Fashion Ecommerce Statistics 2025: Complete Guide

- Sophie Ricci

- Views : 28,543

Table of Contents

Fashion Ecommerce Statistics

- Global fashion ecommerce market will reach $1.5 trillion by 2029 – growing from $974.87 billion in 2025 at a 9.7% CAGR

- US fashion ecommerce market valued at $144.97 billion in 2025 – anticipated to reach $336.86 billion by 2032, with 12.8% annual growth rate

- 81% of fashion ecommerce transactions happen on mobile devices – making mobile the primary channel for fashion purchases

- 58.2% of mobile clothing shoppers in the U.S. are women – with Americans aged 18-34 making up 79.6% of mobile clothing shoppers

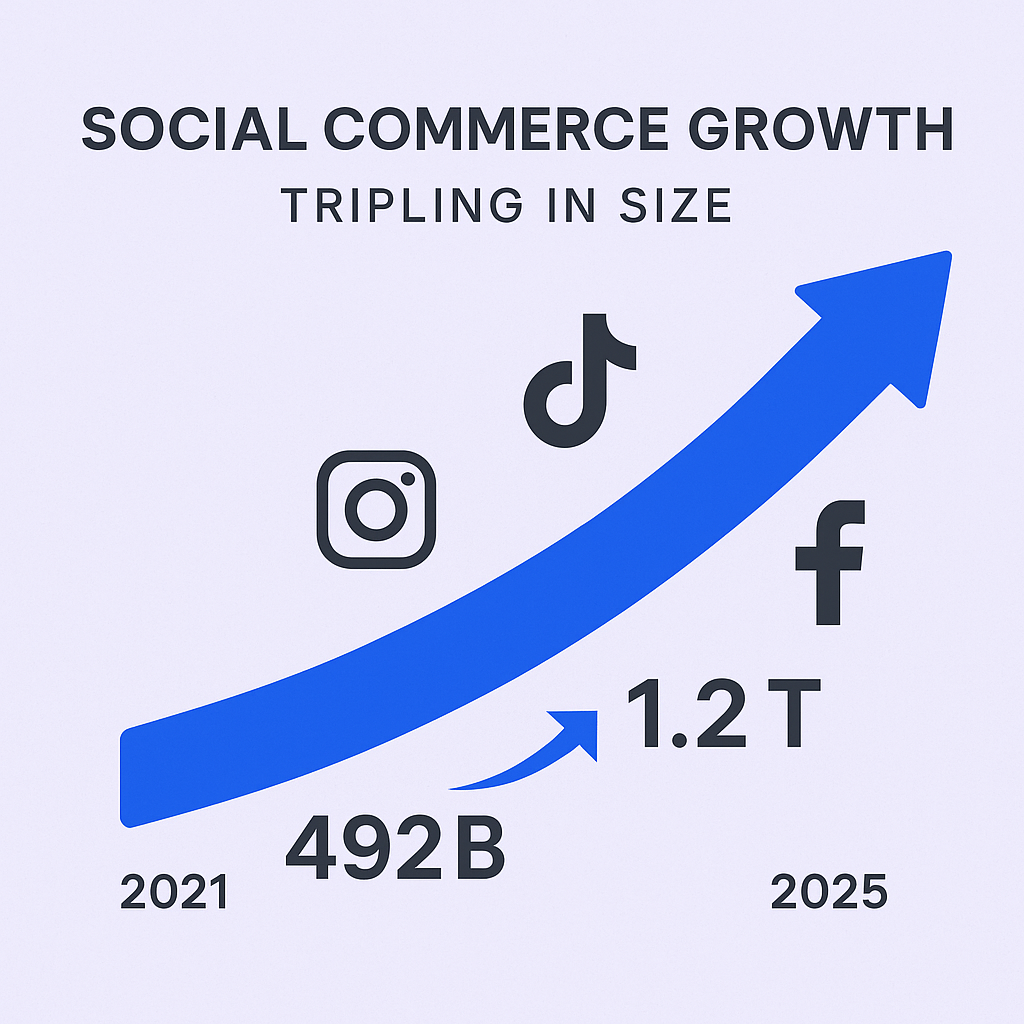

- Social commerce sales projected to triple by 2025 – growing from $492 billion in 2021 to $1.2 trillion by 2025, with fashion leading the trend

- 87% of consumers say social media influences their buying decisions – highlighting massive impact of social platforms on fashion purchases

- Women spend almost $35 trillion on consumer goods – dominating the fashion ecommerce space, with clothing and shoes representing 57% of spontaneous purchases

- Fashion is the top category for impulse purchases – with 57% of women purchasing apparel online on impulse

- 43% of purchases influenced by personalized recommendations – with 75% of consumers preferring brands that offer tailored messaging and experiences

- AI in fashion market projected to expand from $2.23 billion in 2024 to $60.57 billion by 2034 – representing a 39.12% CAGR

- 71% of shoppers more likely to shop with AR-powered applications – virtual try-on experiences reduce return rates while increasing customer confidence

- Fashion ecommerce conversion rates range from 2.9% to 3.3% – with women’s fashion at 3.6% median and menswear lagging at 0.8%

- Accessories achieve highest conversion rates at 7.4% – exceptionally high compared to other fashion ecommerce verticals

- 56% of returns due to product not matching description – representing one of fashion ecommerce’s most costly and preventable problems

- Fashion return rates average 25% industry-wide – with retailers losing $21 to $46 per returned product after accounting for shipping and processing expenses

The fashion ecommerce industry is reshaping how we shop, with trends moving at lightning speed and consumer behaviors evolving faster than ever. If you’re working in retail, marketing, or business development, understanding these shifts isn’t just helpful—it’s essential for staying competitive.

Fashion ecommerce statistics reveal a massive opportunity unfolding before us. The numbers tell a story of explosive growth, mobile-first shopping experiences, and technology-driven personalization that’s transforming how brands connect with customers. These insights can help you optimize strategies, improve customer experience, and boost online sales.

In this comprehensive guide, we’ll explore the most critical fashion ecommerce statistics that matter for your business. From market size projections to consumer behavior patterns, mobile commerce trends to conversion benchmarks—we’ve gathered the data you need to make informed decisions in 2025.

How Do We Collect These Statistics?

The statistics in this guide come from authoritative industry sources including Research and Markets, Statista, Shopify, McKinsey & Company, and specialized ecommerce analytics platforms. We’ve cross-referenced data from multiple sources to ensure accuracy and relevance.

Our methodology focuses on:

- Recent data from 2024-2025 studies

- Global market research from leading firms

- Platform-specific analytics from major retailers

- Consumer behavior surveys and purchasing data

- Industry reports from fashion and ecommerce experts

This approach ensures you’re getting reliable, actionable insights that reflect current market realities.

18 Fashion Ecommerce Statistics

Market Growth & Size

- Global fashion ecommerce market will reach $1.5 trillion by 2029

The fashion ecommerce market size has grown from $888.56 billion in 2024 to $974.87 billion in 2025 at a compound annual growth rate (CAGR) of 9.7%. Looking ahead, the market will grow to $1.5 trillion in 2029 at a compound annu

🎯 Target Fashion Buyers Who Matter

Reach fashion decision-makers with LinkedIn outbound campaigns that book qualified meetings daily

This massive growth reflects the fundamental shift in how consumers approach fashion shopping. The pandemic accelerated digital adoption, but the trend has proven permanent, with online shopping becoming the preferred channel for fashion discovery and purchase.

- US fashion ecommerce market to more than double by 2032

U.S. Fashion Ecommerce Market valued at US$ 144.97 Bn in 2025, is anticipated to reaching US$ 336.86 Bn by 2032, with a steady annual growth rate of 12.8%. This represents one of the fastest-growing segments in American retail.

The US market’s rapid expansion is driven by mobile optimization, social commerce integration, and the rise of direct-to-consumer brands that bypass traditional retail channels.

📈 Scale Your Fashion Brand’s B2B Sales

Connect with retailers and distributors using our complete LinkedIn targeting and campaign framework

Mobile Commerce Dominance

- 81% of fashion ecommerce transactions happen on mobile devices

81% of eCommerce transactions take place on mobile devices, making mobile the primary channel for fashion purchases. This shift has fundamentally changed how brands must approach their digital strategy.

Mobile-first design isn’t optional anymore—it’s the foundation of successful fashion ecommerce. Brands that fail to optimize for mobile experience will lose customers to competitors who prioritize seamless mobile shopping.

- Mobile fashion shoppers are predominantly women aged 18-34

In the United States, 58.2% of mobile clothing shoppers are women, and Americans aged 18 to 34 make up 79.6% of mobile clothing shoppers. This demographic drives the majority of mobile fashion commerce.

Understanding this core audience is crucial for fashion brands. These consumers expect fast-loading pages, intuitive navigation, and seamless checkout processes optimized for smaller screens.

Social Commerce Revolution

- Social commerce sales projected to triple by 2025

Social commerce sales are projected to triple by 2025, with global social commerce market projected to grow from $492 billion in 2021 to $1.2 trillion by 2025. Fashion leads this trend as the most popular category for social shopping.

Social platforms have evolved from discovery channels to full shopping destinations. Instagram, TikTok, and Facebook now offer seamless in-app purchasing experiences that reduce friction between inspiration and purchase.

- 87% of consumers say social media influences buying decisions

87% indicate that social media influences their buying decisions, highlighting the massive impact of social platforms on fashion purchase behavior. This influence extends beyond simple product discovery to actual purchase completion.

For fashion brands, social media isn’t just marketing—it’s the modern storefront. User-generated content, influencer partnerships, and social proof drive purchasing decisions more than traditional advertising.

💼 LinkedIn Outbound for Fashion Brands

Generate qualified leads from fashion buyers, wholesalers, and retail partners through strategic outbound

Consumer Behavior Insights

- Women dominate fashion ecommerce with $35 trillion in spending power

Women dominate the fashion eCommerce space, spending almost $35 trillion on consumer goods, making them the primary target audience for fashion brands. Clothing and shoes represent 57% of women’s spontaneous purchases online.

This enormous spending power explains why successful fashion brands prioritize female-focused marketing strategies, user experiences, and product assortments. Women’s fashion also shows higher conversion rates compared to men’s fashion categories.

- Fashion is the top category for impulse purchases

Fashion being the single most popular category for impulse purchases, with 57% of women purchasing apparel online on impulse. This spontaneous buying behavior creates unique opportunities for fashion brands.

Smart fashion retailers leverage this tendency through flash sales, limited-time offers, and social commerce features that enable instant purchasing when inspiration strikes.

- 43% of purchases influenced by personalized recommendations

43% of purchases are influenced by personalized recommendations or promotions, and 75% of consumers prefer brands that offer tailored messaging, offers, and experiences.

Personalization has moved from nice-to-have to essential. Fashion brands using AI-driven recommendations see significantly higher conversion rates and customer satisfaction scores.

Technology & Innovation

- AI in fashion market to reach $60.57 billion by 2034

The AI in fashion market is experiencing explosive growth, projected to expand from $2.23 billion in 2024 to $60.57 billion by 2034, representing a CAGR of 39.12%. This investment in AI technology is driving personalization, inventory management, and customer service improvements across the fashion industry.

Fashion brands are using AI for everything from trend forecasting to personalized styling recommendations, making shopping experiences more relevant and efficient for consumers.

🚀 Outbound Engine for Fashion Commerce

Our complete targeting, messaging, and scaling system books meetings with your ideal fashion buyers

7-day Free Trial |No Credit Card Needed.

- 71% of shoppers more likely to shop with AR-powered applications

71% of shoppers are more likely to shop frequently when using AR-powered applications. Augmented reality technology addresses one of fashion ecommerce’s biggest challenges: the inability to try products before purchasing.

Virtual try-on experiences reduce return rates while increasing customer confidence in online purchases. Brands implementing AR see measurable improvements in conversion rates and customer satisfaction.

Conversion Rates & Performance Metrics

- Fashion ecommerce conversion rates range from 2.9% to 3.3%

The average conversion rate for fashion ecommerce in 2025 is projected at 2.9%-3.3%, though this varies significantly by category. Women’s fashion has a median conversion rate of 3.6%, in comparison to menswear, which lags at 0.8%.

Understanding these benchmarks helps fashion brands set realistic goals and identify improvement opportunities. Top-performing stores achieve conversion rates above 4.7%, indicating significant room for optimization.

- Accessories achieve highest conversion rates at 7.4%

The median ecommerce conversion rate for accessories is 7.4%, which is exceptionally high compared to other fashion ecommerce verticals. This success stems from lower price points, universal sizing, and cross-selling opportunities.

Fashion retailers can boost overall performance by strategically promoting accessories and using them as gateway products to introduce customers to their brand.

Return Rates & Challenges

- 56% of returns due to product not matching description

Approximately 56% of online returns result from products not matching their online descriptions. This represents one of fashion ecommerce’s most costly and preventable problems.

Investing in high-quality product photography, detailed descriptions, and sizing information can significantly reduce return rates while improving customer satisfaction and profitability.

- Fashion return rates average 25% industry-wide

Online apparel orders have a 25% chance of being returned to the seller, significantly higher than other ecommerce categories. After accounting for shipping, processing, and other expenses related to buying apparel online, retailers lose $21 to $46 per returned product.

Managing returns effectively is crucial for fashion ecommerce profitability. Leading brands focus on accurate product representation and improved sizing guides to minimize returns.

Regional Market Dynamics

- Asia holds largest market share globally

Asia holds the largest market share of online fashion shopping globally, with China represents the largest fashion e-commerce market with a revenue of $207 billion, 13.7% higher than U.S. revenue.

The Asian market’s dominance reflects both large populations and increasing digital adoption. Fashion brands looking for growth opportunities should consider Asian markets, particularly China, India, and Southeast Asian countries.

- Secondhand fashion market reaches $260 billion

The global secondhand apparel market is valued at an estimated $260.2 billion as of 2025, with the resale market growing 18% in 2023 alone—15 times faster than the broader retail sector.

Sustainable fashion and circular economy trends are driving massive growth in resale markets. Forward-thinking fashion brands are launching their own resale programs to capture this growing demand.

Cart Abandonment & Checkout Issues

- Fashion has 2.73% higher cart abandonment than average

Fashion e-commerce has a 2.73% higher cart abandonment rate than the average for all industries, with unexpected fees such as shipping costs lead 55% of shoppers to abandon their carts, while 21% do not complete their purchases due to complicated checkout.

Streamlining checkout processes and being transparent about shipping costs from the beginning can significantly improve conversion rates for fashion retailers.

Conclusion

The fashion ecommerce landscape in 2025 presents unprecedented opportunities for brands willing to adapt to changing consumer behaviors and technological advances. With the market projected to reach $1.5 trillion by 2029, the potential for growth is massive—but so is the competition.

The statistics reveal clear priorities: mobile optimization is non-negotiable, social commerce is the new frontier, and personalization drives purchasing decisions. Brands that invest in AR technology, address return rate challenges, and focus on seamless user experiences will capture market share from slower-moving competitors.

Most importantly, the data shows fashion ecommerce success isn’t just about having great products—it’s about understanding your customers deeply and delivering experiences that meet their evolving expectations. Whether you’re optimizing conversion rates, expanding into new markets, or integrating new technologies, let these statistics guide your strategic decisions.

The fashion brands that thrive in 2025 and beyond will be those that view these statistics not just as interesting data points, but as roadmaps to better customer experiences and sustainable growth.

Other Useful Resources

While fashion ecommerce faces 25% return rates and rising customer acquisition costs, many brands are building lucrative B2B revenue streams through wholesale partnerships and retail distribution. For teams running email outreach campaigns to fashion buyers and retailers, explore our Best GMass Alternative guide and SalesHandy Connect 2 review to scale your B2B prospecting infrastructure.

Fashion brands targeting wholesale buyers, retail partners, and distributors benefit from LinkedIn’s professional network. Compare leading prospecting tools in our LinkedIn Sales Navigator vs ZoomInfo analysis, or review LinkedIn Sales Navigator vs Recruiter to choose the right solution for building fashion industry connections.

When developing B2B relationships with fashion decision-makers, optimize your LinkedIn presence for maximum impact. Master engagement strategies like how to tag someone on LinkedIn for visibility with buyers, understand platform etiquette such as how to unfollow on LinkedIn, and review our LinkedIn Headshot Statistics to ensure your profile converts fashion industry prospects into qualified partnership conversations.

FAQs

What is the current size of the global fashion ecommerce market?

Which device do most people use for fashion shopping online?

Which device do most people use for fashion shopping online?

What's the average conversion rate for fashion ecommerce sites?

How much influence does social media have on fashion purchases?

- blog

- Statistics

- Fashion Ecommerce Statistics 2025: 18 Key Insights