Sales Cycle Length Statistics: What's Really Happening in 2026

- Sophie Ricci

- Views : 28,543

Table of Contents

Sales Cycle Length Statistics

- 58% of B2B professionals report their sales cycles have gotten longer over the past year across industries

- Retail sales cycles average 70 days, while Pharmaceuticals take 138 days—nearly double the time to close

- Manufacturing industry averages 130-day sales cycles due to complex supply chains and capital expenditure requirements

- Companies with 1-10 employees have 38-day sales cycles, while 10,001+ employee companies take 185 days—5x longer

- Average B2B buying committee now has 6.3 stakeholders involved in purchase decisions, extending timelines significantly

- Referrals close in 20 days, while cold calling takes 60 days—a 3x difference in sales velocity

- Partnerships and referrals move through the pipeline at 3.8x the speed of outbound prospecting at just 0.3x

- Deals under $1,000 close in 25 days, while deals over $500,000 take 270 days—more than 10x longer

- Mid-market deals ($50K-$100K) now take an average of 9 months to close, approaching enterprise timelines

- Pipeline generation is up 23%, but win rates are down 18%, creating the Pipeline Paradox of more activity with worse results

- Companies using sales automation tools report sales cycles that are up to 15% shorter through efficiency gains

- Sales teams using Digital Sales Rooms see their cycles shorten by as much as 28% by eliminating friction

- Average sale requires up to 8 touchpoints before closing, demanding consistent value delivery at every interaction

- Teams responding to inbound inquiries within minutes create immediate impressions and catch prospects at peak interest

Multi-threading reduces risk by building relationships with multiple stakeholders instead of relying on single-threaded deals

Here’s something you’ve probably noticed: deals are taking forever to close right now.

You’re not imagining it. And it’s not just you.

58% of B2B professionals report their sales cycles have gotten longer over the past year. The days of quick handshake deals? They’re gone. Today’s buyers are cautious, committees are bigger, and every purchase gets scrutinized like a Supreme Court nomination.

But here’s where it gets tricky. If you search “average sales cycle length,” you’ll find wildly different answers. One source says 102 days. Another says 117. A third claims 192 days. So which is it?

The truth is: there is no universal average. A software sale to a 10-person startup moves completely differently than a manufacturing deal with a Fortune 500 company. Comparing the two is like comparing a 5K run to a marathon—they’re both races, but that’s where the similarity ends.

In this guide, we’re cutting through the noise with actual data. You’ll see exactly how long deals take across different industries, company sizes, sales channels, and deal values. More importantly, you’ll learn what’s causing the slowdown and what you can actually do about it.

Let’s dig into the numbers.

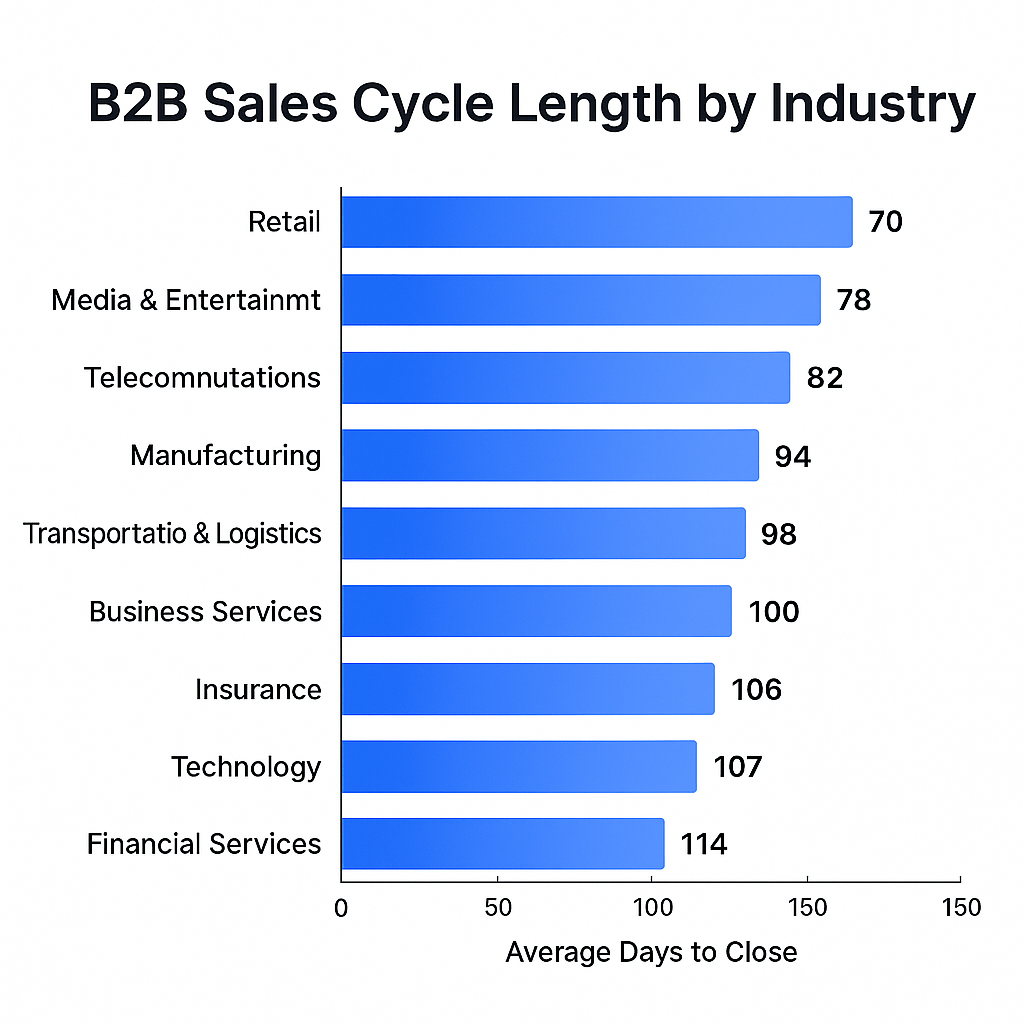

Average Sales Cycle Length by Industry & Pipeline Stage

Your industry isn’t just a label on your LinkedIn profile. It’s the single biggest predictor of whether you’re running a sprint or a marathon.

Some industries move fast. Others? Not so much. And it has nothing to do with how good you are at selling. It’s about how those industries make decisions.

Here’s what the data shows:

Industry | Average Sales Cycle (Days) |

Retail | 70 |

Software | 90 |

Financial Services | 98 |

Real Estate | 102 |

Consulting | 105 |

Technology | 110 |

Telecommunications | 112 |

Healthcare | 125 |

Manufacturing | 130 |

Pharmaceuticals | 138 |

The spread here is massive. Retail deals close in 70 days while Pharmaceuticals take 138 days—nearly double.

Why such a huge gap?

Healthcare and Pharmaceuticals operate in heavily regulated environments. Every purchase needs security reviews, compliance checks, and legal sign-offs. There are layers of approval that simply don’t exist in faster-moving industries.

Manufacturing involves complex supply chains and significant capital expenditure. You’re not just selling software someone can cancel next month. You’re talking about equipment, integration with existing systems, and long-term commitments.

Software and Retail, on the other hand, tend to have more agile decision-making. Subscription models mean lower risk. If something doesn’t work out, they can pivot quickly.

The lesson? Stop comparing yourself to generic benchmarks. If you’re selling into Healthcare, your 125-day cycle isn’t slow—it’s normal. Measure yourself against your actual market, not against some startup selling to tech companies.

🎯 Target Buyers Actually Ready

Our LinkedIn campaigns connect you with qualified decision-makers who match your ideal cycle timeline and budget range.

Average Sales Cycle Length by Company Size

Here’s a rule you can bank on: the bigger the company, the longer the deal.

It’s not complicated. Larger organizations have more people involved, more processes to follow, and more bureaucracy to navigate. A purchase that takes one signature at a small business might need five at an enterprise.

Check out how dramatic this progression is:

Prospect Company Size | Average Sales Cycle (Days) |

1-10 Employees | 38 |

11-50 Employees | 57 |

51-200 Employees | 77 |

201-500 Employees | 95 |

501-1,000 Employees | 115 |

1,001-5,000 Employees | 135 |

10,001+ Employees | 185 |

Look at that jump from small to enterprise: 38 days versus 185 days. That’s almost 5x longer.

Why does this happen?

The average B2B buying committee now has 6.3 stakeholders. But at enterprise companies, that number is often higher. You’re not just convincing one person. You’re navigating an entire organization with competing priorities, budget cycles, and approval chains.

At a 10-person company, the founder can say “yes” and swipe their credit card. At a 10,000-person company, you need buy-in from department heads, finance, legal, procurement, IT security, and sometimes the executive team. Each layer adds weeks.

Small businesses are nimble. Enterprises are thorough.

Neither approach is wrong—it’s just reality. And if you’re going upmarket, you need to plan for it. Longer cycles mean longer cash conversion periods. It means more touches, more nurturing, and way more patience.

If you’re used to closing small deals in 40 days and suddenly target enterprise accounts, don’t be shocked when your pipeline seems to move in slow motion. You didn’t get worse at selling. You just changed the game.

🚀 Get Referral-Speed Results Outbound

Our LinkedIn engine builds warm relationships before first contact—delivering inbound velocity through targeted outbound strategy.

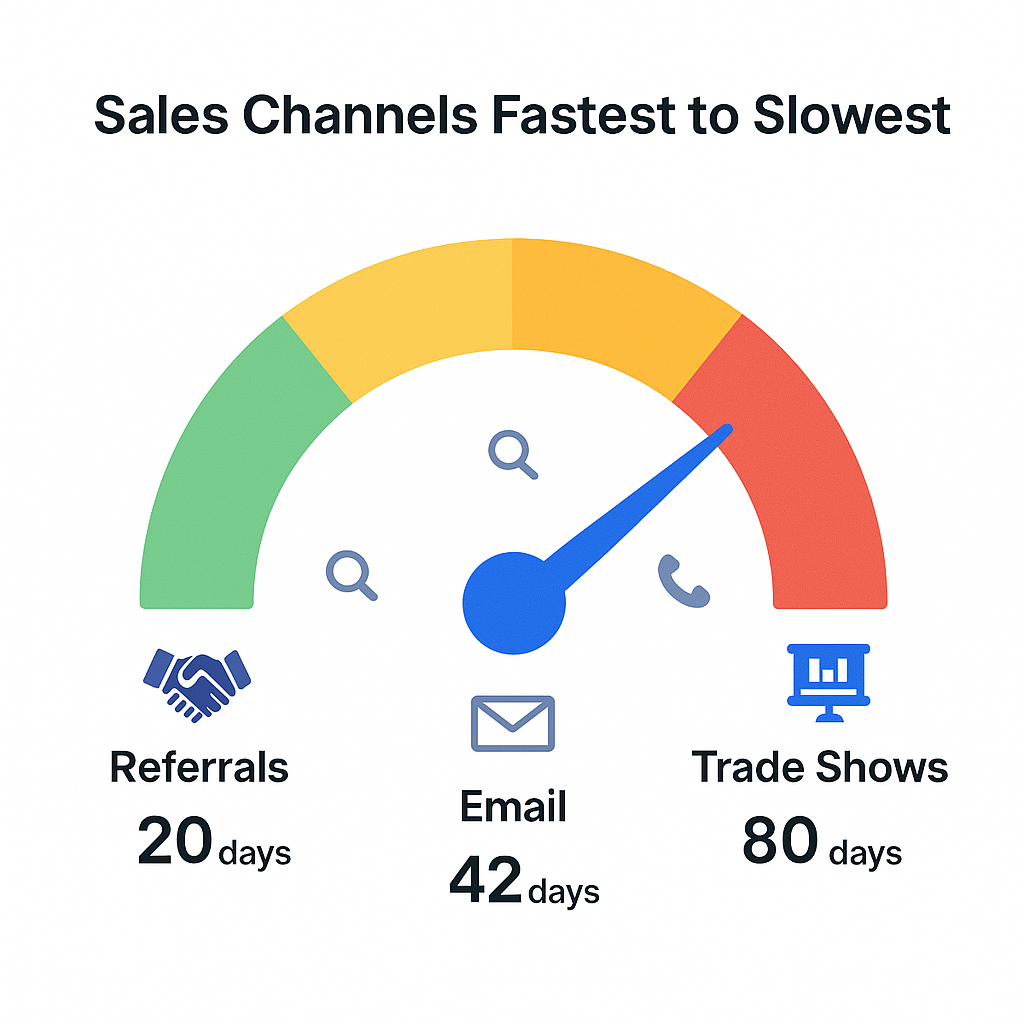

Average Sales Cycle Length by Sales Channel & Complexity of Product

Not all leads are created equal. And nowhere is that more obvious than when you compare how fast different channels close.

The source of your lead is basically a proxy for how interested they are. A referral comes in hot. A cold call? You’re starting from zero.

Here’s what the velocity looks like:

Sales Channel | Average Sales Cycle (Days) |

Referrals | 20 |

SEO | 28 |

Content Marketing | 38 |

Email Marketing | 42 |

Social Media Outreach | 48 |

Cold Calling | 60 |

Trade Shows | 80 |

Referrals close in 20 days. Cold calls take 60 days. That’s a 3x difference.

But even that doesn’t tell the full story. When you look at deal velocity metrics, partnerships and referrals move through the pipeline at 3.8x the speed of outbound prospecting, which crawls along at just 0.3x.

Why such a massive gap?

It comes down to something called the Intent Spectrum.

When someone finds you through SEO, they’re actively searching for a solution. They’ve already recognized they have a problem. They’re comparing options. You’re meeting them halfway through their journey.

When you cold call someone, they didn’t wake up that morning thinking about your product. You have to create awareness, build interest, establish credibility, and nurture them through consideration—all before you even get to evaluation.

Referrals are even better. They come with pre-built trust. If someone they respect says “you should talk to these people,” half the battle is already won.

Does this mean you should abandon outbound? No. But it does mean you need to be realistic about the timeline and resources required. Outbound isn’t slower because you’re bad at it. It’s slower because you’re starting further back.

The smartest teams build a mix. They invest in content and SEO to generate warm inbound leads while using outbound to proactively target high-value accounts. Just don’t expect them to close at the same speed.

💼 Multi-Thread Every Enterprise Deal

We map buying committees, engage all stakeholders simultaneously, and prevent single-threaded deal collapse before it happens.

Sales Cycle Length by Deal Size (ACV)

Here’s another ironclad rule: the bigger the check, the longer the scrutiny.

When someone’s spending $2,000, they might run it by their manager. When they’re spending $200,000, the CFO wants a full ROI model, legal needs contract review, and IT needs a security audit.

The data makes this crystal clear:

Deal Size (ACV) | Average Sales Cycle (Days) |

< $1,000 | 25 |

$1,000 – $5,000 | 40 |

$5,000 – $10,000 | 55 |

$10,000 – $50,000 | 75 |

$50,000 – $100,000 | 120 |

$100,000 – $250,000 | 170 |

> $500,000 | 270 |

Small transactional deals under $1,000 close in 25 days. Enterprise contracts over $500,000 take 270 days—more than 10x longer.

But here’s where it gets interesting: there’s something happening in the middle that nobody expected.

It’s called the Mid-Market Squeeze.

Mid-market deals—those in the $50,000 to $100,000 range—are now taking an average of 9 months to close. That’s approaching enterprise timelines, even though the deal size is much smaller.

Why?

Mid-market companies have adopted enterprise-level procurement processes without the enterprise resources to support them. They’ve got the buying committees, the approval workflows, and the compliance requirements. But they don’t have dedicated procurement teams or the budget flexibility to move quickly.

It creates a worst-case scenario for sellers. You’re dealing with enterprise-level complexity and scrutiny, but without the corresponding deal size or the buyer’s internal infrastructure to navigate it efficiently. Deals stall. Stakeholders change. Priorities shift. And suddenly, what should have been a straightforward 4-month deal stretches to 9.

If you’re targeting mid-market accounts right now, expect enterprise timelines. Build your pipeline accordingly. Forecast conservatively. And get really, really good at keeping deals alive over long periods.

How to Shorten Your Sales Cycle Length

Alright, so deals are taking longer. Buyers are more cautious. Committees are bigger. Budgets are tighter.

But here’s the good news: you’re not helpless.

While you can’t control macroeconomic conditions or how many people your buyer needs to convince, you absolutely can control how you run your sales process. And there are specific, proven tactics that compress timelines.

Let’s break down the four strategies that actually work.

Qualify Ruthlessly

Here’s an uncomfortable truth: the fastest way to shorten your average sales cycle is to stop wasting time on deals that were never going to close.

Right now, there’s a phenomenon happening across B2B sales. Teams are under pressure to hit their numbers, so they’re doing more activity. Pipeline generation is up 23%. Sounds great, right?

Except win rates are down 18%.

This is the Pipeline Paradox. More activity, worse results. Why? Because teams are filling their pipelines with low-quality, low-intent leads that take forever to nurture and rarely convert.

Chasing activity metrics like “meetings booked” without strict qualification is how you end up with a bloated pipeline full of dead-end deals.

So what does ruthless qualification actually look like?

First, implement a real lead scoring system. Not just “do they fit our ICP,” but a combination of firmographic data (company size, industry, budget) and behavioral signals (content downloads, website visits, email engagement). Focus your time on leads that check both boxes.

Second, add value from the very first conversation. Share insights. Send relevant case studies. Position yourself as a trusted advisor, not just another vendor. This builds credibility fast and helps you stand out.

Third, talk about budget and deal-breakers early. Yes, early. Even on the first call. Give them a ballpark range. Ask about their procurement process. Surface any potential blockers.

This might feel uncomfortable. You might worry you’ll scare people away. But here’s the thing: if they were going to say no eventually, you want to know now, not three months from now.

Qualifying ruthlessly means accepting that not every lead is worth pursuing. And that’s okay. Because the time you save on bad-fit prospects can be reinvested in the ones that actually have a shot.

📊 Fill Pipeline With Qualified-Only Leads

Our targeting framework identifies high-intent buyers with budget authority, eliminating 90-day dead-end conversations completely.

7-day Free Trial |No Credit Card Needed.

Build Relationships Across the Buying Committee

Here’s a nightmare scenario: You’ve been working a deal for three months. Your champion is all-in. Everything’s going great. Then they leave the company.

The deal dies.

This is why single-threaded deals are so dangerous. When your entire relationship depends on one person, you’re one resignation, one reorg, or one budget freeze away from losing everything.

The antidote is multithreading—building relationships with multiple stakeholders across the organization.

Remember: the average B2B deal involves 6.3 stakeholders. If you’re only talking to one or two, you’re missing most of the conversation.

Start by asking the right questions: “Who else on your team would find this valuable?” or “Besides yourself, who’s involved in evaluating and approving this?”

Your goal is to map the entire buying committee:

- The Economic Buyer (who controls the budget)

- The Technical Buyer (who evaluates feasibility and integration)

- The User Buyer (who will actually use your product day-to-day)

- Influencers (anyone else with a voice in the decision)

Once you know who they are, tailor your message to each person’s specific concerns. The CFO cares about ROI and total cost of ownership. The IT Director cares about security, integration, and implementation complexity. The end user cares about ease of use and how it makes their job easier.

Generic pitches don’t work anymore. You need to speak to each stakeholder’s priorities individually.

When you build relationships across the committee, you’re not just reducing risk. You’re actively helping the buyer build internal consensus faster. And that’s what shortens the cycle.

Leverage Modern Sales Tools

Let’s be honest: a lot of what slows deals down is just administrative friction.

Manual follow-ups. Endless email chains trying to schedule a meeting. Sending the same deck five times because someone can’t find the attachment. Waiting three days for a prospect to respond because they misplaced your proposal.

This stuff adds up. And it’s all fixable.

Companies using sales automation tools report sales cycles that are up to 15% shorter. Not because automation does the selling for you, but because it eliminates the repetitive, low-value tasks that bog down the process.

Use automation for things like sequencing outreach, tracking engagement, and logging activities in your CRM. This frees you up to focus on what actually matters—strategic conversations and relationship building.

But the real game-changer is something called a Digital Sales Room (DSR).

A DSR is a centralized, secure microsite that you share with your buyer. It houses everything they need in one place: your proposal, case studies, demo recordings, pricing, implementation plans, and any other relevant materials.

No more email chains. No more “can you resend that deck?” No more friction.

Sales teams using Digital Sales Rooms see their cycles shorten by as much as 28%. Why? Because it makes it ridiculously easy for your internal champion to share information with their colleagues. And when the buying committee can access everything they need instantly, decisions happen faster.

Take it a step further with a Mutual Action Plan (MAP). This is a shared document—often housed in your DSR—that outlines every step required to get from “initial conversation” to “signed contract.” It includes deliverables, responsible parties, and timelines for both you and the buyer.

A MAP transforms the sales process from a vague journey into a clear project plan. Both sides know exactly what needs to happen and when. This creates accountability and eliminates the dreaded “we’ll circle back next quarter” stall.

The right tools don’t replace good selling. But they do remove obstacles that slow good sellers down.

Be Hyper-Responsive & Add Value

Here’s something that sounds simple but is shockingly rare: respond fast.

In a world where buyers are researching multiple vendors simultaneously, speed matters. A lot. When someone fills out a form on your website or replies to your email, they’re interested right now. Not tomorrow. Not in four hours. Right now.

Teams that respond to inbound inquiries within minutes—not hours—create an immediate impression of professionalism and urgency. They catch prospects at the peak of their interest, before they move on to the next thing.

But speed alone isn’t enough. You also need substance.

The average sale requires up to 8 touchpoints. That means you’re going to be in contact with this person multiple times before they buy. And here’s the critical part: every single one of those touchpoints needs to add new value.

“Just checking in” emails are a waste of everyone’s time. Instead, every follow-up should include something useful:

- A relevant case study from a similar company

- A new piece of industry research

- An answer to a question from your last conversation

- A breakdown of how your solution addresses a specific pain point they mentioned

Each interaction should move the conversation forward and educate the prospect. This is how you build trust. This is how you position yourself as a consultant, not just another salesperson.

And here’s the thing: this approach only works if you genuinely understand your product and your customer’s problems. The best sales professionals listen more than they talk. They diagnose before they prescribe. They act like advisors, not vendors.

When you combine hyper-responsiveness with consistent value delivery, you create momentum. And momentum is what collapses timelines.

Wrapping Up: Know Your Numbers, Control What You Can

Let’s bring it all together.

Sales cycles are getting longer. That’s just the reality right now. Buyers are more cautious. Budgets are tighter. Committees are bigger. And every purchase decision gets scrutinized from every angle.

But the key insight here is this: there is no universal “average.” A 70-day cycle in Retail is completely different from a 138-day cycle in Pharmaceuticals. A $5,000 deal closes 10x faster than a $500,000 deal. A referral moves at 3.8x the speed of a cold outbound lead.

Your benchmarks need to reflect your reality—your industry, your deal size, your channels, and the size of companies you’re targeting.

Once you know your realistic baseline, you can start working to compress it:

✅ Qualify ruthlessly. Stop chasing low-intent leads that drag out your pipeline. Focus on prospects with real need, real budget, and real urgency.

✅ Engage multiple stakeholders. Single-threaded deals are fragile. Build relationships across the entire buying committee and tailor your message to each person’s concerns.

✅ Use the right tools. Digital Sales Rooms, Mutual Action Plans, and smart automation remove friction from the buyer’s journey and make consensus easier to achieve.

✅ Be fast and valuable. Respond within minutes. Make every touchpoint count. Act like a consultant, not a vendor.

The modern sales process isn’t about convincing one person to say yes. It’s about making it easy for an entire committee to agree. The teams that win are the ones that reduce internal friction for their buyers, not the ones who push the hardest.

And here’s the final piece: as you’re building out your outreach and working to fill your pipeline with high-intent prospects, having the right tools in your stack makes all the difference. Whether you’re sourcing leads, sending cold emails, or tracking engagement, streamlining your outreach process helps you focus on the relationships that matter most.

Because at the end of the day, shorter sales cycles don’t come from working harder. They come from working smarter—focusing on the right deals, engaging the right people, and removing the obstacles that slow everyone down.

Now go shorten some cycles.

Other Useful Resources

To accelerate your sales cycles and improve pipeline efficiency, explore these complementary guides:

Sales Automation & Outreach:

- Compare Quickmail alternatives for cold email automation

- Review Linked Helper 2 for LinkedIn automation workflows

- Discover the best sales cadence tools to structure your outreach sequences

LinkedIn Sales Navigator Optimization:

- Learn about LinkedIn Sales Navigator API integration options

- Master LinkedIn contact sync for CRM efficiency

- Understand how to cancel LinkedIn Sales Navigator if needed

Training & Development:

- Explore LinkedIn Learning usage statistics to upskill your sales team

These resources complement your cycle-shortening strategy with automation tools, CRM optimization, and training insights that help you qualify faster, multi-thread more effectively, and close deals with greater velocity.

- blog

- Statistics

- Sales Cycle Length Statistics 2025 [Complete Data]