LinkedIn Employer Brand Statistics That Prove Reputation Drives Revenue

- Sophie Ricci

- Views : 28,543

Table of Contents

LinkedIn Employer Brand Statistics

Companies with strong employer brands see 31% higher InMail acceptance rates – directly translating employer reputation into sales pipeline efficiency

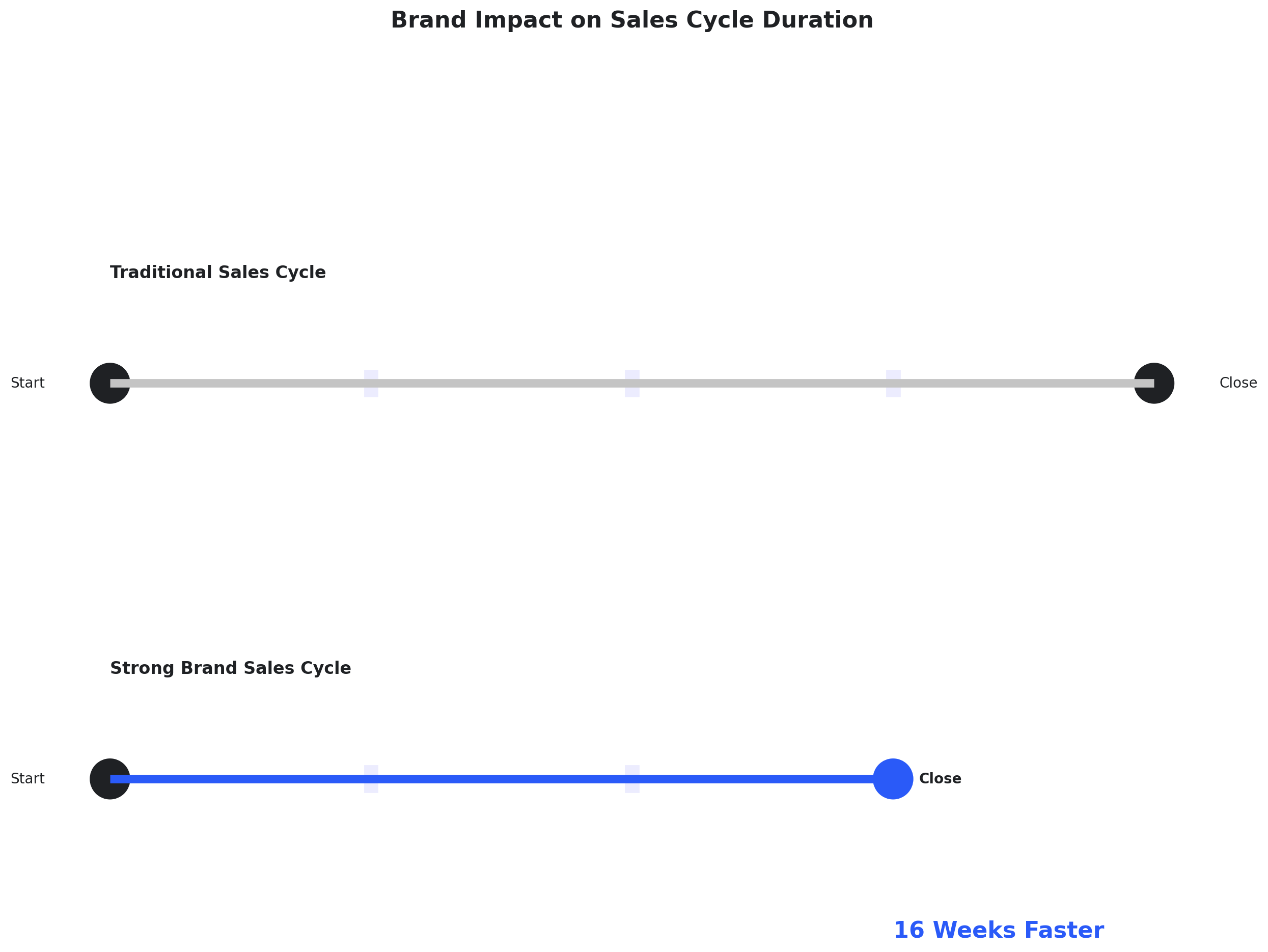

Can cut sales cycles by up to 16 weeks – strong brands eliminate “proof of legitimacy” phase through immediate credibility

82% of buyers say trust in parent company is important or dealbreaker – showing buyers evaluate entire organization, not just product

60% of consumers buy/avoid brands based on values or politics – internal culture is now public and directly affects pipeline

Average cold email response rate sits between 1-5% – meaning 95 out of 100 emails get ignored in current market

17% of cold emails never reach inbox – due to spam filters and authentication issues, reducing effective reach

Prospects exposed to brand + sales messaging are 6x more likely to convert – than those receiving sales messaging alone

44% more likely to accept message if seen brand messaging beforehand – creating “trust environment” where outreach lands differently

Companies with strong talent brands grow 20% faster than peers – representing business velocity, not just headcount growth

11.6% increase in shareholder returns – for companies with strong employer brands versus those without

Companies with poor employer brands pay 10% higher salaries – creating “reputation tax” that diverts capital from growth initiatives

81% of job seekers wouldn’t join company with bad reputation – and if job seekers ghost bad employers, B2B buyers ghost bad vendors

Average buying group involves 6-10 decision-makers – with 74% experiencing unhealthy conflict during decision process

Groups reaching consensus are 2.5x more likely to report high-quality deal – with tailored content increasing consensus by 20%

Complete LinkedIn profile gets 21x more profile views and 36x more messages – making profile optimization critical first touchpoint for prospects

Here’s something most people won’t tell you: your company’s reputation as an employer directly impacts your ability to close deals.

Think about it. Before anyone replies to your outreach, they’re checking you out. They’re looking at your LinkedIn company page, reading employee reviews, and forming opinions about whether they can trust you.

The data backs this up in a massive way. Companies with strong employer brands on LinkedIn see 31% higher InMail acceptance rates and can cut sales cycles by up to 16 weeks. That’s not a recruiting metric—that’s pure sales fuel.

Let’s dig into the numbers that prove employer branding is no longer optional for revenue teams.

Why Your Employer Brand Actually Matters for Sales

The traditional separation between “employer brand” (HR’s job) and “corporate brand” (Sales’ job) has completely collapsed.

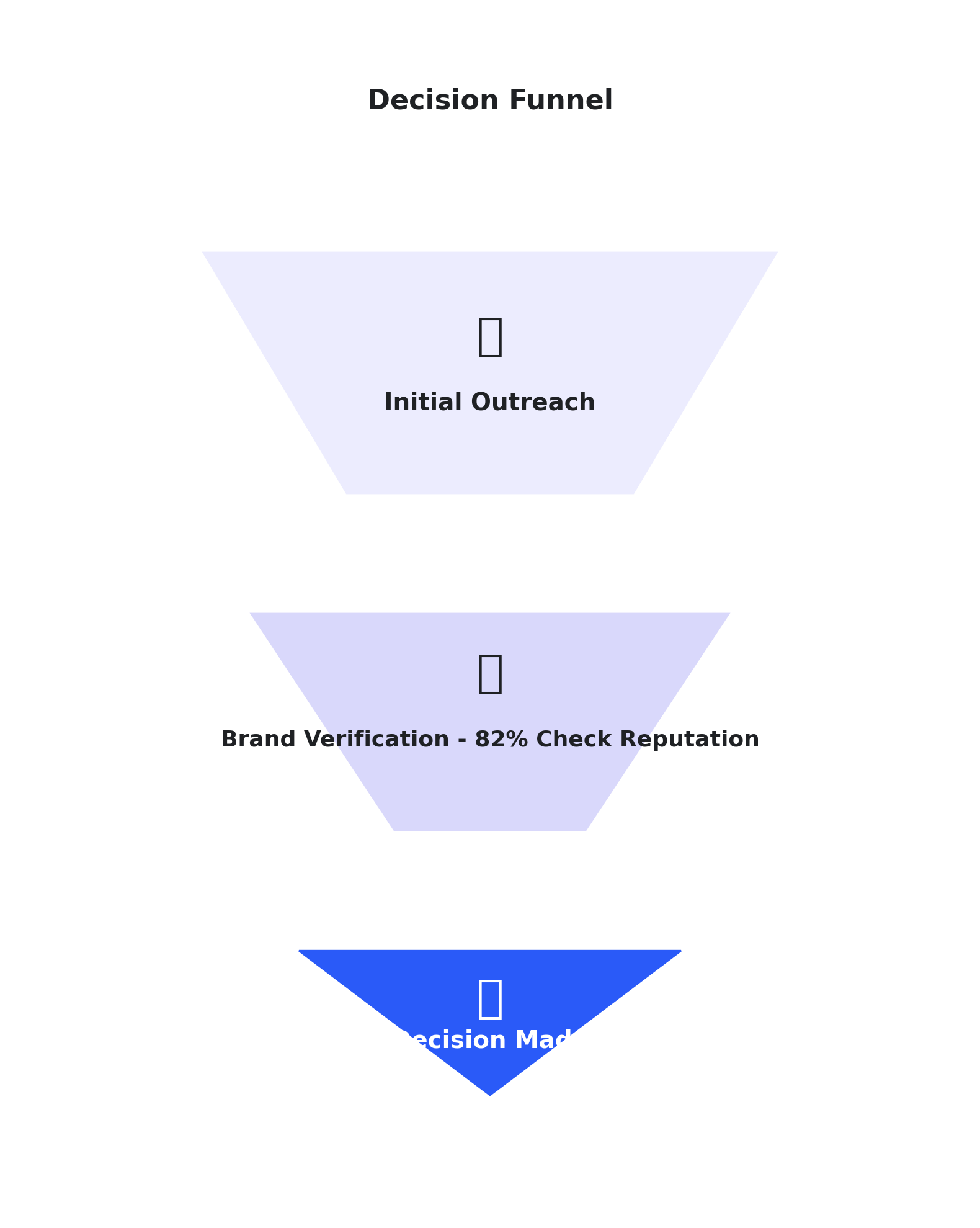

Today’s buyers operate in what experts call the “Vetting Economy.” They’re skeptical, self-directed, and they research everything before taking a meeting. When they receive your cold email or LinkedIn message, their first move is to audit your credibility.

And here’s the kicker: 82% of buyers say their trust in the parent company is important or a dealbreaker when deciding to purchase. They’re not just evaluating your product—they’re evaluating your entire organization.

Even more revealing, 60% of consumers now buy, choose, or avoid brands based on their values or politics. Your internal culture isn’t internal anymore. It’s public, it’s scrutinized, and it’s affecting your pipeline.

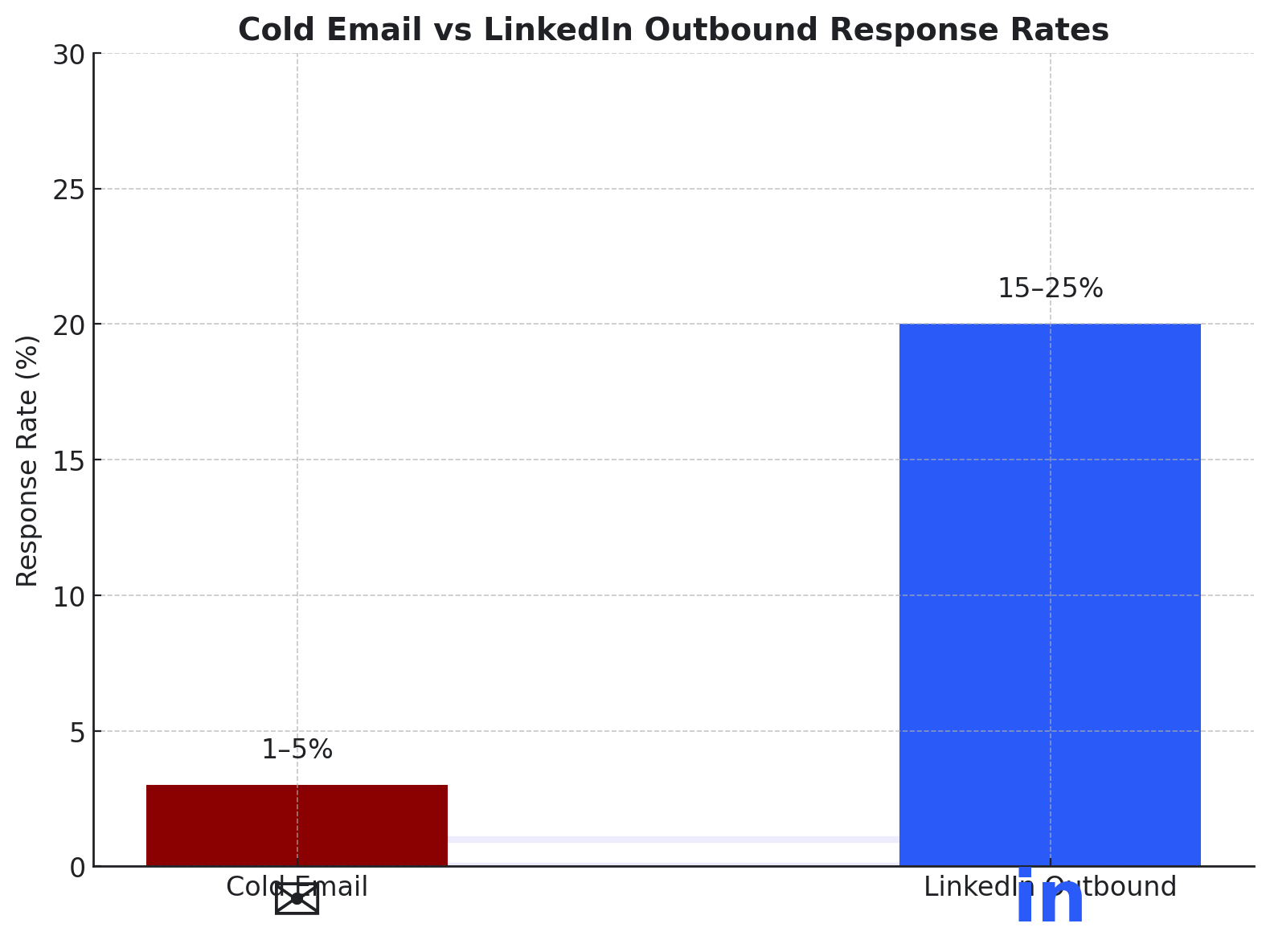

📉 Tired of 1-5% Response Rates?

LinkedIn outbound delivers 15-25% responses with complete targeting, campaign design, and scaling methodology

Let’s talk about what’s actually happening with cold email right now.

The average response rate sits somewhere between 1% and 5%. That means 95 out of 100 emails you send get ignored. The peak reply rate hits around 8.4% on the first email, then drops with every follow-up.

It gets worse. About 17% of cold emails never even reach the inbox due to spam filters and authentication issues. And if you’re sending aggressive follow-up sequences (four or more emails), you’re tripling your unsubscribe and spam complaint rates.

The market has developed immunity to generic outreach. Volume alone doesn’t work anymore.

But here’s what does work: trust.

When your company has a strong reputation, you’re not fighting against skepticism—you’re leveraging existing credibility. Your prospects already believe you might be worth their time.

The InMail Acceptance Multiplier

🎯 Get 31% Higher Acceptance Rates

Our proven LinkedIn outbound system: precision targeting, tested campaigns, scalable pipeline generation every month

This is where employer branding becomes a sales weapon.

Companies with strong talent brands achieve a 31% higher InMail acceptance rate. For context, if you’re booking 10 meetings a month, a company with a better brand would book 13 meetings with the same effort.

That’s a “Brand Dividend” that compounds over time.

But it goes deeper. When prospects are exposed to both brand content and sales messaging, they’re 6 times more likely to convert compared to sales messaging alone. And if they’ve seen your brand messaging before receiving your outreach, they’re 44% more likely to accept your message.

This isn’t about making your company page look pretty. It’s about creating a trust environment where your outreach lands differently than everyone else’s.

The pattern is clear: strong brands open doors that cold tactics can’t.

How Employer Brand Accelerates Your Sales Cycle

Time kills deals. The longer a sales cycle drags, the more likely it is to stall or die.

Research shows that B2B companies with well-established brands can cut decision-making time by as much as 16 weeks. Here’s how that breaks down:

Initial Interaction: Save 16 weeks because immediate credibility eliminates the “proof of legitimacy” phase. Buyers skip preliminary vetting.

Peer Recommendation: Save 11 weeks as strong advocacy accelerates consensus among buying committees, reducing internal debate.

Negotiation & Contracting: Save 11 weeks because high-trust brands face less scrutiny during legal review and contract redlining.

Digital Experience: Save 9 weeks when robust self-serve content allows buyers to educate themselves rapidly, moving through the funnel autonomously.

For sales teams, this is massive. A 16-week reduction often determines whether a deal closes this quarter or slips to next quarter. Your employer brand acts as a lubricant, reducing the friction of skepticism.

The Financial Impact You Can’t Ignore

Employer branding gets miscategorized as a cost center, but the data tells a different story.

Companies with strong talent brands on LinkedIn grow 20% faster than their peers. This isn’t just headcount growth—it’s business velocity.

They also see an 11.6% increase in shareholder returns. Meanwhile, companies with poor employer brands must pay 10% higher salaries to attract the same quality of talent, diverting capital away from product development and sales enablement.

Here’s the reality: 81% of job seekers would not join a company with a bad reputation. And if job seekers ghost bad employers, B2B buyers will ghost bad vendors.

Poor reputation creates a “reputation tax” on every business function. Strong reputation creates a “reputation dividend.”

What LinkedIn Users Actually Want from Companies

Understanding user behavior is critical if you want to leverage employer branding for sales.

The primary reason people follow companies on LinkedIn? To receive educational information. They’re tired of promotional content and product pitches. They want insights, industry analysis, and professional development.

In fact, 66% of social users find “edutainment” (educational + entertaining content) to be the most engaging form of brand content.

For sales professionals, this means your content strategy should shift from “selling” to “teaching.” Share industry reports, how-to guides, and insights that help prospects do their jobs better.

Video matters too. Users are more likely to engage with videos shorter than 15 seconds compared to longer formats. And 25% of LinkedIn users interact with brand content daily—this power user segment often includes the decision-makers you’re trying to reach.

The Buying Committee Reality

💼 Reach Entire Buying Committees

LinkedIn’s 65M+ decision-makers accessible through our complete targeting system, campaign frameworks, and scaling processes

Modern B2B purchases aren’t made by individuals—they’re made by committees.

The average buying group involves 6 to 10 decision-makers. And here’s the challenge: 74% of buying teams experience unhealthy conflict during the decision process.

But when groups reach consensus, they’re 2.5 times more likely to report a high-quality deal. Tailored content that’s relevant to the group increases consensus by 20%.

This is where employer brand content becomes strategic. It speaks to universal values—stability, culture, innovation—that all committee members can agree on, unlike specific feature sets that may cause division.

A strong employer brand serves as a “consensus builder,” providing a unified narrative for the entire buying committee.

How to Operationalize This for Revenue

🚀 Ready to Actually Apply This?

Complete LinkedIn outbound strategy covering targeting, campaign design, and scaling—built specifically for B2B revenue teams

7-day Free Trial |No Credit Card Needed.

Understanding the statistics is one thing. Applying them is another.

Here’s how to leverage employer branding for actual quota attainment:

Optimize Your LinkedIn Profile: A complete profile gets 21x more profile views and 36x more messages. Profiles with a picture are 7x more likely to be found. Your profile is often the first “landing page” prospects visit after receiving your email—make it count.

Create an Educational Content Cadence: Move from a “selling” mindset to an “educating” mindset. Use the “4:1 Rule”—share four pieces of value-driven content for every one promotional post. Leverage short-form video to capture attention.

Leverage Reviews in Outreach: When 71% of candidates say their perception improves when a company responds to reviews, this signals buyer behavior too. Proactively share positive employee reviews or “Best Place to Work” awards in your outreach.

Integrate Brand into Your Email Signature: Include a link to your “Life at [Company]” page or a specific culture video in your signature. This creates a “Trust Loop” that validates your outreach.

The key is consistency. Employer branding isn’t a one-time project—it’s an ongoing strategy that compounds over time.

Looking Ahead: The Future of Sales

Three trends will define the intersection of brand and sales moving forward:

AI vs. Human Authenticity: As AI takes over automation (74% of recruiters say AI improves efficiency), the premium on human connection will skyrocket. “Human-verified” content—real stories from real employees—becomes the new luxury.

Skills-First Selling: Just as hiring is moving to “Skills-First” approaches, selling is moving to “Expertise-First.” Buyers want subject matter experts, not just relationship builders. Employer branding that highlights team expertise directly supports sales claims.

The Transparent Enterprise: With 60% of consumers making buying decisions based on values, companies can no longer hide. Radical transparency regarding supply chain, diversity, and employee treatment will become standard B2B due diligence.

The companies that win will be those that build authentic, transparent employer brands that make prospects want to work with them—not just buy from them.

Other Useful Resources

To convert employer brand equity into systematic outbound execution and predictable pipeline, explore these complementary resources:

LinkedIn Automation & Scaling:

- Read our comprehensive LinkedHelper 2 review for understanding automation tools that scale LinkedIn activities while maintaining the authenticity your brand demands

- Explore our detailed Meet Alfred review to evaluate multi-channel automation platforms that coordinate LinkedIn and email outreach

Strategic Channel Selection & Prospecting:

- Compare LinkedIn InMail vs email to understand when each channel maximizes your brand advantage

- Master LinkedIn Sales Navigator prospecting to leverage premium targeting that complements brand credibility

Email Strategy:

- Discover proven cold call email subject lines that work when brand recognition isn’t established yet

Content Strategy:

- Perfect your LinkedIn post drafts to build the educational content buyers actually want

LinkedIn Sales Intelligence:

- Review comprehensive LinkedIn sales statistics showing how brand equity translates into conversion metrics

Employer brand statistics reveal powerful multipliers—31% higher InMail acceptance, 16-week faster sales cycles, 20% revenue growth—but brand reputation is passive leverage. While strong employer branding opens doors and builds trust (reducing the 82% who won’t engage without it), systematic LinkedIn outbound converts that credibility into booked meetings. Our complete targeting, campaign design, and scaling system applies your brand advantage to deliver 15-25% response rates versus cold email’s 1-5%. Brand creates the opportunity; strategic execution captures it.

FAQs

How does employer branding impact sales quotas?

What is the top reason why LinkedIn users follow a company?

Does LinkedIn have company reviews?

Can a strong employer brand fix low cold email response rates?

What is the ROI of investing in employer branding for sales?

- blog

- Statistics

- LinkedIn Employer Brand Statistics 2025-2026 | Key Data