LinkedIn Statistics by Country: The 2026 Global Market Guide

- Sophie Ricci

- Views : 28,543

Table of Contents

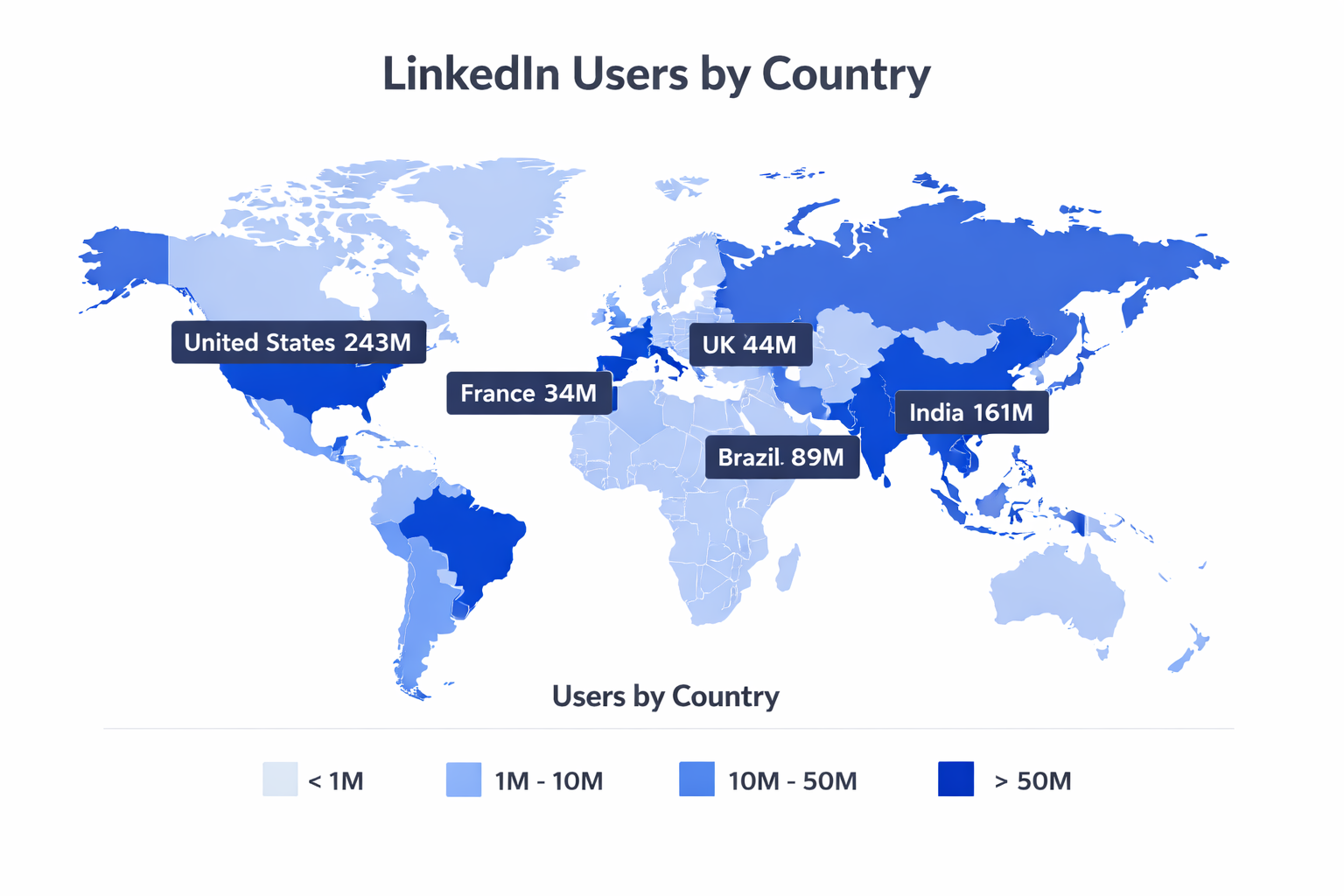

LinkedIn Statistics by Country

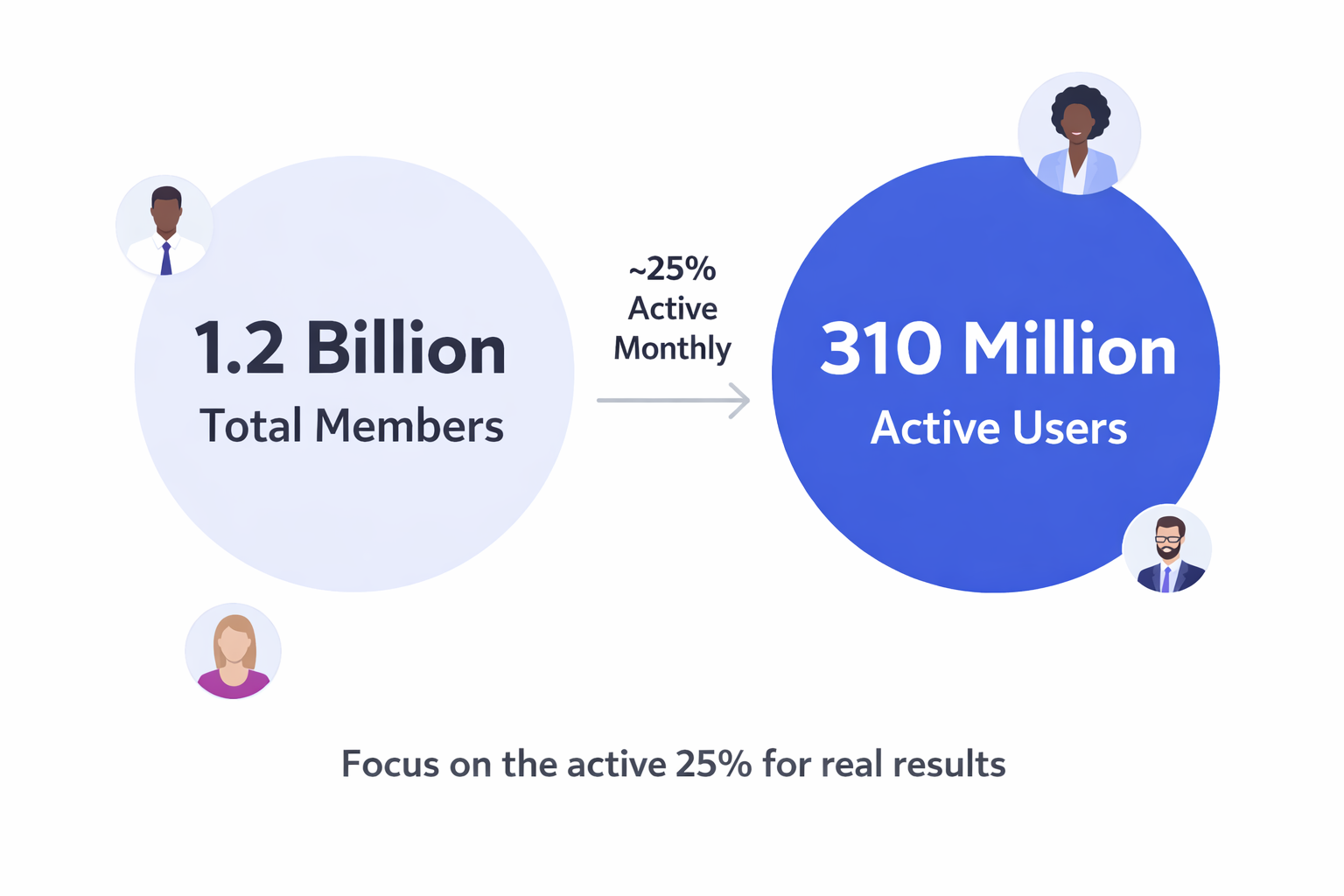

- 1.2 billion total users in late 2025 but only 310 million monthly active (25%) – massive difference between total members since 2003 and people who actually see messages, critical for setting realistic expectations

- United States: 243-250 million users (roughly 75% of entire US adult population) – nearly double any other country making US the LinkedIn powerhouse, highest decision-maker density globally

- 53% of US users earn over $100,000 annually – not just reaching more people but people with serious buying power, making US highest-value market

- 69% of US users check LinkedIn daily – messages won’t sit unread for weeks, most US professionals seeing outreach within 24 hours enabling faster response times

- India: 161 million users and fastest-growing major market – demographic skewing young under 30, making it “future-proof” market for long-term brand building

- India has only 0.31% “self-proclaimed CEOs” vs higher Western markets – user base heavily enterprise employees and middle management rather than solopreneurs, indicating structured organizations with clear hierarchies

- Brazil: 89 million users (third largest) with highest social engagement – Brazilians blurring lines between professional and social networking more than North American counterparts

- UK: 44-45 million users with average 144 connections per user (among highest globally) – incredibly high connectivity making second-degree referral strategies exceptionally effective here

- France: 34-35 million users preferring native language communication – English outreach seeing lower conversion rates unless targeting international tech sectors specifically

- Switzerland: 5.48% CEO density (highest globally) – Germany 4.19% CEO density, making DACH region ideal for high-end executive services or wealth management targeting

- Asia-Pacific: 326-343 million users (technically surpassing North America and Europe) – largest region in raw numbers but diverse maturity levels requiring purchasing power and decision-maker density adjustments

- Latin America: 188-196 million users (beyond Brazil’s 89M) – entire region mobile-first with desktop usage significantly lower than North America/Europe affecting outreach display and response timing

- MENA: 61-74 million users with UAE having 102.8% ad reach relative to population – possible due to massive expat populations maintaining UAE-based LinkedIn profiles creating unique targeting opportunity

- 1.4 billion visits happen monthly with 99.62% of traffic organic – people not being tricked into visiting, going there with intent showing platform health and genuine professional engagement

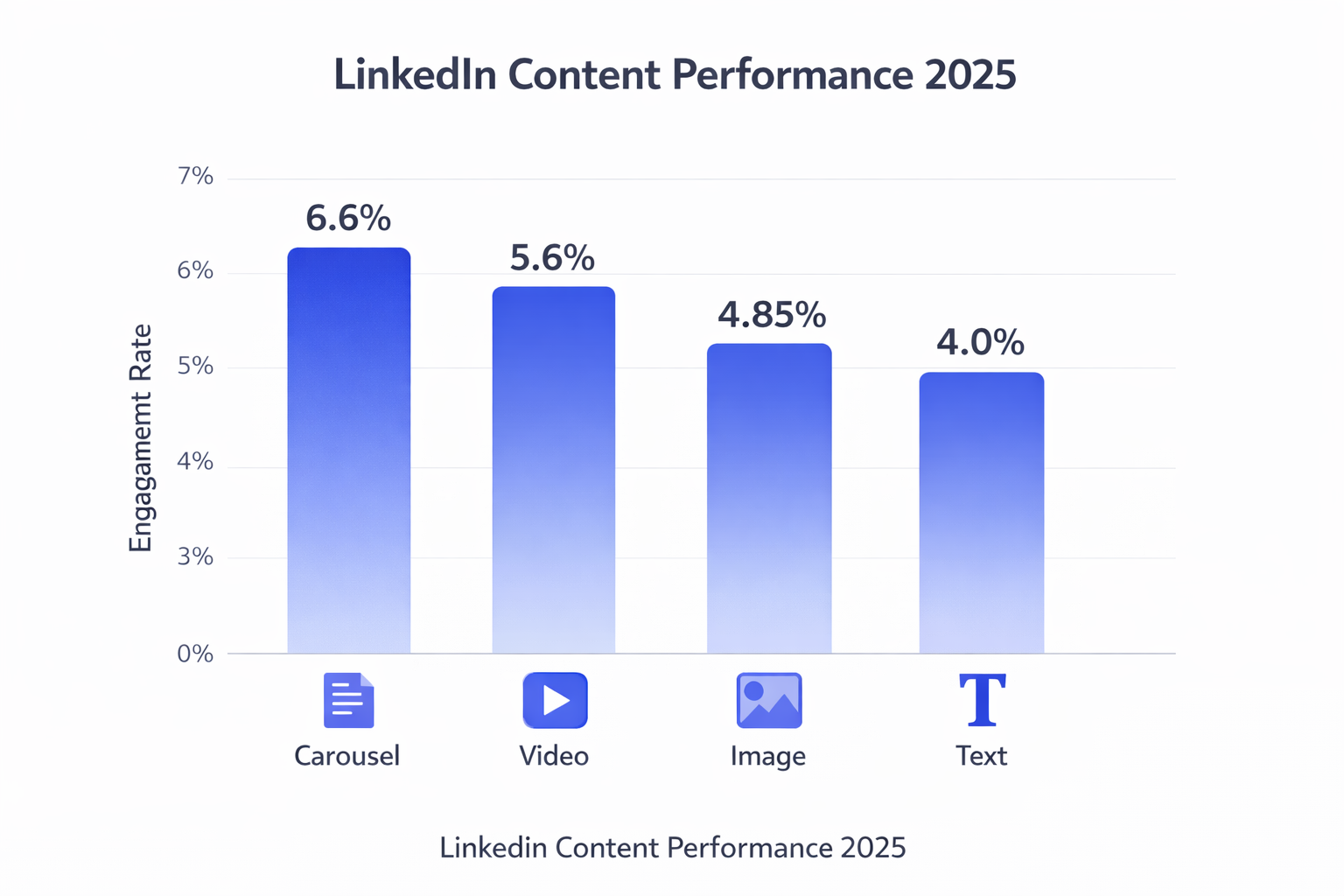

- Only 1% of users post content weekly yet generating 9 billion impressions – massive opportunity for content creators with carousels achieving 6.10-6.60% engagement (highest), video 5.60%, images 4.85%

You’re probably wondering: where exactly are all these LinkedIn users located?

If you’re trying to reach decision-makers, understanding LinkedIn statistics by country isn’t just nice to know—it’s essential. The platform hit 1.2 billion users in late 2025, but they’re not evenly distributed across the globe.

Some countries are packed with active professionals checking their feeds daily. Others? Not so much.

Here’s what matters: The United States leads with 243-250 million users, followed by India with 161 million. But the real story isn’t just about size—it’s about where your ideal customers actually hang out.

In this guide, you’ll discover which countries dominate LinkedIn, where engagement is highest, and how to use this data to improve your outreach strategy.

🎯 Stop Guessing Where Your Prospects Are

Target the right LinkedIn markets with precision using our complete outbound system

The United States: The LinkedIn Powerhouse

Let’s start with the obvious winner.

The United States has 243-250 million LinkedIn users—nearly double any other country. That’s roughly 75% of the entire US adult population.

But here’s what makes the US market really valuable: 53% of US users earn over $100,000 annually. You’re not just reaching more people—you’re reaching people with serious buying power.

Even better? 69% of US users check LinkedIn daily. Your message won’t sit unread for weeks. Most US professionals will see your outreach within 24 hours, which means faster response times and shorter sales cycles.

The competition is fierce here, though. Everyone wants access to these high-value prospects. That’s why advanced LinkedIn search techniques matter more than ever.

Key US Statistics:

- Users: 243-250 million

- Daily active rate: 69%

- High-income users: 53% earn $100k+

- Decision-maker density: Highest globally

📊 Your US Market Strategy Is Broken

Most companies waste 60% of their LinkedIn budget on wrong targets. Our targeting system finds decision-makers others miss.

India: The Fastest-Growing Market

India ranks second globally with 161 million users, and it’s growing faster than any other major market.

What’s interesting about India? The demographic skews young. A huge portion of users are under 30, making it a “future-proof” market for long-term brand building.

The industries dominate here: Information Technology, Engineering, and Business Services. If you’re recruiting technical talent or selling developer tools, India should be your primary focus.

One fascinating detail: India has a lower density of “self-proclaimed CEOs” (just 0.31%) compared to Western markets. This tells you the user base is heavily enterprise employees and middle management rather than solopreneurs.

Translation? You’re dealing with structured organizations and clear hierarchies. Titles matter here. Using LinkedIn automation tools helps maintain consistent outreach at scale.

Brazil: The Social Engagement Champion

Brazil comes in third with 89 million users, but don’t let the numbers fool you.

Brazilian professionals are among the most engaged on the entire platform. They blur the lines between professional and social networking more than their North American counterparts.

What does this mean for you? Visual content and slightly informal communication styles work better here. Personal relationships are paramount in Brazilian business culture.

Brazil also serves as the gateway to Latin America. Success here often ripples into Argentina, Colombia, and other neighboring markets.

IN-CONTENT BANNER 2: (Place after “Success here often ripples into Argentina, Colombia, and other neighboring markets.”)

🌎 Struggling With International Outreach?

We’ve generated meetings across 50+ countries. Our campaign design adapts to local LinkedIn behaviors and cultural nuances.

CTA: Book Strategy Meeting

The United Kingdom: Europe’s LinkedIn Hub

The UK has 44-45 million LinkedIn users, making it the fourth-largest market globally.

Despite having a smaller user base than Brazil or India, the UK offers something unique: incredibly high connectivity. The average UK user has 144 connections—among the highest globally.

Why does this matter? Second-degree referral strategies work exceptionally well here. If you share a mutual connection with a UK prospect, mentioning it significantly boosts your response rates.

London’s concentration of financial services, legal firms, and global headquarters makes the UK one of the highest-value markets per capita. The economic value per user is extremely high.

France and the DACH Region: Europe’s Complexity

Europe isn’t one market—it’s a patchwork of distinct behaviors.

France has 34-35 million users. French professionals are highly active but prefer communication in their native language. English outreach often sees lower conversion rates unless you’re targeting international tech sectors specifically.

The DACH region (Germany, Austria, Switzerland) presents unique challenges and opportunities:

- Germany: As Europe’s largest economy, it has high CEO density (4.19% of profiles). German professionals value privacy and formality.

- Switzerland: Tops the global list for CEO density at 5.48%. If you sell high-end executive services or wealth management, Switzerland is your highest-probability territory.

- Austria: Similar professional culture to Germany but smaller market.

One important note: LinkedIn faces competition from Xing (18 million members) in this region. Many professionals maintain both profiles. Implementing effective LinkedIn growth hacking strategies helps you stand out.

IN-CONTENT BANNER 3: (Place after “Implementing effective LinkedIn growth hacking strategies helps you stand out.”)

🇪🇺 European Markets Feel Impossible?

GDPR, language barriers, and cultural differences killing your outreach? Our scaling methods navigate European complexity systematically.

Asia-Pacific: The Volume Leader

Here’s something that surprises most people: Asia-Pacific has 326-343 million users—technically surpassing North America and Europe in raw numbers.

But raw numbers don’t tell the full story. When you adjust for purchasing power and decision-maker density, the region shows diverse maturity levels.

Key markets include:

- Australia: Highly mature market with Western business practices

- Indonesia: Fast-growing but price-sensitive

- Singapore: Small but extremely high-value for B2B

Mobile usage dominates in APAC. Over 70% of LinkedIn activity happens on mobile devices in this region. Your outreach needs to look perfect on smartphones.

Latin America: The Mobile-First Region

Beyond Brazil, Latin America has 188-196 million total users spread across Mexico, Argentina, Colombia, and Chile.

The entire region is mobile-first. Desktop usage is significantly lower than in North America or Europe. This affects everything from how your promotion posts on LinkedIn display to how quickly prospects respond.

Social selling works particularly well here. The business culture values personal relationships and warm introductions over cold outreach.

Middle East and North Africa: The Emerging Opportunity

MENA has 61-74 million users, with the UAE leading the pack.

Here’s a wild statistic: The UAE has 102.8% ad reach relative to population. How is that possible? The country has massive expat populations who maintain UAE-based LinkedIn profiles.

Saudi Arabia is rapidly growing as the kingdom diversifies its economy. Early movers in this market are capturing significant opportunities.

LinkedIn Statistics by Country: The Complete Table

Want the quick reference? Here’s the breakdown:

Region | Key Countries | User Base | Strategic Note |

North America | USA, Canada, Mexico | 276M+ | High income, high saturation |

Asia-Pacific | India, Australia, Indonesia | 326-343M | Largest region, diverse maturity |

Europe | UK, France, DACH | 304-314M | GDPR regulated, high revenue per user |

Latin America | Brazil, Mexico, Argentina | 188-196M | Mobile-first, high social engagement |

MENA | UAE, Saudi Arabia | 61-74M | High expat usage, rapid growth |

These numbers come from multiple sources tracking active LinkedIn users and verified advertising reach data.

What This Means for Your LinkedIn Strategy

Understanding these LinkedIn statistics by country helps you make smarter decisions.

If you’re targeting high-income decision-makers, focus on the United States and Switzerland. Looking for technical talent? India and Eastern Europe offer massive pools.

Want engagement and relationship-building? Latin America and Brazil respond well to social selling approaches.

The platform isn’t “dying” like some claim. It’s maturing. 1.4 billion visits happen monthly, and 99.62% of traffic is organic—people aren’t being tricked into visiting. They’re going there with intent.

Smart professionals use tools like Apollo.io alternatives to enhance their LinkedIn prospecting, but the platform itself remains the foundation.

One more thing: While you’re building your LinkedIn presence, don’t ignore inbox placement tools for your email campaigns. The best outreach strategies use multiple channels.

The key is understanding where your audience lives and how they use social media differently across regions.

Understanding Active vs. Total Users

Here’s something important: LinkedIn reports 1.2 billion total members but only 310 million monthly active users.

That’s a huge difference.

Total members include every account ever created since 2003. Many are dormant, abandoned, or barely checked.

The active users? Those are the people who will actually see your message. That’s roughly 25% of the total user base actively engaging each month.

This distinction matters for territory planning and setting realistic expectations. You can’t reach someone who hasn’t logged in for six months.

Focus your outreach on professionals showing active signals: recent posts, profile updates, job changes. Check out these LinkedIn user statistics for deeper insights.

The Content LinkedIn Users Actually Want

Understanding where users are is one thing. Knowing what content they engage with? That’s the real advantage.

Only 1% of users post content weekly, yet this content generates 9 billion impressions. There’s a massive opportunity here.

The algorithm heavily favors certain formats:

- Carousels: 6.10-6.60% engagement rate (highest)

- Video: 5.60% engagement rate (growing fast)

- Images: ~4.85% engagement rate

- Text-only: ~4.00% engagement rate

Video gets 5x more engagement than static posts. Images perform 2x better than text-only updates.

The best posting times? Tuesday through Thursday, between 8-10 AM and 12-2 PM in your target’s local time zone.

Conclusion

LinkedIn statistics by country reveal a platform that’s far from dying—it’s thriving and evolving.

The United States dominates with 243-250 million users, but India’s 161 million represents the future. Europe offers high-value prospects despite language barriers. Latin America and MENA are emerging opportunities.

The key isn’t just knowing where users are. It’s understanding how they behave differently across regions.

US professionals expect thought leadership and value upfront. Brazilian users respond to relationship-building. German professionals demand privacy and formality.

Your content, timing, and outreach style should adapt to each market.

The platform hosts 65 million decision-makers globally. Seven people get hired every minute. The opportunity is massive—if you know where to look and how to engage.

Start with the markets that align with your ideal customer profile. Use the statistics above to set realistic expectations and build smarter campaigns.

🚀 Ready to Scale Your Outreach?

Your profile photo is just the start. We design complete LinkedIn prospecting campaigns that fill your calendar with qualified meetings—using proven systems that work.

7-day Free Trial |No Credit Card Needed.

FAQs

Is LinkedIn losing popularity in 2025?

Which country uses LinkedIn the most?

What countries have the most LinkedIn users?

How many decision-makers are on LinkedIn?

Does LinkedIn work better in certain countries?

- blog

- Statistics

- LinkedIn Statistics by Country 2026: Global User Data