Customer Acquisition Cost Statistics 2025: All Questions Answered

- Sophie Ricci

- Views : 28,543

Table of Contents

Customer Acquisition Cost Statistics

- Customer acquisition costs have surged 222% over the last eight years, making growth increasingly expensive

- In 2013, brands lost an average of $9 per new customer, but today it’s $29 per customer acquired

- Average B2B company spends $942 to $1,907 per customer depending on the acquisition channel used

- Probability of selling to a new prospect is only 5-20%, while selling to existing customers jumps to 60-70%

- 44% of companies prioritize acquisition over the 18% who focus on retention, showing massive efficiency gap

- It costs 5 to 25 times more to acquire customers than to retain them, yet most prioritize new customer hunting

- Sustainable businesses maintain at least a 3:1 ratio of LTV to CAC, while ratios below 3:1 are unsustainable

- Email marketing delivers an ROI of $36 to $40 for every $1 spent for warm audiences

- It takes sending 306 cold emails to generate just one B2B lead, showing the challenge of cold outreach

- Personalized subject lines get 32.7% more replies compared to generic subject lines in cold email campaigns

- First follow-up email alone can boost reply rates by 49%, making persistence critical for success

- 80% of sales require five or more follow-ups, yet 92% of sales reps give up after just four attempts

- 84% of B2B decision-makers start their buying process with a referral, making referrals the lowest CAC channel

- Companies with formalized referral programs see 86% more revenue growth than those without structured programs

- Average B2B buying group now includes 10-11 people, directly contributing to longer sales cycles and higher costs

Here’s something that might sting a bit: you’re spending 222% more to win a new customer today than you were eight years ago. And yet, most businesses have no clue what their actual acquisition costs look like.

If you’re burning through your budget on ads, emails, or outreach campaigns without tracking the real numbers, you’re flying blind. The data is clear—customer acquisition is getting expensive, competitive, and complex. But here’s the good news: understanding these numbers can transform how you approach growth.

Let’s dig into the numbers that actually matter.

What Is Customer Acquisition Cost (CAC)?

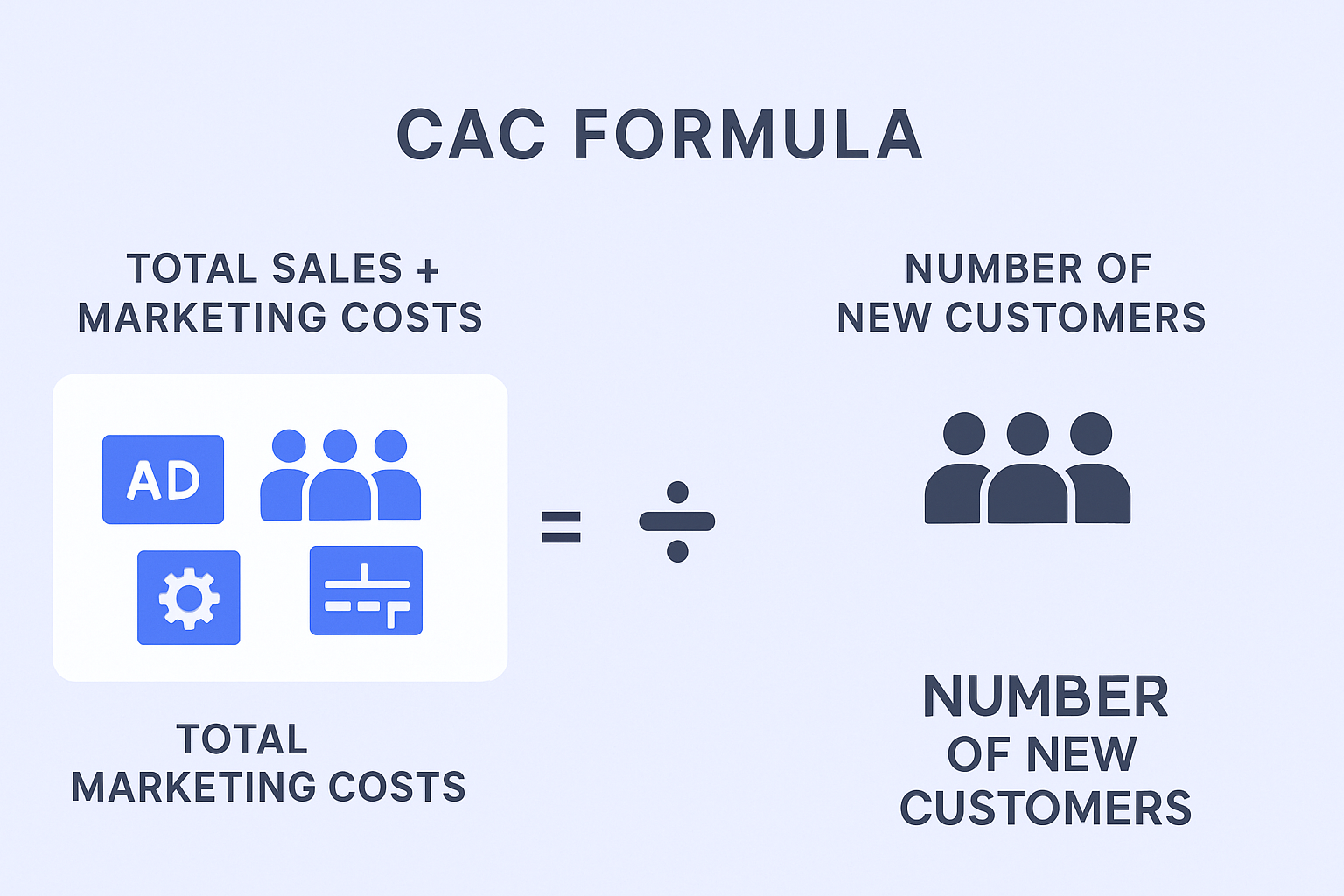

Think of CAC as your “cost per new customer” scorecard. It’s the total amount you spend on sales and marketing divided by the number of new customers you bring in during a specific period.

The formula is simple:

CAC = (Total Sales + Marketing Costs) / Number of New Customers Acquired

This includes everything—your ad spend, your team salaries, software subscriptions, content creation, event sponsorships, the works. Every dollar you spend trying to acquire a customer counts.

Here’s why this matters: a brand that spent $10,000 on marketing last month and gained 50 customers has a CAC of $200. But if those customers only spend $150 with you, you’re losing money on every single one.

Why CAC Is Important?

Knowing your customer acquisition cost isn’t just some vanity metric for finance teams—it’s your early warning system for business health.

Here’s what CAC tells you:

- Whether your growth is profitable or just expensive

- Which marketing channels are actually worth your money

- If your sales process is efficient or wasteful

- How sustainable your current strategy really is

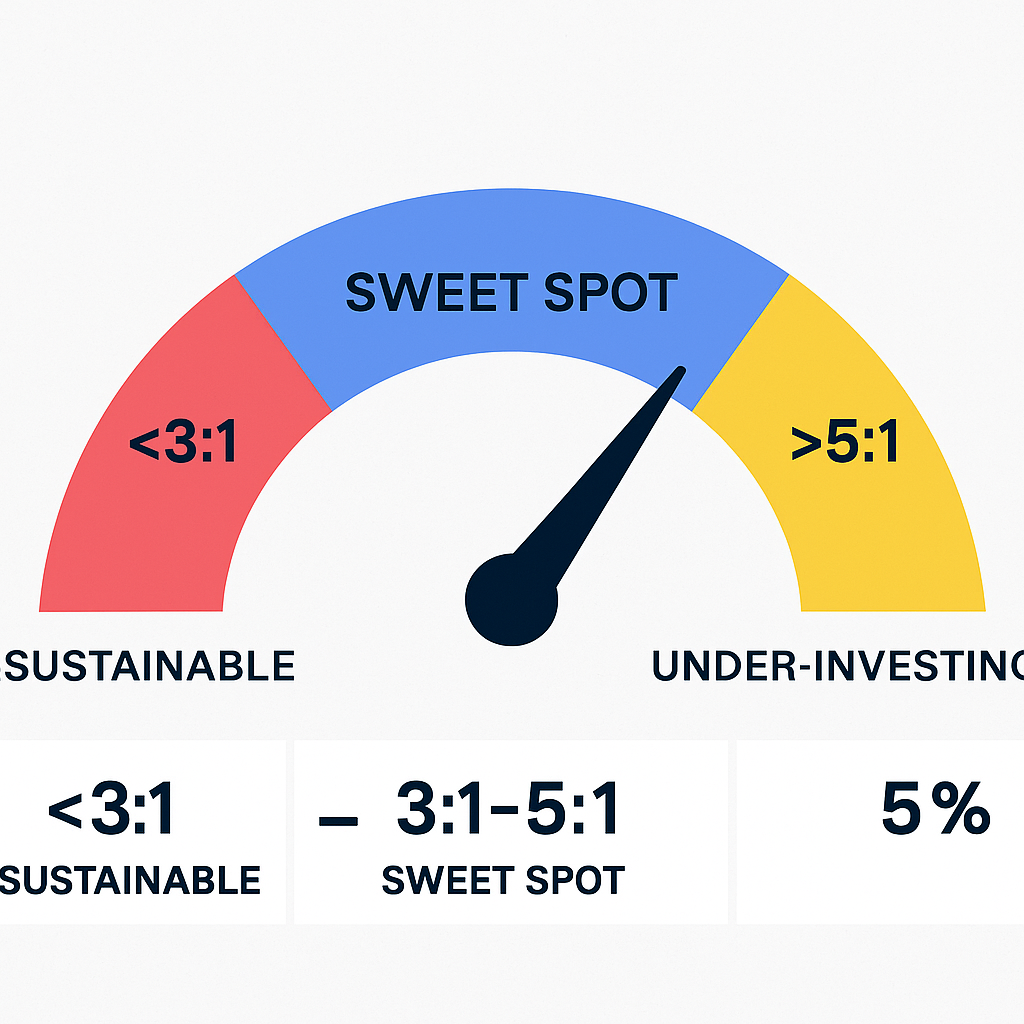

The golden rule? Your Customer Lifetime Value (LTV) should be at least 3 times your CAC. Anything below that ratio means you’re on shaky ground. Above 5:1? You might actually be under-investing in growth opportunities.

And here’s a reality check: acquiring a new customer is 5 to 25 times more expensive than keeping an existing one. Yet, 44% of companies still focus primarily on acquisition while only 18% prioritize retention. That’s a massive efficiency gap.

📉 Cut Your CAC by 40%

Our LinkedIn outbound engine targets decision-makers directly with personalized campaigns that convert at 7.8%

39 Crucial Stats of Customer Acquisition

General Customer Acquisition Stats

Let’s start with the big picture trends that are reshaping how businesses think about growth:

The Cost Crisis:

- Customer acquisition costs have surged 222% over the last eight years

- In 2013, brands lost an average of $9 per new customer. Today, it’s $29 per customer

- The average B2B company spends $942 to $1,907 per customer depending on the channel

The Retention Reality:

- The probability of selling to a new prospect is only 5-20%, while selling to an existing customer jumps to 60-70%

- Yet 44% of companies prioritize acquisition over the 18% who focus on retention

- It costs 5 to 25 times more to acquire customers than to retain them

The Golden Ratio:

- A sustainable business maintains at least a 3:1 ratio of LTV to CAC

- Companies with LTV:CAC ratios below 3:1 are likely on an unsustainable path

- Ratios above 5:1 might indicate under-investment in growth

Decision-Making Complexity:

- The average B2B buying group now includes 10-11 people

- This complexity directly contributes to longer sales cycles and higher costs

Most Effective Channels for Customer Acquisition

Not all lead sources are created equal. Some channels deliver high-quality customers at reasonable costs, while others drain your budget with little to show for it.

Email Marketing Dominance:

- Email marketing delivers an ROI of $36 to $40 for every $1 spent (though this primarily applies to warm audiences, not cold outreach)

- Average cold email open rates sit between 25-39%

- But reply rates? They’re much lower at 1-8.5%

The Cold Email Reality:

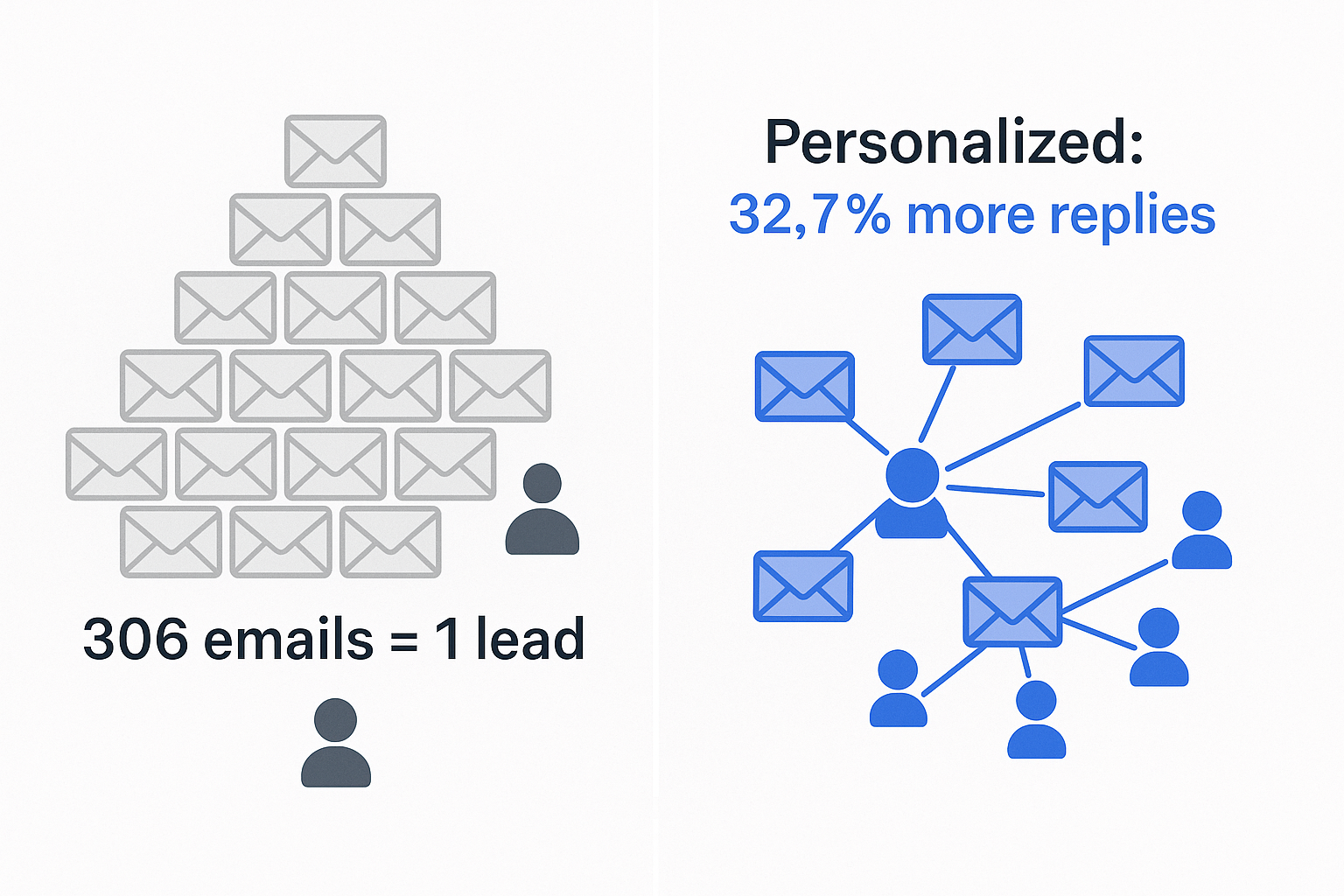

- It takes sending 306 cold emails to generate just one B2B lead

- Personalized subject lines get 32.7% more replies

- Campaigns lacking personalization see reply rates drop to a dismal 1.7%

- The first follow-up email alone can boost reply rates by 49%

🎯 LinkedIn Beats Cold Email

Skip the 306-email grind. Our targeting system connects you directly with 10-11 decision-makers per account

Referral Power:

- 84% of B2B decision-makers start their buying process with a referral

- Companies with formalized referral programs see 86% more revenue growth

- Referrals often have the lowest CAC and highest LTV

Follow-Up Facts:

- 80% of sales require five or more follow-ups

- Yet 92% of sales reps give up after just four attempts

- Adding a third or fourth follow-up can decrease reply rates and increase spam complaints—find the sweet spot

Customer Acquisition Channels and Their Effectiveness

Let’s break down what different channels actually cost and deliver:

Organic SEO/Content Marketing:

- Average B2B CAC: $942

- Pros: Lower long-term costs, highly qualified leads, educational value

- Cons: Slow to build, requires consistent investment

Paid Search (Google Ads):

- Average B2B CAC: $1,907

- Pros: Immediate results, high-intent buyers

- Cons: Expensive, constant budget needed

LinkedIn Ads:

- Average B2B CAC: $982

- Pros: Precise targeting by job title and industry

- Cons: High cost, lower intent (interruption-based)

Organic Social Media:

- Average B2B CAC: $658

- Pros: Builds brand credibility and relationships

- Cons: Very time-consuming, hard to measure direct ROI

💰 LinkedIn CAC: $982 → $400

Our complete outbound strategy—targeting, campaigns, and scaling—delivers qualified leads at half the platform average

How Online Channels are Used for Customer Acquisition

Personalization Makes or Breaks Your Results:

- Targeting 1-2 contacts per company yields a 7.8% reply rate

- Blasting 10 or more people at the same company drops that to 3.8%

- 32.7% higher replies come from personalized subject lines

Targeting Strategy:

- Targeting just 1-2 contacts per company delivers a 7.8% reply rate

- Targeting 10+ people at the same company drops response to 3.8%

- Quality beats quantity every single time

Multi-Channel Sequences Work:

- The optimal follow-up sequence is 4-6 touches across multiple channels

- Mix email with LinkedIn engagement for better results

- Add value with each touchpoint rather than just “bumping to the top”

Average Customer Acquisition Cost in Various Sectors

Your industry matters—a lot. Here’s what different sectors typically spend:

Industry | Average CAC | What This Means |

Fintech | $1,450 | High-value, high-trust sector demands rigorous qualification |

Insurance | $1,280 | Long sales cycles, relationship-driven |

Higher Education | $1,143 | Very competitive with lengthy decision processes |

Legal Services | $749-$1,300 | Competitive market requires early differentiation |

B2B SaaS | $702 | Broad average—your niche determines actual costs |

IT & Managed Services | $454 | Focus on demonstrating clear ROI |

Staffing & HR | $410 | Relationship-driven, higher volume needed |

Legaltech | $299 | Fast, efficient, tech-driven sales process |

B2B eCommerce | $86 | Volume game with transactional efficiency |

Enterprise vs. SMB:

The size of your target customer drastically changes your acquisition costs:

- Agtech SaaS: SMB CAC is $612 vs. Enterprise CAC of $6,948

- Fintech SaaS: SMB CAC is $1,450 vs. Enterprise CAC of $14,772

Enterprise deals involve more stakeholders, longer cycles, and significantly higher costs. If you’re going after big fish, your CAC will reflect that complexity.

🚀 Scale Without Inflating CAC

Whether SMB or Enterprise, our LinkedIn engine maintains efficiency through intelligent targeting and multi-touch campaign design

7-day Free Trial |No Credit Card Needed.

Enhance Your Customer Acquisition Strategies with Salesso

Look, understanding these statistics is step one. Actually doing something about them? That’s where tools like Salesso come in.

If you’re spending too much time manually building prospect lists, writing personalized emails one by one, or losing leads because your follow-up game is inconsistent, you need to streamline your acquisition process.

Salesso helps you:

- Find verified business email addresses so you’re not wasting time on bounces

- Automate personalized outreach at scale without losing that human touch

- Track everything so you know exactly what’s working and what’s burning budget

- Optimize your email deliverability to ensure your messages actually land in inboxes

When your acquisition costs are climbing and every lead matters, efficiency becomes your competitive advantage. Salesso is built specifically for teams who need to lower their CAC without sacrificing quality.

Ready to turn these statistics into action? Try Salesso today and start acquiring customers more efficiently.

Conclusion

Customer acquisition is getting harder and more expensive—that’s just the reality of 2025. But armed with the right data and the right tools, you can flip the script.

Remember the key takeaways:

- CAC has increased 222% in eight years—efficiency is no longer optional

- The LTV:CAC ratio of 3:1 is your benchmark for sustainable growth

- Different industries and customer sizes have wildly different acquisition costs

- Personalization, follow-up, and channel selection directly impact your bottom line

- Retention is 5-25x cheaper than acquisition, yet most companies still prioritize new customer hunting

Stop guessing. Start measuring. And most importantly, start optimizing. Your future growth—and your budget—will thank you.

Other Useful Resources

To understand how to systematically reduce CAC through LinkedIn outbound eliminating cold email’s 306-emails-per-lead burden, explore these resources:

Email Deliverability & Infrastructure:

- Compare Folderly alternatives for email deliverability monitoring preventing wasted CAC on bounced messages

- Explore inbox placement tools ensuring acquisition messages reach decision-makers reducing cost-per-contact waste

Pipeline & Meeting Management:

- Explore free pipeline management tools for tracking CAC by funnel stage and channel

- Learn how to schedule appointments with clients streamlining conversion process reducing time-to-close costs

Decision-Maker Strategy:

- Learn how to reach B2B decision-makers targeting 10-11 person buying committees efficiently

LinkedIn Profile Optimization:

- Review LinkedIn headline for student understanding profile fundamentals

Platform Intelligence:

- Review LinkedIn learning usage statistics showing platform professional development engagement

Customer acquisition cost statistics document the systematic efficiency crisis—CAC surged 222% over 8 years from losing $9 per customer to $29, B2B companies spending $942-$1,907 per customer depending on channel (Organic SEO $942, LinkedIn Ads $982, Paid Search $1,907, Organic Social $658), yet 44% still prioritize acquisition over retention’s 18% despite retention being 5-25x cheaper and selling to existing customers delivering 60-70% success versus 5-20% to new prospects revealing massive misallocation where sustainable 3:1 LTV:CAC ratio requires strategic efficiency most companies burning budgets cannot achieve. The channel economics compound challenges: cold email requires brutal 306 emails per B2B lead with 25-39% opens collapsing to 1-8.5% replies despite $36-$40 ROI for warm audiences (not cold outreach), personalized subject lines boost replies 32.7% yet most lack personalization seeing 1.7% rates, first follow-up increases replies 49% yet 92% quit after 4 attempts while 80% of sales need 5+ touches creating persistence gap, and targeting 1-2 contacts per company yields 7.8% reply versus blasting 10+ dropping to 3.8% proving quality beats quantity every time. The buying committee complexity escalates costs systematically—average B2B purchase involves 10-11 people creating longer cycles and higher expenses, Enterprise CAC drastically exceeds SMB ($6,948 vs $612 Agtech, $14,772 vs $1,450 Fintech) reflecting stakeholder navigation burden, industry variations span $86 (eCommerce volume game) to $1,450 (Fintech high-trust sector) demonstrating vertical-specific challenges, and multi-channel coordination (4-6 touches across email + LinkedIn + other channels adding value per touchpoint) requires orchestration infrastructure most teams manually executing cold outreach cannot maintain while costs climb 222%. The strategic imperative emerges clearly—knowing LTV:CAC ratio of 3:1 is benchmark doesn’t achieve it from unsustainable current state, understanding retention is 5-25x cheaper doesn’t shift the 44% acquisition vs 18% retention priority misallocation, recognizing personalization delivers 32.7% higher replies doesn’t systematically implement it across 306-email sequences, appreciating 1-2 contact targeting yields 7.8% versus 10+ yielding 3.8% doesn’t execute precision at scale, and documenting channel costs ($942-$1,907 B2B average) doesn’t automatically access lower-CAC alternatives eliminating waste preventing sustainable growth. The article’s repeated banner positioning addresses the fundamental CAC solution: “Lower Your CAC With LinkedIn” cutting acquisition costs through precise targeting and scalable campaigns, “Cut Your CAC by 40%” targeting decision-makers with 7.8% conversion systematically, “LinkedIn Beats Cold Email” skipping 306-email grind connecting directly with 10-11 decision-makers per account, “LinkedIn CAC: $982 → $400” delivering qualified leads at half platform average through complete outbound strategy, and “Scale Without Inflating CAC” maintaining efficiency for SMB or Enterprise through intelligent targeting and multi-touch design. Our complete LinkedIn outbound system eliminates the CAC crisis systematically—delivering 15-25% response rates through done-for-you targeting, campaign design, and scaling that reduces acquisition costs 40-60% versus traditional channels by: (1) eliminating cold email’s 306-emails-per-lead waste achieving 7.8% precision targeting efficiency, (2) cutting LinkedIn Ads costs from $982 to $400 through organic outbound bypassing paid interruption costs, (3) avoiding Paid Search’s $1,907 CAC through direct decision-maker access, (4) engaging 10-11 person buying committees systematically rather than sequential single-contact approaches inflating cycles, (5) executing multi-channel coordination (LinkedIn + email + follow-up) with 4-6 value-adding touches implementing the 80%-need-5+-follow-ups discipline 92% abandon after 4, (6) scaling personalization achieving 32.7% reply boost systematically not manually preventing 1.7% generic template rates, and (7) maintaining sustainable 3:1+ LTV:CAC ratios through qualified meeting generation not activity volume, converting CAC knowledge into actual cost reduction without the 306-email cold outreach burden, $942-$1,907 channel costs, 10-11 stakeholder navigation complexity, Enterprise $6,948-$14,772 inflation, multi-channel orchestration challenges, personalization discipline gaps, or 5+ follow-up persistence demands preventing most companies from reversing the documented 222% CAC increase ($9 to $29 loss per customer) through systematic LinkedIn outbound execution that achieves retention-level efficiency (5-25x cheaper) in acquisition motions by targeting decision-makers directly, engaging buying committees coordinately, personalizing at scale, following up persistently, and scaling without inflating costs regardless of SMB or Enterprise focus eliminating the unsustainable below-3:1 LTV:CAC ratios driving the 44% acquisition vs 18% retention misallocation documented throughout customer acquisition cost statistics as primary barrier to profitable sustainable growth in 2025’s increasingly expensive competitive landscape.

- blog

- Statistics

- Customer Acquisition Cost Statistics 2025 | CAC Data