LinkedIn Groups Statistics: What the Data Actually Reveals About Professional Communities

- Sophie Ricci

- Views : 28,543

Table of Contents

LinkedIn Groups Statistics

LinkedIn has 1.2 billion total members, but only 310 million are monthly active users – meaning 74% of the user base (890 million) is essentially dormant but still accessible through group data

Three new members join LinkedIn every second – platform adds approximately 180 users per minute, though growth has slowed to 4.3% in 2025

United States has 243 million LinkedIn users, India has 161 million – geographic concentration makes LinkedIn particularly valuable for B2B targeting in these markets

25-34 age bracket represents 47-56% of LinkedIn’s total user base – these managers and senior managers are typically “Champions” in B2B sales cycles

LinkedIn is 277% more effective for lead generation than Facebook or Twitter – dramatically outperforms other social platforms for B2B prospecting

89% of B2B marketers use LinkedIn for lead generation, 62% report success – making it the dominant platform for professional lead generation strategies

LinkedIn delivers 28% lower cost per lead than Google AdWords – more cost-effective than paid search advertising for B2B targeting

Sales professionals with high SSI scores are 51% more likely to reach their quota – Social Selling Index directly correlates with sales performance

78% of social sellers outsell peers who don’t use social media – demonstrating significant competitive advantage for LinkedIn-active salespeople

Leaders in social selling create 45% more opportunities – engaging in groups and platform activity boosts overall LinkedIn effectiveness

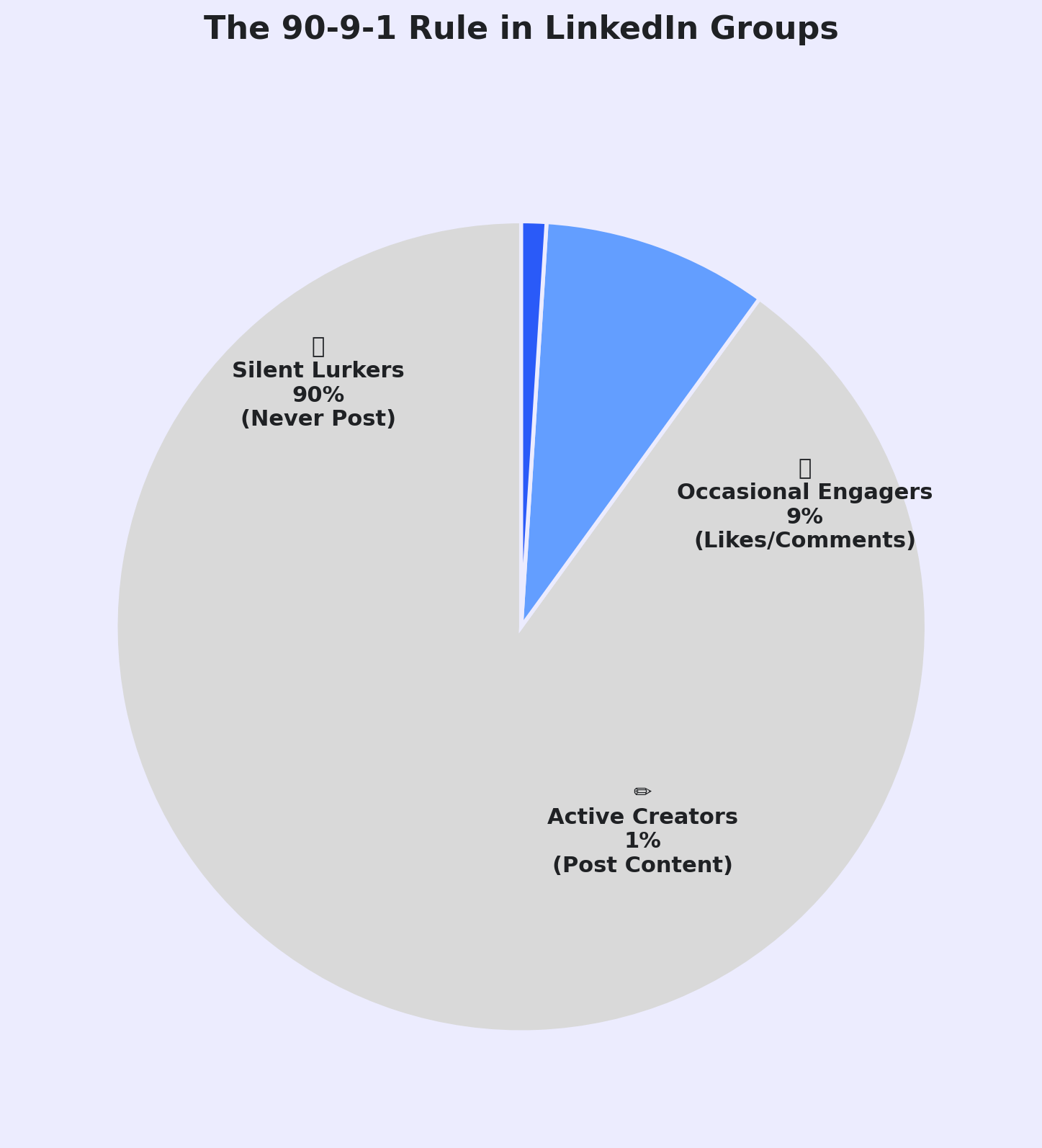

90-9-1 rule: 90% of group members purely lurk, 9% occasionally interact, 1% actively create – vast majority never post or engage publicly

Only 16.2% of LinkedIn users log in daily – meaning 84% won’t see group posts on any given day, requiring direct outreach strategies

Average LinkedIn session duration: 14 minutes and 20 seconds – narrow attention window for content visibility within groups

Polls saw +206% increase in reach, video +73% impressions – low-friction content formats dramatically outperform traditional posts

Email marketing delivers 4200% ROI – making email enrichment from group data more effective than in-platform engagement for reaching passive members

You’re scrolling through LinkedIn. Again.

Looking for decision-makers. Trying to figure out who’s actually interested in what you’re selling. Maybe you’ve joined a few groups—”Digital Marketing Professionals” or “SaaS Sales Leaders”—hoping to find your next customer.

But here’s what nobody tells you: LinkedIn Groups aren’t really about the conversations happening inside them.

They’re databases. Self-segmented, constantly updated databases of people who’ve essentially raised their hand and said, “This topic matters to me.”

The question is: are you treating them that way?

This article breaks down the actual linkedin groups statistics that matter—not vanity metrics, but the numbers that reveal how professionals really use these communities and what that means for anyone trying to reach them.

LinkedIn Groups Statistics

Let’s start with the foundation. LinkedIn isn’t just big—it’s the entire professional world digitized.

The Numbers Behind the Platform

As of 2025, LinkedIn has crossed 1.2 billion total members. That’s more people than the population of most continents. The platform adds approximately three new members every second, which means by the time you finish reading this sentence, another dozen professionals have created profiles.

But here’s the critical distinction: only 310 million of those 1.2 billion users are monthly active users.

Think about that math for a second. 74% of LinkedIn’s user base is essentially dormant. They created profiles. They joined groups. They might check a notification every few months. But they’re not scrolling the feed, engaging with posts, or checking InMail.

This isn’t a weakness—it’s actually the hidden opportunity. Those 890 million “passive” users still exist in groups. Their data is still accurate. They’ve still self-identified their professional interests. You just can’t reach them by posting content and hoping they see it.

Geographic Concentration of Users:

- United States: 243 million users

- India: 161 million users

- Brazil: 83 million users

- China: 58 million users

The concentration in North America and Asia makes LinkedIn particularly valuable for B2B targeting in these markets. The data density is exceptional.

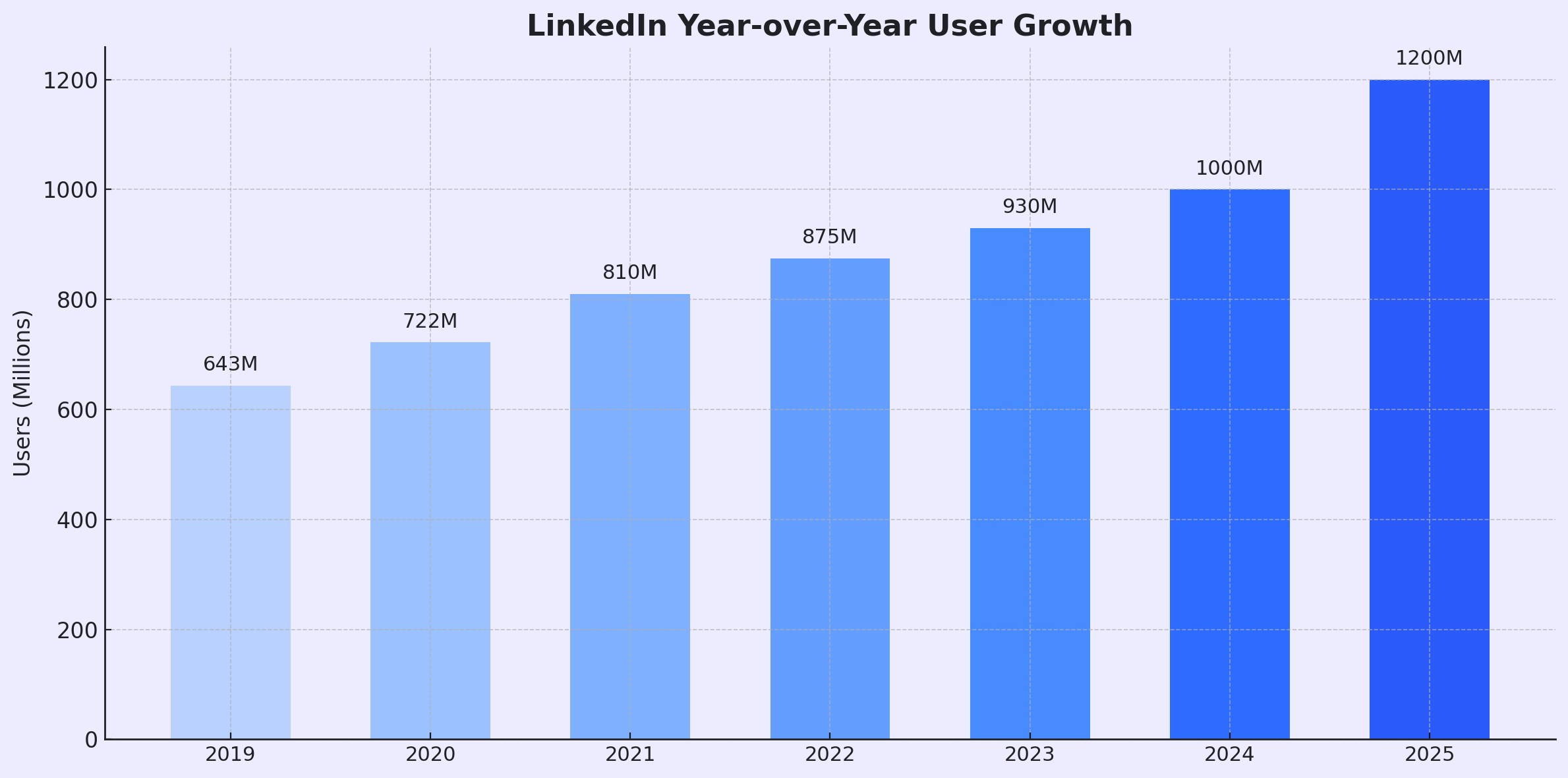

Year | Total Users (Millions) | Year-over-Year Growth | What This Means |

2019 | 643 | 10.5% | Pre-pandemic baseline |

2020 | 722 | 12.3% | Digital transformation accelerates |

2021 | 810 | 12.1% | Remote work boom |

2022 | 875 | 8% | Post-pandemic consolidation |

2023 | 1,000 | 14.3% | Universal corporate adoption |

2024 | 1,150 | 15% | Emerging market growth |

2025 | 1,200 | 4.3% | Market saturation; focus shifts to data quality |

The growth is slowing, which actually makes the data more valuable. We’re past the “everyone’s joining LinkedIn” phase and into the “LinkedIn has everyone who matters” phase.

Who’s Actually Inside These Groups?

Demographics tell you everything about targeting strategy.

The 25-34 age bracket dominates LinkedIn, representing roughly 47-56% of the total user base. These are your managers, senior managers, and directors. In a B2B sales cycle, they’re typically the “Champions”—the people researching solutions, vetting vendors, and building internal cases for purchase.

But they’re not usually the final decision-makers.

Age Group | % of User Base | Role in B2B Sales | Engagement Level |

18-24 | ~29% | Entry level, SDRs | High frequency, low authority |

25-34 | ~47-56% | Managers, Champions, Researchers | High intent, actively researching |

35-54 | ~20% | VPs, Directors, Decision-makers | Lower frequency, high authority |

55+ | ~3.3% | C-Suite, Executive Leadership | Lowest frequency, highest authority |

Here’s the pattern: The younger the demographic, the more visible they are. The older the demographic, the scarcer—and more valuable—they become.

Think of it as an “Inverse Authority Curve.” A group for “Junior Accountants” might have 100,000 members. A group for “Chief Financial Officers” might have 8,000. But the value per member in that CFO group is exponentially higher.

The 35-54 and 55+ segments are often lurkers. They’re in the groups. They read occasionally. But they don’t post, comment, or engage publicly. You can’t reach them with content alone. You need direct outreach—and that means getting their contact information from the group membership data.

The Mega Groups vs. The Niche Communities

LinkedIn Groups follow a power law distribution. A handful of massive groups contain millions of members, while hundreds of thousands of smaller communities serve specific niches.

Largest LinkedIn Groups (2025):

- Harvard Business Review Discussion Group: ~3,000,000 members

- Artificial Intelligence, Machine Learning, Data Science & Robotics: ~2,999,772 members

- Social Media Marketing Group: ~2,934,280 members

- Digital Marketing: ~2,328,015 members

- Python Developers Community: ~2,697,519 members

These mega-groups are essentially digital city-states. Joining one is less about intimate networking and more about attaching a tag to your profile. A member of the “Artificial Intelligence” group has self-identified their professional interest, even if they never post a single comment.

But here’s the catch: engagement in these massive groups is abysmal.

Platform-wide engagement benchmarks for LinkedIn content in 2025 hover around 5.2% to 6.5% for organic posts, but that’s driven by personal profiles and company pages. Inside large groups, organic reach is often suppressed by LinkedIn’s algorithm, which prioritizes feed content over group discussions.

Content Performance by Format (2025 Benchmarks):

Content Type | Avg. Engagement Rate | Best Use Case |

Multi-image/Carousel | 6.60% | Educational “how-to” content |

Native Documents (PDFs) | 6.10% | Whitepapers, research reports |

Video | 5.60% | Trust building, authenticity |

Single Images | 4.85% | Visual storytelling |

Text Only | 4.00% | Thought leadership, if copy is strong |

Video content gets approximately 5 times more engagement than static posts, which matters if you’re trying to build authority through social selling. But for most groups with millions of members, even great content gets buried quickly.

The real value of these large groups isn’t engagement—it’s data mining. A group with 3 million members is a spreadsheet with 3 million rows of qualified prospects who’ve already told you what they care about.

📊 Stop Scrolling. Start Extracting.

Turn any LinkedIn Group into a pipeline-generating database with our complete extraction and outreach system

Niche Groups: Where Depth Beats Breadth

While mega-groups offer volume, niche groups offer precision.

Key Niche Group Statistics (Data Analytics Focus):

- Big Data and Analytics: ~336,000 to 500,000+ members

- Data Science Central: ~400,000+ members

- Business Intelligence Professionals: ~213,000 members

- Microsoft Power BI Community: ~90,000 members

These communities act as watering holes for specific personas. Someone in the “Data Warehousing Professional’s Group” isn’t just a data scientist doing a job—they’re actively interested in the field’s development. They’re more likely to be internal champions for new tools and solutions.

The difference between broad and niche groups comes down to signal clarity:

Broad Interest Groups (e.g., “Leadership Think Tank”):

- Volume: High (2M+)

- Specificity: Low

- Noise: High

- Best Use: Brand awareness, generalist targeting

Technical Niche Groups (e.g., “Python Developers Community”):

- Volume: Medium (2.6M)

- Specificity: High

- Technical Barrier: High

- Best Use: Technical sales, developer tools, recruitment

Local/Regional Groups (e.g., “Dubai Professionals”):

- Volume: Low

- Specificity: Geographic

- Best Use: Territory-based sales, events

For anyone selling into specific verticals—especially big data, analytics, or technical products—these niche communities represent the highest concentration of qualified prospects available on the open web.

Lead Generation: What the Numbers Actually Say

The ultimate question: does LinkedIn actually drive business results?

The answer is overwhelmingly yes—but with an important caveat about how you use it.

LinkedIn’s Lead Generation Efficacy:

- 277% more effective for lead generation than Facebook or X (formerly Twitter)

- 89% of B2B marketers use LinkedIn for lead generation

- 62% of those marketers report it successfully generates leads

- 28% lower cost per lead than Google AdWords

- 2x the buying power of the average web audience

That last statistic is critical. A lead from LinkedIn isn’t just another name—it’s statistically more likely to represent someone with budget authority and purchasing power.

But here’s where strategy diverges from common wisdom.

The Social Selling Index (SSI) Correlation

LinkedIn measures your effectiveness with a score called the Social Selling Index (SSI). It ranges from 0-100 and measures four things:

- Establishing your professional brand

- Finding the right people

- Engaging with insights

- Building relationships

Sales professionals with high SSI scores are 51% more likely to reach their sales quota. That’s not a minor edge—that’s the difference between hitting target and falling short.

Additionally:

- 78% of social sellers outsell peers who don’t use social media

- Leaders in social selling create 45% more opportunities

One of the four SSI pillars is “Engage with Insights,” which explicitly includes participating in groups. So even if you don’t directly source a lead from a specific group comment, joining and engaging in groups boosts your algorithmic authority across the entire platform.

Every other action you take on LinkedIn—connection requests, content posts, InMails—becomes more effective when your SSI score is higher.

This creates a meta-strategy: Use groups to improve your SSI, which amplifies everything else you do on the platform.

The Silent Majority: Why 90% of Group Members Never Engage

Here’s the uncomfortable truth about online communities: most members never participate.

The internet follows a rough “90-9-1 rule”:

- 90% of users purely consume or lurk

- 9% of users occasionally interact (likes, comments)

- 1% of users actively create content

In professional settings like LinkedIn Groups, this skew is often even more extreme.

For the 90% who never post, standard engagement strategies completely fail. You can’t build a relationship through group discussions if they never comment. You can’t catch their attention with a brilliant post if they’re not checking the feed.

This is where data mining becomes essential.

The vast majority of a group’s value is locked in its silent members. These are often the most senior people, the busiest decision-makers, the ones who joined the group years ago and forgot about it—but whose professional interests are still perfectly captured by that membership.

The technological solution: Tools exist (PhantomBuster, Evaboot, and similar services) that allow extraction of public profile data from groups—names, headlines, company details, profile URLs.

The strategic bridge: Once you have that data, you enrich it with professional email addresses using a service like Salesso. Then you move the conversation off-platform entirely.

Why does this work?

Email marketing delivers an average ROI of 4200%. Meanwhile, LinkedIn imposes strict limits on connection requests (roughly 100 per week) and InMail credits are expensive and finite.

For the 890 million passive users who rarely check LinkedIn, email isn’t just another channel—it’s the only reliable way to reach them.

The combination is powerful: LinkedIn Group data provides targeting precision. Email provides delivery reliability.

🎯 Reach The 90% Who Never Engage

Our proven system extracts member data, enriches emails, and books meetings with silent decision-makers

Behavioral Patterns: When Are Users Actually Active?

Understanding timing is just as important as understanding who to target.

LinkedIn Usage Patterns:

- Average session duration: 14 minutes and 20 seconds

- Monthly usage (casual users): ~17 minutes per month

- Monthly usage (power users/recruiters): Significantly higher

- Daily active users: Only 16.2% of the total user base

Read that last stat again. On any given day, nearly 84% of LinkedIn users won’t log in.

This has profound implications for outreach strategy. If you post content in a group hoping a specific prospect will see it, you’re betting on:

- Them logging in that day (16.2% chance)

- Them checking the group feed (even lower)

- Them scrolling far enough to see your post (lower still)

Meanwhile, 57% of LinkedIn traffic comes from mobile devices. Content needs to be optimized for small screens—short subject lines, concise formatting, easily scannable.

The attention window is narrow. Most users spend minutes per month on the platform. A cold email sits in an inbox until it’s processed. A LinkedIn post scrolls into oblivion within hours.

Direct outreach—triggered by group membership data but delivered via email—statistically has a higher probability of securing attention than passive content marketing within the group itself.

💼 84% Won’t See Your Posts

H2: Skip the algorithm. We’ll show you how to extract group data and reach decision-makers directly via email

What Content Actually Works in Groups

If you do choose to engage in groups for authority building or social selling, understanding content performance is critical.

Recent Content Trends (2024-2025):

Format | Trend | Strategic Use |

Polls | +206% reach | Market research; identifying engaged prospects |

Video | +73% impressions | Personal branding; building trust |

Text | +18% usage | Storytelling; case studies; thought leadership |

Carousels | Steady high | Education; complex topics made skimmable |

Polls are particularly interesting. They’ve seen a massive increase in reach (+206%) and generate high impressions because they’re low-friction. Clicking a vote button is easier than writing a comment.

Tactically, this creates an opportunity: Post a poll asking about a pain point relevant to your product. Extract the list of voters. Those votes are digital hand-raises—signals of active interest from otherwise silent members.

A follow-up email saying “I saw you voted on my poll about [topic] in the [Group Name]…” converts a cold interaction into a context-rich conversation.

Text-only posts also perform surprisingly well on LinkedIn compared to other platforms, often outperforming single images if the copywriting is strong. This validates the “thought leader” style of long-form text updates.

Video content creates 5x more engagement than static posts and helps establish trust through authenticity. Even low-production-quality video (selfie-style updates) can cut through noise in crowded groups.

Big Data Meets LinkedIn Groups

Since we’re talking about data analytics, it’s worth noting how the big data industry itself shows up on LinkedIn.

Macro Context:

- 61% of global companies have implemented big data solutions by 2025

- The United States captures over 50% of the Big Data market

- 328.77 million terabytes of data are created daily worldwide

This explosion of data creation underscores the urgency of the problems that analytics companies solve. It also fuels the growth of related LinkedIn Groups.

Groups like “Big Data and Analytics” (336,000-500,000+ members) aren’t just social spaces—they’re essential hubs for recruitment, vendor discovery, and professional development in one of the fastest-growing sectors in business.

For anyone selling into this vertical, these groups represent arguably the most concentrated source of qualified leads available. The members have explicitly identified themselves as working in or interested in data analytics, making them pre-qualified for relevant products and services.

The intersection is perfect: LinkedIn Groups are themselves a form of big data—unstructured collections of millions of professional profiles. Analyzing this data (job titles, group memberships, activity patterns) allows you to apply data analytics to prospecting itself, predicting who’s most likely to buy based on their digital footprint.

🚀 Turn Group Data Into Revenue

Master the complete outbound system: precision targeting, verified emails, and campaigns that convert members into meetings

7-day Free Trial |No Credit Card Needed.

Conclusion

LinkedIn Groups aren’t social networks in the traditional sense.

They’re structured, searchable databases of professional intent. People join them, tag themselves with interests, and then—74% of the time—fade into passive mode.

The statistics tell a clear story: Organic reach in groups is limited. Engagement rates are low. Most members never post.

But that doesn’t make groups worthless. It just means you need a different approach.

Don’t rely on groups for organic reach. Leverage them for data intelligence.

The real opportunity isn’t posting content and hoping someone sees it. It’s recognizing that every group member has self-identified their professional interests, then using that data to initiate direct, personalized conversations—often via email, where response rates are predictable and inboxes are checked daily.

The winners in modern B2B prospecting aren’t the ones making the most noise in the group feed. They’re the ones who best utilize the group’s data to drive meaningful, one-to-one conversations with the right people at the right time.

LinkedIn Groups are goldmines. You just need to stop panning for gold and start mining.

Other Useful Resources

To convert LinkedIn group membership data into systematic outreach campaigns that reach the silent 90%, explore these resources:

LinkedIn Automation & Data Extraction:

- Read our comprehensive LinkedHelper 2 review for understanding group member extraction tools

- Explore our detailed Meet Alfred review to evaluate multi-channel automation for LinkedIn and email coordination

Contact Intelligence & Enrichment:

- Learn how to get contact info from LinkedIn without connecting to reach group members who never engage

- Compare the top BetterContact alternatives for enriching group data with verified emails

Email Infrastructure & Deliverability:

- Understand how Gmail’s 2025 email rules will kill most cold emailers and ensure your group-derived campaigns reach inboxes

Content Strategy:

- Master LinkedIn post drafts for the 1% who actually want to build authority through group engagement

LinkedIn Sales Intelligence:

- Review comprehensive LinkedIn sales statistics showing how group-based prospecting converts into revenue

LinkedIn groups aren’t engagement platforms—they’re databases of 3 million self-identified prospects per group. While 90% of members never post and only 16.2% of users are daily active, that silence represents opportunity, not failure. The 890 million passive users who rarely check LinkedIn still exist in group member lists with accurate job titles and verified interests. Our complete system extracts group data, enriches it with verified emails (delivering 4200% ROI), and reaches the silent majority through multi-channel campaigns. Stop waiting for the 84% who won’t see your posts—start mining the database they’ve already joined.

FAQs

Are LinkedIn Groups still effective for lead generation in 2025?

How many members are in the largest LinkedIn Groups?

What is a good engagement rate for LinkedIn content?

Can I export email addresses from LinkedIn Groups?

What does "Big Data" have to do with LinkedIn Groups?

- blog

- Statistics

- LinkedIn Groups Statistics: Data & Insights (2026