Recruitment Outsourcing Statistics: 2026 Market Data & Growth Trends

- Sophie Ricci

- Views : 28,543

Table of Contents

Recruitment Outsourcing Statistics

- Global recruitment outsourcing market: $10.3B in 2024 surging to $25.8B by 2034 – growing at 9.9% CAGR representing fundamental shift in how organizations approach talent acquisition not just growth

- North America commanding 38-41.2% of global market share – United States alone generating $3.29B in 2024, dominance stemming from mature HR technology ecosystem featuring LinkedIn, Workday, Greenhouse platforms

- Asia-Pacific fastest-growing region with 18.8% CAGR through 2030 – countries like India and China driving surge through digital transformation and cost-effective yet highly skilled labor forces

- RPO delivers 25-50% reduction in cost-per-hire – shifting from fixed internal costs to variable model where you pay for results, not pocket change but fundamental restructuring

- Internal HR cost-per-hire: $4,683-$4,700 vs external partners $2,350-$3,500 – substantial savings with same outcome quality, making financial case for outsourcing compelling

- Comprehensive internal hiring can exceed $28,000 per position – when factoring indirect expenses including opportunity costs, time investment, infrastructure overhead beyond direct recruiting costs

- Unfilled position costs companies $500 per day in lost opportunity – 30-day delay in filling critical role translating to $15,000 hole in potential productivity, speed mattering for growth trajectory

- Internal HR: 44-100+ days to fill role vs external partners 27-64 days – 30-55% faster placement rate with speed advantage compounding over time as partners maintain active talent pools

- RPO providers achieve 18-20% higher retention rates through better matching – offer acceptance rate 77% vs 62% for internal teams, testament to professionalized candidate journey and selection

- 37% of organizations integrating generative AI tools in 2025 (up 10 points from previous year) – AI not just changing recruitment but completely rewriting playbook with staggering efficiency gains

- AI automation saves recruiters 20% of work week (one full workday every week) – time redirected toward strategic activities requiring human judgment and relationship building not administrative tasks

- AI resume screening: 85% time reduction, interview scheduling 60% coordination reduction – administrative work 45% reduction in total hours, diversity hiring 48% increase in effectiveness through technology

- Organizations lose $9.7M-$15M annually through bad data operational inefficiencies – in recruiting meaning high bounce rates, wasted hours chasing leads that don’t exist, damaged sender reputations

- Bad hire costs 30% of first-year salary ($18,000 average) in lost productivity – email bounce rates up to 35% in poor databases, data silos costing $7.8M annually, failed integrations $2.5M

- 38% of B2B SaaS companies outsource sales development – in-house SDR taking 4-6 months to reach productivity, outsourced teams pre-trained with proven playbooks delivering pipeline in 1-2 weeks, 40% CAC reduction with 13:1 ROI

Hiring the right people has always been tough, but in 2026, it’s become a whole different ball game. Companies are dealing with talent shortages, rising costs, and the pressure to fill roles faster than ever. That’s where recruitment process outsourcing comes in—a strategic move that’s transforming how businesses build their teams.

The numbers tell a compelling story. The global recruitment outsourcing market is projected to surge from $10.3 billion in 2024 to over $25.8 billion by 2034, growing at a 9.9% compound annual growth rate. This isn’t just growth—it’s a fundamental shift in how organizations approach talent acquisition.

Recruitment Outsourcing Statistics 2026

Market Size and Growth Projections

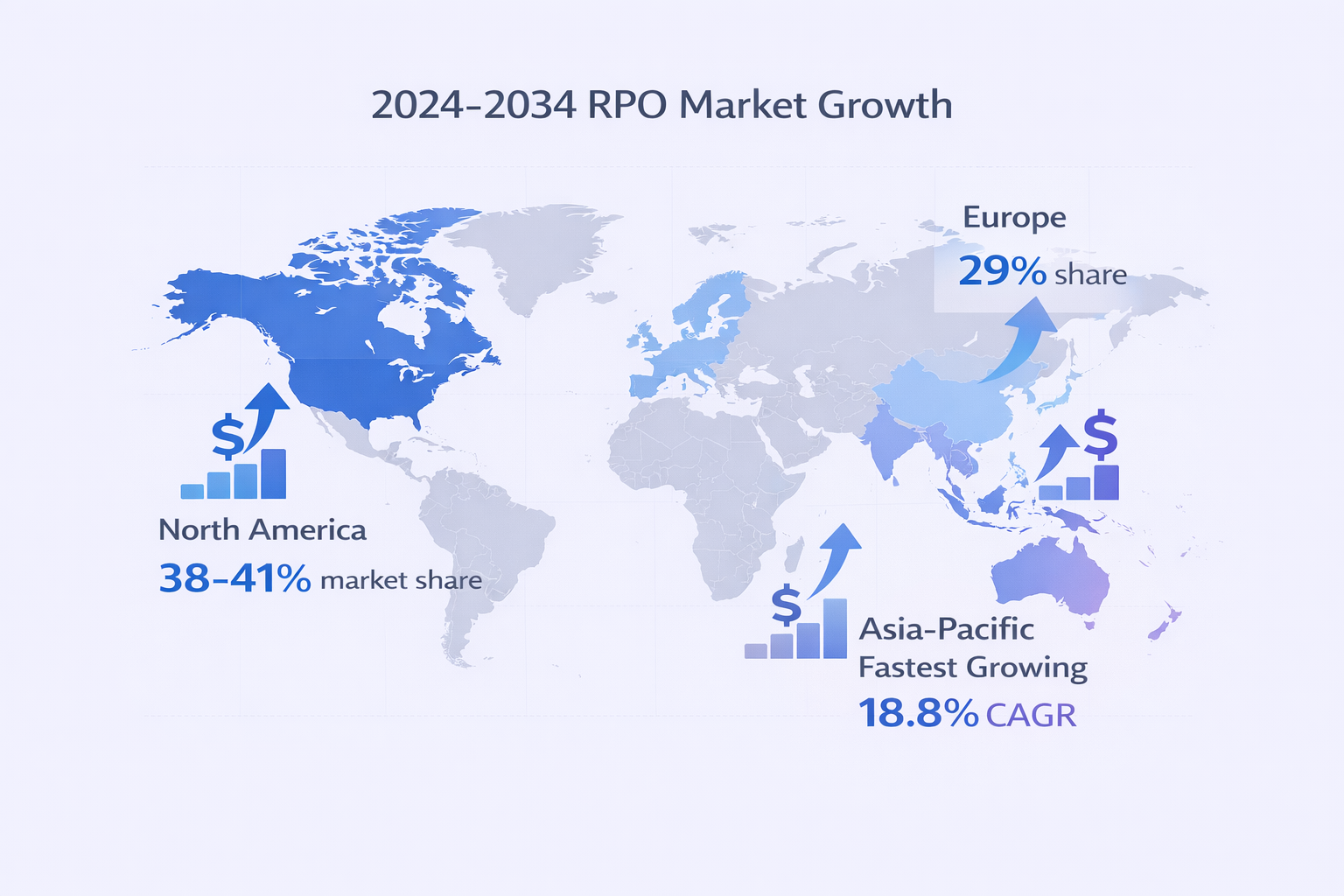

The recruitment outsourcing industry is experiencing explosive growth across all regions. North America leads the charge, commanding 38% to 41.2% of global market share, with the United States alone generating $3.29 billion in 2024. This dominance stems from a mature HR technology ecosystem featuring platforms like LinkedIn, Workday, and Greenhouse.

But the real story is happening in Asia-Pacific. With an expected CAGR of 18.8% through 2030, the APAC region is rapidly becoming the fastest-growing frontier. Countries like India and China are driving this surge through digital transformation and cost-effective yet highly skilled labor forces.

labor forces.

Europe maintains a solid 29% of global demand, focusing heavily on compliance-driven hiring due to complex regional labor laws. Meanwhile, the Middle East and Africa region holds 9% global share, with growth concentrated in oil, gas, and construction infrastructure development.

Global Market at a Glance:

- 2024 Baseline: $10.3 – $11.0 Billion

- 2034 Projection: $25.8 – $26.4 Billion

- Key Driver: Skill shortages and AI adoption

- Fastest Growing Region: Asia-Pacific (18.8% CAGR)

Cost Efficiency and Financial Impact

Here’s where things get really interesting. Organizations that leverage recruitment process outsourcing typically see a 25% to 50% reduction in cost-per-hire. That’s not pocket change—we’re talking about shifting from fixed internal costs to a variable model where you pay for results.

The average cost-per-hire with an internal HR department runs between $4,683 and $4,700. External hiring partners can deliver the same outcome for $2,350 to $3,500. When you factor in comprehensive costs including indirect expenses, internal hiring can exceed $28,000 per position.

📊 Cost Comparison Snapshot:

- Internal HR Cost-Per-Hire: $4,683 – $4,700

- External Partner Cost: $2,350 – $3,500

- Savings: 25% – 50% lower spend

- Comprehensive Internal Cost: $28,000+ (including indirect expenses)

But here’s the kicker—an unfilled position costs companies an average of $500 per day in lost opportunity. A 30-day delay in filling a critical role translates to a $15,000 hole in potential productivity.

💰 Tired of Expensive Recruitment Cycles?

Our LinkedIn outbound engine reduces hiring costs by 40% while filling roles 3x faster

Time-to-Fill Advantages

Speed matters. In today’s competitive landscape, the ability to fill critical positions quickly can make or break your growth trajectory. Internal HR departments typically require 44 to 100+ days to fill a role. External hiring partners slash this to 27 to 64 days—a 30% to 55% faster placement rate.

This speed advantage compounds over time. While an internal team might be sorting through hundreds of resumes, external partners are already conducting second-round interviews. They maintain active talent pools even when there isn’t an open requisition, giving them a significant head start.

Time-to-Fill Metrics:

- Internal HR: 44 – 100+ days

- External Partners: 27 – 64 days

- Speed Improvement: 30% – 55% faster

- Specialized Roles: Can extend beyond 100 days internally

The retention impact is equally impressive. Recruitment outsourcing providers achieve 18% to 20% higher retention rates through better cultural and skill matching. Their offer acceptance rate hovers around 77% compared to 62% for internal teams—a testament to their professionalized candidate journey.

AI’s Revolution in Talent Acquisition

Artificial intelligence isn’t just changing recruitment—it’s completely rewriting the playbook. In 2025, 37% of organizations are actively integrating generative AI tools into their hiring workflows, up 10 percentage points from the previous year.

The efficiency gains are staggering. AI automation saves recruiters approximately 20% of their work week—essentially one full workday every week. This time isn’t wasted; it’s redirected toward strategic activities that require human judgment and relationship building.

AI Impact Breakdown:

- Resume Screening Time: 85% reduction

- Interview Scheduling: 60% reduction in coordination time

- Administrative Work: 45% reduction in total hours

- Diversity Hiring: 48% increase in effectiveness

🤖 Manual Prospecting Eating Your Time?

AI-powered LinkedIn outbound automates targeting while maintaining personalization—fill your pipeline 5x faster

AI-assisted messaging increases the likelihood of a quality hire by 9%, while skills-based searches boost this metric by 12%. These aren’t marginal improvements—they’re the difference between filling a role with someone adequate and securing top-tier talent.

Advanced platforms now use AI to visit company websites, identify signals like new product launches or executive appointments, and automatically draft personalized outreach messages. This allows recruiters to execute high-volume, hyper-personalized campaigns that were previously impossible.

Recruitment Software Market Landscape

Choosing the right technology stack is critical for scaling your hiring operations. The HR software market reached $50 billion in 2024 and is expected to grow to $73.95 billion by 2029. Cloud-based solutions now capture 68.74% of market share as organizations prioritize scalability and rapid updates.

Top Recruitment Platforms for 2026:

- Greenhouse: Structured hiring and large-volume sourcing

- Lever: Relationship-focused pipelines with CRM-style hiring

- Apollo.io: High-volume outreach and B2B lead database

- ZoomInfo: Comprehensive SalesOS/TalentOS with buyer signals

- Workable: AI-driven candidate sourcing (50 leads per post)

AI-assisted messaging increases the likelihood of a quality hire by 9%, while skills-based searches boost this metric by 12%. These aren’t marginal improvements—they’re the difference between filling a role with someone adequate and securing top-tier talent.

Advanced platforms now use AI to visit company websites, identify signals like new product launches or executive appointments, and automatically draft personalized outreach messages. This allows recruiters to execute high-volume, hyper-personalized campaigns that were previously impossible.

Recruitment Software Market Landscape

Choosing the right technology stack is critical for scaling your hiring operations. The HR software market reached $50 billion in 2024 and is expected to grow to $73.95 billion by 2029. Cloud-based solutions now capture 68.74% of market share as organizations prioritize scalability and rapid updates.

Top Recruitment Platforms for 2026:

- Greenhouse: Structured hiring and large-volume sourcing

- Lever: Relationship-focused pipelines with CRM-style hiring

- Apollo.io: High-volume outreach and B2B lead database

- ZoomInfo: Comprehensive SalesOS/TalentOS with buyer signals

- Workable: AI-driven candidate sourcing (50 leads per post)

🎯 Quality Data = Quality Hires

Our LinkedIn outbound system accesses 65M+ verified professionals with complete targeting, campaign design, and scaling methods

High-quality contact data is the difference between meaningful conversations and dead ends. LinkedIn-originated leads lead to average deal values that are 25-35% higher than those from other platforms. This confirms that a “quality over quantity” approach is the only sustainable strategy for scaling recruitment efforts.

The Outsourced Sales Development Model

An increasingly relevant subset of recruitment outsourcing focuses on sales roles. Over 38% of B2B SaaS companies now outsource part or all of their sales development operations. This shift isn’t just about cost savings—it’s about predictability and speed.

An in-house sales development representative typically takes 4 to 6 months to reach full productivity. Outsourced teams come pre-trained with proven playbooks, delivering meaningful pipeline in as little as 1 to 2 weeks. The numbers speak for themselves:

Sales Outsourcing ROI:

- Customer Acquisition Cost Reduction: 40%

- Return on Investment: 13:1 ($13 for every $1 spent)

- Ramp-up Time: 1-2 weeks vs. 3-4 months internally

- Infrastructure Savings: 30% (zero costs for seats, equipment, CRM)

- Multi-Channel Conversion: 4-7x higher with AI optimization

The elasticity of an outsourced model allows companies to scale up for product launches or territory tests without the legal and financial commitment of permanent hires. This flexibility is invaluable in today’s volatile market.

🚀 Build Pipeline Without Building Headcount

Skip the 6-month ramp time—our LinkedIn outbound delivers qualified meetings in weeks, not months

7-day Free Trial |No Credit Card Needed.

Industry Sentiment and Career Outlook

While the statistics paint a picture of growth and opportunity, the human sentiment tells a more nuanced story. Professional forums like Reddit reveal that many recruiters describe 2024 as “brutal” with job seekers having minimal leverage.

Career Landscape Insights:

- Job Market Status: Described as “hot mess” with 6-18 month wait times

- Income Potential: High-performing recruiters reach $120k OTE

- AI Impact: Augmenting roles rather than replacing them

- Stability: Recruiters often first to go during downturns

The recurring advice for those in the field is clear: stay adaptable. Learning AI tools, mastering employer branding, and focusing on specialized niches like healthcare or renewable energy are seen as the only ways to thrive. The “easy money” days of 2021 are over, but opportunities remain for those who bring genuine relationship-building skills and strategic thinking.

Conclusion

The recruitment outsourcing landscape of 2026 represents a fundamental shift from transactional hiring to strategic talent acquisition. With the market poised to more than double over the next decade, organizations that embrace external partnerships gain significant advantages in speed, cost efficiency, and quality of hire.

The data is clear: companies leveraging recruitment process outsourcing fill roles 30-55% faster, reduce costs by 25-50%, and achieve 18-20% higher retention rates. When you factor in the $500 daily cost of vacant positions and the $28,000+ comprehensive cost of internal hiring, the financial case becomes compelling.

But beyond the numbers, successful talent acquisition in 2026 requires three critical elements: high-quality data, AI-powered efficiency, and strategic partnerships that extend beyond simple placement. Organizations that master these components won’t just fill roles—they’ll build competitive advantages that compound over time.

The future belongs to companies that view recruitment not as an administrative burden, but as a strategic lever for growth. Whether you’re scaling rapidly or optimizing existing operations, the question isn’t whether to explore recruitment outsourcing—it’s how quickly you can implement it.

FAQs

What makes recruitment process outsourcing more effective than traditional hiring?

How much can companies save by outsourcing recruitment?

Is AI replacing human recruiters in 2026?

What's the typical time-to-fill improvement with RPO partners?

Which industries benefit most from recruitment outsourcing?

- blog

- Statistics

- Recruitment Outsourcing Statistics 2026 | Market Data