Sales Qualified Lead Statistics: Data-Driven Insights to Build a Better Pipeline in 2025

- Sophie Ricci

- Views : 28,543

Table of Contents

Sales Qualified Lead Statistics

- SQLs convert to opportunities at rates of 20-30%, compared to just 5-15% for marketing qualified leads

- Average MQL to SQL conversion rate sits at 13%, but top performers using behavioral scoring achieve 40%—triple the average

- Top-performing sales development teams convert 59% of SQLs into opportunities, showing quality leads lead to quality pipeline

- Average SQL to customer conversion is around 6%, with top performers reaching closer to 25% through better execution

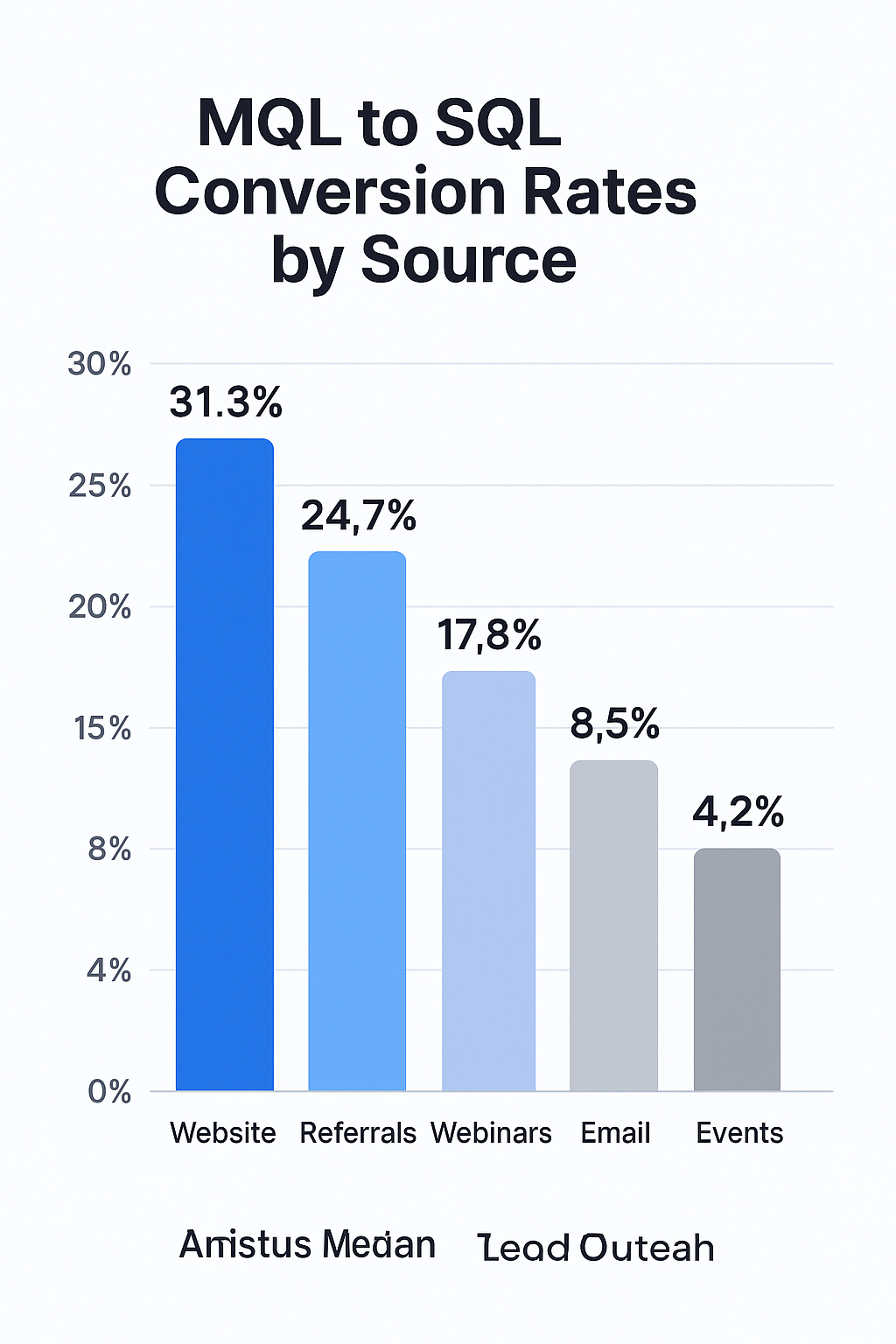

- Website leads convert at 31.3%, customer and employee referrals hit 24.7%, and webinars reach 17.8% MQL to SQL

- Untracked lead attribution gaps result in 34% of qualified leads getting lost between departments due to poor tracking

- B2B contact data decays at 22.5% annually, and biotech companies experience 22% monthly data decay in pipelines

- 82% of consumers expect responses within 10 minutes, yet average lead response time is 47 hours

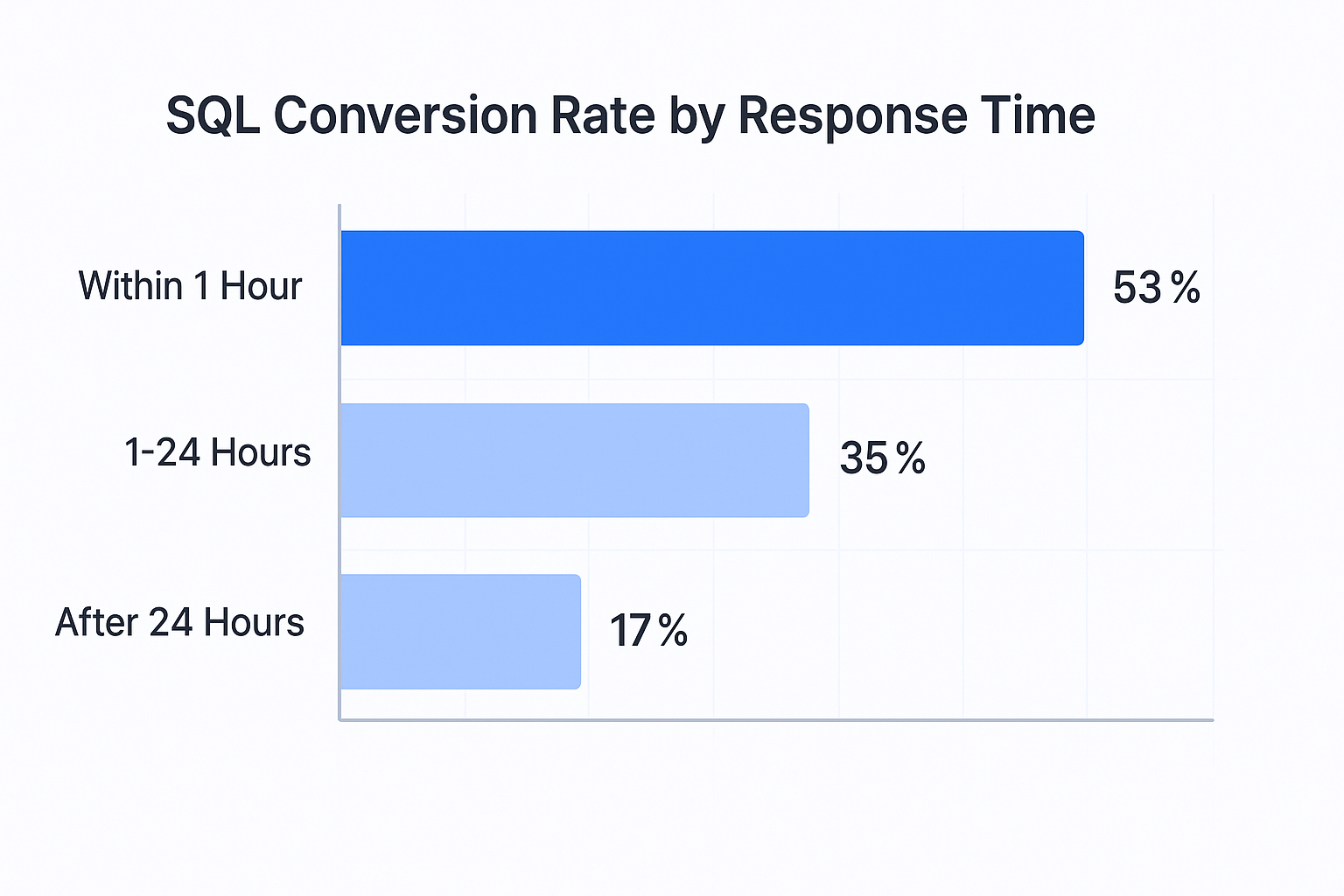

- Companies following up within the first hour report a 53% conversion rate, compared to just 17% after 24 hours

- Leads contacted within 5 minutes are 21 times more likely to turn into customers compared to those contacted after 30 minutes

- Responding within one minute can improve lead conversions by 391% compared to responding after one hour

- 80% of sales require 5+ follow-up attempts, yet 92% of sales reps quit after just 4 attempts

- 50% of all sales happen after the 5th contact, proving persistence is critical for SQL conversion

- Companies implementing BANT saw a 59% increase in conversion rates, while MEDDIC increased win rates by 25%

- B2B SaaS companies using behavioral scoring achieve 39-40% conversion rates, far better than basic demographic scoring

You’ve spent weeks nurturing prospects. Your marketing team delivered leads that looked promising on paper. The handoff happened. And then… crickets. Three follow-ups later, you discover they don’t have budget, don’t have authority, and honestly don’t even have a real need.

Sound familiar?

The problem isn’t that you’re bad at sales—it’s that not every lead deserves the same attention. The difference between spinning your wheels on tire-kickers and closing real deals comes down to one thing: knowing which prospects are actually ready to buy.

That’s where sales qualified leads come in. When you get SQLs right, everything changes. Your pipeline becomes predictable. Your team focuses on winnable deals. Your conversion rates stop being a mystery.

In 2025, the data tells a clear story. Teams that nail lead qualification see 7x higher conversion rates, close deals 30% faster, and waste dramatically less time on prospects who were never going to close. But most organizations still struggle with the basics—defining what “qualified” really means, aligning marketing and sales around it, and responding fast enough to actually capitalize on buyer intent.

This guide cuts through the noise with real statistics that show you exactly what works in lead qualification today.

What is a Sales Qualified Lead?

Let’s keep this simple. A sales qualified lead is a prospect who’s been vetted by your sales team and is ready for a real conversation about buying. They’re not just browsing. They’re not just downloading whitepapers. They’ve shown genuine buying intent and meet your specific criteria for budget, authority, need, and timing.

The key difference? Marketing qualified leads have raised their hand and shown interest. Sales qualified leads have been validated by sales and are actively evaluating solutions.

Here’s what makes an SQL different: they’ve typically engaged with high-intent content like pricing pages or product demos, they’ve had direct conversations with your team, and they meet clear qualification criteria that both marketing and sales have agreed on.

According to recent data, SQLs convert to opportunities at rates of 20-30%, compared to just 5-15% for marketing qualified leads. That’s not a small difference—it’s the difference between a pipeline full of hope and a pipeline full of deals.

The Current State: SQL Statistics for 2025

Understanding where you stand starts with knowing the benchmarks. The data from 2025 reveals some eye-opening truths about sales qualified leads and what it actually takes to convert them.

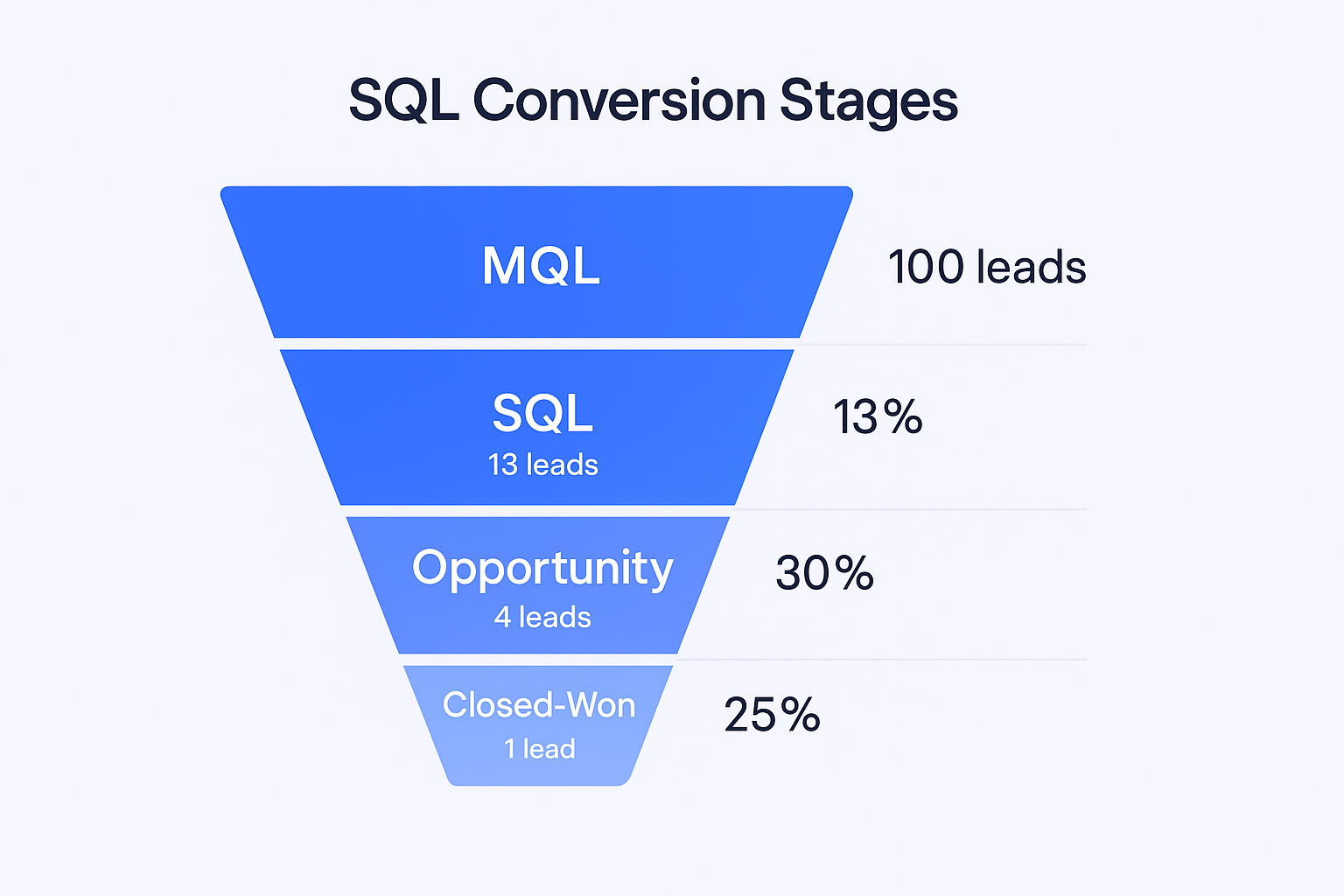

The average MQL to SQL conversion rate sits at 13%, but here’s where it gets interesting. Top performers using behavioral lead scoring achieve conversion rates as high as 40%—more than triple the average. This massive gap reveals that most teams aren’t just slightly behind, they’re fundamentally approaching qualification the wrong way.

For B2B SaaS companies specifically, the conversion rate averages around 13-15%, while B2C and D2C models outperform at 18-22% thanks to shorter decision cycles. Consumer Electronics leads the pack at 21%, followed by FinTech at 19% and Automotive at 18%. On the other end, Healthcare and Oil & Gas struggle at 12-13% due to lengthy buying cycles and compliance hurdles.

Once you have an SQL, the journey isn’t over. Top-performing sales development teams convert 59% of SQLs into opportunities. Organizations falling below that figure typically struggle with poorly defined qualification criteria, unclear handoff processes, or slow response times from the sales team.

The ultimate metric? SQL to customer conversion. The average sits around 6%, with top performers reaching closer to 25%. The difference comes down to lead quality, sales execution, and how quickly teams can move qualified prospects through the pipeline.

SQL Conversion Rates: The Funnel Reality

Every stage in your pipeline has a conversion rate, and understanding these benchmarks helps you identify exactly where deals are falling through the cracks.

The journey starts with marketing qualified leads. On average, 13% of MQLs become SQLs, but this varies wildly. Website leads convert at 31.3%, customer and employee referrals hit 24.7%, and webinars reach 17.8%. Meanwhile, email campaigns struggle at just 0.9%, lead lists convert at 2.5%, and events sit at 4.2%. The source matters enormously.

Once a lead becomes an SQL, the next critical conversion is SQL to opportunity. Successful organizations typically see 30-40% conversion rates at this stage. This represents prospects moving from initial interest to active consideration, usually involving direct sales conversations, product demonstrations, or detailed needs assessment calls.

The final conversion—opportunity to closed-won—depends heavily on deal complexity and sales team closing skills. The 20-30% benchmark reflects organizations that properly qualify opportunities before entering them into the pipeline. Companies consistently below this range often discover they’re advancing unqualified prospects or lack effective closing processes.

Understanding these conversion rates helps you forecast accurately and identify bottlenecks. If your website-to-lead conversion is strong but MQL-to-SQL is weak, you have a qualification problem. If SQL-to-opportunity is solid but opportunity-to-close is low, you have a closing problem. The data shows you exactly where to focus.

The Qualification Gap: Why Most Leads Don’t Convert

Here’s the uncomfortable truth: most leads in your pipeline aren’t going to close. Understanding why helps you avoid the same mistakes.

Poor lead quality costs companies real money. Untracked lead attribution gaps result in 34% of qualified leads getting lost between departments due to poor tracking systems. That’s one-third of your qualified pipeline vanishing simply because marketing and sales aren’t aligned on who owns what.

Data decay makes the problem worse. B2B contact data decays at 22.5% annually as people change jobs, titles, and contact details. Biotech companies experience a staggering 22% monthly data decay rate in their pipelines, directly hampering conversion rates. A contact list that was reliable last quarter is now largely obsolete.

Then there’s the speed problem. Research shows that 82% of consumers expect responses within 10 minutes, yet the average lead response time is 47 hours. Just 27% of leads get contacted at all. Companies that follow up within the first hour report a 53% conversion rate, compared to just 17% for follow-ups after 24 hours. Timing isn’t everything—it’s the only thing.

The qualification criteria gap is equally damaging. A good average qualification rate falls between 13-25%. When conversion rates fall significantly below 50% at the SQL-to-opportunity stage, it indicates the sales development team isn’t performing quality control and is sending too many poor-quality leads to account executives. The sales team then wastes time on prospects who should never have been qualified in the first place.

Finally, there’s the follow-up problem. While 80% of sales require 5+ follow-up attempts, 92% of sales reps quit after just 4 attempts. Meanwhile, 50% of all sales happen after the 5th contact. The data is clear: persistence pays, but most teams give up right before the breakthrough.

🎯 Skip the 47-Hour Wait Time

Our LinkedIn campaigns book qualified meetings in 72 hours through precision targeting and proven message frameworks.

of $50 to $500 per B2B sales qualified lead, depending on factors like industry, lead souWhat Makes a Lead “Sales-Qualified”? The Data on Qualification Criteria

Not all qualification frameworks are created equal, and the statistics prove which approaches actually work.

BANT—Budget, Authority, Need, and Timeline—remains the most widely recognized framework. Companies that effectively implemented BANT saw a 59% increase in conversion rates according to InsideSales research. BANT is simple, fast, and ideal for straightforward sales cycles, making it perfect for quickly qualifying leads from the first interaction.

MEDDIC—Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, and Champion—takes qualification deeper. Companies implementing MEDDIC experienced an average win rate increase of 25%. This framework excels in complex sales cycles where understanding the buyer’s journey and multiple stakeholders is crucial. MEDDIC doesn’t just qualify once; it enables ongoing qualification throughout the deal lifecycle.

The choice between frameworks matters. BANT works best for transactional sales with clear buying processes, typically involving fewer than three decision-makers. MEDDIC shines in enterprise sales with complex buying ecosystems involving five or more decision-makers and intricate internal dynamics.

High-performing organizations often use a hybrid approach. They might deploy BANT for initial qualification to quickly identify promising leads, then apply MEDDIC principles as deals progress to navigate complex decision-making processes. This staged approach ensures efficient filtering at the top of the funnel while providing depth for serious opportunities.

The data shows one clear pattern: teams using structured qualification frameworks report higher conversion rates across the board. The framework itself matters less than having clear, documented definitions that both marketing and sales agree upon and consistently apply.

Speed to Contact: The SQL Response Time Advantage

When a lead becomes sales-qualified, the clock starts ticking. Every minute of delay costs you conversions.

The numbers are stark. Leads contacted within 5 minutes are 21 times more likely to turn into customers compared to those contacted after 30 minutes. Within that first hour, businesses are 7 times more likely to have meaningful conversations with decision-makers. But only 37% of businesses respond within the hour.

The first-minute advantage is even more dramatic. Responding within one minute can improve lead conversions by 391% compared to responding after one hour. Just one minute later—a two-minute response time—offers less than half as much improvement at 160%. Each passing minute is like a ticking time bomb that rapidly stunts conversion growth.

Why does speed matter so much? When a prospect raises their hand—by requesting a demo, filling out a contact form, or asking for pricing—they’re in a buying mindset right now. Every minute that passes is a minute where their enthusiasm cools, distractions mount, and competitors can swoop in.

Fast responders capture 35-50% more sales opportunities than those with slower response times. This advantage is especially critical for outbound leads, where prospects may not be actively seeking your solution. In these cases, a fast follow-up is essential to capturing attention before they disengage or turn to competitors.

The average response time today? A sobering 42 hours. That’s nearly two days for competitors to plant the seeds for a strong relationship or for leads to become less excited or change their mind altogether. Speed to lead isn’t just about acting quickly—it’s understanding that response time directly impacts your ability to turn leads into paying customers.

The Handoff Problem: MQL to SQL Transition Challenges

The moment when marketing passes a lead to sales should be seamless. In reality, it’s where most pipeline leakage happens.

The statistics reveal a systematic breakdown. Organizations lose 22% of potential SQLs annually due to unattributed lead gaps between sales and marketing. Poor tracking systems and unclear ownership mean qualified prospects simply disappear between departments.

Only 56% of B2B companies provide their sales team with marketing qualified leads. The other 44% leave their salespeople to sift through leads and determine what might be viable on their own. This creates massive inefficiency and frustration on both sides.

The misalignment manifests in specific ways. Poorly defined qualification criteria mean different sales reps accept qualified leads based on different standards. Without a clear handoff process, sales and sales development teams remain unclear on who owns next steps after a handoff call is complete. When service-level agreements aren’t followed, sales doesn’t accept and take ownership of qualified leads in a timely manner.

The cost is measurable. Regular process audits can reduce this loss by 40%. Companies with shared CRM dashboards and real-time lead activity tracking report 30%+ conversion rates thanks to better visibility and collaboration.

The solution requires both teams to agree on explicit criteria before any leads change hands. Marketing needs to understand exactly what sales is looking for, and sales needs to commit to following up on leads that meet the agreed-upon standards. Without this alignment, even the best marketing campaigns and sales strategies will underperform.

Lead Scoring Accuracy: What the Data Says

Lead scoring can either be your competitive advantage or your Achilles’ heel. The difference comes down to how accurately your system predicts which leads will actually convert.

Traditional manual lead scoring is becoming obsolete. Most marketers rely on marketing automation tools that use a quantitative approach based on actions—five points for downloading a whitepaper, for example. This approach actually encourages prospects to delay engaging with a salesperson and increases the risk of losing a sale.

AI-powered lead scoring is changing the game. B2B SaaS companies using behavioral scoring models achieve 39-40% conversion rates, far better than those relying on basic demographic scoring. This 21% gap in performance between top and bottom-tier companies shows the transformative impact of better scoring systems.

Companies using AI-powered lead scoring see an average increase of 25% in conversion rates and a 30% reduction in sales cycles. AI tools like Clari cut false MQLs by 40% using historical data patterns to refine lead quality. Predictive scoring platforms like 6sense and Apollo.io boost conversions by 22%.

The predictive lead scoring market is exploding. Expected to grow from $1.4 billion in 2020 to $5.6 billion by 2025—a compound annual growth rate of 26.7%—this growth is driven by the increasing adoption of AI and machine learning in sales and marketing.

Nearly 14 times more B2B organizations are using predictive lead scoring than in 2011. One case study from Fifty Five and Five found that after adopting AI-driven lead generation, the conversion rate of leads to sales-qualified opportunities quadrupled from 4% to 18%.

The key to AI scoring effectiveness is the quality and breadth of data inputs. Over 52% of companies merge both explicit data (job title, company size, industry) and implicit data (website behavior, email engagement, content downloads) when scoring leads, highlighting the trend toward more comprehensive and data-driven approaches.

Industry Benchmarks: How You Stack Up

Your industry fundamentally shapes what good performance looks like. Understanding these benchmarks helps you set realistic targets and identify where you’re truly excelling or lagging.

MQL to SQL conversion varies dramatically by industry. Consumer Electronics tops the chart at 21%, thanks to fast-moving purchase cycles and emotionally-driven decisions. FinTech comes in at 19%, supported by strong demand and streamlined digital processes. Automotive hits 18%, benefiting from similar emotional decision-making and shorter cycles.

At the other end, Oil & Gas lags at 12%, reflecting long and complex procurement cycles typical of heavy industry. Healthcare follows at 13%, influenced by cautious and highly regulated decision-making processes where compliance requirements lower conversion rates by 12% compared to industry norms.

B2B SaaS deserves special attention. While the overall B2B average sits at 13-15%, top-performing B2B SaaS companies achieve an impressive 40% MQL to SQL conversion rate—far exceeding the overall average. This massive variance shows that in SaaS, excellence is possible, but most companies are nowhere close.

Business model matters enormously. B2C and D2C models consistently outperform B2B with rates ranging from 18-22% compared to 13-15%. The difference is largely due to shorter decision timelines and more direct sales channels without complex stakeholder management.

The cost side also varies by industry. Businesses spend an averagerce, and location. High-demand sectors like SaaS and finance face fierce competition, increasing lead acquisition costs. Some estimates for enterprise software put SQL costs between $4,000-$5,000 per lead for complex solutions.

Deal size and sales cycle length create the final variance. Organizations with straightforward solutions and shorter sales cycles—like basic IT services—spend between $50-$100 per qualified lead. Complex enterprise deals in regulated industries can see costs 10-50x higher.

The Role of Technology in SQL Generation

Technology isn’t just making lead qualification faster—it’s making it fundamentally smarter and more accurate.

AI is revolutionizing lead scoring and qualification. By 2025, 75% of B2B sales organizations are expected to run AI-guided workflows. Sales reps who embrace this shift are 3.7 times more likely to hit quota compared to those who resist.

The results are measurable. Email response rates increase by 28% when AI helps craft messages that sound more human. Sales cycles shorten by a full week because AI surfaces the right information at the right time. Admin and call prep time drops by 60-70%, finally giving sales teams more time for actual selling.

Predictive analytics tools deliver even more dramatic improvements. Platforms using behavioral analysis and engagement metrics help teams identify high-intent leads with remarkable accuracy. AI-powered tools like Gong and Chorus improve trigger identification by 31% through conversation analysis. Funnel analytics solutions like Mixpanel and Hotjar help pinpoint drop-off points so teams can fix leaks in real time.

Lead enrichment technology addresses the data quality problem. AI-powered systems automatically fill in missing lead details, verify contact information, and enhance profiles for better targeting. This automation can reduce data-related time waste—which typically consumes 27.3% of a sales rep’s time—by more than half.

CRM integration ensures all this intelligence flows where teams actually work. Tools that push lead scores directly into Salesforce, HubSpot, or other platforms create seamless workflows. Sales reps don’t need to log into multiple systems or manually update records—the qualification happens automatically in the background.

Marketing automation platforms tie everything together. When lead scoring, enrichment, qualification, and routing all happen automatically, teams can follow up with SQLs within minutes instead of hours or days. This automation is what enables the first-hour response rates that drive 7x higher conversion.

The technology exists. The data proves it works. The question is whether your team will adopt it before your competitors do.

Multi-Touch Attribution: The Path to SQL Status

Leads don’t become sales-qualified in a single interaction. Understanding the journey helps you optimize every touchpoint.

On average, it takes 8 touches just to reach a prospect in the first place. But the path to SQL status involves far more. High-growth organizations report an average of 16 touchpoints per prospect within a 2-4 week span before that prospect becomes truly qualified.

The multi-channel advantage is undeniable. Omnichannel follow-up strategies combining email, phone, social media, and direct mail have a 287% higher purchase rate than single-channel approaches. Sales cadences with 12-16 touches result in a 2x contact rate compared to shorter sequences.

Content type matters enormously at each stage. Early-stage prospects engage with educational content—blog posts, industry reports, webinars. Mid-stage prospects download case studies and watch product demos. Late-stage prospects request pricing, schedule consultations, and engage with ROI calculators.

The data shows clear patterns in what drives qualification. Leads who visit pricing pages before product overview pages convert 40% more often. Prospects who engage with three or more pieces of content are 4x more likely to become SQLs than those who engage with just one. Time spent on site correlates directly with qualification likelihood.

Email sequences alone show the power of persistence. Sending a first and second cold email follow-up increases your chances of getting a reply by 21% and 25% respectively. Emailing the same contact multiple times leads to 2x more responses. Sending up to 8 follow-up emails can double or triple conversion rates.

The attribution insight matters for budget allocation. Website leads convert at 31%, customer and employee referrals at 24.7%, webinars at 17.8%, social media at 8.5%, email campaigns at 7.8%, events at 4.2%, lead lists at 2.5%, and cold outreach at under 1%. Knowing which channels drive the highest-quality SQLs helps you invest in what actually works.

💼 LinkedIn Beats Cold Calling by 7X

We build outbound campaigns that target decision-makers directly—complete targeting strategy, message design, and scaling systems included.

The takeaway? SQL generation isn’t a single moment—it’s a journey. Teams that map and optimize every touchpoint in that journey systematically outperform those who hope prospects magically self-qualify.

What is the Future of Lead Qualification?

The next 12-24 months will see more change in lead qualification than the previous decade combined.

AI adoption is accelerating. By 2025, 30% of all outbound messages will be machine-generated—a 98% jump from 2022. The teams winning aren’t using AI to send generic spam at scale. They’re using AI to draft initial outreach, then spending 30 seconds humanizing each message with personal insights. This hybrid approach achieves 40% higher reply rates while enabling 3x more volume.

Predictive analytics is becoming the standard. 70% of high-growth companies already use predictive lead scoring to prioritize prospects. These systems analyze behavioral patterns across thousands of historical deals to continuously learn what separates high-quality leads from dead ends. The result is scoring that updates in real time as prospects engage.

Intent data is making qualification proactive rather than reactive. Platforms like 6sense and Bombora capture behavioral signals from across the web—including third-party research activity, website visits, and ad interactions—to identify hidden demand and surface in-market accounts before competitors even know they’re shopping.

Real-time qualification is replacing batch processing. Instead of waiting for marketing automation to score leads overnight, modern systems qualify prospects the moment they take action. When someone visits your pricing page three times in one day, AI immediately flags them as high-intent and routes them to sales within minutes.

Buyer committee mapping is solving the multi-stakeholder challenge. Tools now identify all members of the buying committee, track their individual engagement, and help sales navigate complex organizations. This addresses the reality that the average tech purchase involves 14-23 people, most in senior operations or product roles.

Continuous qualification throughout the deal lifecycle is replacing one-time checks. Instead of qualifying once at the SQL stage and hoping nothing changes, modern teams re-qualify at every major milestone. This approach prevents deals from stalling because the champion lost budget authority or a new stakeholder joined with different priorities.

The skillset required is shifting. The most valuable sales professionals won’t be those who can make 100 dials a day. They’ll be those who combine technical proficiency with sales tools, strategic thinking about buyer psychology, and the communication skills to navigate complex stakeholder environments. Technical proficiency becomes table stakes—human judgment becomes the differentiator.

🚀 AI-Powered LinkedIn Outbound That Converts

We combine AI lead scoring with human personalization to generate SQLs at 40%+ conversion rates—fully managed campaigns.

Key Takeaways

The data paints a clear picture of what works in lead qualification today.

Not all leads are created equal. SQLs convert to opportunities at 20-30%, compared to just 5-15% for marketing qualified leads. Focusing your team’s time on properly qualified leads is the single biggest lever for improving conversion rates and shortening sales cycles.

Speed determines success. Following up within the first hour increases conversion rates to 53%, compared to just 17% after 24 hours. Leads contacted within 5 minutes are 21 times more likely to convert than those contacted after 30 minutes. The faster you respond to qualified leads, the more you’ll close.

Qualification frameworks matter. Companies using BANT see 59% higher conversion rates. Those implementing MEDDIC experience 25% higher win rates. Pick a framework that fits your sales cycle complexity, document clear criteria that both marketing and sales agree on, and apply it consistently.

AI and behavioral scoring deliver massive advantages. B2B SaaS companies using behavioral scoring achieve 39-40% MQL to SQL conversion rates, compared to the 13% average. AI-powered lead scoring increases conversion rates by 25% and reduces sales cycles by 30%. The technology exists and the ROI is proven.

The handoff is where deals die. 22% of potential SQLs are lost annually due to poor handoffs between marketing and sales. Companies with shared CRM dashboards and real-time lead tracking report 30%+ higher conversion rates. Fix the handoff process before worrying about anything else.

Persistence pays off. 80% of sales require 5+ follow-up attempts, yet 92% of reps quit after just 4. Meanwhile, 50% of all sales happen after the 5th contact. Multi-channel sequences with 12-16 touches result in 2x higher contact rates. Don’t give up on qualified leads too early.

Data quality is non-negotiable. B2B contact data decays at 22.5% annually, and inaccurate data wastes 27.3% of a sales rep’s time. Invest in data enrichment, verification, and regular cleaning. Bad data makes even the best qualification process worthless.

The path forward is clear. Focus on fewer, better-qualified leads. Respond to them faster. Use technology to automate scoring and enrichment. Align marketing and sales around shared definitions and processes. Persist through multiple touches across multiple channels.

Do this, and your SQL metrics won’t just improve—they’ll transform how predictably you can build pipeline and close deals.

Other Useful Resources

To understand how to eliminate the qualification gap and generate SQLs proactively rather than chasing reactive leads, explore these resources:

Sales Engagement Infrastructure:

- Compare best GMass alternative options for email sequencing supporting multi-touch SQL generation

- Explore introducing Saleshandy Connect 2 understanding sales engagement platform evolution

LinkedIn Infrastructure:

- Review LinkedIn Sales Navigator integration with Salesforce for systematic CRM workflows eliminating 22% handoff losses

- Explore LinkedIn auto connect tool understanding automation supporting qualification outreach

- Learn what does 1st mean on LinkedIn for platform relationship fundamentals

Email Configuration:

- Explore Lycos SMTP settings for email infrastructure understanding

Platform Intelligence:

- Review LinkedIn job posting statistics showing hiring signals indicating buying intent

Sales qualified lead statistics document the systematic qualification crisis—13% average MQL to SQL conversion versus top performers achieving 40% (3x gap) revealing most teams fundamentally approach qualification wrong, while 22% of potential SQLs lost annually in marketing-sales handoffs compounds inefficiency across organizations where only 56% of B2B companies even provide sales teams with MQLs. The speed imperative proves critical yet unexecuted: 53% conversion within first hour collapses to 17% after 24 hours, leads contacted within 5 minutes are 21x more likely to convert versus 30 minutes, yet average response time sits at sobering 42 hours while 82% of consumers expect responses within 10 minutes and only 27% of leads get contacted at all. Qualification frameworks deliver documented improvements—BANT implementation drives 59% conversion increase, MEDDIC delivers 25% win rate improvement—yet systematic application remains inconsistent preventing competitive advantages from materializing. AI/behavioral scoring addresses some challenges (B2B SaaS companies using behavioral models achieve 39-40% conversion versus 13% average, AI-powered scoring increases conversions 25% and reduces cycles 30%, one company quadrupled conversion 4% to 18%) yet adoption gaps persist with technology existing but systematic implementation lacking. The persistence requirements compound execution burden: 80% of sales require 5+ follow-ups yet 92% of reps quit after just 4, 50% of all sales happen after 5th contact, multi-channel sequences with 12-16 touches result in 2x higher contact rates, and multi-channel approaches deliver 287% higher purchase rates versus single-channel—creating systematic follow-up orchestration demands most teams manually executing BANT/MEDDIC qualification while chasing reactive leads within 42-hour average response windows cannot maintain. But here’s what SQL statistics alone don’t solve: knowing 40% top-performer conversion doesn’t achieve it from 13% baseline, understanding 53% within-hour conversion doesn’t implement instant response infrastructure eliminating 42-hour delays, recognizing BANT delivers 59% gains doesn’t systematically apply frameworks across all leads, appreciating AI delivers 25% conversion increases doesn’t deploy those tools, acknowledging 22% handoff loss doesn’t fix marketing-sales alignment, and documenting 5+ follow-up necessity (80% of sales) doesn’t execute that persistence when 92% quit after 4. The article’s repeated banner positioning addresses the fundamental alternative: “Stop Chasing SQLs. Generate Them.” through LinkedIn delivering qualified meetings proactively, “Skip the 47-Hour Wait Time” booking qualified meetings in 72 hours, “LinkedIn Beats Cold Calling by 7X” with complete targeting strategy, “AI-Powered LinkedIn Outbound That Converts” achieving 40%+ rates systematically, and “Predictable Pipeline from LinkedIn Outbound” with transparent targeting and proven frameworks. Our complete LinkedIn outbound system eliminates the qualification crisis systematically—delivering 15-25% response rates through done-for-you targeting, campaign design, and scaling that generates pre-qualified SQLs proactively (not reactive MQL qualification), achieves instant decision-maker access bypassing 42-hour response delays and 22% handoff losses, applies AI-powered targeting delivering 40% top-performer conversion benchmarks, executes multi-channel 5+ follow-up persistence systematically (287% advantage), and provides predictable SQL generation without the 13% average conversion struggle, speed-to-contact infrastructure gaps, BANT/MEDDIC manual application burden, 22.5% annual data decay, handoff alignment challenges, or qualification framework execution complexity preventing most teams from converting SQL knowledge into actual top-performer 40% MQL-SQL conversion through systematic proactive lead generation rather than reactive qualification of marketing-generated leads requiring 42-hour chases and losing 22% in handoffs.

📊 Predictable Pipeline from LinkedIn Outbound

Stop guessing at SQL generation. Our complete LinkedIn outbound system delivers qualified meetings with transparent targeting and proven frameworks.

7-day Free Trial |No Credit Card Needed.

Text #5

FAQs

What's a good MQL to SQL conversion rate?

How long should SQL qualification take?

What's the difference between SQL and opportunity?

How many SQLs do I need to hit my quota?

What tools help improve SQL quality?

- blog

- Statistics

- Sales Qualified Lead Statistics 2025: Key Data & Insights