Sales Forecast Accuracy Statistics: The Complete 2025 Guide

- Sophie Ricci

- Views : 28,543

Table of Contents

Sales Forecast Accuracy Statistics

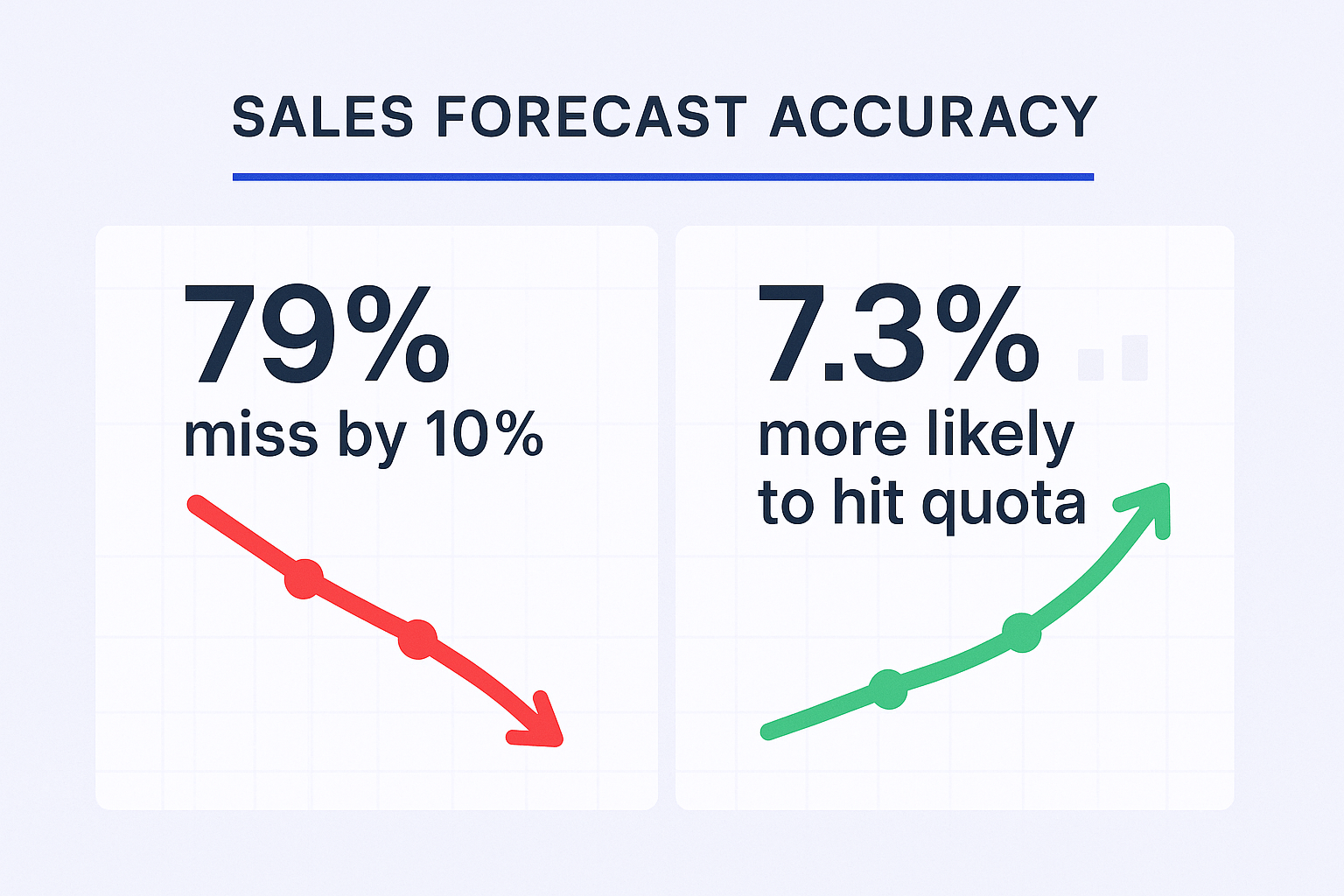

- 79% of sales organizations miss their forecast by more than 10%, creating operational chaos and misallocated resources

- Companies with accurate forecasts are 7.3% more likely to hit quota consistently than those with poor predictions

- 50% of executives report delayed deliverables when forecasts miss the mark, disrupting entire business operations

- 46% of executives lose real business opportunities they could have captured due to inaccurate sales forecasting

- Best-in-class teams target a minimum of 85% forecast accuracy, with elite performers regularly achieving 90-95% accuracy

- Companies using automated forecasting tools improve their accuracy by 20% or more compared to manual spreadsheet methods

- Data decay costs organizations 12% to 25% of revenue annually due to incomplete or outdated CRM records

- Stale deals with no activity for 30+ days are 80% less likely to close but inflate forecasts dramatically

- Sales reps spend 23% of their time on data entry and administrative tasks instead of actual selling activities

- Poor data quality is recognized as the single most critical factor determining forecast accuracy across organizations

- Weighted pipeline forecasting requires multiplying each deal value by stage probability based on historical close rates

- Discovery stage deals typically carry 25% probability, while negotiation stage reaches 90% close probability

- Organizations must maintain complete CRM records with amount, close date, stage, and next step before deals advance

- Automated sales forecasting tools analyze massive datasets and spot patterns that humans inevitably miss or overlook

- Pipeline hygiene requires removing zombie deals that automatically inflate forecasts and guarantee missed revenue targets

Here’s the uncomfortable truth: 79% of sales organizations miss their forecast by more than 10%.

That’s not just embarrassing—it’s expensive. When your prediction is off, Finance over-hires for growth that never shows up, Operations can’t deliver on time, and everyone scrambles to explain the gap to leadership.

But here’s the good news: the companies that nail their forecasting? They’re 7.3% more likely to hit quota. And the gap between average and elite isn’t some secret sauce—it’s just discipline, better data, and knowing which numbers actually matter.

Let’s cut through the noise and get you to accurate predictions faster.

What is sales forecasting?

A sales forecast is your best educated guess about future revenue based on real data—not wishful thinking.

It combines three inputs: what you’ve closed historically, what’s sitting in your pipeline right now, and what the market is actually doing. Think of it as your GPS for revenue. Without it, you’re just driving blind and hoping you end up somewhere good.

Here’s the critical distinction most people miss: A forecast isn’t a goal. Your goal is aspirational—what you want to close. Your forecast is probabilistic—what you actually expect to close based on evidence.

Finance makes hiring decisions based on your forecast. Operations orders inventory. Marketing plans campaigns. When your prediction is wrong, everyone downstream pays for it with chaos and missed opportunities.

Why is sales forecasting important?

Because 50% of executives report delayed deliverables when forecasts miss the mark, and 46% lose real business opportunities they could have captured.

Let me paint the picture: You overestimate revenue. Finance hires 20 new people. Three months later, that revenue doesn’t materialize. Now you’re burning cash on salaries while scrambling to course-correct. Or flip it—you underestimate. You don’t staff Customer Success properly, implementation backlogs pile up, and customers churn because you can’t deliver fast enough.

The organizations that consistently deliver accurate forecasts target a minimum of 85% accuracy, with best-in-class teams regularly achieving 90-95% accuracy.

📊 LinkedIn Outbound = Predictable Pipeline

Fill your funnel with qualified prospects. Complete targeting, messaging, and scaling strategy included.

That spread—85% versus 95%—is the difference between constantly firefighting and running a predictable revenue machine. And according to recent data, companies using automated forecasting tools improve their accuracy by 20% or more compared to manual methods.

The reward? Predictability. You hit your number consistently. Leadership trusts your pipeline calls. You stop surprising Finance with bad news. And personally? You become the person everyone looks to for reliable pipeline reads—the exact trait that accelerates career growth.

Who is responsible for sales forecasting?

Short answer: everyone touching the pipeline owns a piece of it.

Managers aggregate the numbers. Revenue Operations builds the models. But the sales team creates the raw material that determines whether the whole system works or falls apart.

The foundation starts at the very beginning of the funnel. If lead data enters your CRM incomplete, outdated, or just flat wrong, every weighted probability calculation downstream becomes garbage. Data decay—that slow rot of bad CRM records—costs organizations 12% to 25% of revenue annually.

2

🎯 Skip CRM Chaos. Start Fresh.

LinkedIn outbound brings pre-qualified leads directly to your pipeline with complete engagement tracking.

Then comes the critical handoff. Once an opportunity enters the pipeline, ownership shifts to managing the full cycle. This requires intimate knowledge of the customer’s world: their budget constraints, internal politics, competing priorities, and real timeline.

The “commit” call—that firm promise about which deals are locked for the period—only works if it’s grounded in verified facts, not optimistic guesses.

Here’s the table that shows how daily actions translate directly into forecast reliability:

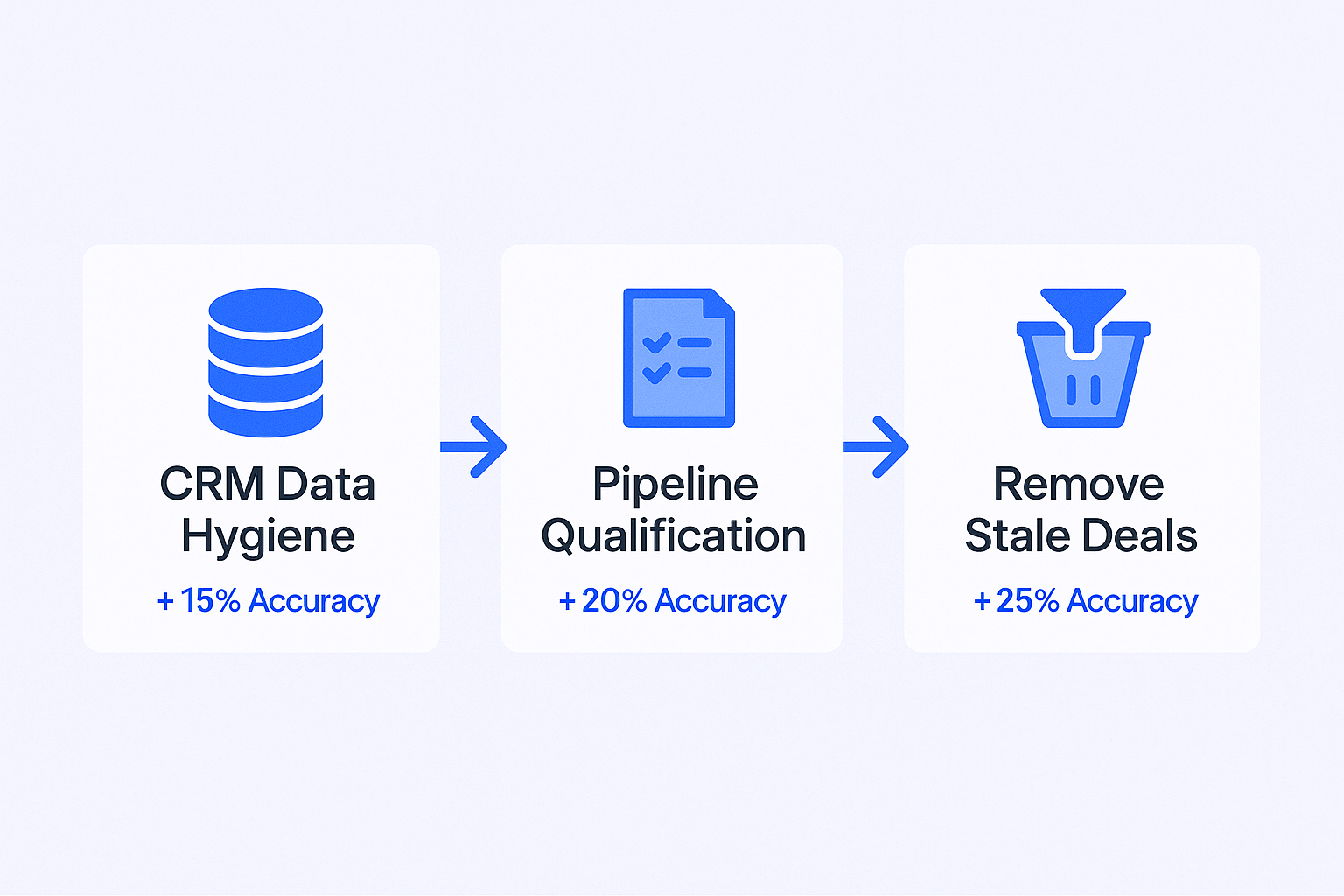

Key Daily Action | Direct Impact on Forecast Accuracy |

Maintaining CRM Data Hygiene (Accurate contact roles, updated fields) | Ensures weighted probabilities are based on verifiable data, preventing data decay losses |

Pipeline Qualification (Using MEDDPICC/BANT framework) | Reduces subjective bias by confirming Budget, Economic Buyer, and Decision Process |

Removing Stale Deals (No activity >30 days) | Prevents pipeline clutter and inflated forecasts. Stale deals are 80% less likely to close |

Sales forecasting methods and when to use them

The best approach isn’t picking one method—it’s blending quantitative data with experienced human judgment.

Weighted Pipeline Forecasting

This is your data foundation. Every stage in your sales process gets a probability percentage based on historical close rates. “Discovery” might be 25%. “Proposal Sent” might be 60%. “Negotiation” could be 90%.

You take each deal’s value, multiply it by its stage probability, and suddenly you have a weighted revenue estimate that’s far more realistic than raw pipeline totals.

When to use it: Complex B2B sales with long cycles and multiple stakeholders. When you need structure to remove guesswork.

The catch: The whole system collapses if your data is dirty or if reps game the system by pushing deals forward prematurely. Garbage in, garbage out.

Intuitive Forecasting

This is where experienced judgment enters. You know things the data doesn’t capture: the executive sponsor seems distracted lately, a competitor just dropped their price, or the champion left the company.

When to use it: When launching new products in unfamiliar markets. When economic conditions shift suddenly. When hard data is limited but you have relevant context.

The trap: Relying purely on intuition is the fastest route to the “optimism trap”—that tendency to overestimate your chances because you want the deal to close.

The Synthesis Approach

Here’s what actually works: Use weighted pipeline as your baseline reality check. Then layer in intuitive adjustments for factors the data can’t capture. Your final forecast should be the most conservative number among your system calculation, your manager’s expectation, and your gut feel.

This triangulation keeps you honest and grounded in both data and reality.

How to forecast sales step by step

Creating a reliable forecast isn’t complicated, but it requires discipline. Here’s the three-step process that actually works:

Step 1: Pipeline Hygiene—Eliminate the Ghosts

Before you calculate anything, audit your pipeline for “zombie deals”—those opportunities with no activity for 30+ days.

Research shows these stale opportunities are 80% less likely to close. Including them automatically inflates your forecast and guarantees you’ll miss your number.

The fix is simple but requires courage: remove them, archive them, or re-qualify them from scratch. But don’t include them in your commit.

Step 2: Deep Qualification—Pressure-Test Every Deal

Optimism kills forecast accuracy. To stay grounded, use a standardized qualification framework like MEDDPICC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion, Competition) on every deal you’re committing.

This isn’t bureaucracy—it’s risk management. If you can’t confirm the Economic Buyer or you don’t understand their Decision Process, your probability needs to drop, regardless of how confident you feel.

Frameworks convert unknown risks into measurable variables, which stabilizes your predictions.

Step 3: Calculate and Triangulate Your Weighted Revenue

Once your pipeline is clean and deals are qualified, calculate your weighted baseline: Deal Value × Stage Probability for each opportunity.

Then triangulate against three inputs:

- The system-generated forecast

- Your manager’s expectation

- Your personal intuitive assessment

Your final commit should always be the most realistic, conservative number among these three. Here’s what that calculation looks like in practice:

Deal Stage | Standard Probability (%) | Deal Value | Weighted Forecast Value |

Discovery/Qualified | 25% | $50,000 | $12,500 |

Proposal Delivered | 60% | $75,000 | $45,000 |

Negotiation/Commit | 90% | $100,000 | $90,000 |

Total Forecast | N/A | $225,000 | $147,500 |

Notice the gap between raw pipeline ($225k) and weighted reality ($147.5k). That $77,500 difference is where most missed forecasts live.

Common challenges in sales forecasting (and how to solve them)

Two problems kill forecast accuracy more than anything else: human bias and dirty data.

Challenge A: The Optimism Trap

Sales professionals are wired to be optimistic—it’s how you survive rejection. But that same trait destroys forecast accuracy when you convince yourself a deal is “90% likely to close” while historical data shows similar deals at that stage only close 40% of the time.

The solution: Stop relying on gut feel alone. Balance every intuitive assessment against objective historical metrics. And demand that Revenue Operations enforces standardized stage definitions. If “Proposal Sent” means different things to different reps, your weighting system is useless.

Challenge B: Data Decay

Poor data quality is recognized as the single most critical factor determining forecast accuracy. Incomplete or outdated CRM records don’t just make reporting annoying—they fundamentally break the prediction engine.

Here’s the friction paradox: Sales reps spend 23% of their time on data entry and administrative tasks. They’re paid to sell, not administer databases, so they resist manual updates. This creates incomplete records, which feeds flawed data to the forecasting system, which produces unreliable predictions.

The solution: Mandate that critical fields (amount, close date, stage, next step) must be complete before deals advance. But more importantly, deploy automation tools that capture activity—emails, calls, meetings—automatically. This removes the administrative burden while simultaneously improving data quality.

Tools and software for sales forecasting

Manual spreadsheet forecasting is dead. Modern technology isn’t just helpful—it’s a competitive requirement.

Companies using automated sales forecasting tools improve their accuracy by 20% or more compared to manual methods. AI can analyze massive datasets and spot patterns that humans inevitably miss.

🚀 Better Than Better Tools

Our LinkedIn outbound engine generates quality pipeline before forecasting even starts. Targeting + campaigns + scale.

Here are the technology categories that matter:

Core CRM Platforms (Salesforce, HubSpot): Provide the foundation—data structure, pipeline visualization, and basic stage-based forecasting.

Specialized Forecasting & RevOps Tools (Clari, Forecastio): Offer deep predictive analytics, scenario modeling, and AI-powered predictions that counteract human bias.

Sales Engagement Platforms (Outreach, Salesloft): Capture real-time engagement signals—email frequency, buyer sentiment, meeting notes—that AI models need to generate objective probability assessments.

The critical requirement: data unification. If your sales engagement platform isn’t feeding activity data directly into your CRM and forecasting engine, you’re flying blind. The behavioral insights from daily execution must flow seamlessly into the prediction model, or accuracy suffers.

Level up your sales forecasting process with Salesso

Look, you can keep manually tracking outreach, deals can keep slipping through the cracks, and forecasts can keep missing by double digits. Or you can close the data gaps that are killing your accuracy.

Salesso integrates seamlessly with your existing CRM to ensure every touchpoint, every email, every call gets automatically logged and tracked. No more manual data entry. No more incomplete records. Just clean, reliable pipeline data that feeds accurate predictions.

When your contact data is complete and your engagement history is automatically captured, your weighted forecasts become trustworthy. Your commits stop surprising leadership. And you finally get the predictability that separates consistent quota hitters from the rest.

Ready to stop guessing and start predicting? See how Salesso closes the data gaps holding your forecast back.

💼 Forecast More by Sourcing Better

LinkedIn outbound fills your pipeline with decision-makers. Complete campaign strategy from targeting to conversion.

7-day Free Trial |No Credit Card Needed.

Conclusion

Achieving consistent forecast accuracy isn’t about having perfect data or flawless intuition—it’s about building a disciplined system that combines both.

The statistics are clear: 79% of organizations miss their forecast by more than 10%, yet companies with accurate forecasts are 7.3% more likely to hit quota. That gap between failure and success isn’t about luck—it’s about implementing the right methodology, maintaining clean data, and using technology to eliminate human bias.

Start with pipeline hygiene. Remove those ghost deals inflating your numbers. Use qualification frameworks to pressure-test every opportunity before you commit. Calculate weighted probabilities and triangulate against multiple inputs. And leverage automation to capture the activity data that makes your predictions reliable.

The path to predictable revenue starts with a single accurate forecast. Make that your focus, and everything else—quota attainment, leadership trust, career growth—follows naturally.

Internal Linking Opportunities:

- Link “CRM data hygiene” to relevant CRM management content

- Link “sales engagement platforms” to cold email best practices

- Link “qualification frameworks” to lead qualification guides

Here’s the “Other Useful Resources” section to add before the Conclusion section in the Sales Forecast Accuracy Statistics article:

Other Useful Resources

To achieve 90-95% forecast accuracy through better data quality and pipeline hygiene, explore these complementary resources:

LinkedIn Prospecting & Data Quality:

- Use the best LinkedIn email finder extension to eliminate data decay at the source

- Learn how to systematically find LinkedIn prospects for accurate pipeline building

- Compare top LinkedIn prospecting tools that integrate with your CRM

Pipeline Automation:

- Review Dripify for LinkedIn automation that reduces manual data entry

- Evaluate Phantom Buster for advanced LinkedIn data extraction

Forecast Optimization:

- Understand LinkedIn screenshot detection to maintain compliant prospecting workflows

- Leverage LinkedIn newsletter statistics to enhance your pipeline generation strategy

These resources help you eliminate the 12-25% revenue loss from data decay, improve forecast accuracy by 20%+ through automation, and build the clean pipeline foundation necessary to consistently achieve 90-95% forecast accuracy.

FAQs about sales forecasting

What is a good sales forecast accuracy rate?

How often should I update my sales forecast?

What is the simplest way to calculate forecast accuracy?

Forecast Accuracy = (1 - |Forecast - Actual| / Actual) × 100

Is the "Who's Viewed Your Profile" feature truly useful?

- blog

- Lead Generation, Statistics

- Sales Forecast Accuracy Statistics 2025 | Complete Guide