LinkedIn Career Page Statistics: What Top Companies Know That You Don't

- Sophie Ricci

- Views : 28,543

Table of Contents

LinkedIn Career Page Statistics

- Organizations with headcount growth 38% more likely to purchase new software – hiring isn’t just HR signal but buying signal, behavioral economics playing out across LinkedIn’s 1.15 billion user platform

- 5.18-7.78 million new members every single month (2-3 new users per second) – constant influx means target account database needs regular updates as lists become partially obsolete within months

- United States: 234 million users (31% of total traffic), India: 148+ million – global reach means recruitment signals reflect real-time business expansion across multiple markets simultaneously

- 1.73 billion visits with average session 11 minutes 19 seconds – high “dwell time” distinguishing LinkedIn from other platforms as users in work mindset actively seeking vendor solutions

- Video engagement surged 40% year-over-year with 5.6% engagement rate – videos under 60 seconds retain 87% of viewers but users decide whether to continue within first 8 seconds

- Peak activity Tuesdays-Thursdays 9 AM-12 PM and 1-4 PM – reaching decision-makers during these windows dramatically increasing message visibility versus overnight queues getting buried

- 74.24% of visits on desktop, but 73% of video consumption on mobile – “Hybrid Usage Paradox” requiring desktop-optimized research content and mobile-optimized direct outreach messages

- Millennials (25-34) comprise 47.3% of user base, Gen Z (18-24) make up 28.7% – millennials now occupying Director/VP roles expecting vendors to understand digital footprint before contact

- 53% of LinkedIn users earn $100K+ annually – suggesting higher purchasing power and tolerance for premium B2B solutions from educated sophisticated audience

- IT support system failures drive 54% increase in Help Desk Software purchases when scaling 200-250 employees – operational breakage as companies scale forcing tool investments

- New executives spend 70% of budgets within first 100 days – “Fresh Eyes Effect” as new leaders mandated to make impact and prefer toolstacks from previous successful roles

- New executives 2.5x more likely to convert on cold outreach in first 3 months vs tenured – representing distinct churn risk for existing vendors with no loyalty to legacy providers

- Job posts 54x more likely to list specific skills – “Technographic Signal” broadcasting internal infrastructure (“Must be proficient in Salesforce”) enabling highly targeted campaigns

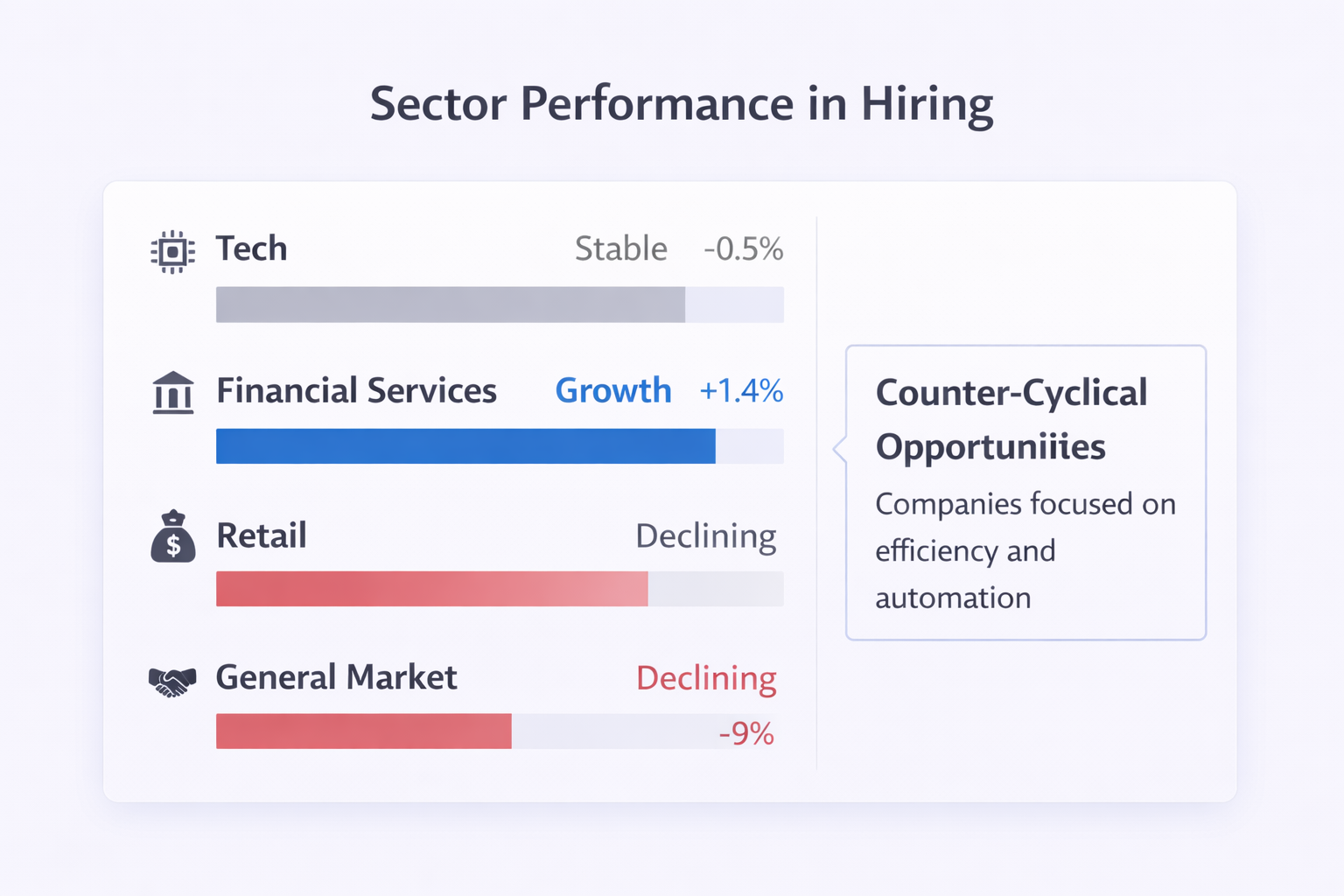

- Tech sector hiring down only 0.5%, Financial Services grew 1.4% despite national hiring slowing 9% – sector-specific resilience revealing counter-cyclical opportunities in companies investing in efficiency

- Keep page views under 500-1,000 daily for data extraction compliance – excessive use triggering LinkedIn’s commercial limits, requiring proxies mimicking human behavior for sustainable scraping

Your competitor just posted 15 new job openings on LinkedIn. While you’re checking if they’re hiring, smart sales teams are already booking meetings with their decision-makers.

Why? Because hiring isn’t just an HR signal—it’s a buying signal. When companies expand their teams, they’re simultaneously opening their wallets for tools, software, and services to support that growth.

LinkedIn career page statistics confirm this: organizations exhibiting headcount growth are 38% more likely to purchase new software than their static counterparts. This isn’t speculation—it’s behavioral economics playing out in real-time across LinkedIn’s 1.15 billion user platform.

In this guide, you’ll discover the recruitment intelligence that separates average outreach from strategic prospecting. Whether you’re in sales, recruitment, or business development, understanding these patterns transforms how you identify opportunities before your competitors even notice them.

LinkedIn Career Page Statistics

The Scale of Professional Recruitment in 2025

LinkedIn has become the central nervous system of global recruitment, and the numbers prove it. The platform welcomes between 5.18 million and 7.78 million new members every single month—that’s roughly 2-3 new users per second.

For anyone building prospect lists, this constant influx means your target account database needs regular updates. A list created in January becomes partially obsolete by March as millions of new decision-makers enter the ecosystem.

The geographic distribution matters too. While the United States dominates with 234 million users (approximately 31% of total traffic), emerging markets like India contribute 148+ million users. This global reach means recruitment signals on LinkedIn reflect real-time business expansion across multiple markets simultaneously.

🎯 Stop Chasing Cold Leads

Skip the crowded inboxes. LinkedIn outbound delivers 15-25% response rates vs. email’s 1-5%.

The Engagement Reality: How Users Actually Interact

Understanding user behavior helps you time your approach perfectly. LinkedIn recorded 1.73 billion visits with users spending an average of 11 minutes and 19 seconds per session. This high “dwell time” distinguishes LinkedIn from other platforms—users are in a work mindset, actively seeking industry insights and vendor solutions.

Video engagement surged 40% year-over-year, with video posts commanding a 5.6% engagement rate. Short-form videos under 60 seconds retain 87% of viewers, but here’s the critical part: users decide whether to continue watching within the first 8 seconds.

Peak activity occurs Tuesdays through Thursdays between 9 a.m.–12 p.m. and 1–4 p.m. Reaching decision-makers during these windows dramatically increases your message visibility compared to overnight queues that get buried by morning.

🎯 Stop Losing Opportunities to Bad Photos

Your LinkedIn profile should work for you 24/7. We help B2B companies turn connections into qualified meetings through systematic outreach.

The Engagement Reality: How Users Actually Interact

Understanding user behavior helps you time your approach perfectly. LinkedIn recorded 1.73 billion visits with users spending an average of 11 minutes and 19 seconds per session. This high “dwell time” distinguishes LinkedIn from other platforms—users are in a work mindset, actively seeking industry insights and vendor solutions.

Video engagement surged 40% year-over-year, with video posts commanding a 5.6% engagement rate. Short-form videos under 60 seconds retain 87% of viewers, but here’s the critical part: users decide whether to continue watching within the first 8 seconds.

Peak activity occurs Tuesdays through Thursdays between 9 a.m.–12 p.m. and 1–4 p.m. Reaching decision-makers during these windows dramatically increases your message visibility compared to overnight queues that get buried by morning.

📊 Your Prospects Are on LinkedIn

65+ million decision-makers, zero spam filters. Access verified buyers without technical setup headaches.

Mobile vs. Desktop: The Hybrid Usage Pattern

While 74.24% of visits occur on desktop devices, 73% of video consumption happens on mobile. This creates what we call the “Hybrid Usage Paradox” that smart prospecting must navigate.

Desktop usage associates with deep research—reading case studies, updating company pages, and evaluating vendor solutions. Mobile usage connects with quick communication, scrolling, and messaging responses. For advanced LinkedIn search strategies, understanding this split matters immensely.

Strategic insight: Content aimed at the research phase (like detailed case studies) must be desktop-optimized with clear formatting. Direct outreach messages need mobile optimization—short subject lines, scannable paragraphs, and immediate value propositions.

Demographics That Define Modern B2B Buying

The demographic composition of LinkedIn directly impacts how you should structure your outreach:

- Millennials (25–34): Comprise 47.3% of the user base and represent the dominant B2B buyer persona. They prefer digital-first engagement, social proof, and value-based messaging over traditional relationship selling.

- Gen Z (18–24): Make up 28.7% of users and are rapidly entering the workforce as influencers and researchers. They respond to authenticity and resist corporate jargon.

- High-Income Households: 53% of LinkedIn users earn $100k+ annually, suggesting higher purchasing power and tolerance for premium B2B solutions.

The overwhelming millennial dominance means “social selling” is no longer optional—this cohort now occupies Director and VP roles and expects vendors to understand their digital footprint before initial contact.

💼 Hiring = Buying Opportunity

Companies adding headcount need tools to scale. Our targeting finds them before your competitors do.

7-day Free Trial |No Credit Card Needed.

The Career Page as Intelligence Gold

Here’s where recruitment data transforms into revenue intelligence. LinkedIn career pages aren’t just HR assets—they’re financial disclosures showing exactly where companies are allocating capital and experiencing operational pain.

Recent analysis confirms companies exhibiting headcount growth are 38% more likely to purchase new software. This correlation outperforms traditional triggers like funding announcements because hiring reflects immediate operational reality, not just bank balances.

The mechanism is “Operational Breakage.” As companies scale, existing processes managed via spreadsheets or legacy tools break under the strain:

- When a company grows from 200 to 250 employees, IT support system failures drive a 54% increase in Help Desk Software purchases

- Rapid onboarding creates information silos, leading to a 65% increase in Knowledge Base tool adoption

- New teams require coordination, resulting in a 47% increase in Project Management platform purchases

For LinkedIn growth hacking enthusiasts, this data suggests “Headcount Growth” filters predict deal closure better than traditional “Revenue” filters.

The New Executive Multiplier Effect

New C-level executives and Vice Presidents represent the single most potent trigger event. Data indicates new executive hires spend approximately 70% of their budgets within their first 100 days. This “Fresh Eyes Effect” occurs because new leaders are mandated to make impact, optimize efficiency, and often prefer toolstacks from their previous successful roles.

Consider these conversion probabilities:

- New executives are 2.5x more likely to convert on cold outreach in their first 3 months compared to tenured executives

- For existing vendors, new executives represent distinct churn risk—they have no loyalty to legacy providers and are often incentivized to cut costs or modernize the stack

Tactical application: When you access LinkedIn data through advanced search filters, prioritizing “Recent Senior Leadership Changes” (last 90 days) as your primary workflow dramatically improves conversion rates.

Skills-Based Hiring Reveals Tech Stacks

The shift toward skills-based hiring has unintentionally exposed corporate technology stacks. Job posts are now 54x more likely to list specific skills—”Must be proficient in Salesforce” or “Experience with Kubernetes”—broadcasting internal infrastructure to anyone paying attention.

This “Technographic Signal” enables highly targeted campaigns:

Integration Play: If a prospect hires for a “Marketing Manager” with “HubSpot experience” and you sell a tool that integrates seamlessly, your outreach can claim immediate compatibility.

Displacement Play: If they’re hiring “Legacy Tool X” administrators, they’re entrenched in older ecosystems. However, posting for a “Digital Transformation Director” signals an active project to replace legacy tech.

Understanding how to get phone numbers from LinkedIn becomes more effective when you’re targeting the exact decision-maker hiring for your category.

Economic Resilience in Sector-Specific Hiring

Despite broad economic uncertainty where national hiring slowed nearly 9%, specific sectors show remarkable resilience:

- Tech sector remained stable (down only 0.5%)

- Financial Services grew 1.4%

- Companies focused on “efficiency,” “loss prevention,” or “automation” hiring indicate counter-cyclical opportunities

Understanding these macro-trends is crucial for territory planning. Rather than avoiding contracting sectors, look for companies within those sectors displaying “Counter-Cyclical” signals—they’re the ones investing in efficiency while competitors cut costs.

Accessing and Interpreting Hiring Data

Accessing granular career page data requires navigating LinkedIn’s tiered access levels effectively. While the free version offers basic keyword searches, Sales Navigator unlocks the “Hiring on LinkedIn” filter—a toggle that instantly isolates companies with open roles.

For users exploring apply jobs opportunities or researching applying job trends, the “Advanced Search” capabilities serve as the primary mechanism for finding high-intent prospects. Boolean logic becomes essential for anyone without Sales Navigator:

Finding Hiring Managers:

(“hiring” OR “looking for” OR “vacancy”) AND (“Sales Manager” OR “Account Executive”) AND “SaaS”

This string searches for posts where talent acquisition professionals discuss specific open roles, often before they’re formally indexed or after they’ve become urgent. When you apply advanced search filters strategically, you discover opportunities competitors miss entirely.

The often-overlooked “Applicant Count” visible on job postings provides additional intelligence:

- High Applicant Volume: Signals strong employer brand but likely overwhelming screening processes—perfect for selling automated screening tools or HR efficiency platforms

- Low Applicant Volume: Indicates “Hard-to-Fill” roles—opportunities for staffing agencies, specialized recruitment tools, or consulting services

Automation and Data Extraction Considerations

As teams scale, manual searching becomes inefficient, leading many to explore data extraction technologies. The official LinkedIn API is highly restricted, focusing on member authorization and preventing mass data extraction for outreach purposes.

Third-party scraping tools fill this gap, though they come with compliance considerations. Browser-based extensions extract data from current Sales Navigator views, while cloud-based tools can automate extraction of job engagement data. However, excessive use can trigger LinkedIn’s commercial use limits.

Best practices suggest keeping page views under 500–1,000 daily and using proxies that mimic human behavior. Many professionals find that combining Apollo.io alternatives with compliant data providers offers better long-term sustainability.

The Future: AI and Predictive Intent

The future of leveraging LinkedIn career page statistics lies in autonomous agents and predictive intent models. New platforms use AI agents to perform complex enrichment workflows—detecting job postings, scraping text, using large language models to summarize core pain points, finding hiring managers, and drafting personalized emails.

This reduces research time from 15 minutes per lead to near-zero, enabling contextual prospecting at scale. Advanced tools are evolving to predict hiring before jobs are posted by analyzing “Topic Surges”—companies researching specific implementations likely need specialists in those areas soon.

The value of network intelligence—knowing who knows the hiring manager—will skyrocket. Features showing if colleagues are connected to prospects become essential for warm introductions, dramatically improving conversion rates over cold outreach.

Conclusion

LinkedIn career pages aren’t just recruitment tools—they’re ledgers of corporate ambition and buying signals hidden in plain sight. Every job posting represents a funded project. Every new executive is a change agent with budget authority. Every skill requirement is a technographic fingerprint pointing to tech stack decisions.

The data confirms what smart sales professionals already suspect: companies that hire are companies that buy. New executives spend money quickly. Organizations experiencing rapid growth need supporting infrastructure immediately. The only question is whether you’ll leverage this intelligence before your competitors do.

The career page has become the new lead list. Those who know how to access linkedin data effectively, interpret hiring signals accurately, and time their outreach strategically will systematically outperform those relying on outdated cold prospecting methods.

FAQs

How can I access LinkedIn advanced search filters without Premium?

What keywords find hiring managers posting jobs?

Is scraping LinkedIn data for sales legal?

How accurate is hiring intent data from career pages?

What's the best way to contact prospects after seeing hiring signals?

- blog

- Statistics

- LinkedIn Career Page Statistics 2026 (Recruiting Data)