Lead Generation Software for Financial Advisors: Your 2026 Growth Engine

- Sophie Ricci

- Views : 28,543

Table of Contents

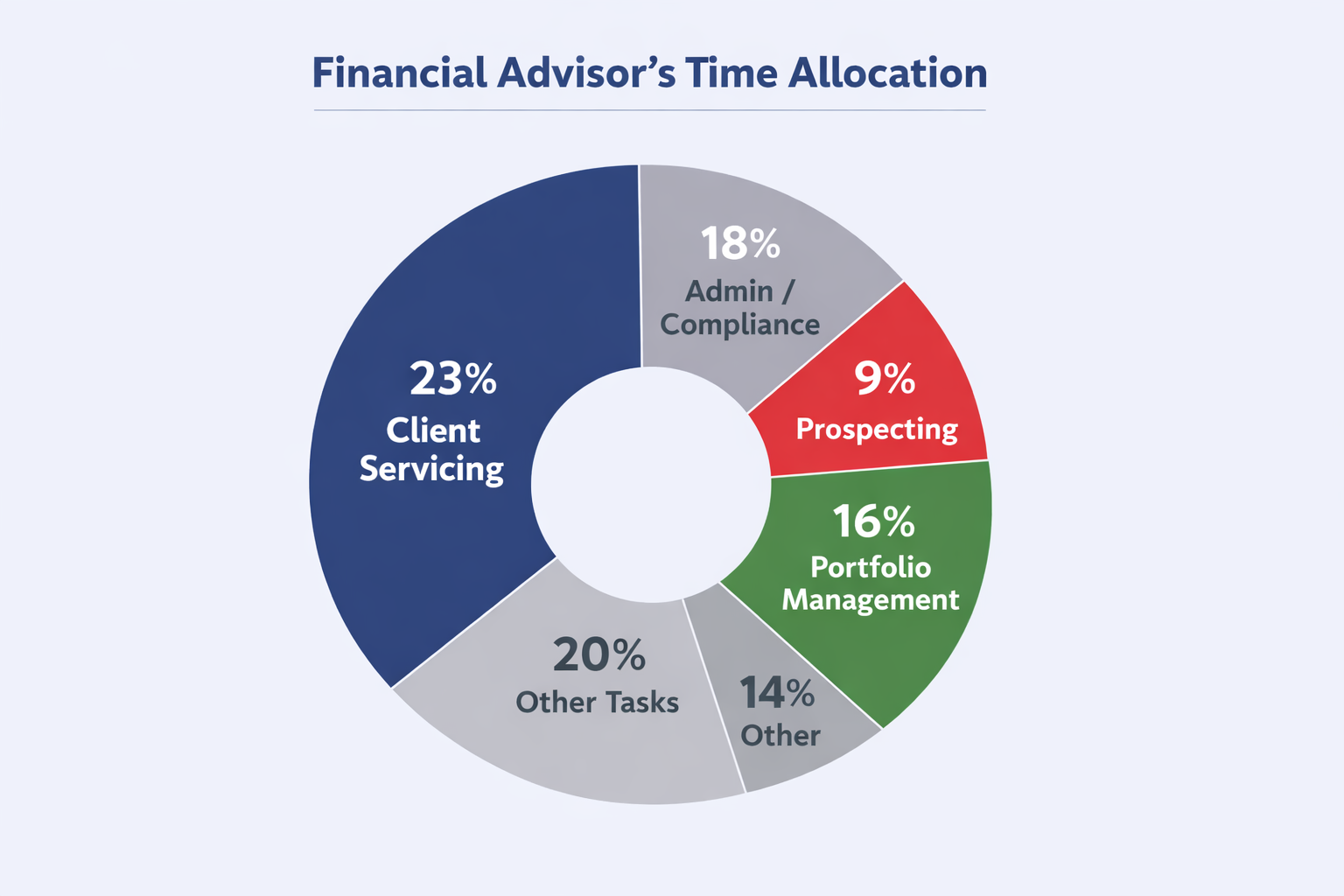

Here’s the brutal truth about financial services: advisors spend only 9% of their time actually prospecting for new clients. The rest? Buried in client meetings, compliance paperwork, and portfolio management.

But here’s what’s worse—72% of new advisors fail within their first three years. And it’s almost never because they lack financial expertise. It’s because they run out of leads before they run out of runway.

Cold calling is dead. The “Do Not Call” lists killed it. Seminars are expensive and unpredictable. Referrals are great, but they’re not a system—they’re luck with a fancy name.

So what actually works in 2025? Automated prospecting systems that put qualified leads in your pipeline while you focus on closing.

This guide breaks down exactly which lead generation tools work for wealth managers, how to set them up without triggering compliance nightmares, and the exact workflow that turns cold contacts into warm meetings.

No fluff. No theory. Just what works right now.

Why Financial Advisors Need Lead Generation Software Yesterday

Let’s talk about the elephant in the room. Over 109,000 advisors are planning to retire in the next decade. That represents 37.5% of the entire industry headcount and 41.5% of total assets under management.

This creates two massive problems:

First, the succession crisis. As senior advisors retire, firms are desperately recruiting new talent. But those rookies immediately face the “prospecting cliff”—they exhaust their natural market (friends, family, former colleagues) within 12-18 months, then hit a wall.

Second, the generation gap. Millennials and Gen X investors don’t respond to the old playbook. They don’t attend dinner seminars. They research online, check LinkedIn profiles, and expect you to reach them in their inbox—not at a hotel conference room.

The math is simple: If you don’t have a systematic way to generate leads, your practice withers.

The Economics That Matter

Here’s why this is worth fixing. Email marketing delivers an average ROI of 4200%—that’s $42 for every $1 spent. Compare that to direct mail (0.5% response rate) or seminars ($5,000 to acquire 1-2 clients), and the winner is obvious.

A single client with $1 million in investable assets generates roughly $10,000 in recurring annual revenue. Over a 10-year relationship, that’s $100,000 in lifetime value.

If your prospecting system costs $200/month but lands you just one qualified client per quarter, you’re looking at 100x ROI. That’s not hype—that’s math.

What Changed: From Phone to Inbox

The shift happened fast. Answer rates on cold calls dropped to practically zero. Caller ID and spam filters made phone prospecting obsolete.

The battleground moved. Now it’s all about “inbox warfare.” The advisors winning in 2025 are the ones using LinkedIn prospecting combined with verified email lists to reach decision-makers where they actually pay attention.

📈 Stop Wasting 91% of Your Time

LinkedIn Outbound gets you 15-25% response rates (vs email’s 1-5%) while bypassing spam filters and reaching verified decision-makers directly.

The Lead Generation Software Landscape: What You Actually Need

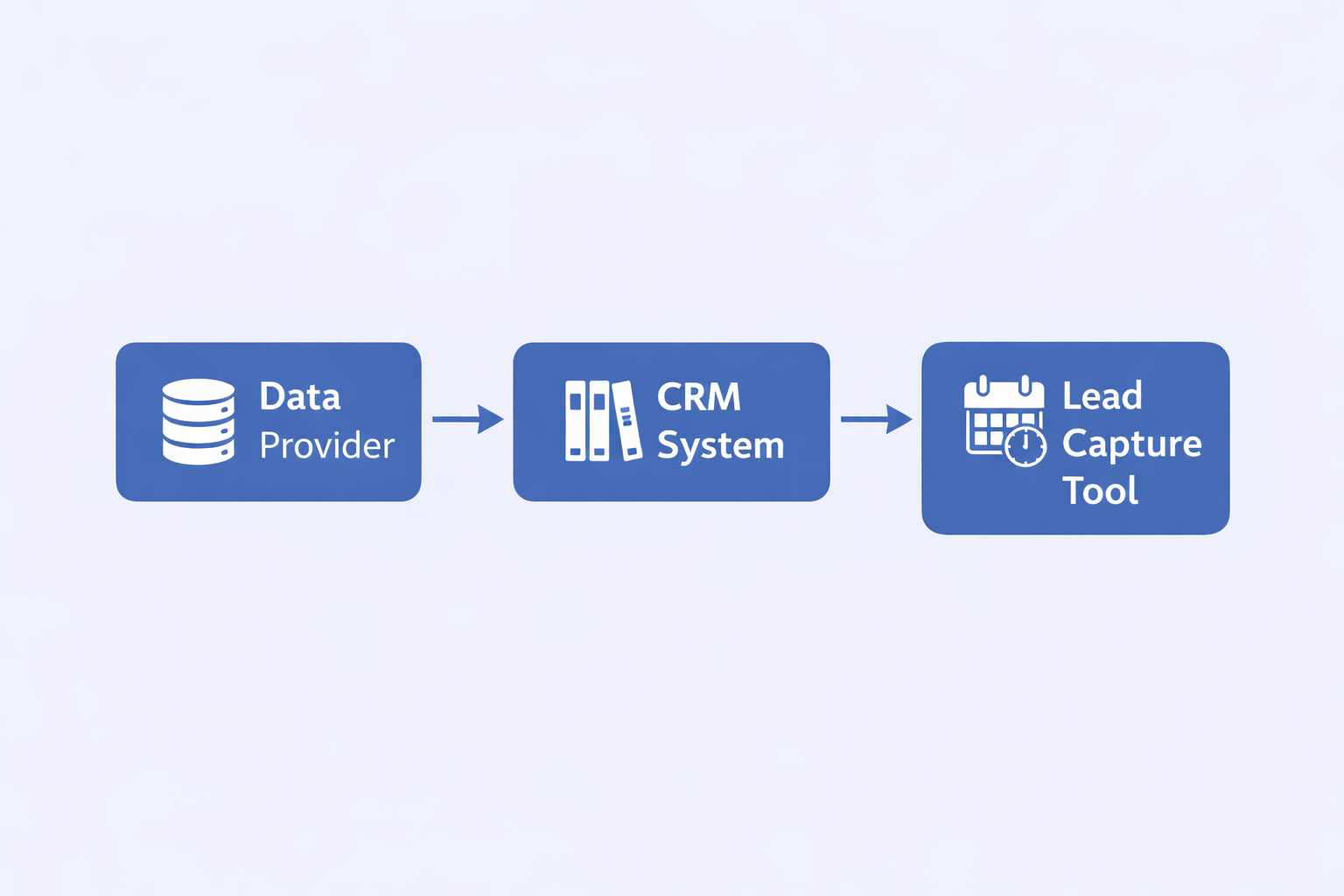

Most advisors get confused because “lead generation software” isn’t one thing—it’s three different categories working together. Understanding this is the difference between throwing money away and building a machine.

Category 1: Data Providers (The Foundation)

These tools give you the raw material: verified email addresses, phone numbers, and firmographic data about your ideal prospects.

Think of these as your fishing spot. You’re not casting a line yet—you’re just identifying where the fish are.

Key players include: ZoomInfo, Apollo, UpLead, GrowMeOrganic, and Lusha. Each has different pricing, data quality, and compliance implications we’ll break down in a minute.

What advisors specifically need: High accuracy rates (bounced emails trigger compliance flags), trigger event data (identifying when prospects have liquidity events like IPOs or mergers), and clean exports that integrate with your CRM.

Category 2: CRM & Engagement Platforms (The Engine)

Once you have the contact data, it needs to live somewhere compliant. This is where your CRM comes in.

For financial services, the big names are Redtail, Wealthbox, Salesforce Financial Services Cloud, and Junxure. These aren’t just contact managers—they’re your regulatory safety net.

Here’s why this matters: Every email you send is a business record that must be archived under SEC Rule 17a-4. Using your personal Gmail to send cold outreach? That’s a compliance violation waiting to happen.

The smart play is using tools like cold email software that integrate directly with compliant CRMs, ensuring every touchpoint is automatically logged.

Category 3: Lead Capture & Qualification Tools (The Closer)

This is where prospects convert from cold to warm. Tools like eMoney Advisor, RightCapital, and Asset-Map have built-in lead capture features.

Here’s how it works: A prospect lands on your website, sees a “Get Your Retirement Readiness Score” widget, enters their age and income, and boom—they’re in your pipeline as a qualified lead.

The genius of this approach is it’s educational, not promotional. You’re not selling in the email—you’re offering value. This keeps you in the compliance safe zone while building trust.

🎯 LinkedIn Outbound > Cold Email Alone

Skip the spam folder entirely. Our complete targeting, campaign design, and scaling methods get you face-to-face with decision-makers using advanced LinkedIn search strategies.

The Competitor Breakdown: Who Actually Delivers

Let’s cut through the marketing noise and look at what each major player actually offers financial advisors.

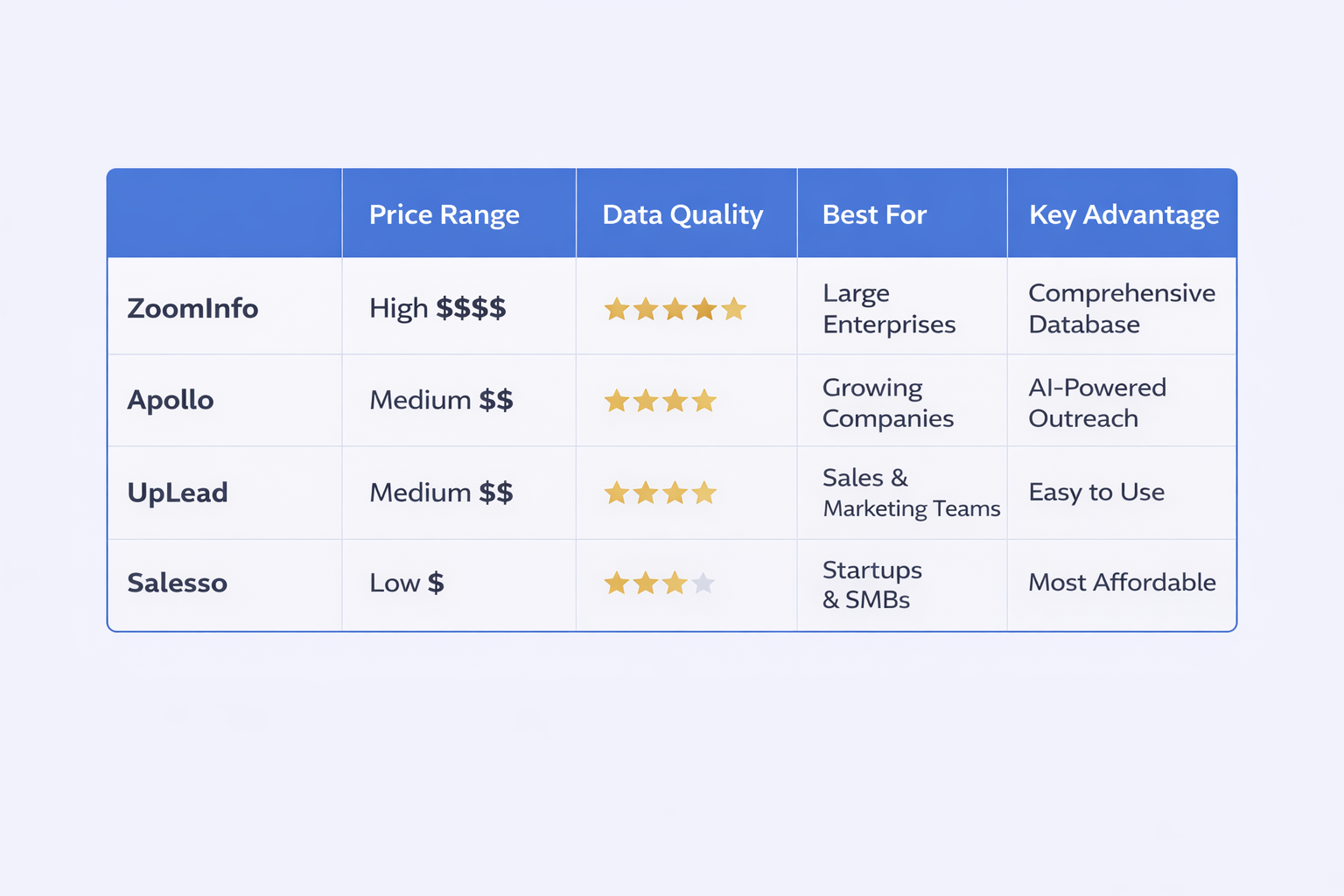

ZoomInfo: The Enterprise Gorilla

What it is: The market leader with the deepest database and most sophisticated “intent” signals.

The good: Their “Scoops” feature can identify companies with recent funding rounds, leadership changes, or expansion news—absolute gold if you’re targeting executives for stock option planning or rollover services.

The bad: Pricing starts around $14,000-$15,000 per year with forced annual contracts. For a two-person RIA, that’s a huge chunk of overhead for features you’ll probably never use.

Best for: Large wirehouses and wealth management firms with dedicated BDR teams.

Apollo.io: The Volume Play

What it is: An all-in-one platform (data + sending) with a freemium model.

The good: Accessibility. Plans start at $49/month, making it affordable for practically any advisor.

The bad: Data quality issues are common. Bounced emails don’t just waste your time—they damage your sender reputation and create compliance headaches. Multiple reviews mention outdated phone numbers and unverified contacts.

Best for: Tech-savvy advisors willing to manually verify data before sending.

UpLead: The Accuracy Specialist

What it is: A data provider focused specifically on 95% real-time verification accuracy.

The good: High-quality data reduces bounce rates, protecting your domain reputation and keeping compliance officers happy.

The bad: Smaller database compared to ZoomInfo. The cost-per-lead is higher upfront, though the effective cost might be lower when you factor in wasted time on bad data.

Best for: Quality-focused RIAs who want clean data without enterprise pricing.

Salesso: The LinkedIn Outbound Engine

What it is: A specialized LinkedIn automation tool combined with verified cold email capabilities—built specifically for B2B outreach.

The good: 15-25% response rates (compared to cold email’s 1-5%) by reaching prospects on LinkedIn where they’re already in “business mode.” No spam folder. No deliverability issues. Direct access to 65+ million decision-makers. Includes complete campaign design, targeting strategies, and scaling methods.

The bad: Requires LinkedIn Sales Navigator for maximum effectiveness. Not a fit if you’re only comfortable with traditional email.

Best for: Growth-focused advisors and firms ready to leverage LinkedIn lead generation statistics for systematic prospecting.

🚀 Complete LinkedIn Outbound Strategy

Stop comparing tools. Start booking meetings. Our proven targeting, campaign design, and scaling system gets you 15-25% response rates with zero spam risk.

The “Secret Weapon” Workflow: Email + eMoney Lead Capture

Here’s where most advisors fail: they get the data, send the emails, and then ask for a meeting immediately. That’s too big a jump. The friction is too high.

The winning workflow is different. It uses a “value-first” approach that qualifies prospects while building trust.

How the Bridge Strategy Works

Step 1: Target the Right List Use your data provider to build a hyper-targeted list. Example: “Tech employees aged 30-45 in Austin with $200k+ income.” This specificity matters because generic messaging dies in the inbox.

Step 2: Send Value, Not Sales Your cold email doesn’t ask for a meeting. Instead, it offers immediate value: “See if your current savings rate puts you on track for retirement—takes 2 minutes.”

Step 3: Direct to eMoney Lead Capture The email link goes to your eMoney Lead Capture page (or RightCapital/Asset-Map equivalent). This is a specialized landing page where prospects enter basic financial data to get instant feedback.

Step 4: The Double Win Two things happen simultaneously:

- The prospect gets a retirement readiness score or financial insight

- Their data automatically flows into your eMoney dashboard as a lead, triggering a notification

Step 5: Follow Up Smart Now you’re not cold calling. You’re following up with someone who actively engaged with your planning tool. That’s a warm lead—maybe even hot.

Why This Workflow Crushes Traditional Outreach

Measurability: You can track exactly how many email clicks resulted in lead capture submissions. No more guessing about attribution.

Qualification: Someone who takes time to enter their financial data is infinitely more qualified than someone who just replied “Maybe interested.”

Compliance Safety: Directing prospects to an educational planning tool is viewed as informational content, not securities solicitation. This significantly lowers regulatory risk on your initial outreach.

Many advisors also combine this with LinkedIn growth hacking techniques to warm up prospects before even sending the email, creating a multi-touch strategy that feels less cold and more like relationship building.

⚡ LinkedIn Outbound: The Compliance-Friendly Alternative

No spam filters. No deliverability issues. No CAN-SPAM worries. Just direct conversations with verified prospects using proven LinkedIn prospecting methods.

7-day Free Trial |No Credit Card Needed.

Staying Compliant: The Rules You Can’t Ignore

Let’s address the fear that kills most cold outreach before it starts: “Is this even legal?”

Short answer: Yes, with the right guardrails.

FINRA Rule 2210: The Content Police

Every communication you send to prospects falls under FINRA Rule 2210, which requires all advisor communications to be “fair and balanced.” This means:

Don’t make promissory claims. No “Guaranteed 10% returns” or “We’ll double your portfolio.” These trigger instant red flags.

Focus on education, not solicitation. Talking about tax efficiency strategies or retirement planning concepts? Usually fine. Pitching specific investment products? Risky territory.

Use compliant templates. If you’re using software that provides email templates, remember—you’re responsible for that content as if you wrote it yourself. This is called the “Entanglement Doctrine.”

SEC Rule 17a-4: The Recordkeeping Hammer

Here’s the big one: Every business-related electronic communication must be archived in a format that can’t be altered.

This creates a massive problem if you’re using personal email accounts to send cold outreach. You’re bypassing your firm’s archiving system (like Smarsh or Global Relay), which is a major compliance violation.

The solution: Load your prospect data into a compliant CRM that’s already integrated with your firm’s archiver. Or use email platforms that specifically integrate with these archiving systems.

The CAN-SPAM Act: The Basics

This is federal law, not industry-specific. Every cold email must include:

- A clear, functional unsubscribe link

- Your physical mailing address

- No deceptive subject lines

Most modern cold email software forces these footers automatically, giving you a safety layer that manual Outlook sends don’t provide.

Pro Tip: Many advisors are now pivoting to LinkedIn outreach specifically because it sidesteps many of these email-specific compliance concerns while still allowing systematic prospecting. Platforms focused on cold emailing agencies can help navigate these waters.

The ROI Math: Why This Actually Works

Let’s talk numbers. Because at the end of the day, none of this matters if it doesn’t produce measurable results.

The Lifetime Value Reality

Financial services has one of the highest Customer Lifetime Values (CLV) of any industry. A single client with $1 million in investable assets generates approximately $10,000 annually. Over a 10-year relationship, that’s $100,000 in value.

Now look at your acquisition costs:

- Traditional seminars: $5,000 to acquire 1-2 clients

- Direct mail: 0.5% response rate at $1-2 per piece

- Cold email: $200 for data + $50/month for software

The Conservative Scenario

Let’s say you invest in verified data from a quality provider:

- Cost: $200 for 1,000 verified contacts

- Software: $50/month for sending platform

- Total Investment: $250

You send 1,000 targeted emails to CFOs of mid-sized companies:

- Open Rate: 25% (250 opens)

- Click-Through to Lead Capture: 2% (20 clicks)

- Lead Capture Submissions: 25% of clicks (5 qualified leads)

- Consultation Bookings: 40% of submissions (2 meetings)

- Close Rate: 50% (1 new client)

Result: One client worth $100,000 over 10 years from a $250 investment. That’s 40,000% ROI.

Even if your conversion rates are half of this conservative scenario, you’re still looking at returns that dwarf traditional marketing channels.

Realistic Benchmarks

Set expectations correctly from the start:

- Open Rates: 20-30% is your target zone. Above 30% is exceptional.

- Reply Rates: 1-5% is standard for cold outreach. Don’t expect miracles immediately.

- Bounce Rates: Must stay under 5% (ideally under 2%) to avoid blacklisting. This is why data quality matters so much.

The “Seminar Filling” Use Case

Here’s a specific application that kills: using cold email to fill physical events.

Advisors book expensive venues for dinner seminars but struggle to fill seats. The old approach was broad direct mail with that 0.5% response rate.

The new approach:

- Purchase a geo-targeted list: “Retirees within 10 miles of Zip Code X”

- Send personalized invites: “Join us for a complimentary dinner discussion on Tax Changes for 2025”

- Effectiveness: You’re combining the low cost of digital outreach with the high closing rate of face-to-face interaction

This hybrid model is crushing it in 2025, especially when combined with social proof and limited seating urgency.

Conclusion

The financial advisory landscape changed. The old playbook of cold calls and hope-based referrals isn’t enough anymore.

The data is clear:

- Advisors spending only 9% of their time on prospecting can’t compete

- 72% failure rates are directly tied to pipeline problems, not knowledge gaps

- Email marketing’s 4200% ROI demolishes traditional methods

- Cold email + lead capture workflows qualify prospects while staying compliant

You don’t need a $15,000 enterprise platform. You need clean data, a compliant sending system, and a qualification workflow that turns cold contacts into warm meetings.

The tools exist. The workflows are proven. The only question is whether you’ll implement them before your competitor does.

Stop guessing. Start connecting. Build your systematic prospecting engine today.

FAQs

s cold emailing legal for financial advisors?

What's the best lead generation software for small advisory firms?

How does this integrate with Redtail or Wealthbox?

What's the difference between data providers and CRMs?

Can I use eMoney Lead Capture without eMoney Advisor?

We deliver 100–400+ qualified appointments in a year through tailored omnichannel strategies

- blog

- Sales Development

- Lead Gen Software for Financial Advisors | 2026 Guide