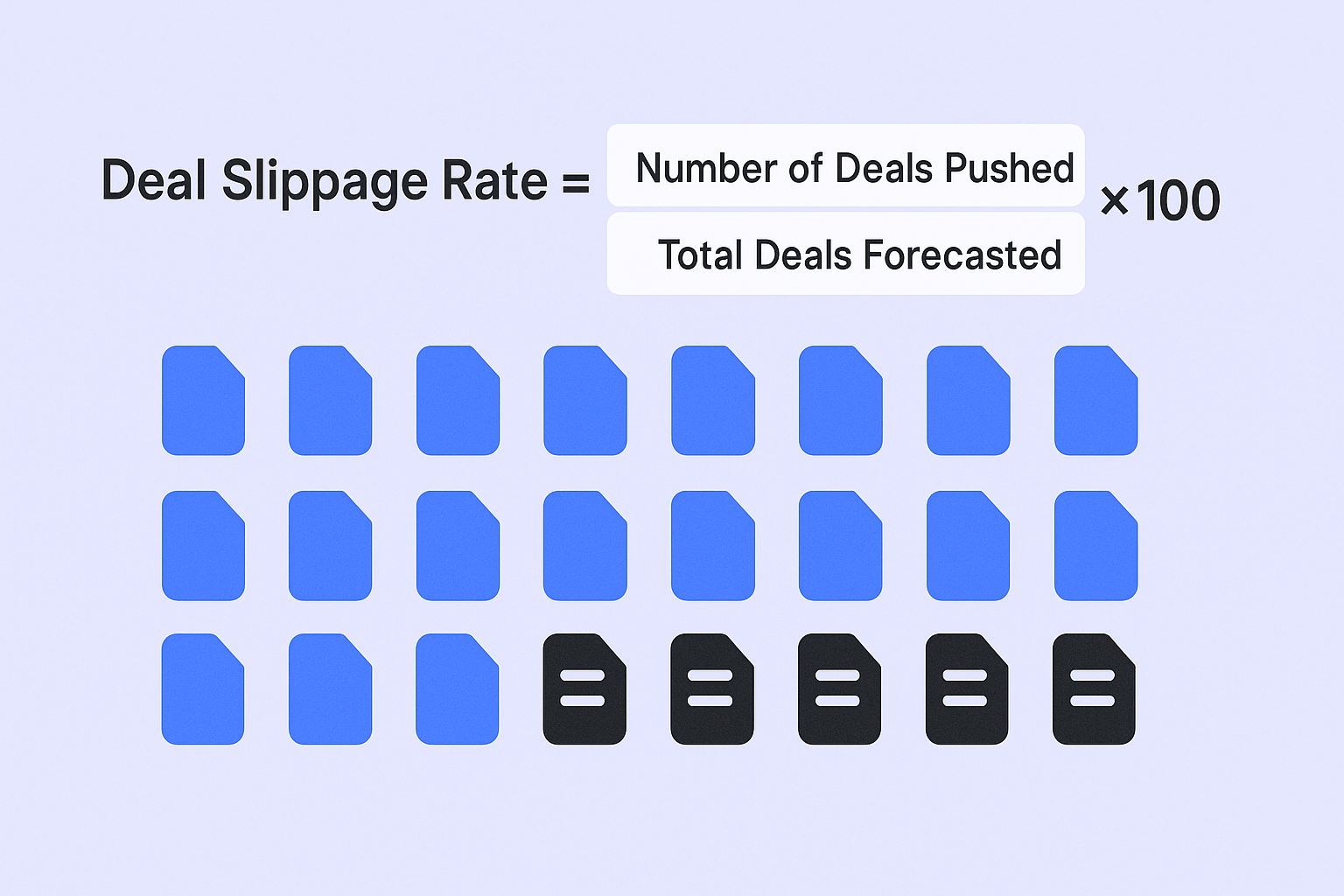

- Deal slippage rate formula is (Number of Deals Pushed ÷ Total Deals Forecasted) × 100 for tracking

- Reducing slip rate from 40% to 20% or 25% to 15% directly translates to more closed revenue

- Multi-threaded engagement from day one prevents deals from collapsing when single champions leave or lose influence

You know that feeling. Quarter’s ending, you’re checking your pipeline for the tenth time today, and that deal you were certain would close? The one marked “90% confident”? Just got pushed to next quarter.

Again.

Most sales pros think deal slippage is just bad luck. A few deals here and there that “weren’t meant to be.” But here’s the thing nobody tells you: slippage isn’t random. It’s predictable. And it’s killing your numbers.

The data tells a different story than what you’ve been hearing. While everyone’s focused on getting more leads at the top of the funnel, the real money leak is happening right before the finish line. And if you’re like 78% of sellers who are missing quota, understanding slippage might be exactly what separates you from crushing your number.

What is Deal Slippage?

Let’s get crystal clear on this. Deal slippage happens when a sales opportunity you forecasted to close in a specific period—like this month or quarter—doesn’t close on time and gets pushed to a future date.

Here’s what makes it tricky: a slipped deal isn’t dead. It’s still technically active in your pipeline. But let’s be honest—it’s not healthy either. Think of it as your pipeline’s way of waving a yellow flag at you. Something changed. Maybe a new stakeholder entered the picture. Maybe there’s an objection you never uncovered. Maybe the buyer’s priorities shifted overnight.

And before you shrug it off, check this stat: low-performing sales reps are 217% more likely to experience deal slippage than top performers. This isn’t about luck or territory. It’s about process, qualification, and control.

🎯 Target Decision-Makers Who Actually Close

LinkedIn outbound reaches multiple stakeholders simultaneously—eliminating single-threaded risk before deals enter your pipeline

Why It Matters in B2B SaaS

You might be thinking, “Okay, so a deal got pushed a few weeks. Big deal.” But that pushed close date? It’s not just an administrative change. It’s a domino effect that can wreck your entire quarter.

Your Forecast Becomes Fiction

When deals slip, forecasting accuracy goes out the window. Right now, 79% of sales organizations miss their forecast by more than 10%, and slippage is one of the primary culprits. Every time you tell your manager a deal will close and it doesn’t, you’re not just wrong about one deal—you’re eroding trust in your entire pipeline.

Time Is Your Enemy

Here’s a brutal truth: the longer a deal sits in your pipeline, the more likely it is to die. When B2B SaaS deals extend beyond two months, win rates drop by a staggering 113%. Every extra day gives competitors more time to swoop in, gives decision-makers more time to second-guess, and gives budget holders more time to reallocate funds.

The Opportunity Cost Is Massive

Every hour you spend chasing a stalled deal is an hour you’re not spending on fresh, closable opportunities. You’re sending follow-up emails that get ignored. You’re preparing for meetings that keep getting rescheduled. Your time is your most valuable asset, and slippage is stealing it.

⚡ Fill Your Pipeline With Pre-Qualified Buyers

Our LinkedIn targeting identifies companies with compelling events and budget—only reaching prospects ready to buy now

It Signals Bigger Problems

A high slip rate is your pipeline screaming at you. It often points to fixable issues: weak qualification, not engaging enough stakeholders, or selling reactively instead of proactively. The good news? Once you spot these patterns, you can fix them.

How to Track Deal Slippage

You can’t fix what you don’t measure. The first step toward control is getting visibility into exactly where and why your deals are slipping.

Your CRM Is Your Command Center

Modern CRMs like HubSpot and Salesforce can automate this entire process. Look for reports called “Deal Push Rate” or “Deal Change History.” These will automatically flag every deal where the close date changed, showing you which opportunities are slipping and how often it’s happening.

Pro tip: Create a custom report for stalled deals—opportunities sitting in late stages like “Proposal Sent” or “Negotiation” longer than your average deal cycle. If it’s not moving forward, it’s about to slip backward.

Calculate Your Personal Slip Rate

Knowledge is power. Use this simple formula:

Deal Slippage Rate = (Number of Deals Pushed ÷ Total Deals Forecasted) × 100

For example: If you committed 20 deals for Q2 and 5 pushed to Q3, your slippage rate is 25%.

Once you know your historical rate, you can forecast more accurately. If your rate is 25%, and you need to close $100k this quarter, you actually need $125k in your commit column to account for inevitable slippage. That’s the difference between hoping and planning.

Visualize the Flow

Some advanced tools can create visual pipeline flow charts (Sankey diagrams) that show exactly how revenue moved from the start of the quarter to the end. You’ll see what closed, what was lost, and what slipped at a glance. This makes patterns impossible to ignore.

Key Statistics Related to Deal Slippage

Here’s the hard data that should change how you think about your pipeline forever:

76% of deals lack a compelling event to drive urgency. Without a strong “why now,” your deal is vulnerable to endless delays. Urgency isn’t optional—it’s the difference between a closed deal and a perpetually “almost there” opportunity.

🚀 Create Urgency From First Contact

Our campaign design framework uncovers compelling events during outreach—building urgency before opportunities reach your CRM

3% of all lost deals die at the contract/closing stage. And the reasons? Budget freezes hit 40% of these deals, leadership changes account for 35%, and lost momentum kills 25%. You survived the entire sales cycle only to lose at the one-yard line.

Top sales teams convert around 80% of committed deals, while lower-performing teams only close 60%. That 20-point gap is often the difference between President’s Club and a performance improvement plan.

Only 20% of sales organizations forecast with less than a 5% margin of error. Meanwhile, 43% miss their forecast by more than 10%. If you’re not tracking slippage, you’re probably in that 43%.

These numbers paint a clear picture: slippage isn’t caused by one catastrophic failure. It’s death by a thousand small cuts throughout the entire sales cycle.

Best Practices

Understanding the problem is half the battle. Here’s how to actually stop deals from slipping through your fingers.

Master the Art of Qualification

Most people think BANT (Budget, Authority, Need, Timeline) is enough. It’s not. You need to dig deeper. Ask “why now?” questions until you uncover the real compelling event. Is there a compliance deadline? A competitor breathing down their neck? An executive mandate?

💼 Scale Outreach Without Sacrificing Qualification

We handle targeting, multi-threaded engagement, and qualification—delivering only high-intent meetings to your calendar

7-day Free Trial |No Credit Card Needed.

Better yet, use more robust frameworks like MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion). This ensures you’re not wasting time on deals that were never going to close.

Build a Mutual Close Plan

This is your secret weapon. A mutual close plan is a shared document with your buyer that maps out every single step required to get the deal signed—their procurement process, legal review, security questionnaires, stakeholder meetings, all of it.

When you create this together, you transform from just another vendor into a trusted advisor helping them navigate their own internal bureaucracy. Plus, it makes slippage obvious immediately when steps start getting delayed.

Go Multi-Threaded From Day One

Relying on a single champion is like building your house on quicksand. If that person leaves, loses budget, or gets overruled, your deal is toast. From the very first conversation, work to identify and build relationships with multiple stakeholders—the economic buyer, end users, legal, finance, IT, and anyone else with influence.

Create Real Urgency

Stop accepting “we’ll probably close it sometime next quarter” as an answer. Tie your solution to quantifiable ROI with a clear timeline. Help them calculate what every day of delay actually costs their business. Create legitimate urgency by aligning your solution to their business priorities.

Uncover Hidden Obstacles Early

Elite sellers don’t just ask about pain points. They ask about procurement processes, compliance requirements, and internal approval chains from the very first discovery call.

Here’s a perfect example: digital accessibility standards are increasingly becoming unexpected deal-killers, especially when selling to enterprise, government, or educational institutions. Smart sales professionals proactively ask, “What are your company’s requirements for ADA compliance and digital accessibility?” This question alone can prevent an 11th-hour compliance review from derailing your deal. Understanding these requirements has become essential knowledge for anyone pursuing accessibility careers in B2B sales, positioning you as a more thorough partner.

Track Buyer Actions, Not Just Your Activity

Stop relying on “good vibes” from calls. Look at concrete signals: Are they opening and forwarding your proposal? Did they invite their boss to the demo? Are they completing tasks in the mutual close plan on time? These actions predict outcomes far better than verbal commitments.

Final Thought

Here’s the reality: deal slippage will never go to zero. Some deals will always push for legitimate reasons completely outside your control. But the difference between average performers and quota crushers isn’t eliminating slippage entirely—it’s reducing it from 40% to 20%, or from 25% to 15%.

Every percentage point you reduce your slip rate directly translates to more closed revenue.

The good news? Unlike getting more leads or changing your territory, reducing slippage is 100% within your control. Better qualification, tighter process discipline, stronger stakeholder engagement—these are skills you can develop starting today.

Stop letting your pipeline happen to you. Start making it work for you. Track your metrics, implement the strategies above, and watch your forecast accuracy—and your closed-won revenue—transform.

Ready to take control of your outreach and stop deals from slipping in the first place? Verify your contact data to ensure you’re reaching the right decision-makers from the start, and check out our guide on B2B email marketing statistics to craft messages that actually move deals forward.

Other Useful Resources

To understand how to systematically achieve LinkedIn’s 40-50% connection rates and 10-25% reply rates eliminating email’s 5.8% and cold calling’s 2.3% challenges, explore these resources:

Data Quality & Pipeline Tools:

- Compare Glockapps alternative options for email deliverability monitoring supporting multi-channel outreach

- Compare UpLead alternatives understanding data solutions for multi-threading 9 contacts per account

- Explore free pipeline management tools for tracking 189 touches per account across 21 per contact

Prospecting Strategy:

- Review the ultimate B2B prospecting tool understanding comprehensive solution requirements

- Learn how to reach B2B decision-makers applying multi-threading to 10-stakeholder buying committees

LinkedIn Content:

- Review LinkedIn graduation post for platform content engagement fundamentals

Platform Intelligence:

- Review LinkedIn learning usage statistics showing platform professional development engagement

BDR outreach statistics document the systematic multi-channel complexity crisis—90% of teams multi-thread engaging 9 contacts per account with 21 touches each totaling 189 touches per account to qualify opportunities, yet maintaining this orchestration across email (5.8% reply down from 6.8%, brutal 0.2153% conversion requiring 464 emails per deal, 17% personalized vs 7% generic demonstrating 142% personalization boost only 5% execute), phone (70% pipeline source despite 2.3% cold call success requiring 18+ dials to connect and 8 calls per meeting), and LinkedIn (40-50% connection acceptance, 45% personalized vs 15% generic, 10-25% InMail reply, 19.98% post-connection response) demands infrastructure most teams lacking systematic coordination cannot implement consistently. The optimization opportunities documented prove difficult to execute simultaneously: email requires 6-8 sentences/101-200 words achieving 6.9% reply with Thursday 6.87% best day and evening 8-11PM/morning 7-11AM timing optimization plus 49% boost from single follow-up (but 20% decrease from third creating diminishing returns management), phone demands converting intent signals not pure cold discovery since 2.3% raw success fails as standalone channel, and LinkedIn needs profile optimization, personalized connection requests, sub-400 character messages, and Tuesday 6.90% timing coordination—all while AI adoption creates Pipeline Paradox where 87% report positive impact and 65% enhanced productivity yet 71.5% receive minimal training resulting in 35% qualified pipeline increase but only 10-20% revenue growth revealing efficiency-not-effectiveness application preventing 200-300% ROI, 15-25% productivity gains, 30-40% cost savings, and 15% win rate improvements from materializing without strategic AI implementation beyond tactical automation. The funnel leakage compounds execution challenges: 1000 emails → 58 replies (5.8%) → 3 meetings (5% conversion) → 2.25 attended (75% show) → 1 opportunity (46% conversion) demonstrates compound attrition where even perfect channel optimization battles leaky meeting funnel (67-80% show rates, 46% opportunity conversion), lead-to-meeting conversion varying wildly (5-10% low-intent vs 75-80% high-intent vs 2-5% outbound general), and meetings-booked vanity metrics hiding that quality focus (10 meetings × 90% show × 60% opportunity = 5.4 pipeline) beats volume (15 meetings × 67% show × 46% opportunity = 4.6 pipeline). The environmental factors compound individual performance: 88% average quota attainment masks massive divide where supported teams hit 95% but unsupported hit only 80%, yet only 58% feel supported (down from 76% in 2022) creating widening performance gap, while 39% raised quotas in 2024 and 35% in 2025 creating rising expectations without proportional support infrastructure preventing systematic 189-touch-per-account multi-threading across all channels most teams coordinating 21 touches per contact across 9 stakeholders cannot execute while maintaining email personalization, phone intent conversion, LinkedIn optimization, AI strategic application, and quality-over-volume focus preventing vanity meeting metrics from converting into actual qualified pipeline opportunities. The article’s repeated banner positioning addresses the fundamental solution: “Crushing Quota with LinkedIn Outbound” delivering 40-50% connection + 10-25% reply systematically, “Master Multi-Threading on LinkedIn” engaging 9+ stakeholders per account with personalized scalable sequences, “LinkedIn Beats Email 3X” achieving 10-25% reply versus 5.8% email with complete strategy, “Scale Your LinkedIn Pipeline” delivering 40-50% connections and 3x email performance consistently, and “LinkedIn + AI = Pipeline Growth” generating 35% more qualified pipeline through complete targeting and scaling combining platform advantages with AI strategic application. Our complete LinkedIn outbound system eliminates the multi-channel orchestration crisis systematically—delivering 15-25% response rates through done-for-you targeting, campaign design, and scaling that achieves LinkedIn’s documented 40-50% connection rates and 10-25% reply rates (3x email’s 5.8%, 10x cold calling’s 2.3% success) without requiring 189-touch-per-account coordination, email’s 6-8 sentence/101-200 word optimization plus Thursday 6.87%/evening timing management plus 49% follow-up discipline, phone’s 18+ dial burden converting intent signals, AI’s 71.5% minimal training preventing strategic effectiveness application, or the environment/support dependency (58% vs 76% supported) creating 95% vs 80% quota attainment divide, executing multi-threading across 9+ stakeholders per account automatically, combining LinkedIn verified data with AI personalization eliminating Pipeline Paradox (35% pipeline but 10-20% revenue), and converting outreach statistics into actual qualified pipeline generation through systematic execution that achieves supported-team 95% quota benchmarks without the multi-channel coordination complexity, leaky funnel waste (67-80% shows, 46% opportunities), meetings-booked vanity metrics, or rising quotas without proportional support preventing most teams from converting outreach knowledge into consistent quota-crushing performance across every channel and funnel stage documented throughout comprehensive outreach statistics revealing what separates 95% supported performers from 80% unsupported strugglers through systematic LinkedIn-first execution eliminating the entire email/phone/multi-channel orchestration burden.

- blog

- Statistics

- Deal Slippage Statistics: Fix Your Sales Pipeline in 2025