LinkedIn UK Statistics 2026: Key Data Every Professional Needs

- Sophie Ricci

- Views : 28,543

Table of Contents

LinkedIn UK Statistics

47.6 million LinkedIn users in the UK as of early 2025 – representing 81.8% of all UK adults, showing near-universal professional platform adoption

LinkedIn advertising reach covers 68.6% of entire UK population – not just working professionals but massive demographic penetration across all age groups

15.4% year-over-year growth adding 6 million new users – platform added 2 million users just between October 2024-January 2025 (4.7% quarterly growth)

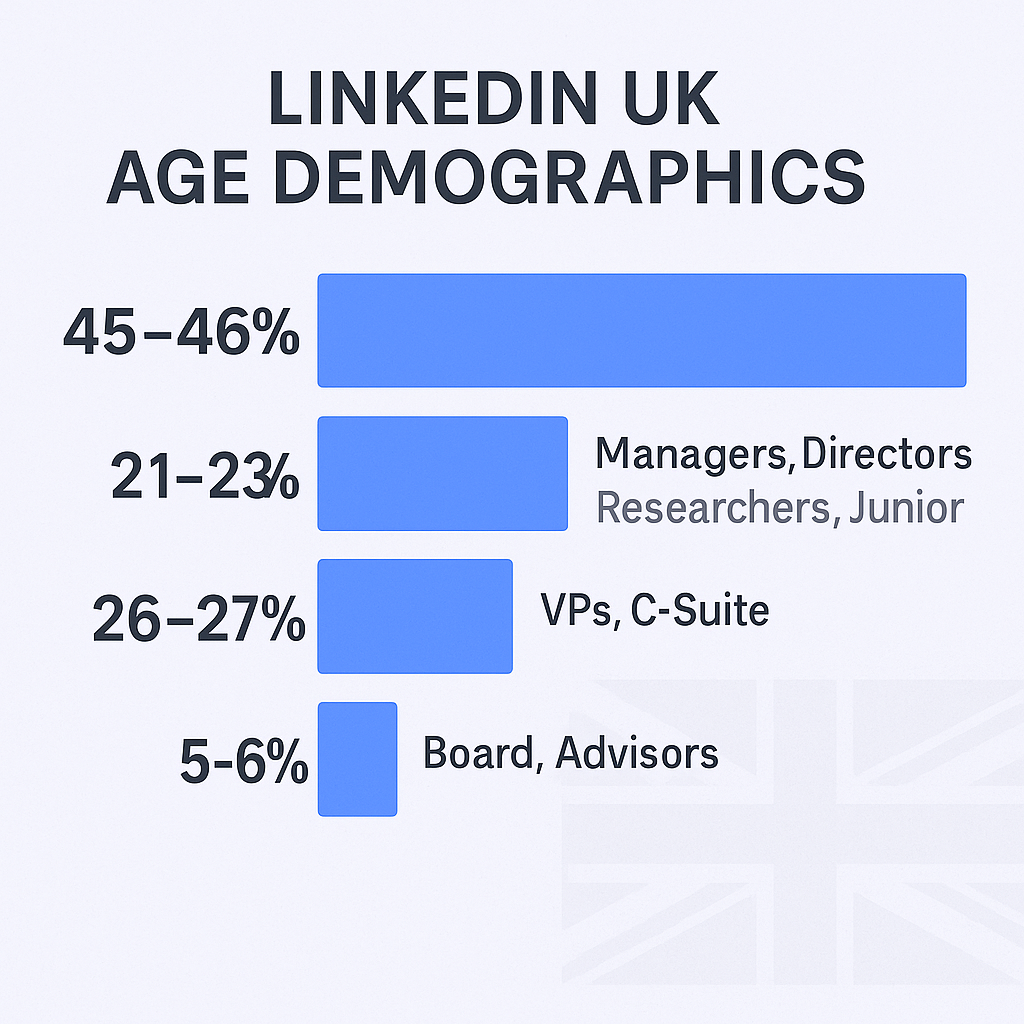

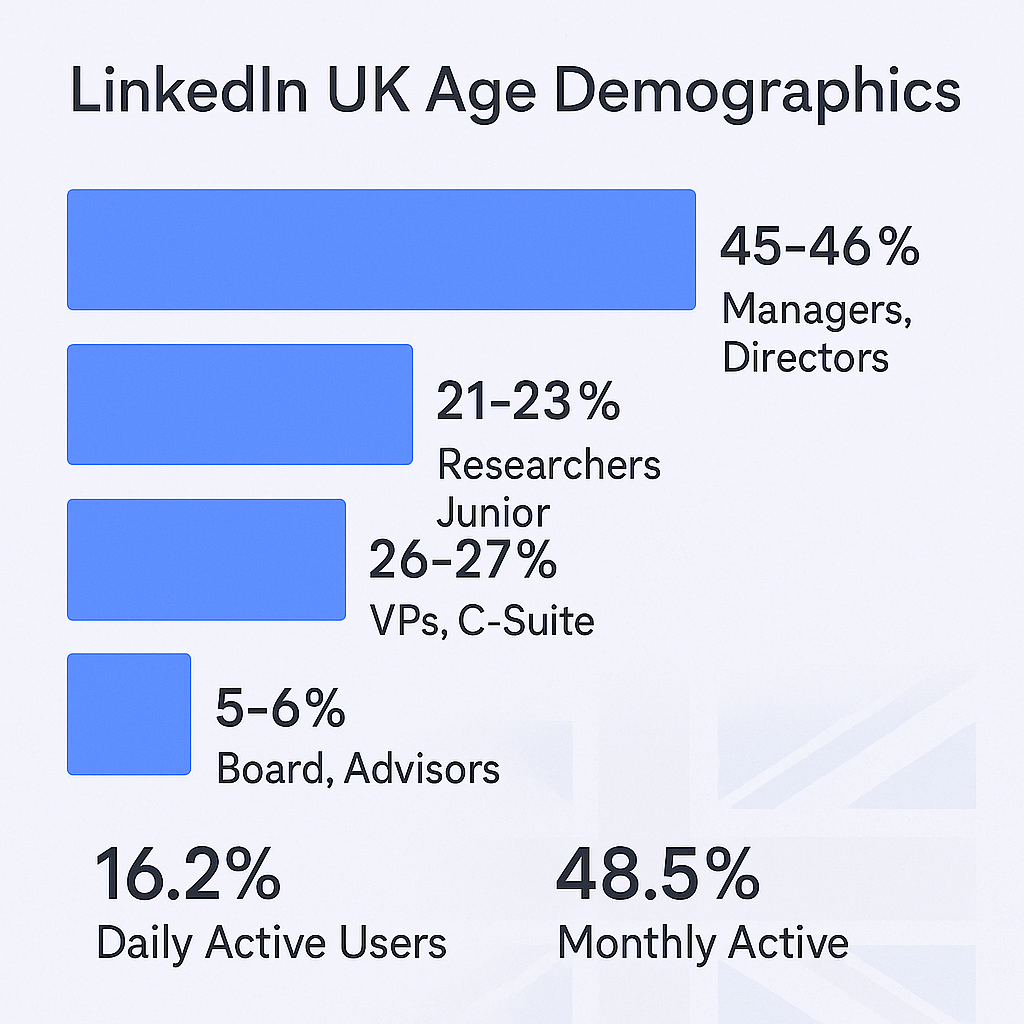

25-34 age group dominates at 45-46% of user base – these managers and senior managers are digital natives with budget authority, ideal B2B champions

18-24 year olds account for 21-23% of users – researchers who shortlist vendors before presenting options to leadership, shouldn’t be dismissed

35-54 demographic makes up 26-27% of users – where heavy signing authority lives with VPs, Heads of Department, and C-Suite executives

Only 16.2% are daily active users – power users who check LinkedIn every day including recruiters, salespeople, marketers, and engaged executives

48.5% log in at least monthly – browsing, updating profiles, and responding to messages occasionally but inbox may sit unread for weeks

65% of LinkedIn ad impressions happen on mobile devices – users spend average 48 hours per month on mobile app, requiring mobile-optimized content

Document posts (PDF carousels) lead with 6.10% engagement rates – highest-performing format because they’re educational, easy to save, and feel less salesy

Video content follows at 5.60% engagement – surged throughout 2024-2025, offering personal way to build trust and explain complex concepts

LinkedIn InMail response rates: 10-25% vs cold email’s 1-5% – roughly 5-8x better performance due to scarcity value, instant context, and professional environment

Brand exposure increases purchase intent by 33% – marketing team ads provide crucial air cover making cold outreach land in “warm” territory

40% of B2B marketers rate LinkedIn as most effective channel for high-quality leads – platform delivers average 6.3% conversion rate, exceptional for B2B advertising

Data analytics, big data, and data mining consistently rank as most in-demand skills – UK faces significant skills shortage; companies posting these roles are likely investing heavily in infrastructure

If you’re serious about networking in the UK, you need to know what’s actually happening on LinkedIn right now.

Forget the generic advice. The UK LinkedIn landscape in 2025 is massive, sophisticated, and full of opportunity—but only if you understand the real numbers behind it.

Here’s the thing: 47.6 million professionals are on LinkedIn in the UK. That’s not just a vanity metric. It’s 81.8% of all UK adults. Your prospects, competitors, and future collaborators are there. The question isn’t whether you should be on LinkedIn—it’s whether you’re using it effectively.

This guide breaks down the linkedin uk statistics that matter. You’ll discover who’s actually active, what content works, which industries dominate, and how professionals are using the platform to build careers and close deals.

Let’s dive into the data.

The Big Picture: LinkedIn’s Reach in the UK

LinkedIn isn’t just another social network in the UK. It’s become the professional infrastructure.

The platform reaches 47.6 million users in the United Kingdom as of early 2025. To put that in perspective, LinkedIn’s advertising reach covers 68.6% of the entire UK population—not just working professionals, but everyone.

When you narrow it down to adults (18+), the numbers get even more compelling: 81.8% of UK adults have a LinkedIn presence. That means roughly 8 out of 10 adults you meet professionally are findable on the platform.

Here’s what makes this interesting: despite already dominating the market, LinkedIn UK grew by 15.4% year-over-year, adding 6 million new users between early 2024 and early 2025. Even in just the last quarter (October 2024 to January 2025), the platform added 2 million users, representing 4.7% quarterly growth.

🎯 Target the Right 25-34 Decision-Makers

We build campaigns that reach active UK buyers, not just profiles

LinkedIn UK shows a relatively balanced gender split:

- Male users: 55-57%

- Female users: 43-45%

But here’s the nuance: these percentages shift dramatically by industry. Engineering, manufacturing, and construction skew more male. Marketing, HR, education, and healthcare show female majorities or near-parity.

The smart move? Don’t make assumptions. Use data analytics to understand the specific gender dynamics of your target vertical before crafting outreach campaigns.

The Activity Gap: Who’s Actually Paying Attention?

Having a LinkedIn profile and using LinkedIn actively are two completely different things.

Of the 47.6 million registered UK users, only a fraction log in consistently:

16.2% are daily active users—the power users who check LinkedIn every single day. These are recruiters, salespeople, marketers, and engaged executives who live on the platform.

48.5% log in at least monthly, browsing, updating profiles, and responding to messages occasionally.

What This Means for active users linkedin

If you’re trying to reach someone through LinkedIn, you need to know which camp they fall into.

The 16.2% daily active users are your prime targets for social selling. They see your comments, engage with your posts, and check InMail regularly. Expect quick replies and ongoing conversations.

The remaining users who log in monthly are better reached through email or phone follow-up. Their LinkedIn inbox might sit unread for weeks.

Mobile-First Reality

Here’s a critical stat: 65% of LinkedIn ad impressions happen on mobile devices. Active users spend an average of 48 hours per month on the LinkedIn mobile app.

Translation? If your outreach message is a wall of text, it’s getting ignored. On mobile screens, 300 words looks like a novel. Successful messages are short, scannable, and built for thumb-scrolling.

Content That Actually Gets Engagement

📊 Reach the 16% Daily Active Users

Our targeting finds engaged prospects, our campaigns convert them into meetings

Not all LinkedIn content performs equally. The platform’s algorithm and user behavior favor specific formats.

Document posts (PDF carousels) lead with 6.10% engagement rates. These work because they’re educational, easy to save, and feel less salesy than traditional marketing content.

Video content follows closely at 5.60% engagement. Video posts have surged throughout 2024-2025, offering a more personal way to build trust and explain complex concepts.

Text and image posts still perform respectably, especially for starting conversations and building authentic connections.

Here’s the trend: engagement rates across all content types have been climbing steadily through 2024 and into 2025. Users aren’t just consuming content—they’re actively liking, commenting, and sharing more than ever.

Mobile Content Strategy

Remember that 65% mobile usage stat? It dictates everything.

Your content needs to:

- Load fast

- Display clearly on small screens

- Hook attention in the first 2 seconds

- Use short paragraphs (2-3 lines max)

- Include clear visual breaks

Posts that work on desktop but fail on mobile are dead on arrival for most of your audience.

Decision-Makers and Industry Insights

LinkedIn’s real power for B2B professionals? Direct access to decision-makers.

4 out of 5 LinkedIn members globally drive business decisions. The UK market, with its heavy service-sector orientation and concentration of corporate headquarters in London, reflects this pattern strongly.

The platform hosts over 10 million C-level executives worldwide, with the UK contributing significantly. London alone serves as a global hub for corporate headquarters, making executive density exceptionally high.

SMEs and Buying Committees

It’s not just enterprise giants. Most SMEs have 3+ decision-makers involved in purchase decisions. LinkedIn lets you map these buying committees—finding not just the CEO but the Finance Director and Operations Manager who also need to sign off.

Industry Activity: Where the Action Is

Certain UK sectors show exceptionally high LinkedIn activity:

Technology and Software leads the pack. Digital transformation has made this vertical highly active, though professionals here are also the most desensitized to generic outreach.

Financial Services thrives with London as a global financial capital. High concentration of banking, fintech, and investment professionals. This sector combines high compliance with high thought leadership activity.

Construction and Engineering has seen a digitization surge. The push for “green skills” and sustainable building practices is driving unprecedented engagement.

Retail and E-commerce professionals flock to LinkedIn to discuss supply chain resilience and omnichannel strategies as the high street digitizes.

The Skills Shortage Creating Opportunity

🚀 Dominate Your UK Industry Vertical

Target tech, finance, or construction leaders with campaigns proven across sectors

2025 has seen an explosion in data-centric roles across the UK.

Data analytics, big data, and data mining consistently rank among the most in-demand skills. The UK faces a significant skills shortage in this area, driving high engagement on recruitment content.

Watch for this trigger event: when a company posts a job for “Head of Data” or similar roles, they’re likely investing heavily in infrastructure, software, and consultancy. That’s your signal to reach out.

The Rise of linkedin groups

Remember LinkedIn Groups? They’re back—and thriving.

While some groups remain dormant, many industry-specific and alumni networks have revitalized into active communities. Groups focused on specific trades (UK Construction Networking, London Tech Startups) or professional associations show consistent engagement.

These groups are intelligence goldmines. By observing the questions asked in a “UK HR Directors” group, you understand exactly what pain points keep your prospects awake at night.

Participants who actively post and comment in linkedin groups are, by definition, engaged professionals. They’ve self-identified as active users, making them prime candidates for targeted outreach.

Why LinkedIn Outperforms Traditional Outreach

Here’s where the data gets really interesting for anyone doing outbound.

LinkedIn InMail response rates fall between 10-25%—significantly higher than cold email’s typical 1-5% average. That’s roughly 5-8x better performance.

Why the massive gap?

Scarcity value: InMail costs money or requires a connection, so recipients subconsciously assign higher value than free email.

Instant context: Recipients can immediately click your profile, see your face, company, and mutual connections. This built-in social proof is absent in standard email.

Professional environment: LinkedIn is where business conversations are expected. Email inboxes are battlegrounds; LinkedIn is neutral territory.

Advertising Performance for Sales Support

💬 Get 10-25% Response Rates Today

Complete LinkedIn outbound system: targeting precision, campaign design, automated scaling

7-day Free Trial |No Credit Card Needed.

While outbound teams focus on organic reach, marketing teams using LinkedIn Ads provide crucial air cover.

Brand exposure increases purchase intent by 33% according to platform data.

40% of B2B marketers rate LinkedIn as their most effective channel for high-quality leads.

The platform delivers an average 6.3% conversion rate—exceptional for B2B advertising—justifying the higher cost-per-click (averaging around $6.20).

For sales professionals, this means if your marketing team is running ads, your cold outreach lands in “warm” territory. Prospects may have already seen your logo, making them more receptive to your message.

Connecting the Dots: From Data to Strategy

Looking at all these linkedin uk statistics together, several strategic principles emerge:

Precision targeting eliminates waste. With 81.8% of UK adults on the platform, your prospects are there. Use demographic and industry filters to find exactly who you need.

Mobile-first messaging is mandatory. With 65% of engagement on mobile, your outreach must be concise, scannable, and visually clean.

Activity signals matter more than profile existence. Focus on the 16.2% daily active users for immediate engagement. Use other channels to reach monthly users.

Content is your credibility. Engagement rates are rising—posting insights positions you as a trusted voice before you even send a message.

Industry timing matters. Watching for hiring signals in big data, data analytics, or data mining roles can identify companies in active growth mode, creating perfect outreach windows.

While these statistics reveal the massive opportunity within LinkedIn, remember that a complete outbound strategy requires multiple channels working together. Email deliverability, cold email campaigns, and LinkedIn outreach each play distinct roles in a winning sales strategy.

The companies dominating UK markets in 2025 aren’t the ones with the most leads—they’re the ones with the deepest insights into those leads. These statistics are your map; how you navigate is up to you.

Other Useful Resources

To convert UK market intelligence into systematic multi-channel outreach and pipeline generation, explore these complementary resources:

Market Intelligence:

- Review ecommerce platform statistics to understand UK digital commerce trends and online buyer behavior patterns

Data Intelligence & Contact Discovery:

- Read our detailed Seamless AI review for understanding verified contact data tools beyond LinkedIn’s native search

- Learn how to get contact info from LinkedIn without connecting to accelerate UK prospecting

- Compare the top BetterContact alternatives for enriching UK contact data with verified emails and phone numbers

- Discover the best LinkedIn email finder tools to complement UK profile targeting with direct outreach

Email Infrastructure:

- Master ESP matching strategies to ensure UK emails actually reach inboxes across multiple providers

LinkedIn Sales Intelligence:

- Review comprehensive LinkedIn Sales Navigator statistics showing how premium features maximize UK market access

UK market statistics reveal unprecedented opportunity—47.6 million professionals representing 81.8% of adults, with the 25-34 demographic (45-46% of users) holding key decision-making authority. But knowing that 16.2% are daily active users and InMail gets 10-25% response rates versus email’s 1-5% doesn’t automatically fill your UK pipeline. Converting these statistics into consistent meetings requires systematic execution: precision targeting of engaged UK professionals, mobile-optimized campaigns (65% engagement happens on mobile), and multi-channel coordination. Our LinkedIn outbound system combines UK market intelligence with proven targeting frameworks and campaign sequences that deliver predictable results across London’s financial district, Manchester’s tech corridor, and beyond.

FAQs

How many LinkedIn users are in the UK?

What age group dominates LinkedIn UK?

How many users are actually active on LinkedIn UK?

Which industries have the strongest LinkedIn presence in the UK?

Are linkedin groups still relevant in 2025?

- blog

- Statistics

- LinkedIn UK Statistics 2026: Key Data Every Professional Needs