Holiday Spending Statistics 2026: Your Ultimate Guide to the Biggest Shopping Season

- Sophie Ricci

- Views : 28,543

Table of Contents

The holiday shopping season is here, and the numbers are staggering. Understanding holiday spending statistics isn’t just about satisfying curiosity—it’s about positioning yourself to capitalize on the biggest consumer spending event of the year.

💼 Sell to Companies Planning $989B Season

Target retail executives making Q4 decisions with precision LinkedIn outbound campaigns today

Whether you’re planning marketing campaigns, inventory strategies, or simply trying to understand where the market is heading, these statistics reveal the hidden patterns that drive consumer spending during the most important shopping season.

Let’s dive into the data that matters.

How Do We Collect These Statistics?

Before we explore the numbers, it’s crucial to understand where these insights come from. Different sources measure different aspects of holiday spending, which explains why you might see varying figures across reports.

The three main sources provide complementary perspectives:

Government Agencies like the U.S. Census Bureau track actual consumer purchases through comprehensive household spending surveys. This data represents ground truth but arrives with a delay due to the extensive verification process required.

Industry Organizations such as the National Retail Federation combine government data analysis with large-scale consumer surveys. They forecast total retail sales and gauge consumer sentiment, providing both historical context and forward-looking insights.

Private Analytics Firms including Adobe Analytics, Deloitte, and Mastercard leverage real-time transaction data from millions of anonymized purchases. This gives us up-to-the-minute insights into spending patterns, especially during peak shopping events like Black Friday.

These different methodologies create a comprehensive view of holiday spending trends, capturing both what people plan to spend and what they actually purchase.

Essential Holiday Spending Statistics to Know

The Big Picture: Record-Breaking Season

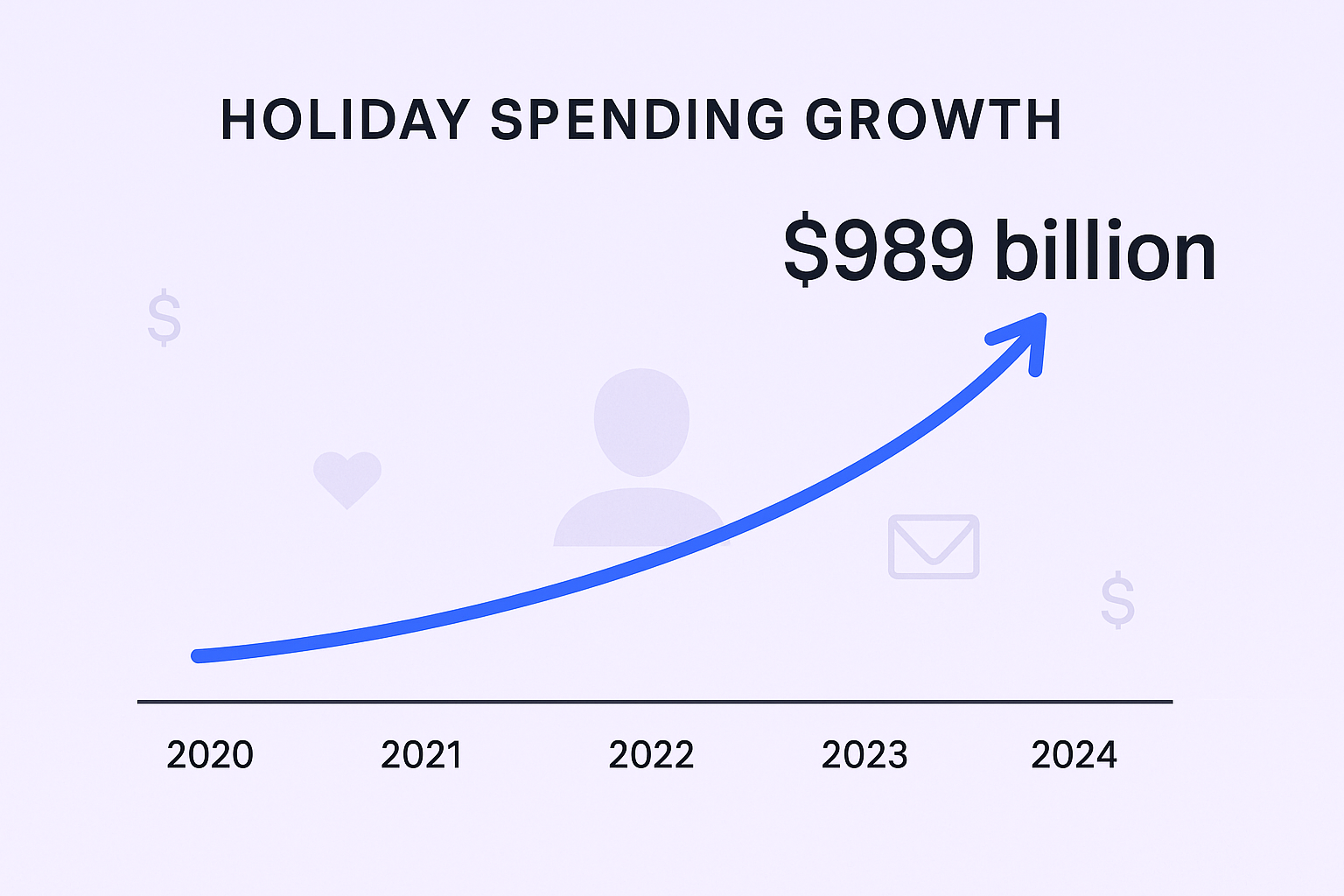

- Total holiday sales are projected to reach $989 billion

The National Retail Federation forecasts holiday season sales will grow between 2.5% and 3.5% compared to last year. This massive figure represents a return to steady, sustainable growth levels after years of pandemic-influenced volatility.

What this means: The retail sector is healthy and businesses are investing in growth. Companies across all industries are planning for increased capacity, better customer experiences, and expanded market reach.

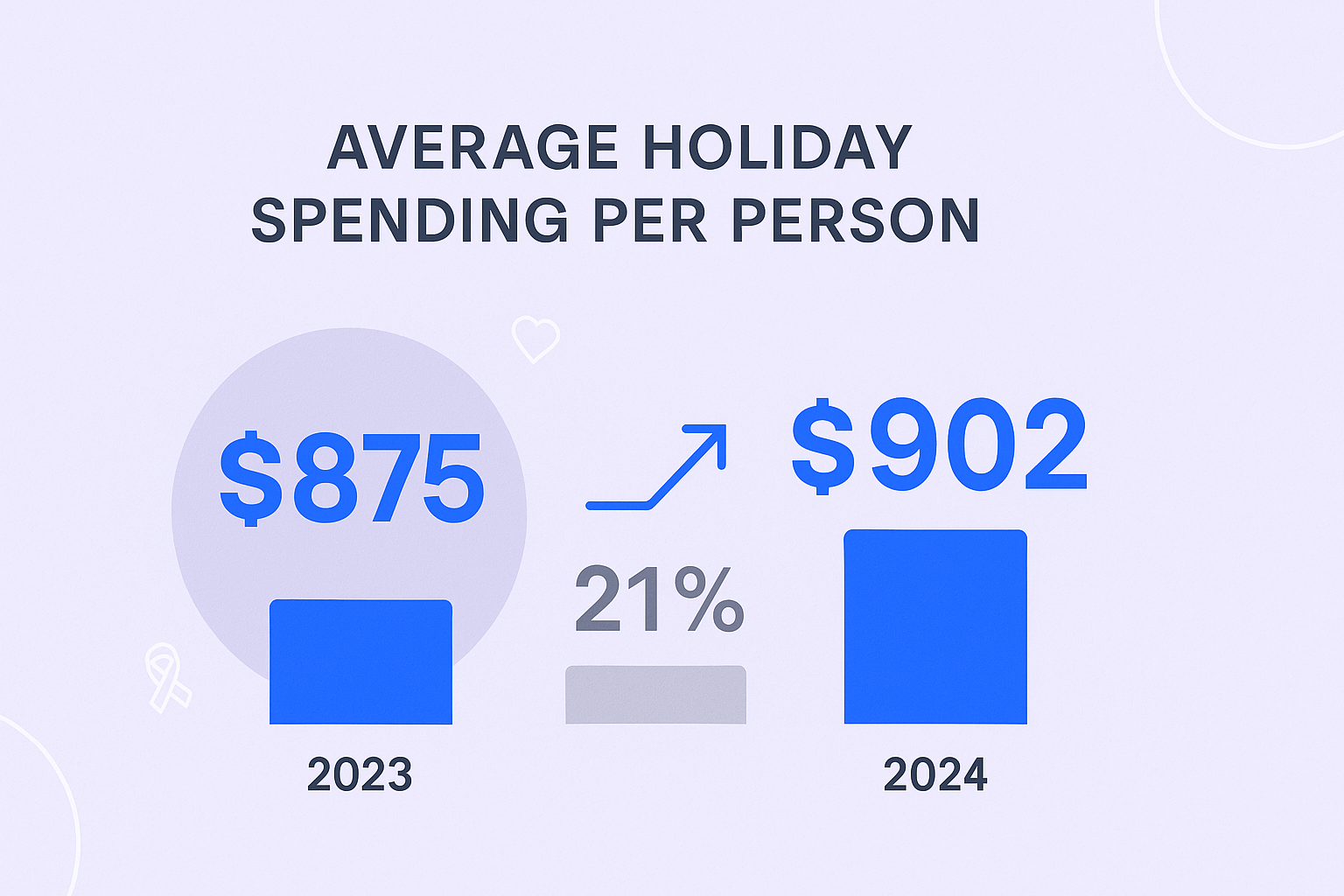

- Average holiday spending per person hits a record $902

Individual consumer spending continues climbing, with the average person planning to spend $902 during the holiday shopping season—up from $875 last year. This marks the highest per-person spending ever recorded.

The psychology behind this number reveals consumer confidence in the economy and willingness to invest in experiences and relationships during the festive period.

- The Frugality Paradox: 62% of shoppers plan to trade down to cheaper brands

Here’s where it gets interesting. Despite record spending levels, nearly two-thirds of consumers are actively seeking value and considering lower-priced alternatives. This isn’t a contradiction—it’s strategic shopping behavior.

Modern consumers are willing to spend more overall while being extremely selective about where each dollar goes. They want premium experiences but at competitive prices.

🎯 Reach Retailers Before They Finalize Budgets

Our LinkedIn targeting finds decision-makers planning holiday inventory, marketing, and logistics spend

- “Buy Now, Pay Later” will drive nearly $10 billion in November spending alone

BNPL services have become the secret engine powering increased holiday spending. These payment options allow consumers to make larger purchases during sales events while managing their cash flow over time.

This trend represents a fundamental shift in how people approach major purchases, enabling higher transaction values during peak shopping periods.

Shopping Channel Evolution

- Online sales continue surging with 8.6% year-over-year growth

E-commerce dominance in holiday shopping isn’t slowing down. Online sales grew 8.6% last season, with Deloitte forecasting another 7-9% increase this year. Digital channels have become the primary battleground for customer acquisition.

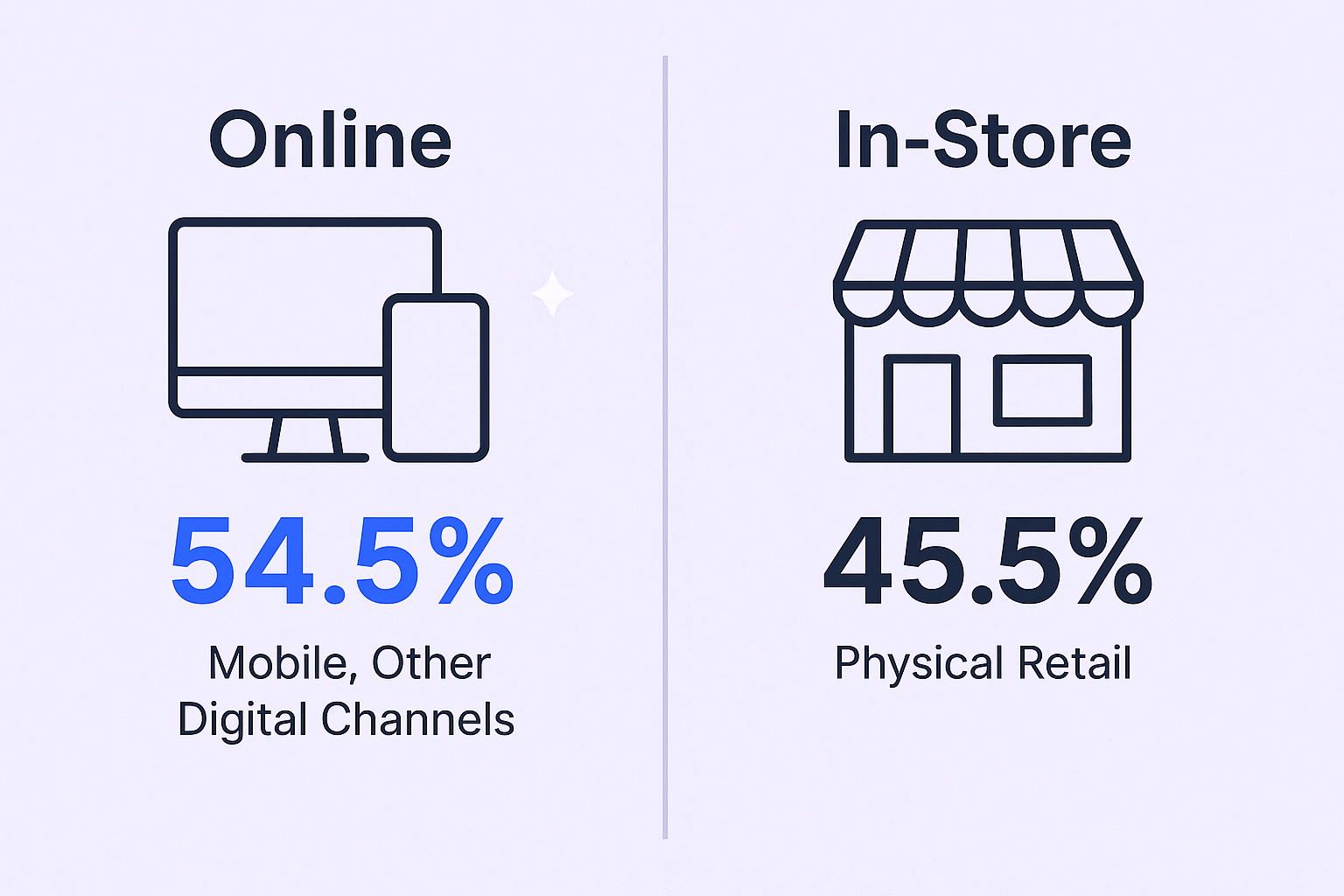

- Mobile-first reality: 54.5% of online holiday revenue comes from phones

More than half of all online holiday spending now happens on mobile devices. This shift reflects changing consumer behavior where smartphones have become the primary tool for product discovery, comparison shopping, and purchase completion.

- Physical stores make a surprising comeback

While online grows, in-store shopping is experiencing renewed interest. During the Black Friday Thanksgiving weekend, foot traffic in physical stores actually increased year-over-year, driven by consumers seeking tactile experiences and immediate gratification.

The New Holiday Calendar

- Early bird shopping: 2 in 5 shoppers start before November

The traditional holiday shopping timeline has expanded significantly. Consumers now spread their purchases across multiple months, starting as early as October to manage budgets and avoid last-minute stress.

This extended shopping window creates more opportunities for businesses but also intensifies competition across a longer timeframe.

- Cyber Monday reaches $13.3 billion in single-day sales

Despite the extended shopping season, Cyber Monday remains the single biggest online shopping day. This concentration of purchasing power puts enormous pressure on digital infrastructure and customer service systems.

- Black Friday online sales hit $10.8 billion

The traditional doorbusters day has transformed into a massive digital event. Black Friday online sales demonstrate how consumers have shifted from physical store stampedes to strategic digital shopping.

- Small Business Saturday drives $17 billion in economic activity

The focus on supporting small businesses during the holiday shopping season has created significant economic impact. Black Friday small business participation continues growing as consumers balance convenience with community support.

Emerging Trends Reshaping Retail

- Gen Z leads social commerce with over half planning TikTok Shop purchases

Social media platforms have evolved from discovery channels to complete shopping destinations. This generational shift toward social commerce represents a fundamental change in how products are marketed and sold.

- Experience spending grows 16% year-over-year

Consumers increasingly prioritize experiences over physical products. Concert tickets, travel bookings, and event experiences represent one of the fastest-growing segments of holiday spending.

- Seasonal hiring reaches 500,000 new positions

Retailers prepare for the holiday shopping surge by hiring massive temporary workforces. This hiring boom ripples throughout the economy, affecting everything from payroll services to transportation logistics.

What These Numbers Really Mean

The 2024 holiday spending statistics reveal a fascinating contradiction: record spending combined with value-conscious shopping behavior. Consumers are confident enough to spend more while being strategic about maximizing every dollar.

This creates unprecedented opportunities for businesses that can deliver value, convenience, and quality simultaneously. The companies that thrive will be those that understand this duality and position themselves accordingly.

Key Insights for Business Strategy:

The data shows clear winners emerging in several categories. E-commerce platforms, mobile payment solutions, and logistics companies are positioned for significant growth. Meanwhile, businesses serving the experience economy—from travel to entertainment—are seeing renewed demand.

The extended shopping timeline means competition is more intense but opportunities are more distributed. Rather than focusing solely on Black Friday and Cyber Monday, successful businesses are creating value throughout the entire season.

📈 Convert Holiday Data Into Pipeline

Launch targeted LinkedIn campaigns to retailers, brands, and logistics companies capitalizing on record spending

Consumer behavior has permanently shifted toward research-heavy, value-focused purchasing decisions. The days of impulse buying during doorbusters events have evolved into strategic, multi-channel shopping journeys that span weeks or months.

Other Useful Resources

The $989 billion holiday season represents a massive B2B opportunity for companies selling to retailers, logistics providers, and brands preparing for peak shopping periods. For teams running email campaigns to reach retail decision-makers, explore our Best GMass Alternative guide and SalesHandy Connect 2 review to build scalable outreach infrastructure that reaches buyers before they finalize holiday budgets.

LinkedIn outbound offers direct access to the 500,000+ retail executives and operations managers planning holiday logistics, inventory, and marketing campaigns. Compare leading prospecting solutions in our LinkedIn Sales Navigator vs ZoomInfo analysis, or review LinkedIn Sales Navigator vs Recruiter to find the right tool for reaching seasonal hiring managers and retail leadership.

When targeting holiday-focused decision-makers, optimize your LinkedIn presence for maximum credibility. Master engagement tactics like how to tag someone on LinkedIn for visibility with retail executives, understand platform etiquette such as how to unfollow on LinkedIn, and review our LinkedIn Headshot Statistics to ensure your profile converts prospects into qualified sales conversations during this critical planning season.

For businesses looking to capitalize on these trends, the message is clear: holiday spending patterns reward those who understand their customers’ evolving needs and deliver value at every touchpoint. The businesses that combine data-driven insights with customer-focused execution will capture the largest share of this record-breaking season.

The statistics don’t just tell us what happened—they reveal what’s coming next. Use these insights to position your business for success during the most important shopping season of the year.

🚀 Turn Insights Into Booked Meetings

We build LinkedIn outbound engines targeting holiday-focused companies with complete campaign design and scaling

7-day Free Trial |No Credit Card Needed.

FAQs

How much do Americans typically spend during the holiday season?

When does holiday shopping season officially start?

What percentage of holiday sales happen online?

How important is Black Friday for retailers?

What drives the increase in holiday spending each year?

- blog

- Statistics

- Holiday Spending Statistics 2024: 14 Key Insights for Success