Fractional CFO Jobs: Your Complete Guide to High-Value Finance Careers in 2026

- Sophie Ricci

- Views : 28,543

Table of Contents

The world of finance is changing fast. Traditional full-time CFO roles used to be the only path for experienced financial leaders, but now there’s something better. Fractional CFO jobs are exploding in demand, offering financial experts the freedom to work with multiple clients while earning premium rates.

If you’re tired of the corporate grind and want more control over your career, fractional work might be your ticket. According to recent data, demand for fractional CFOs has surged over 310% since 2020. Business owners need strategic financial leadership, but they can’t always afford a $300,000+ full-time executive.

That’s where you come in.

This guide breaks down everything about fractional cfo jobs—from what they actually pay to how you can land your first clients and scale to six figures. Whether you’re exploring fractional cfo jobs remote or searching for fractional cfo jobs near me, this is your roadmap.

What Are Fractional CFO Jobs?

Let’s get clear on what we’re talking about. A fractional CFO isn’t a part-time employee. You’re a strategic consultant who provides high-level financial leadership to multiple companies simultaneously.

Think of it like this: instead of working 50 hours a week for one company, you work 10-15 hours per week for 3-5 companies. You’re delivering the same strategic value—forecasting, fundraising prep, board reporting—but you’re doing it more efficiently.

Here’s what makes fractional different:

Most chief financial officer roles require full-time commitment. You’re buried in the day-to-day operations, managing a team, attending endless meetings. As a fractional CFO, you focus purely on strategy. You’re the architect, not the builder.

Research shows that fractional CFOs typically charge $5,000-$12,000 per month per client. With 4 clients, that’s $240,000-$576,000 annually. Not bad for 40-60 hours of work per week total.

The Difference Between Fractional, Interim, and Full-Time CFOs

Confusion often exists between these roles. An interim CFO is hired to fill a gap—usually when someone quits suddenly or during a crisis. They work full-time but only for 3-18 months. They’re firefighters.

A controller looks backward. They close books, handle tax compliance, ensure accuracy. They’re historians.

You, as a fractional CFO, look forward. You’re building financial models, preparing companies for fundraising, optimizing capital allocation. You’re the strategic partner business owners desperately need.

The beauty? Companies get a $300,000 brain for $60,000-$100,000 per year. That’s the value proposition that makes this market explode.

The Fractional CFO Jobs Market: Opportunity and Reality

The market for fractional cfo jobs is growing faster than most people realize. Economic pressures are forcing companies to prioritize capital efficiency over expensive full-time hires.

Here are the numbers: A full-time CFO in major US cities costs $250,000-$400,000 annually when you include salary, benefits, and equity. For a Series A startup burning through runway, that’s untenable.

Meanwhile, experienced finance professionals are leaving traditional roles. The “Silver Tsunami” of Baby Boomers exiting corporate life is creating a massive supply of talent ready for portfolio careers. According to industry reports, over 65% of finance executives over 55 are interested in fractional work.

This creates perfect market conditions.

🎯 Stop Chasing Referrals Alone

Automate your client acquisition with our proven LinkedIn targeting and campaign system

Business owners need help, but they’re skeptical about hiring part-time executives. Your job is to prove value quickly. That’s why understanding the <a href=”https://salesso.com/blog/linkedin-automation-tool/”>LinkedIn automation</a> landscape matters—you need systematic lead generation, not just referrals.

Who’s Hiring Fractional CFOs?

Three main categories of companies hire fractional financial leadership:

Startups ($1M-$10M revenue): These companies need someone to clean up their books, build proper forecasting models, and prepare for Series A fundraising. They can’t afford full-time yet, but they need expertise. Pain point: runway management.

Growth companies ($10M-$50M revenue): They’re scaling fast and need unit economics analysis, audit preparation, and sophisticated reporting. Pain point: scalability and controls.

Turnaround situations: Private equity firms or struggling companies need aggressive cost-cutting and cash flow triage. Pain point: speed of execution.

Each of these represents different opportunities. Startups pay less but offer equity upside. Growth companies pay premium rates. Turnarounds are intense but short-term.

Remote Work Has Changed Everything

The shift to remote work eliminated geographic constraints. Before 2020, searching “fractional cfo jobs near me” was necessary. Most clients wanted someone local who could visit the office.

Now? Over 80% of fractional CFO engagements are fully remote. Cloud-based tools like QuickBooks Online, Xero, and Zoom make location irrelevant. This means you can serve clients anywhere.

That’s huge. You’re no longer limited to businesses in your city. The whole country (or world) is your market. Searching for fractional cfo jobs uk or fractional cfo jobs remote opens up unlimited opportunities.

How Much Do Fractional CFO Jobs Pay?

Let’s talk money. One of the biggest questions people have about cfo jobs in the fractional model is compensation.

The short answer: You can make $150,000-$500,000+ per year, depending on your client load and expertise.

The breakdown:

Hourly rates in the US range from $175-$450 per hour. In the UK, rates are typically £100-£300 per hour. If you work 20 billable hours per week at $300/hour, that’s $312,000 annually.

Monthly retainers are more common and predictable. Most fractional CFOs charge $5,000-$12,000 per client per month. Industry data shows the average retainer is around $8,000/month.

Do the math: 4 clients × $8,000 = $32,000/month = $384,000/year.

That’s significantly more than the median full-time CFO salary of $250,000, and you control your schedule.

📈 Build Your $400K+ Practice

We help fractional CFOs systematically fill their client roster with qualified opportunities

But here’s the catch: You need a full book of business to hit those numbers. Most fractional CFOs struggle with business development. They’re excellent at finance but terrible at sales. Sound familiar?

That’s why having a systematic approach to <a href=”https://salesso.com/blog/linkedin-growth-hacking/”>LinkedIn growth</a> is critical. You can’t rely on referrals alone.

Pricing Models That Work

There are three main pricing approaches:

Retainer model (recommended): Fixed monthly fee for defined scope. This provides predictable income and makes planning easier. Example: $7,500/month for monthly close, board reporting, and strategic planning calls.

Hourly model: Good for ad-hoc consulting or project-based work. The downside? Income is unpredictable and you’re constantly tracking time.

Value-based pricing: Taking lower cash fees in exchange for equity or success fees (percentage of funds raised). This works for high-growth startups where you believe in the upside.

Most successful fractional CFOs use a combination. Retainers for core clients, hourly for special projects.

Landing Your First Fractional CFO Jobs

Getting started is the hardest part. You have the skills—you’ve been a controller, VP of finance, or full-time CFO. But how do you transition to fractional work?

Step 1: Position yourself correctly

Stop calling yourself “available for part-time work.” That sounds desperate. Instead, you’re a “Fractional CFO specializing in SaaS companies preparing for Series A funding.” Specificity sells.

Create a simple one-page website. List your services, case studies (even if disguised), and testimonials. Use <a href=”https://salesso.com/blog/advanced-linkedin-search/”>advanced LinkedIn search</a> to find companies matching your ideal client profile.

Step 2: Leverage your network initially

Your first 1-2 clients will likely come from people who already know you. Former colleagues, board members, investors. That’s fine. Get those initial engagements to build case studies.

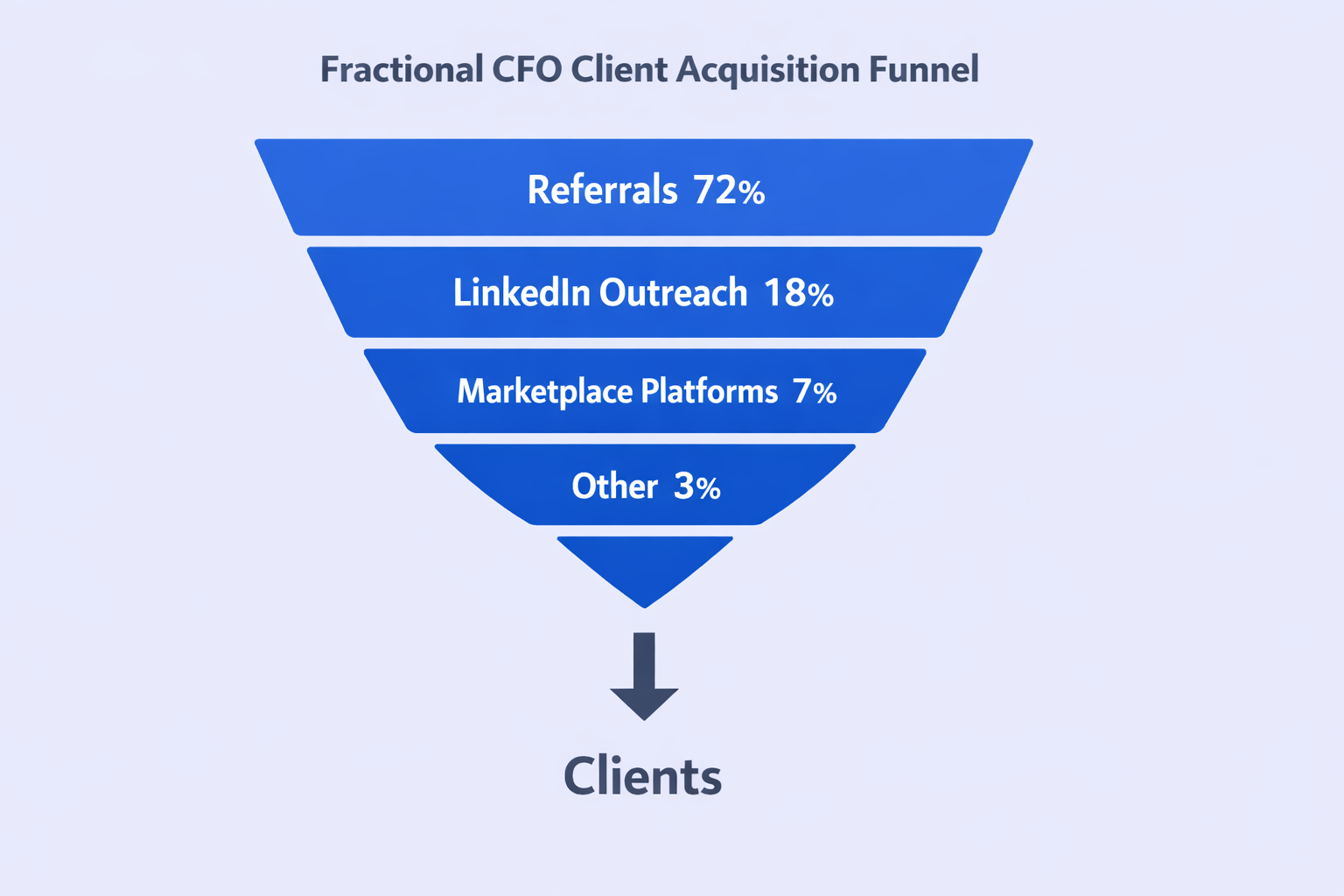

According to research, 72% of fractional CFOs get their first client through referrals. But relying solely on referrals isn’t scalable.

Step 3: Build a systematic outbound engine

This is where most fractional CFOs fail. You can’t wait for the phone to ring. You need proactive outreach.

That means:

- Building targeted lists on <a href=”https://salesso.com/blog/linkedin-sales-navigator-alternatives/”>LinkedIn Sales Navigator</a>

- Sending personalized connection requests and messages

- Offering free value (financial health assessments, quick audits)

- Following up consistently

The data is clear: Companies using systematic outbound generate 5-7x more qualified leads than passive strategies alone.

Where to Find Opportunities

If you’re actively searching “fractional cfo jobs remote” or “fractional cfo jobs uk,” here are the best sources:

LinkedIn: The #1 platform. Use filters for “CFO,” “Finance,” “Startup,” “Series A” to find companies in growth mode. Look for job postings mentioning “fractional” or “part-time CFO.”

Marketplace platforms: Sites like Paro, Toptal, The CFO Centre, and FocusCFO connect fractional talent with companies. The downside? They take 20-40% commission.

Job boards: Indeed, LinkedIn Jobs, and AngelList occasionally post fractional openings. These are decent for supplemental income but aren’t the main game.

Direct outreach: This is where the real money is. Identify companies at inflection points (recent funding, rapid growth, executive departures) and reach out proactively.

What You’ll Actually Do: The Work of Financial Leadership

Let’s get practical. What does a typical fractional engagement look like?

Your first 90 days follow a predictable framework:

Days 1-30: Diagnosis You’re putting out fires and assessing damage. Build a 13-week cash flow forecast immediately. Audit the chart of accounts. Review the tech stack integration between CRM and accounting systems.

Deliverable: A “Financial Health Report” showing immediate risks and quick wins.

Days 31-60: Stabilization Reduce the monthly close cycle from 20+ days to 5-10 days. Implement proper KPIs (not just revenue—think Net Revenue Retention, CAC Payback, Rule of 40 for SaaS).

Deliverable: First accurate, timely financial statements and board deck.

⚡ Scale Beyond Manual Networking

Our targeting and campaign design delivers consistent qualified meetings for your practice

Days 61-90: Strategy Build a rolling 12-24 month operating model. Connect financial outcomes to operational drivers (“If we hire 3 sales reps in May, revenue converts in August”). Prepare capital planning for debt or equity financing.

Deliverable: Comprehensive strategic plan and long-term financial model.

This framework works across industries. Whether you’re working with SaaS, agencies, manufacturing, or healthcare, the bones stay the same.

Tools You’ll Need

Technology is your friend in fractional work. You can’t manually manage 4-5 clients with spreadsheets alone.

Essential stack:

- Accounting: QuickBooks Online or Xero (cloud-based is non-negotiable)

- Spend management: Bill.com, Ramp, or Brex for tracking expenses

- Forecasting: Excel is still dominant, but tools like Mosaic, Jirav, or Fathom overlay nicely

- Reporting: Fathom, Syft Analytics for automated dashboards

- Payroll: Gusto, Rippling, or Deel for global teams

Don’t forget your own business tools. You need a CRM (HubSpot, Close) to manage your pipeline and <a href=”https://salesso.com/blog/top-workflow-automation-software/”>workflow automation</a> to stay organized.

Industries with the Highest Demand

Not all fractional cfo opportunities are equal. Some industries desperately need financial leadership while others can get by with just a good controller.

SaaS (Software as a Service): This is the holy grail. SaaS companies have complex subscription metrics, deferred revenue challenges, and investor reporting requirements. They need CFOs who understand ARR, churn, CAC payback, and the Rule of 40. Demand is highest here.

Marketing agencies: Project-based revenue creates cash flow volatility. Agencies need help transitioning to retainer models and managing contractor vs. employee classification (IR35 in UK). Common pain point: feast or famine cycles.

eCommerce and manufacturing: Capital-intensive businesses with cash trapped in inventory. They need expertise in working capital optimization, supply chain financing, and inventory forecasting. Growing demand, especially post-pandemic.

Healthcare and dental practices: Complex insurance reimbursement, regulatory compliance, and margin pressures create strong demand for fractional support. Stable, recession-resistant sector.

Each vertical has unique needs. Specializing in one makes you infinitely more valuable than being a generalist.

The Biggest Challenges (And How to Overcome Them)

Fractional CFO jobs aren’t all sunshine. Let’s be honest about the difficulties:

Challenge 1: Client acquisition is hard Most fractional CFOs are excellent at finance but struggle with sales. You’re competing against referrals, marketplaces, and other independents. Solution: Build a systematic outbound system using <a href=”https://salesso.com/blog/zoominfo-review/”>quality data</a> and consistent follow-up.

Challenge 2: Managing multiple clients simultaneously Juggling board meetings, month-end closes, and strategic projects across 4-5 companies is intense. Solution: Implement strict processes, leverage automation, and set clear boundaries on availability.

Challenge 3: The trust barrier Business owners worry that a part-timer won’t care as much as a full-time employee. Solution: Deliver exceptional results in your first 30 days. Nothing builds trust faster than solving immediate problems.

Challenge 4: Inconsistent income Client churn happens. Startups fail. Projects end. Solution: Maintain a pipeline of prospects even when fully booked. Never stop marketing.

According to industry surveys, the average fractional CFO loses 1-2 clients per year. If you don’t have replacement pipeline, your income drops dramatically.

Building Your Fractional CFO Practice: A 90-Day Plan

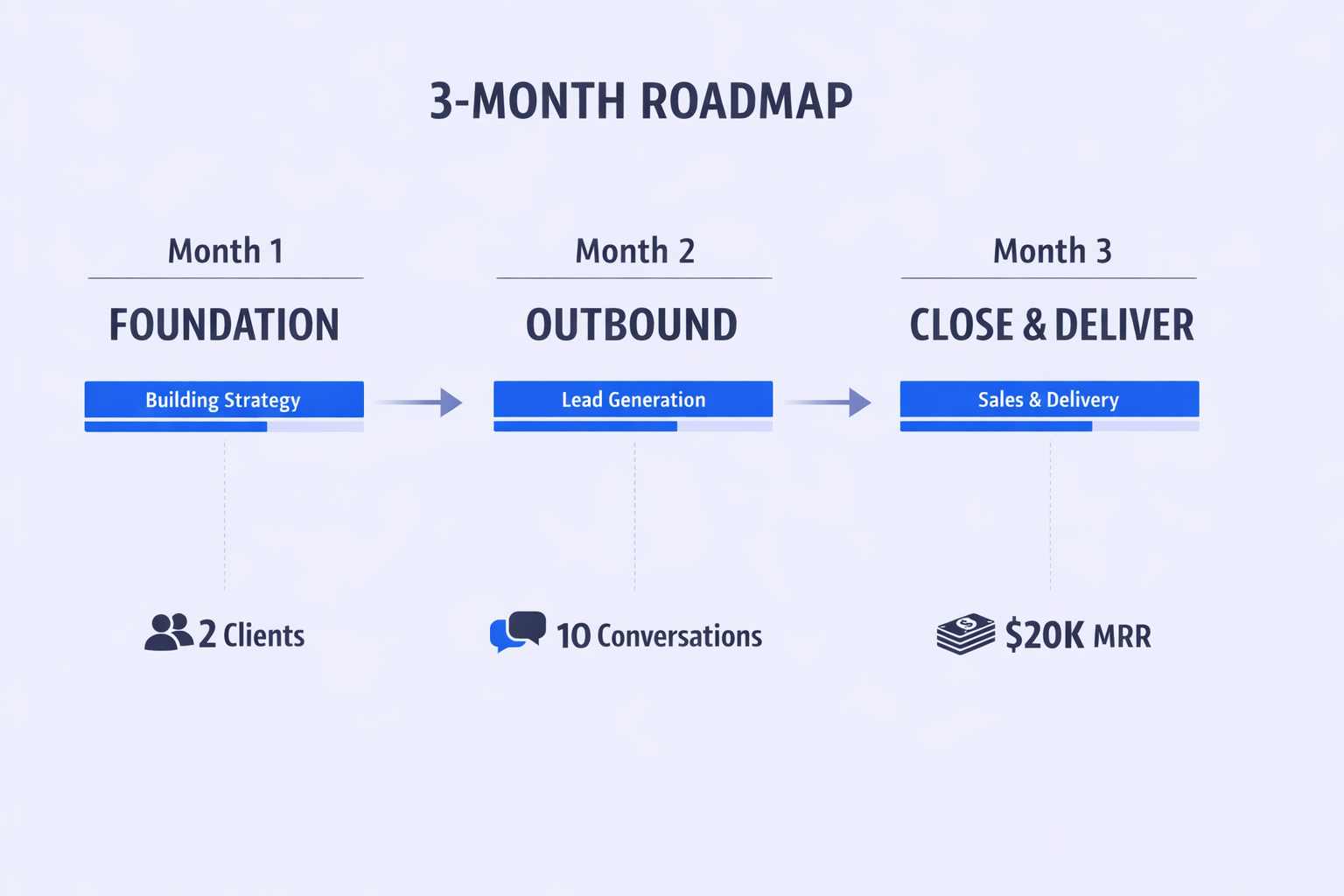

Ready to make the leap? Here’s your actionable roadmap:

Month 1: Foundation

- Define your niche (industry + company stage)

- Build a simple website with case studies

- Set up LinkedIn profile optimization using <a href=”https://salesso.com/blog/linkedin-profile-statistics/”>best practices</a>

- Reach out to your immediate network

- Goal: 1-2 discovery calls

Month 2: Outbound engine

- Build targeted prospect lists (100-200 companies)

- Launch LinkedIn outreach campaign

- Create valuable content (LinkedIn posts, short articles)

- Attend 2-3 industry events (virtual or in-person)

- Goal: 5-10 qualified conversations

Month 3: Close and deliver

- Convert 1-2 clients from pipeline

- Deliver exceptional first month results

- Ask for referrals and testimonials

- Refine outreach based on feedback

- Goal: $10,000-$20,000 in monthly recurring revenue

This isn’t overnight success. But with focus and consistency, you can build a $200,000+ practice in 6-12 months.

🚀 Ready to Scale Your Outreach?

Your profile photo is just the start. We design complete LinkedIn prospecting campaigns that fill your calendar with qualified meetings—using proven systems that work.

7-day Free Trial |No Credit Card Needed.

FAQs

What is the difference between a fractional CFO and a controller?

n I get my first fractional CFO clients through LinkedIn outreach instead of just referrals?

How much do fractional CFO jobs pay in 2026?

What industries hire the most fractional CFOs?

Do fractional CFOs work remotely?

- blog

- Sales Development

- Fractional CFO Jobs: Build a High-Value Finance Career (2026)