Recruitment Agencies Statistics 2026: The Complete Data Guide

- Sophie Ricci

- Views : 28,543

Table of Contents

Recruitment Agencies Statistics

- Global staffing industry: $525.9 billion in 2024, projected $626.2 billion by 2033 – growing at 1.96% CAGR with broader definitions including RPO/MSP pushing estimates between $643B-$925B

- North America dominates with 35% of global revenue share – Asia-Pacific emerging as fastest-growing region due to massive digital sector investments, Europe holding steady at 30% market share

- Top 100 staffing firms: $269 billion in 2023 (43% of entire market) – massive concentration showing how much scale matters, Big 3 (Randstad, Adecco, ManpowerGroup) controlling roughly 10% of all global revenue

- Randstad leads at $23.05B, Adecco $22.28B, ManpowerGroup $17.28B – followed by Allegis Group $11.42B and Recruit $11.03B, yet specialized players like Insight Global thriving with $3.7B on just 2% market share

- UK recruitment sector contributes £40.6-43 billion economic value by 2025 – despite payrolled employees contracting 117,000 YoY, specialized sectors red-hot with 2.3 people competing per vacancy

- 45% of global companies can’t find skilled candidates – yet 61% of job seekers ghosted after interviews creating paradox breakdown in hiring process making agencies more essential

- 61% of job seekers ghosted by employers after interviews (up 9 points in one year) – while 76% of recruiters also ghosted by candidates creating destructive feedback loop where ghosted candidates become 44% more likely to ghost back

- Open Account Executive territory costs $300-$600 per day in lost revenue – 60-day vacancy resulting in $36,000 unrealized revenue, making speed critical business metric

- Specialized agencies cut time-to-fill from 60 days to 30 days – essentially saving $15,000-$18,000 in revenue per hire, cutting time-to-meeting by 50% compared to internal recruiting

- Average ramp-up time increased to 5.7 months – top-quartile hires producing 2.05x revenue of bottom-quartile, with 54% of top performers reaching full productivity within 3 months vs 30% of average

- 43% of organizations use AI for HR tasks in 2025 (up from 26% in 2024) – organizations with full AI integration reporting 90% greater hiring efficiency and 85% time savings

- AI resume screening: 82% adoption rate scanning hundreds of resumes in minutes – chatbots dropping response times from average 7 days to under 24 hours revolutionizing candidate experience

- Application abandonment: 41.2% (process too long) – for average job seeker applying to 50 positions, approximately 47 hours of effort lost to processes receiving zero response

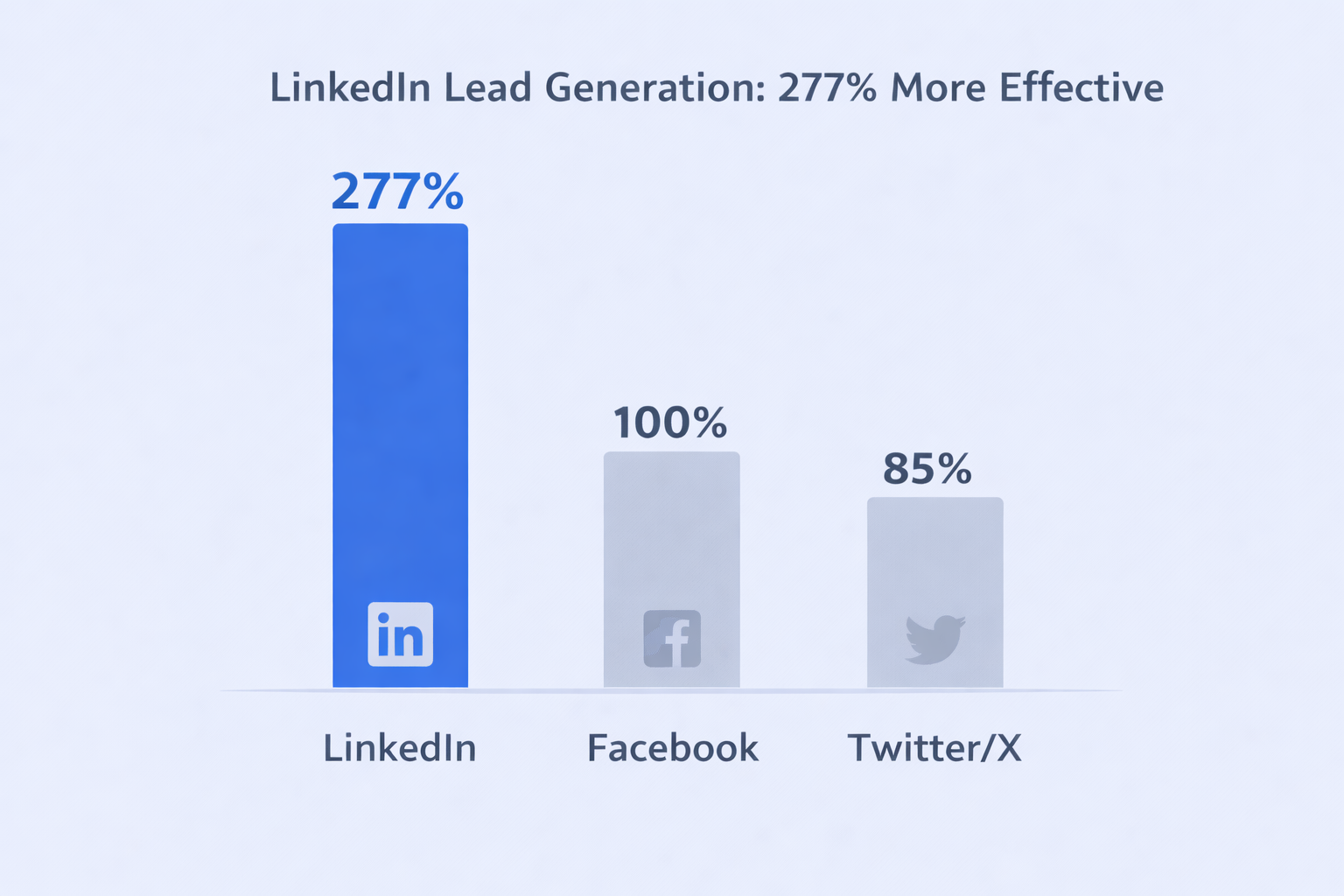

- LinkedIn 277% more effective for lead generation than Facebook/X – 89% of B2B marketers using LinkedIn for lead generation with 40% rating it #1 most effective channel for high-quality leads

- Apollo.io average data accuracy around 73% with up to 31% of “verified” emails bouncing – email deliverability dropping from 65% inbox rate in month 1 to just 23% by month 6 requiring alternative approaches

The recruitment agency market isn’t just big—it’s $525.9 billion big in 2024 and climbing toward $626.2 billion by 2033. But here’s what really matters: understanding whether these agencies actually deliver ROI for your hiring needs.

The staffing industry faces a fascinating paradox. 45% of global companies can’t find skilled candidates, yet 61% of job seekers report being ghosted after interviews. This breakdown in the hiring process has made recruitment agencies more essential than ever.

This guide cuts through the noise. You’ll find hard numbers on market leaders, regional powerhouses, and the actual cost of vacant positions. Whether you’re evaluating agencies for the first time or comparing options, these recruitment agencies statistics will help you make faster, smarter decisions.

🎯 Fill Your Pipeline Faster

Skip recruitment chaos. Our LinkedIn outbound engine delivers qualified decision-makers directly to your inbox.

Global Recruitment Market: The Numbers That Matter

The worldwide staffing industry generated approximately $525.9 billion in 2024, with broader definitions (including RPO and MSP services) pushing estimates between $643 billion and $925 billion. The market grows steadily at a 1.96% CAGR, reaching a projected $626.2 billion by 2033.

North America dominates with 35% of global revenue share, while Asia-Pacific emerges as the fastest-growing region due to massive digital sector investments. Europe holds steady at 30% market share, though some firms saw fee income decline 12% to 17% in early 2025.

The top 100 staffing firms globally pulled in a combined $269 billion in 2023—that’s 43% of the entire market. This concentration shows how much scale matters in this industry.

The Big Players: Who Controls the Market

Here are the five largest recruitment agencies in the world by revenue:

- Randstad (Netherlands) – $23.05 billion

- The Adecco Group (Switzerland) – $22.28 billion

- ManpowerGroup (United States) – $17.28 billion

- Allegis Group (United States) – $11.42 billion

- Recruit (Japan) – $11.03 billion

These three giants—Randstad, Adecco, and ManpowerGroup—control roughly 10% of all global revenue. Yet specialized players thrive too. Insight Global generated over $3.7 billion in U.S. staffing revenue in 2023 with just a 2% market share, proving niche focus drives growth.

[IN-CONTENT BANNER 1 – After “Yet specialized players thrive too” paragraph]

Before: “Insight Global generated over $3.7 billion in U.S. staffing revenue in 2023 with just a 2% market share, proving niche focus drives growth.”

💼 Target Decision-Makers Directly

Bypass recruitment agencies. Our outbound system connects you with hiring managers on LinkedIn in 48 hours.

UK Recruitment: A £40.6 Billion Powerhouse

The UK recruitment sector contributes an estimated £40.6 billion to £43 billion in economic value (GVA) by 2025. Despite payrolled employees contracting by 117,000 year-on-year, specialized sectors remain red-hot with approximately 2.3 people competing for every vacancy.

Impellam Group leads as the largest staffing firm in the UK by revenue, using diverse brand portfolios to address critical skills shortages. The market rapidly adopts Recruit-Train-Deploy (RTD) models, where agencies equip candidates with specific technical skills before placement.

Four sectors drive UK demand in 2025:

- Technology – AI and cybersecurity roles surge

- Healthcare – Persistent nursing shortages continue

- Renewable Energy – Offshore wind creates new opportunities

- Logistics – E-commerce fuels supply chain hiring

London dominates technology and AI roles, followed by Manchester and Bristol hubs. Northern Ireland reports the lowest unemployment at 1.6%, yet faces the highest economic inactivity rate at 26.6%—a unique recruiter challenge.

Australia’s Recruitment Landscape

The Australian market emphasizes professional services, mining, and healthcare. Hays, Michael Page, and Robert Half are the most recognized names for mid-to-senior level roles.

Client satisfaction ties directly to communication efficiency. Agencies like OnHires and Avomind show 100% positive sentiment for delivering suitable candidates within 2-4 months for technical roles.

Top Australian agencies by specialization:

- Hays – Multi-sector (IT, Construction, Engineering)

- Robert Half – Finance & Executive specialist

- Michael Page – Engineering & Sales focus

- Chandler Macleod – Mining & Industrial projects

- Randstad Australia – Large enterprise solutions

In Sydney specifically, Hudson Australia leads for finance roles while Six Degrees Executive dominates marketing and executive search. Budget-conscious companies increasingly turn to offshore RPO providers like Vanator RPO for scalable sourcing without local overhead.

🚀 Scale Outreach Without Overhead

Our complete LinkedIn strategy—targeting, campaigns, and scaling—eliminates agency fees while filling your pipeline.

Illinois Staffing: The Chicago Hub

Illinois, particularly Chicago, serves as a critical hub for industrial and professional staffing in the U.S. The regional market benefits from top-tier universities like Northwestern and University of Chicago, providing steady entry-level talent.

Manufacturing and light industrial segments form the backbone of Illinois staffing. Away Staffing and Malone Workforce Solutions established themselves as key partners for food production and assembly plants.

Key Illinois staffing players by specialty:

- IT & Technical – Murray Resources, Motion Recruitment, Strategic Search Corp

- Industrial/Manufacturing – Away Staffing, Malone Workforce Solutions, FlexTrades

- Healthcare – Cross Country Medical, Acumen Medical Staffing

- Administrative – JobGiraffe, AppleOne, North Bridge Staffing

For companies in Illinois, the message focuses on speed and reliability. Firms like Adecco highlight their “deep bench” of experts and decades of experience as primary differentiators for quickly filling contingent or permanent positions.

The Real Cost of Empty Seats

Here’s where recruitment agencies statistics get financially critical. An open Account Executive territory costs companies between $300 and $600 per day in lost revenue. For a mid-market role with standard quota, a vacancy longer than 60 days results in $36,000 in unrealized revenue.

Specialized staffing firms cut Time-to-Fill from an internal average of 60 days to approximately 30 days—essentially saving $15,000 to $18,000 in revenue per hire.

Time-to-Fill Comparison: Internal vs. Agency

- Account Executive: 53-60 days (internal) vs. 30-35 days (agency) – Daily cost: $500-$600

- Sales Development Rep: 45 days (internal) vs. 25-30 days (agency) – Daily cost: $200-$300

- Customer Support: 45+ days (internal) vs. 30 days (agency) – Daily cost: $150

But finding candidates is only half the battle. The average ramp-up time has increased to 5.7 months. Top-quartile hires produce 2.05 times the revenue of bottom-quartile reps. 54% of top performers reach full productivity within three months, compared to only 30% of average performers.

This acceleration of productivity can be worth tens of thousands of dollars in the first year of employment through better pipeline management.

⚡ Cut Time-to-Meeting by 50%

Stop waiting weeks for agency placements. Our LinkedIn outbound delivers qualified conversations in days, not months.

7-day Free Trial |No Credit Card Needed.

AI’s Recruitment Revolution

The integration of ai recruitment jumped from futuristic concept to operational necessity. 43% of organizations worldwide now use AI for HR tasks in 2025, up from 26% in 2024.

Organizations with full AI integration report nearly 90% greater hiring efficiency and 85% time savings. AI chatbots dropped response times from an average of seven days to under 24 hours.

AI Impact on Recruitment Workflow

- Resume Screening – 82% adoption rate, scanning hundreds of resumes in minutes

- Automated Scheduling – Reduces no-shows by 20-35%

- Skills Inference – 25% improvement in internal mobility

- AI-Assisted Messaging – 9% higher quality of hire

However, rapid AI adoption introduces new risks. The EU AI Act now classifies AI used for employment as “high-risk,” and New York City’s Local Law 144 requires bias audits for automated employment tools. Recruiters must balance AI speed with legal transparency requirements and enrichment accuracy.

The Ghosting Crisis Destroying Hiring

Despite more communication tools than ever, both employers and candidates increasingly abandon the hiring process without notice. 61% of job seekers report being ghosted by employers after interviews in 2025—up nine percentage points in just one year.

Paradoxically, 76% of recruiters also report being ghosted by candidates. This creates a destructive feedback loop: candidates experiencing ghosting become 44% more likely to ghost employers in return.

The Communication Breakdown

- Post-Interview Ghosting: 61% of candidates experience it

- Application Abandonment: 41.2% (process too long)

- Response Rate (Indeed): 20-25%

- Response Rate (LinkedIn): 3-13%

- Response Rate (Direct Site): 2-5%

For the average job seeker applying to 50 positions, approximately 47 hours of effort are lost to processes receiving zero response. For companies, this communication breakdown destroys the candidate experience and creates long-term employer brand damage.

Companies with strong employer brands see a 50% reduction in cost-per-hire and up to 30% lower turnover rates. Candidates are 2.5 times more likely to apply when they see positive reviews on platforms like Glassdoor.

LinkedIn Statistics for Small Businesses

LinkedIn has become essential infrastructure for B2B outreach, particularly for small businesses lacking enterprise marketing budgets. The platform currently has over 1.2 billion members, and its effectiveness for lead generation is 277% higher than Facebook or X.

89% of B2B marketers use LinkedIn for lead generation, and 40% rate it as the most effective channel for driving high-quality leads. The platform’s professional data allows precise targeting by seniority, industry, and specific business context.

SME Lead Generation Performance

- Effective Lead Source: 40% of B2B marketers rank LinkedIn #1

- Conversion Rate: Up to 2x higher than other platforms

- Brand Attribution: 2x to 3x lift when advertising

- Decision Maker Reach: 80% of users influence buying decisions

Small businesses find success through organic engagement too. Approximately 40% of LinkedIn visitors engage with pages organically each week—consistent, high-quality content generates results without significant ad spend. 75% of buyers state that thought leadership content helps determine which vendor makes their shortlist.

Prospecting and Outreach Dynamics

53% of B2B marketers use LinkedIn for identifying prospects and sourcing contact details. Engagement rates peak during mid-week (Tuesday through Thursday), providing a strategic window for outbound messaging and LinkedIn optimization.

Automation has become standard for SME growth. Roughly 97% of the B2B market uses LinkedIn for social lead generation, and nearly a third adopted automation tools to manage prospecting workload. However, 36% of users find personalization their biggest challenge when turning off generic outreach.

Data Quality: The Hidden Challenge

For sales teams, prospecting tool quality directly impacts success. Industry leaders like ZoomInfo and Apollo.io are primary engines for sourcing contact data that fuels recruitment pipelines.

ZoomInfo remains the top-purchased sales analytics tool, investing over $110 million annually in data quality. It provides intelligence on over 100 million companies and 500 million contacts, with approximately 300 data points per company. However, comprehensive plans often exceed $40,000 once all seats and features are added, similar to alternative solutions.

Apollo.io gained popularity through its 275 million B2B contacts database and accessible pricing. However, users report significant quality challenges. Independent testing shows average data accuracy around 73%, and up to 31% of “verified” emails may still bounce. Email deliverability often drops from a 65% inbox rate in month one to just 23% by month six, requiring alternative approaches.

Strategic Recommendations for 2025

The 2025 recruitment landscape demands a shift from volume-based outreach to high-precision, value-driven engagement. Here’s what the data suggests:

Prioritize Candidate Journey: With 79% of candidates demanding transparency regarding AI, ensure technology enhances rather than replaces human communication. Reducing application complexity can immediately lower the 41% abandonment rate.

Leverage LinkedIn for Growth: Focus on organic thought leadership and pre-filled Lead Gen Forms to compete with larger enterprises for talent and leads through proven strategies.

Address Vacancy Costs: Recognize that every day a territory remains vacant costs approximately $500 in revenue. Partnering with specialists who cut time-to-fill by 50% delivers measurable ROI.

Embrace Human-in-the-Loop AI: While AI automates 90% of hiring tasks, final decision-making and relationship-building must remain human to avoid the 40% “impersonalization” fear reported by talent specialists.

Conclusion

The 2025 recruitment agency market reveals a fascinating contradiction: $525.9 billion in global market value coexisting with a 61% candidate ghosting rate. While the staffing industry demonstrates massive economic scale, success depends on bridging the gap between digital efficiency and human connection.

The numbers are clear—specialized agencies reduce time-to-fill by 30-50% and top-quartile hires produce 2.05x the revenue of average performers. Yet with 43% of organizations now using ai recruitment and 36% of users struggling with personalization, the human element remains irreplaceable.

For small businesses and sales teams, LinkedIn’s 277% higher effectiveness for lead generation compared to traditional channels presents a compelling alternative to conventional recruitment approaches. The choice isn’t whether to use agencies—it’s understanding when their ROI justifies the investment versus when direct outreach delivers better results.

The 2025 data suggests a hybrid approach: leverage agencies for critical, time-sensitive hires where vacancy costs exceed $500 daily, while building internal capabilities for ongoing talent acquisition and relationship development.

FAQs

What are the top 5 largest recruitment agencies in the world?

How much does the UK recruitment industry contribute to the economy?

Why is ghosting increasing in recruitment?

What is the ROI of using a recruitment agency for sales roles?

What are the best staffing agencies in Illinois for manufacturing?

- blog

- Statistics

- Recruitment Agencies Statistics 2026: ROI & Market Data