Insurance Lead Generation Software: The 2026 Guide to Fill Your Pipeline

- Sophie Ricci

- Views : 28,543

Table of Contents

Your inbox is full. Your calendar is packed. But here’s the problem: most of your leads never turn into policies.

The insurance industry in 2025 isn’t what it was five years ago. Premiums are up 11% across personal lines, customers are shopping harder than ever, and that old referral network? It’s not cutting it anymore. Research shows 61% of sales reps say finding leads is their biggest challenge, and for insurance pros, it’s even worse.

You’re competing against hundreds of other agents for the same tired internet leads. By the time you call, four other people already have. The prospect hangs up before you finish your pitch.

There has to be a better way.

That’s where insurance lead generation software comes in. But not all tools are created equal. Some will waste your time. Others will spam your prospects. And a select few? They’ll transform how you build your book of business.

This guide breaks down everything you need to know about lead generation software for insurance agents in 2025. We’ll cover the tools that actually work, the strategies that drive results, and why the smartest agents are ditching email entirely for something that works 5x better.

What Is Insurance Lead Generation Software?

Let’s get clear on what we’re actually talking about.

Insurance lead generation software helps you find, contact, and convert potential policyholders without manually searching for hours. Think of it as your digital prospecting engine—automating the grunt work so you can focus on what you do best: selling policies and building relationships.

These tools fall into three categories:

- Contact Databases – Where you find prospects (Apollo, ZoomInfo, UpLead) 2. Outreach Platforms – How you reach prospects (cold email software, LinkedIn automation, dialers) 3. CRM Systems – Where you manage relationships (HubSpot, AgencyBloc, Applied Epic)

But here’s where most insurance agents get it wrong.

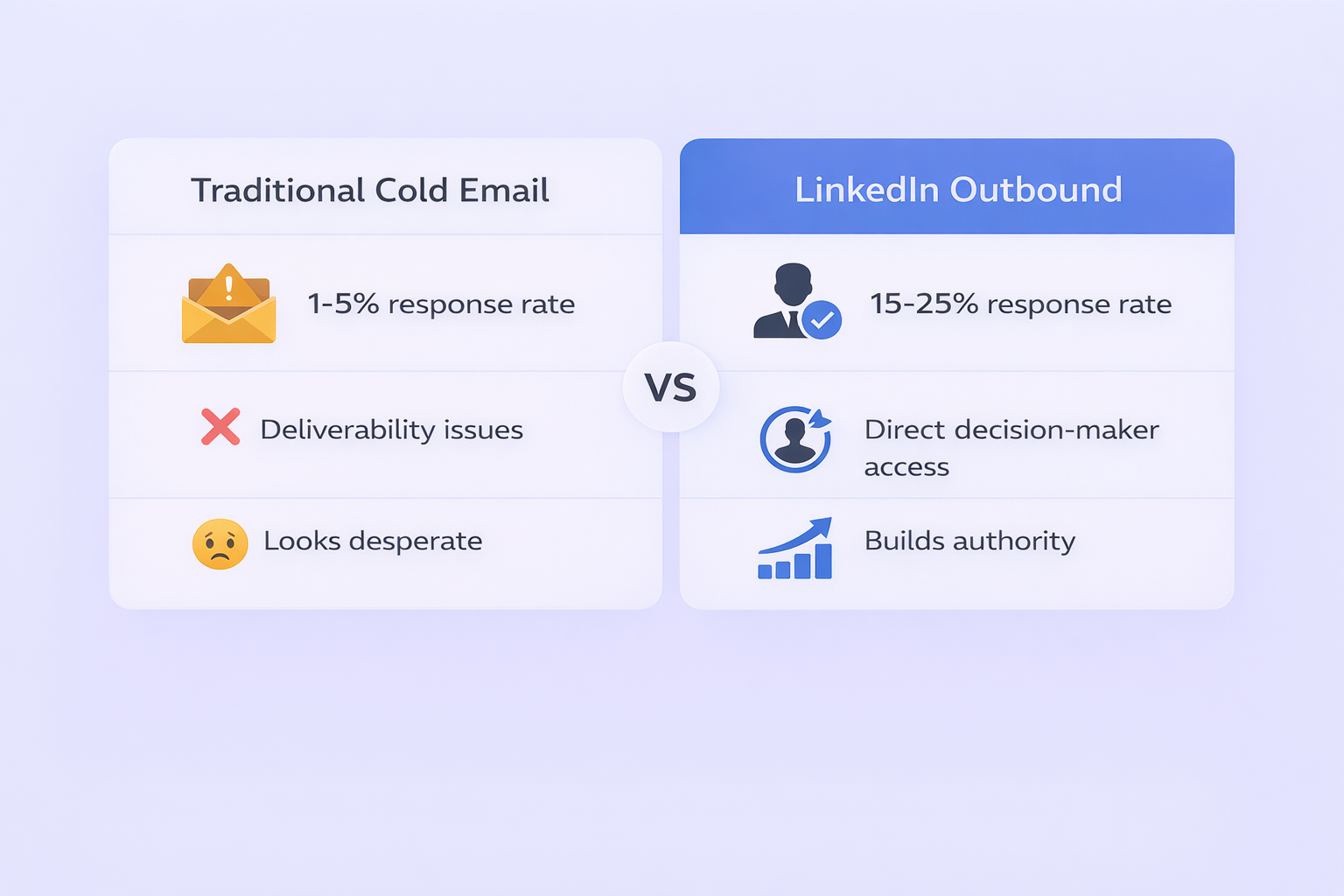

They buy expensive databases. They blast thousands of cold emails. They pray something sticks. The average cold email gets a 1-5% response rate, which means you’re annoying 95-99% of people just to get one conversation.

What if there was a platform where decision-makers actually want to network? Where your message lands in their primary feed, not a spam folder? Where 15-25% of prospects actually respond?

The Traditional Approach (And Why It’s Failing)

Most insurance agents follow this playbook:

Step 1: Buy a list from a lead vendor Step 2: Upload it to an email tool Step 3: Send generic templates Step 4: Watch your deliverability tank

Sound familiar?

The problem isn’t your effort. The problem is the channel.

Email worked great in 2010. In 2025? Your prospects get 120+ emails per day. Yours gets buried, deleted, or marked as spam. Even if you get through, you’re competing with their colleagues, their boss, and ten other insurance agents who bought the same list.

According to HubSpot’s latest research, 69% of buyers want to research independently before talking to sales. They don’t want cold emails. They want value, credibility, and a reason to trust you.

🚀 Stop Fighting Spam Filters

Go Where Decision-Makers Actually Engage

The top insurance producers aren’t using email anymore. They’re using LinkedIn—where 65+ million decision-makers are actively networking, discussing business challenges, and looking for solutions. Our complete targeting, campaign design, and scaling methods help you book 5-10 qualified meetings per week without touching a spam folder.

Why LinkedIn Outbound Crushes Traditional Methods

Let me be blunt: If you’re still relying only on cold email for insurance leads in 2025, you’re leaving money on the table.

Here’s why LinkedIn prospecting is dominating:

Verified Decision-Makers LinkedIn profiles are real. No fake emails. No gatekeepers. You’re messaging the actual CFO, business owner, or benefits manager—not bouncing off a spam filter.

Professional Context When you reach out on LinkedIn, you’re not interrupting. You’re networking. Research shows LinkedIn messages have 300% higher engagement than cold emails because people expect professional conversations there.

No Deliverability Nightmares Email requires domain warm-up, SPF records, DMARC policies, IP reputation management. LinkedIn? You just send. No technical complexity. No blacklists. No spam traps.

15-25% Response Rates The numbers don’t lie. While cold email averages 1-5% responses, LinkedIn outbound consistently delivers 15-25%. That’s not a marginal improvement. That’s a complete game-changer.

Relationship Building Email feels transactional. LinkedIn feels professional. You can engage with prospects’ content, comment on their posts, and warm them up naturally before pitching policies.

Salesso: Your LinkedIn Outbound Engine

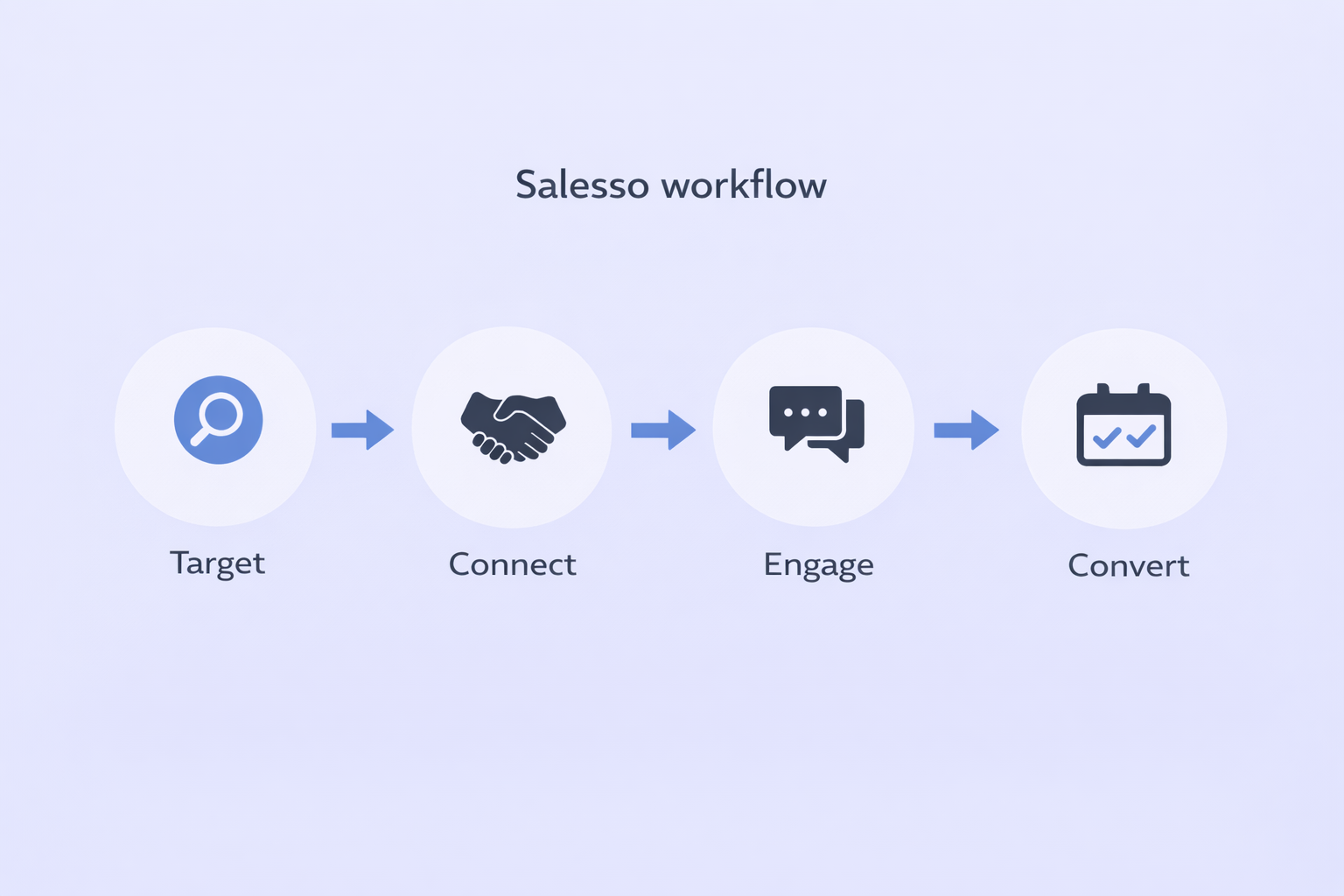

This is where Salesso comes in.

We’re not another “spray and pray” email tool. We’re a LinkedIn outbound automation platform specifically built for insurance professionals who are tired of spam folders and low response rates.

Here’s what makes Salesso different:

Precision Targeting

Find your ideal prospects using advanced LinkedIn search filters: job title, company size, industry, location, and more. Want to target manufacturing CFOs with 50-200 employees in Texas? Done.

Automated Sequences

Send personalized connection requests and follow-up messages automatically. No manual work. No copy-pasting. Just smart automation that feels human.

Unified Inbox

Manage all conversations in one place. Reply instantly when prospects respond. Never lose a hot lead in your notifications.

Built-In Compliance

Stay within LinkedIn’s guidelines with smart daily limits and natural sending patterns. No risk of account bans or restrictions.

Real Results

Our clients consistently book 5-10 qualified meetings per week using our proven campaign frameworks. Some are seeing 20-30 new quote requests per month just from LinkedIn outreach.

[Pricing starts at just $97/month—less than a single shared lead from most vendors.]

The Cold Email Alternative (If You Must)

Look, I get it. Some of you aren’t ready to ditch email completely. Maybe you’re running multi-channel campaigns. Maybe your prospects aren’t active on LinkedIn.

If you’re going the email route, here are the tools that don’t completely suck:

Apollo.io

Best for: Data + sending in one platform Price: Starts at $49/month

Apollo gives you access to 275+ million contacts with built-in sequencing. You can search for prospects, verify emails, and launch campaigns without leaving the platform. The problem? Phone data accuracy is hit-or-miss, and you’re still facing email deliverability issues.

ZoomInfo

Best for: Enterprise-level accuracy Price: $15,000-$30,000/year (yes, really)

ZoomInfo is the gold standard for data accuracy. Their “intent signals” tell you when companies are actively researching insurance solutions. But unless you’re a large brokerage, the cost is prohibitive.

Saleshandy

Best for: Email deliverability focus Price: Starts at $25/month

Saleshandy specializes in landing emails in the primary inbox. Features include sender rotation, unified inbox management, and automated follow-ups. But here’s the catch: great deliverability still means landing in a crowded inbox where 95% ignore you.

Woodpecker

Best for: Agency teams Price: Starts at $39/month

Woodpecker offers agency-level management with condition-based campaign logic. You can create complex workflows based on prospect behavior. Perfect if you’re managing multiple producers. Still faces the fundamental problem: email fatigue is real in 2025.

Want to see how these stack up against LinkedIn approaches? Check out our breakdown of cold emailing agencies to understand the landscape.

💡 Tired of Email Bounce Rates?

LinkedIn Profiles Never Bounce

Email databases decay at 22% per year. Phone numbers change. Spam filters evolve. LinkedIn profiles? They’re updated by the professionals themselves, in real-time. Our LinkedIn automation tool connects you with verified decision-makers who actually respond—no bounces, no spam traps, no wasted budget.

Top Lead Generation Companies in India

If you’re operating in the Indian market or outsourcing lead generation, here are the key players:

The Swarm

Best for: Daily data refreshes on Indian prospects High-quality B2B profiles with mobile numbers. Strong for domestic Indian insurance sales targeting corporates and SMBs.

EasyLeadz (Mr. E)

Best for: Finding mobile numbers for decision-makers Critical for Indian business culture where deals happen via WhatsApp. Note: Credit limits can be restrictive for high-volume prospecting.

SalesAladin

Best for: Full-service outbound campaigns Not just data—they run your entire outbound engine. Ideal if you want to outsource prospecting completely.

LeadSquared

Best for: BFSI (Banking, Financial Services, Insurance) automation Purpose-built for high-volume Indian insurance workflows. Handles lead routing, nurturing, and conversion tracking.

Pro tip: If you’re targeting Indian business owners, mobile-first communication is essential. Combine EasyLeadz data with LeadSquared automation for maximum efficiency.

The Integration Ecosystem: Making It All Work Together

Software tools are useless if they don’t talk to each other.

Your ideal tech stack should flow like this:

Data Source (Apollo/ZoomInfo) → Outreach Platform (Salesso/Email) → CRM (HubSpot/AgencyBloc) → Policy Management (Applied Epic)

Use Zapier to connect everything. Example workflow:

Prospect responds to your LinkedIn message

Zapier creates a deal in your CRM

Automatic reminder set for follow-up call

Notes sync back to your AMS for E&O compliance

67% of sales teams using CRM automation see increased productivity, according to Salesforce research. The goal? No lead falls through the cracks.

📊 Your Competitors Are Already On LinkedIn

They’re Booking Meetings While You’re Stuck In Spam

The insurance agents crushing it in 2025 have one thing in common: They fish where the fish are. That’s LinkedIn—where 4 out of 5 LinkedIn members drive business decisions. Our proven LinkedIn growth hacking strategies put you in front of decision-makers actively discussing risk management, benefits, and coverage gaps. No spam folders. No bounces. Just conversations.

Buy Leads vs. Generate Leads: The 2025 Verdict

The age-old debate: Should you buy leads or generate your own?

The case against buying:

- Shared leads sold to 5-10 agents simultaneously

- Data often fake or incentivized (iPad giveaways)

- Rising costs with declining quality

- Conversion rates as low as 2-5%

The case for generating:

- Exclusive leads that belong only to you

- Control over targeting and messaging

- Long-term nurturing (today’s “no” becomes next quarter’s “yes”)

- Build brand authority instead of chasing aggregators

The verdict? Hybrid approach. Use software like Salesso for your primary pipeline. Buy leads only to supplement during slow periods. 82% of top-performing insurance agents generate at least 50% of their leads in-house, according to McKinsey.

Want proof? LinkedIn lead generation statistics show that self-generated leads have 3x higher close rates than purchased leads.

Compliance: Don’t Get Sued

Quick reality check: The insurance industry is heavily regulated, and lead generation isn’t exempt.

For LinkedIn outreach: ✅ Stay within daily connection limits (50-100/day) ✅ Personalize messages (no copy-paste spam) ✅ Respect “not interested” responses immediately ✅ Follow LinkedIn’s Terms of Service

For email (CAN-SPAM Act): ✅ Include physical mailing address in footer ✅ Clear unsubscribe link in every email ✅ Honor opt-outs within 10 business days ✅ Accurate “From” name and subject lines

For calling (TCPA/DNC): ✅ Scrub against National Do Not Call Registry ✅ B2B exception applies in most states ✅ Avoid auto-dialers without express written consent ✅ Fines can reach $1,500 per violation

Salesso builds compliance into the platform. Our automation respects limits, tracks engagement, and helps you stay on the right side of regulations.

Your 2025 Game Plan

Here’s how to dominate insurance lead generation in 2025:

Month 1: Foundation

- Sign up for Salesso ($97/month)

- Build your ideal customer profile (ICP)

- Create 3-5 message templates that don’t suck

- Start with 30 connection requests per day

Month 2: Scale

- Optimize based on response rates

- A/B test different hooks

- Expand targeting to similar profiles

- Aim for 5-10 conversations per week

Month 3: Convert

- Focus on booking meetings, not just replies

- Track which messages lead to closed policies

- Document your best-performing campaigns

- Scale winning formulas

The best part? You don’t need a massive budget. You don’t need a tech team. You just need the right system—and the discipline to work it consistently.

🎯 Still Reading? You're Serious About Fixing This.

Let's Build Your LinkedIn Outbound Engine—Together.

7-day Free Trial |No Credit Card Needed.

Conclusion

Insurance lead generation in 2025 comes down to one decision: Work smarter or work harder.

The traditional playbook—buying shared leads, blasting cold emails, praying for responses—is dying. The agents who thrive are the ones who control their pipeline, target the right prospects, and show up where decision-makers actually engage.

LinkedIn outbound isn’t a trend. It’s the future. 15-25% response rates, verified profiles, no spam filters, and conversations that feel professional instead of desperate.

You have two choices:

Option 1: Keep doing what you’re doing. Keep getting what you’re getting.

Option 2: Try something that actually works.

Book a strategy session with Salesso. Let’s build your outbound engine. Let’s fill your calendar with qualified meetings. Let’s turn LinkedIn into your highest-performing sales channel.

The question isn’t whether LinkedIn outbound works. The question is: How long are you willing to leave money on the table?

FAQs

Q: What is the best insurance lead generation software?

Q: How much does lead generation software cost?

Q: Is cold emailing legal for insurance agents?

Q: How many leads should I generate per week?

Q: What's better: buying leads or generating them?

We deliver 100–400+ qualified appointments in a year through tailored omnichannel strategies

- blog

- Sales Development

- Insurance Lead Generation Software Guide 2026